Sports Protective Equipment Market Research, 2033

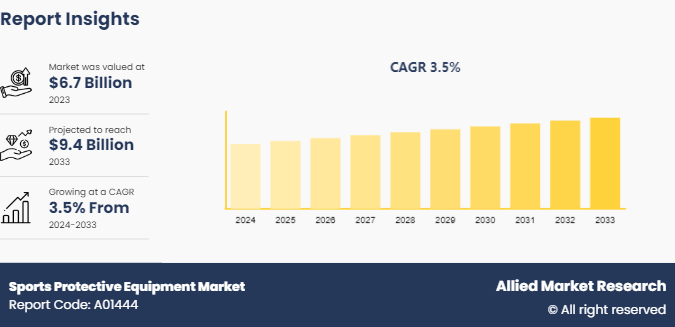

The global sports protective equipment market size was valued at $6.7 billion in 2023 and is projected to reach $9.4 billion by 2033, growing at a CAGR of 3.5% from 2024 to 2033. Sports protective equipment refers to specialized gear designed to safeguard athletes from injuries during sports and physical activities. This equipment includes helmets, pads, gloves, goggles, and other accessories tailored to the demands of different sports. The sports protective equipment market exists primarily to reduce the risk of injuries such as concussions, fractures, and strains, which are common in sports. These products are engineered with materials that absorb impact, distribute forces, and provide support to vulnerable body parts, thereby enhancing safety and performance. The key benefits of sports protective equipment include injury prevention, enhanced confidence for athletes, compliance with safety regulations, and prolonged athletic careers. This sports protective equipmentmarket continues to evolve with advancements in materials science and biomechanical research, ensuring that athletes can compete safely and effectively across various sports disciplines.

Key Takeaways

The sports protective equipment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the forecast period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major sports protective equipment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

There are various national & international sports events conducted worldwide. These events are of prime importance and fuel the adoption of sports protection equipment. Major international sports events that are popular across the world include World Baseball Classic, Baseball World Series, FIBA Basketball World Cup, ICC Cricket World Cup, Super Bowl, FIFA World Cup, Golf Ryder Cup, Olympic Games, Commonwealth games, Asian Games, and others. Some regional sports events such as the Great Wall Marathon, Formula One Chinese Grand Prix, Huangshan Mountain Bike Festival in China and the U.S. Open in Golf, ATP World Tour Masters 1000 in tennis have driven the adoption of sports protective equipment in recent years and is expected to drive sports protective equipment market growth in the upcoming years.

An increase in participation in sports activities positively impacts market growth. Participant numbers are on the rise in various sports worldwide. As per industry sources, the participation in sports for children aged above six has experienced a rapid rise over the past few years in the U.S. Participation in outdoor and racquet sports has remained consistent; however, rates in team sports, water sports, and other fitness sports have shown a consistent increase in the last few years. In 2015, the figures reported for participation in individual, racquet, team, outdoor, winter, water, and fitness sports were 34.8, 13.5, 23.1, 48.4, 7.4, 14.2, and 61.5%, respectively which expected to boost the sports protective equipment market demands in the upcoming years

Online retailers have shown increased popularity as they facilitate faster delivery and easy return policies. Moreover, the increase in the number of sites offering free shipping of products has boosted product sales through online platforms. in Sports protective equipment market outlook, online retail provides access to a wide variety of products and price comparisons of different brands. As per a recent study, Europe witnessed 18–19% growth in e-commerce retail sales, with the UK, Germany, and France leading the e-commerce transactions. This trend is expected to drive online retail sales of the sport’s protective equipment market.

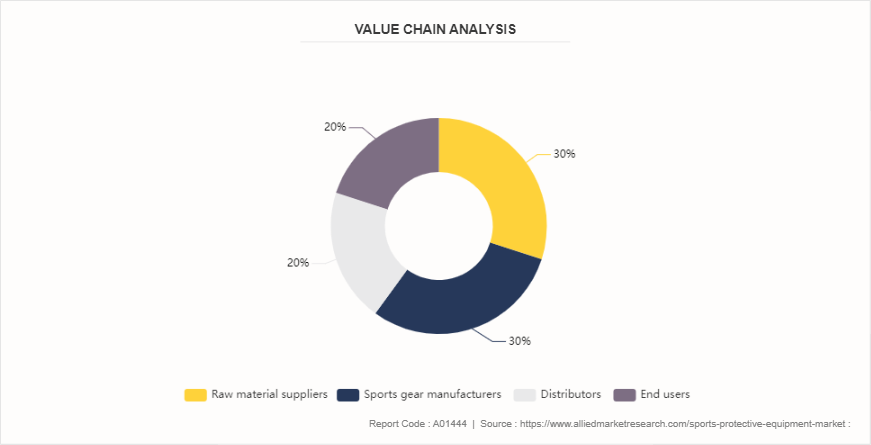

Value Chain Analysis

The value chain of the sports protective equipment market comprises various stages that add a unique value to the overall market. Each of these stages shares a specific value at their point of operation and, in turn, contributes to the competitive value of the end product provided.

