Start Stop Technology Market Research, 2032

The global Start Stop Technology Market was valued at $1.8 billion in 2022, and is projected to reach $3.5 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

Start-stop technology plays an important role in the automobile industry, altering how vehicles work and increasing fuel efficiency significantly. This unique innovation, also known as idle-stop, micro-hybrid, or stop-start technology, automatically turns off the engine when the vehicle comes to a standstill, such as at traffic signals or in heavy traffic, and restarts it seamlessly when the driver applies the pedal. The primary purpose is to decrease unnecessary fuel usage and exhaust emissions during idle periods, further contributing to a greener and more sustainable transportation future.

The rising awareness regarding environmental sustainability is one of the key driving forces behind the development and integration of start-stop technology. Automakers are urged to implement eco-friendly solutions as public awareness regarding climate change and the need to decrease carbon emissions increases. This issue is addressed with start-stop technology, which greatly reduces the time a vehicle spends waiting, resulting in decreased fuel consumption and emissions. To fight the environmental effects of the automobile industry, global regulatory organizations have adopted severe fuel economy and emission regulations.

Automotive energy efficiency, especially in the Start-Stop technology, plays a crucial role in improving fuel efficiency and reducing environmental impact. Start-Stop technology aims to minimize idle fuel consumption by automatically shutting off the engine when the vehicle is stationary, such as at traffic lights or in heavy traffic. This reduction in idle time contributes significantly to improved overall automotive energy efficiency.

Start-stop technology has become an essential tool for manufacturers to achieve these regulations and avoid large penalties. This technology helps manufacturers achieve improved fuel efficiency and fewer emissions by automatically shutting off the engine when the vehicle is stationary. The advancement of more efficient and dependable battery technology has been important in the overall acceptance of start-stop systems.

The reliability and lifespan of start-stop technology has increased as automobile batteries have become more powerful and capable of enduring numerous start-ups. In a typical car, repeated starting and stopping of the engine can lead to wear and strain on numerous engine components. Start-stop technology is designed to handle these cycles effectively, resulting in reduced load on the engine. Therefore, the engine's total lifespan may be prolonged, lowering vehicle owners' maintenance expenses. All these factors are anticipated to drive the start stop technology market growth in upcoming years.

The impact on the overall driving experience is a major barrier to start-stop technology. The engine's frequent starting and stopping might cause noticeable vibrations and noise, which can be uncomfortable for certain drivers. The rapid engine restarts may also cause a lag in acceleration, reducing the smoothness of the driving experience. This is especially important in circumstances requiring swift and flawless acceleration, such as merging into highways or navigating through congested traffic.

When it comes to start-stop technology, the reliability and endurance of specific engine components are also an issue. The increased number of engine cycles caused by repeated starts and pauses can put extra strain on components like the starting motor and battery. While manufacturers build these components to endure the demands of start-stop systems, there are still concerns regarding their long-term durability and the possibility of increasing maintenance expenses throughout the life of the vehicle.

Implementing start-stop technology entails more than simply turning engines on and off. It requires complex control systems, smart sensors, and clever algorithms, and marks a paradigm leap in automobile engineering. Manufacturers are investing extensively in R&D to improve the reliability and efficiency of start-stop systems, which are frequently integrated with other sophisticated technologies like regenerative braking and mild-hybrid systems. This drive for innovation is propelling the growth of automotive technology, creating a competitive field in which firms try to provide more frictionless, responsive, and intelligent start-stop systems.

Therefore, technological advancements are not only altering the automobile sector, but also opening chances for cross-industry collaborations and partnerships. In addition, the emergence of start-stop technology emphasizes the significance of software integration in modern automobiles. The technology uses complex algorithms and sensors to handle engine shutdowns and restarts flawlessly, highlighting the increasing significance of software in improving overall vehicle performance.

The key players profiled in this report include Valeo, Robert Bosch GmbH, Continental AG, DENSO CORPORATION, Mitsubishi Electric Corporation, BorgWarner Inc., AISIN SEIKI Co., Ltd., Delphi Automotive LLP, Johnson Controls, and Hitachi Automotive Systems, Ltd. Investment & agreement are common strategies followed by major market players. For instance, in March 2019, BorgWarner Inc. unveiled its next generation of cam torque actuators, intelligent cam torque actuation (iCTA), which uses revolutionary technologies to improve fuel economy and cut pollution. The iCTA technology combines the greatest features of cam torque actuation (CTA) with torsional assist phaser technologies. These factor drive the start stop technology market share by company.

