Squalene Market Overview:

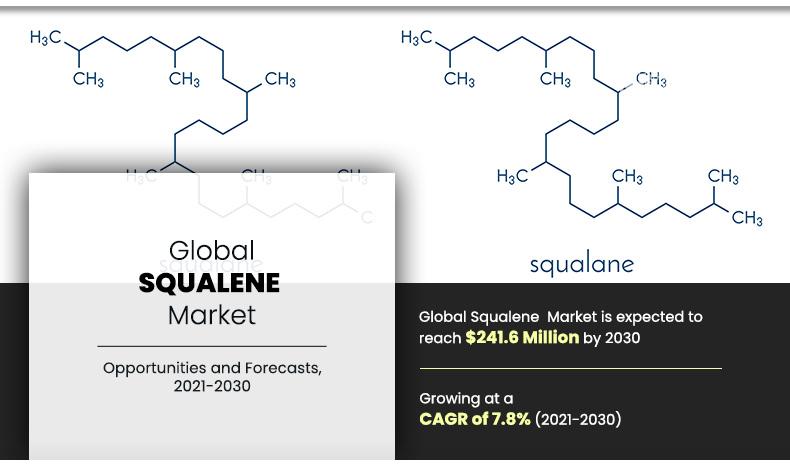

The global squalene market size was valued at $114.5 million in 2020, and is projected to reach $241.6 million by 2030, growing at a CAGR of 7.8% from 2021 to 2030. The pharmaceutical industry has seen a notable increase in the use of squalene, driven by its diverse applications and benefits. Squalene is valued for its role as an adjuvant in vaccines, where it enhances the body’s immune response and boosts the effectiveness of vaccines.

Key Market Insights

- By Source: The vegetable segment is the fastest-growing.

- By End-Use Industry: Soil amendment is the most lucrative application.

- By Region: Asia-Pacific is the fastest-growing market.

Market Size & Forecast

- 2030 Projected Market Size: USD 241.6 Billion

- 2021 Market Size: USD 114.5 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 7.8%

How to Describe Squalene

Squalene is an unsaturated hydrocarbon that can be used in various industries, which include cosmetics, nutraceutical, and healthcare. It is found in large quantities in animal oil and can be obtained in small quantities from vegetables & synthetic biotechnology. Other sources of squalene include vegetable sources, such as amaranth seeds, olives, and wheat germ. It is naturally produced by all organisms, even humans, where the amount of squalene gradually decreases with age. It is mainly used for its medicinal and pharmacological benefits, such as acting as a chemo-preventive agent, antioxidant, and immune system restorer.

Market Dynamics

Increase in awareness regarding hygiene and personal grooming activities has surged the demand for various cosmetic products where squalene is widely used in producing creams and lotions to increase their spread ability and absorption. In addition, squalene supplementation has shown positive response in humans, owing to its potential to reduce cholesterol levels, normalizing plasma sterol levels, and enhancing the overall immunity. All these factors are expected to drive the demand for the squalene market during the forecast period.

However, increasing regulations aimed at protecting marine animals have significantly impacted the supply of squalene, a vital compound used in various industries, including cosmetics, pharmaceuticals, and health supplements. Squalene is most commonly derived from shark liver oil, making it a crucial product for companies reliant on this natural source. However, as conservation efforts intensify to safeguard marine biodiversity, especially sharks, the availability of shark-derived squalene has decreased. These regulations are a response to the alarming decline in shark populations due to overfishing and the shark fin trade, which has severely depleted many species. All these factors are expected to hamper the growth of the squalene market during the forecast period.

On the contrary, increase in R&D activities have led to rise in potential applications of squalene in several end-use sectors. For instance, experimental studies have shown that squalene-supplemented diets lead to increased performance of the immune system. In addition, laboratory studies have confirmed that squalene enhances the function of macrophages. Furthermore, it exhibits anti-viral, anti-fungal, and anti-bacterial properties that make it suitable for use in the pharmaceutical sector. All these factors are anticipated to offer new opportunities in the global squalene industry.