Raw material suppliers:

Different materials used in the manufacture of sports protective gear include polycarbonate, acrylonitrile butadiene styrene, neoprene, polyethylene, polyurethane, polyurethane, polystyrene, polypropylene, Kevlar, and other fibers. The manufacturers procure all these materials from different vendors, design them as per the requirement and assemble them to form the desired equipment. The suppliers of these materials/components ensure a smooth supply in the manufacture and production stages and add value to the final product by supplying technically advanced raw materials for the equipment.

Sports gear manufacturers

These players are responsible for the design and manufacture of end-to-end equipment along with providing all the service requirements. Sports protective equipment is manufactured by several leading players in the market such as Amer Sports Corporation, Nike, and Puma. To effectively conceptualize and implement the design, these players keep track of changing consumer preferences.

Distributors

The distributors of sports protective equipment comprise specialty retail stores that include sporting goods stores, specialty sports shops, specialty fitness, and other company-owned stores, multi-retail stores that include department stores, discount stores, and other warehouse clubs, online stores that include company’s owned online stores and other third-party e-commerce stores.

End users

The end users of sports protective gear comprise consumers, college & high school authorities, and other sports clubs. Sports protective gear is worn by consumers across all age groups. Consumer spending on protective gear is on the rise in developed economies such as the U.S. As per the statistics, consumer expenditure in the country increased from $165 million to $218 million on helmets and other protective gear from 2007 to 2012.

Market Segmentation

The sports protective equipment market is segmented into product type, area of protection, distribution channel, and region. Based on product type, the market is divided into helmets & other headgear, pads, guards, chest protectors, & gloves, protective eyewear, and face protection & mouth guards. Based on the area of protection, the market is segregated into head & face protective equipment, trunk & thorax protective equipment, upper extremity protective equipment, and lower extremity protective equipment. Based on distribution channel, the market is divided into specialty retail stores, multi-retail stores, and online stores & others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional Market Outlook

North America held the major sports protective equipment market share in 2023. The North American market has witnessed rapid adoption of sports protective gear in recent years. The U.S. is the leading market for such equipment globally and is expected to maintain its dominant position during the forecast period. Overall youth participation has been fairly stable over the years; however, has declined in some of the major sports in North America. As per the statistics, children aged 6–17 years in the U.S. are the most active in basketball, baseball, soccer (outdoor) , and football, which is exemplified by the youth participation statistics with the number pegged in thousands at 9, 694; 6, 711; 7, 656; and 2, 032, respectively. However, the point of concern is that youth participation has declined in these sports by 6.80%, 4.30%, 8.40%, and 32.40%, respectively. ???????

Industry Trends

The industry is witnessing a shift towards advanced materials like carbon fiber and impact-resistant polymers. Companies are integrating technology such as sensors and IoT to enhance performance monitoring and injury prevention. For instance, BeOne Sports has partnered with research institutions to develop helmets with integrated sensors that measure impact forces, providing real-time feedback to athletes and coaches to mitigate potential injuries.

With increasing environmental awareness, the industry is focusing on sustainable materials and manufacturing processes. BeOne Sports has launched initiatives to use recycled materials in their equipment production and reduce carbon footprint throughout the supply chain. This not only aligns with global sustainability goals but also enhances brand reputation among eco-conscious consumers.

There's a growing demand for customized protective gear tailored to individual athletes’ needs. Companies like BeOne Sports offer customization options through 3D scanning and printing technologies. This allows athletes to have gear that fits perfectly, optimizing comfort and protection while catering to specific sport requirements.

Companies are investing in biomechanical research to better understand injury mechanisms and improve protective gear design. BeOne Sports collaborates with biomechanics experts to study injury patterns and develop gear that effectively mitigates risks specific to different sports, thereby enhancing overall safety and performance.