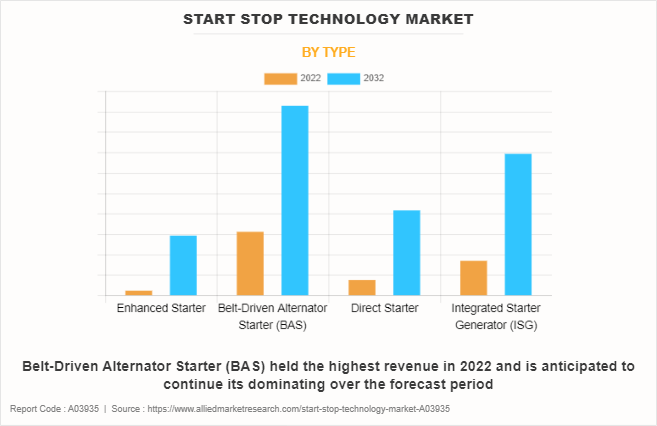

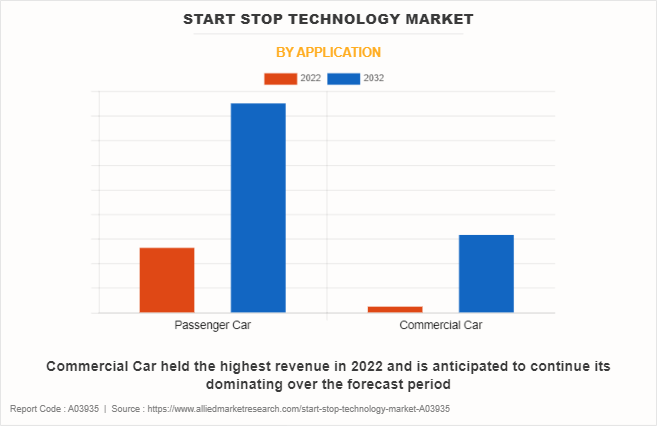

The start stop technology market analysis is segmented on the basis of type, application, and region. By type, the market is divided into belt-driven alternator starter (BAS) integrated starter generator (ISG) and direct starter, integrated starter generator. By application, the market is classified into passenger car and commercial car. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

The start stop technology industry is segmented into Type and Application.

By type, the belt-driven alternator starter sub-segment dominated the global start stop technology market share in 2022. The belt-driven alternator starter allows for instant engine restarts, guaranteeing a smooth transition from idle to motion. This quick and smooth restart is essential in city driving, where frequent stops and starts are required. Traditional starting motor delays are eliminated, resulting in a more responsive and agile driving experience. Many belt-driven alternator starters include regenerative braking capability. The system may catch and convert kinetic energy into electrical energy during braking or slowing down, which is then stored in the vehicle's battery. This energy can be used to power additional components or to help the engine during acceleration, increasing fuel economy.

The use of BAS allows a smooth and unobtrusive transition between start and stop modes for the driver and passengers. The technology uses powerful control algorithms to find the best times to shut down and restart the engine, ensuring that the process is undetectable and does not impair the vehicle's performance.

In traditional automobiles, frequent starting and stopping of the engine can lead to wear and strain. BAS systems, on the contrary, are designed to reduce these consequences. The belt-driven alternator starter reduces stress on engine components by offering a smoother and more regulated starting, resulting in a longer engine life. This is an important factor in improving the overall dependability and lifetime of cars equipped with start-stop systems.

By application, the passenger car sub-segment dominated the global start stop technology market share in 2022. One of the primary driving factors driving the use of start-stop technology in passenger vehicles is fuel efficiency. Fuel consumption is considerably decreased by automatically turning off the engine when the vehicle is stationary. Idleness is a key source of inefficiency, since it burns gasoline without adding to actual vehicle movement. Start-stop technology efficiently addresses this issue by shutting down the engine during times of inactivity and effortlessly resuming it when needed.