Squalene Market Segmentation Review:

The global squalene market analysis is done on the basis of source, end use industry, and region. Depending on source, the market is divided into animal, vegetable, and synthetic biotechnology. On the basis of end use industry, it is fragmented into cosmetics, nutraceuticals, and healthcare. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Squalene market, by Region

By Region

Asia Pacific is the fastest growing region

The Asia-Pacific squalene market size is projected to grow at the highest CAGR of 8.7% during the forecast period and accounted for more than one-fourth of the squalene market share in 2020. This is attributed to increase in demand for squalene in cosmetics, health care, and nutraceuticals industries in Asia-Pacific. Furthermore, manufacturers across the globe find Asia-Pacific as an attractive market, owing to cheap labor cost, low cost of setting up manufacturing units, and low cost of squalene. These factors drive the market in this region.

Squalene market, by Source

By Source

Vegetable is the fastest growing segment

In 2020, the vegetable segment is projected to grow at the highest CAGR of 9.5% during the forecast period and accounted for less than one-fifth of the squalene market share in 2020. This is attributed to the rapid shift toward organic sources such as vegetables for production of squalene. Furthermore, increase in awareness regarding environment and ecosystem and strict regulations imposed by various governments to produce squalene from animal has made the manufacturers become more linear towards using vegetable as a prime source for squalene production. This factor is escalating the growth of this segment in the global market.

Squalene market, by End Use Industry

By End-use Industry

Soil Amendment is the most lucrative segment

By end use industry, the cosmetics segment dominated the global market in 2020 and is anticipated to grow at a CAGR of 7.7% during the forecast period. This is attributed to increase in awareness regarding personal grooming, which, in turn, has led the cosmetics sector to witness a significant increase in demand where squalene is widely used in creams and lotions to enhance its spreadability and absorption. In addition, increasing young population in both developed and developed economies has led to rise in demand for various beauty care products, which may increase sales of squalene for enhancing absorption in creams and lotions. These factors propel growth of the cosmetics segment in the global squalene market.

Which are the Leading Companies in Squalene

The major companies profiled in this report include Amyris, Inc., ARISTA INDUSTRIES INC, Empresa Figueirense De Pesca, Lda, Gracefruit Limited, Kshimoto Special Liver Oil Co., LTD., New Zealand Green Health Ltd, NUCELIS LLC, Otto Chemie Pvt. Ltd., SEADRAGON MARINE OILS LIMITED, and SOPHIM IBERIA S.L. For instance, in June 2022 Amyris, Inc., has announced the launch of production for 13 molecules, including squalene, at its Brazilian facility. The company also highlighted its development of a sustainable production process for sugarcane-derived squalene, providing an eco-friendly alternative to the traditionally used shark-derived squalene.

What are the Key Benefits For Stakeholders

Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

It outlines the current squalene market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

The key drivers, restraints, and squalene market opportunities and their detailed impact analysis are explained in the study.

The profiles of key players and their key strategic developments are enlisted in the report.

Squalene Market Report Highlights

| Aspects | Details |

| By Source |

|

| By End Use Industry |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to CXOs of leading companies, the global squalene market is expected to exhibit high growth potential. Rise in demand from end users, especially from developing countries and continuous technological advancements are the key driving factors for the global squalene market. However, the overall slowdown in extraction of squalene from shark liver due to government regulations is expected to hinder the market growth. According to CXOs, Asia-Pacific is projected to register significant growth as compared to the markets of North America and Europe.

In addition, squalene is widely used as a chemo-preventive agent that reduces chemical initiation of some kinds of cancers and promotes regression of pre-existing tumors. This has made customers more linear toward purchasing squalene-based pharmaceutical ingredients for chemotherapy and cancer treatment.

CXOs further added that sustained economic growth and development of healthcare sector have increased the popularity of squalene.

The growth of cosmetics industry, increase in value and potential of dietary supplements, and the use of squalene as a chemo-preventive agent are the key factors boosting the squalene market growth.

Amyris, Inc., ARISTA INDUSTRIES INC, Empresa Figueirense De Pesca, Lda, Gracefruit Limited, Kshimoto Special Liver Oil Co., LTD., New Zealand Green Health Ltd, NUCELIS LLC, Otto Chemie Pvt. Ltd., SEADRAGON MARINE OILS LIMITED, and SOPHIM IBERIA S.L are the leading players in squalene market.

Cosmetics, nutraceuticals, and healthcare industries are projected to increase the demand for squalene market.

The global squalene market analysis is done on the basis of source, end use industry, and region. Depending on source, the market is divided into animal, vegetable, and synthetic biotechnology.

The increasing use of squalene in manufacturing creams and lotions, dietary supplements, and various drugs are expected to drive the adoption of squalene.

Loading Table Of Content...