Competitive Landscape

The major players operating in the sports protective equipment market include PUMA SE, Under Armour, Inc., Amer Sports Corporation, Adidas AG (Adidas) , ASICS Corporation, Vista Outdoor Operations LLC., United Sports Brands, XENITH, BRG Sports, and Nike, Inc.

Recent Key Strategies and Developments

In June 2024, PUMA announced a worldwide partnership with HYROX, the world series of fitness racing. The partnership sees PUMA become the official apparel and footwear partner for all HYROX races from 2024 to 2027.

In June 2024, Under Armour becomes the Official and Exclusive Uniform, Apparel, and Footwear Partner of USA Football and the U.S. National Team Through the 2028 Summer Olympics.

In March 2023, Under Armour, Inc. announced that it is strengthening its partnership with Golden State Warriors point guard and four-time NBA Champion Stephen Curry. The enhanced partnership is designed to capture market share, fuel business growth and create new business opportunities on a global basis.

Key Sources Referred

National Sporting Goods Association (NSGA)

Sports and Fitness Industry Association (SFIA)

European Federation of Sports Goods Retailers (FEDAS)

World Federation of the Sporting Goods Industry (WFSGI)

Consumer Product Safety Commission (CPSC)

European Committee for Standardization (CEN)

American Society for Testing and Materials (ASTM)

International Organization for Standardization (ISO)

National Institute for Occupational Safety and Health (NIOSH)

Centers for Disease Control and Prevention (CDC)

Health and Safety Executive (HSE, UK)

Australian Competition and Consumer Commission (ACCC)

Japan Sports Agency

Korea Consumer Agency

China National Institute of Standardization (CNIS) ???????

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sports protective equipment market analysis from 2024 to 2033 to identify the prevailing sports protective equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sports protective equipment market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sports protective equipment market trends, key players, market segments, application areas, and market growth strategies.

Sports Protective Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.4 Billion |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 305 |

| By Product Type |

|

| By Area Of Protection |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Puma SE, Xenith, Vista Outdoor, Shock Doctor, Asics Corporation, Nike Inc., Adidas AG, BRG Sports, Amer Sports Corporation, Under Armour Inc. |

Analyst Review

A steady rise in demand for sports protective gear is observed on account of the growing participation in sports and the regulations mandating the use of such products in certain sports. Protective gear, namely, pads, guards, chest protectors, & gloves continues to lead the sports protective equipment market. This is followed by protective eyewear, which has largely witnessed a rise in its adoption as a lifestyle product. These products have long been distributed through specialty retail stores as the traditional channel of choice. However, the multi-retail distribution format and online retail stores have tremendous potential for the distribution of such products, and are expected to gain popularity in the coming years. Online retail growth is attributed to the extensive adoption of smartphones & tablets among the masses and growth in Internet penetration.

Developed economies such as North America and Europe have higher penetration of sports gear owing to higher consumer spending and greater sports participation. Moreover, healthy growth has been observed in consumer spending on helmets and other sports protective equipment in these geographies. Developing regions such as Asia-Pacific and LAMEA are expected to witness higher growth rates over developed economies on account of growing penetration of sports in these regions. Key players operating in this market have adopted diverse strategies to strengthen their foothold. For instance, BRG Sports entered into a partnership with MIPS AB, a leading player for sports helmets, which promoted the technological cooperation between the two companies. BRG Sports is expected to incorporate the multi-directional impact protection system (MIPS) technology in its helmet design, which offers protection to the brain against rotational forces in most hits or falls.

The global sports protective equipment market was valued at $6.7 billion in 2023, and is projected to reach $9.4 billion by 2033, growing at a CAGR of 3.5% from 2024 to 2033.

The sports protective equipment market is segmented into product type, area of protection, distribution channel and region. Based on product type, the market is divided into helmets & other headgear, pads, guards, chest protectors, & gloves, protective eyewear, and face protection & mouth guards. Based on area of protection, the market is segregated into head & face protective equipment, trunk & thorax protective equipment, upper extremity protective equipment, and lower extremity protective equ

North America is the largest regional market for sports protective equipment

The major players operating in the sports protective equipment market include PUMA SE, Under Armour, Inc., Amer Sports Corporation, Adidas AG (Adidas), ASICS Corporation, Vista Outdoor Operations LLC., United Sports Brands, XENITH, BRG Sports, and Nike, Inc.

The global sports protective equipment market report is available on request on the website of Allied Market Research.

Loading Table Of Content...