Therefore, drivers benefit from greater fuel efficiency, lowering total fuel costs and making the passenger vehicle more cost-effective to run. Technological advancements in battery are also critical to the broad deployment of start-stop systems in passenger vehicles. The technique depends on a strong battery system to power auxiliary operations and easily restart the engine. The development of high-performance batteries with higher power density and longevity has enabled start-stop systems to be used without compromising dependability. Therefore, start-stop technology has been integrated into a greater range of cars, leading to its overall adoption in the automotive start-stop systems market.

By region, Europe dominated the global start stop technology market in 2022. Congestion and traffic jams characterize Europe's urban landscape, particularly in big cities. In such cases, where vehicles spend a large amount of time motionless, start-stop technology becomes extremely important. This technique reduces fuel consumption and pollutants by automatically switching off the engine during traffic waits or at traffic signals, while traditional engines would continue to idle. The EU's strict pollution requirements need new solutions from the automobile sector. Manufacturers satisfy these standards more effectively using start-stop technology, avoiding penalties, and guaranteeing that their cars are compliant. This conformity not only builds a strong relationship with regulatory organizations, but it also presents automakers as responsible about protecting the environment.

European customers are becoming more aware regarding the environmental effect of their purchasing decisions. This attitude is aligned with start-stop technology, and as awareness spreads, it becomes a selling point for automakers. Vehicle electrification with start-stop systems are typically viewed as more modern, eco-friendly, and sensitive to current environmental issues, which contributes to their commercial attractiveness. All these factors are anticipated to drive the start stop technology market size by country in upcoming year.

Impact of COVID-19 on the Global Start Stop Technology Industry

Lockdowns and mobility limitations resulted in a considerable decrease in overall driving activity. As there were fewer automobiles on the road and less urban congestion, the potential fuel savings from start-stop systems were not as significant.

- The elimination of the necessity for repeated engine pauses and restarts lessened the apparent immediate advantages of this technology, making it less appealing to both customers and manufacturers. Consumer preferences evolved during the pandemic owing to economic uncertainty and an emphasis on vital expenditures.

- Many prospective automobile purchasers were more concerned with criteria such as safety, dependability, and cost than with fuel economy. Although promising long-term economic benefits, start-stop technology took a back seat as consumers were cautious to invest in what would have been considered as an extra, non-essential feature at a financially unstable period.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the start stop technology growth projections from 2022 to 2032 to identify the prevailing start stop technology market opportunity

- The report provides exclusive and comprehensive analysis of the global start stop technology market overview along with the start stop technology companies.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the start stop technology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The start stop technology market report includes the analysis of the regional as well as global start stop technology market trends, key players, market segments, application areas, and market growth strategies.

Start Stop Technology Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.5 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BorgWarner Inc., AISIN SEIKI Co., Ltd., Robert Bosch GmbH, Delphi Automotive LLP, Continental AG, Johnson Controls, DENSO CORPORATION, Valeo, hitachi automotive systems, ltd. |

The start stop technology market size is expected to grow due to a reduction of fuel in idle times of the vehicle. In addition, the market is driven by developments in battery technology which improves the effectiveness of start-stop systems.

The major growth strategies adopted by the start stop technology market players are mergers, acquisitions, and strategic partnerships.

Asia-pacific will provide more business opportunities for the global start stop technology market in the future.

Valeo, Robert Bosch GmbH, Continental AG, DENSO CORPORATION, Mitsubishi Electric Corporation, BorgWarner Inc., AISIN SEIKI Co., Ltd., Delphi Automotive LLP, Johnson Controls, and Hitachi Automotive Systems, Ltd are the major players in the start stop technology market.

The belt-driven alternator starter (BAS) sub-segment of the product segment acquired the maximum share of the global start stop technology market in 2022.

Automobile manufacturers companies are the major customers in the global start stop technology market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global start stop technology market from 2022 to 2032 to determine the prevailing opportunities.

Start-stop technology is primarily adopted to improve fuel efficiency by reducing unnecessary fuel consumption when a vehicle is stationary, such as at traffic lights or in heavy traffic.

Advancements in battery technology, rising consumer demand for fuel efficiency, and surge in technological developments to drive the global start stop technology market.

Loading Table Of Content...

Loading Research Methodology...