Sterility Indicator Market Research, 2031

The global sterility indicators market size was valued at $879.3 million in 2021, and is projected to reach $2,599.3 million by 2031, growing at a CAGR of 11.5% from 2022 to 2031. Sterility indicators are used to demonstrate or characterize how well a sterilization process is performing. Sterilization is removing all living things as well as other foreign or biological agents, such as bacteria, viruses, fungi, prions, spore forms, and other species, from a specific region or site. Chemicals, heat, high pressure, radiation, and filtration are a few of the sterilization methods used. Biological, mechanical, and chemical sterility markers must be used to evaluate sterilization procedures. Sterilization processes must be observed using sterility indicators, such as biological, mechanical, and chemical sterility indicators. In addition, sterilization process includes, steam, ethylene oxide, dry heat, and others.

Growth of the global sterility indicators market size is majorly driven by increase in R&D activities by the pharmaceutical industry, high prevalence of chronic diseases such as cancer, diabetes, arthritis, and cancer, and rising demand for medicines and medical devices. Rise in the prevalence of hospital acquired infection, upsurge in the likelihood of epidemic or pandemic outbreak, and rise in the adoption of key strategies by sterility indicators industry boost the sterility indicators market growth. For instance, in April 2019, Fortive Corporation, a manufacturer of professional & engineered products, announced the acquisition of the advanced sterilization products (ASP) business from Ethicon Inc., a subsidiary of Johnson & Johnson. Moreover, rise in the number of product launch of sterility indicators drives the market growth. For instance, in May 2020, Getinge AB, a medical equipment manufacturing company, announced the launch of Superfast 20 Biological Indicator. It is used in the Central Sterile Supply Department (CSSD) to release loads safely, ensuring that the sterile instruments can be in the right place, at the right time.

Rise in the number of surgeries such as orthopedic surgeries, cardio-vascular surgeries, general surgeries, and others fuels the number of sterilization procedure of surgical instrument. Thus, this factor is anticipated to fuel the demand of sterility indicators and drive the growth of market. For instance, according to the American Joint Replacement Surgery, in 2020, around 2 million knee and hip replacement procedures were conducted in the U.S. In addition, according to the report shared by personalized orthopedics of the palm beaches, in November 2021, approximately 800,000 knee replacement surgeries were reported to have been performed each year in the U.S. Moreover, according to The German Arthroplasty Registry in May 2021, it was reported that around 723 hospitals submitted data sets of more than 315,000 arthroplasties, among which more than 175,000 were for hip replacement and more than 140,000 were knee replacements.

On the other hand, sterility indicators equipment flaws like the inability to identify operational issues like overloading the sterilizer, challenging package configuration in the load, improper sterilization equipment, noncompliance with sterilization standards, high device costs, and chemical exposure can hamper the growth of the sterility indicators market.

Sterility Indicators Market Segmentation

The sterility indicators market share is segmented into type, sterilization process and end user and region. By type, the market is divided into chemical indicators and biological indicators. The biological indicators are further bifurcated into self-contained vials, spore strips, and others. On the basis sterilization process steam, the market is segmented into steam, ethylene oxide, dry heat, and others. Others includes hydrogen peroxide and formaldehyde. On the basis of end user, the market is segmented into hospitals, pharmaceutical companies and medical device companies, and clinical laboratories/research centers. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

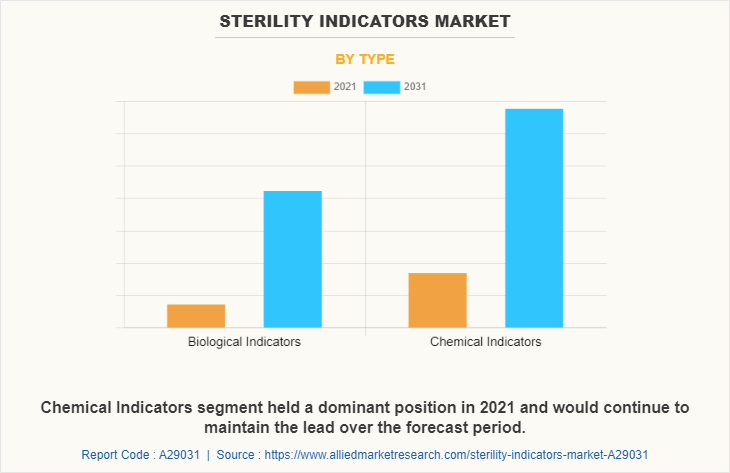

Sterility Indicators Market, By Type

The chemical indicators segment dominated the market in 2021, and is expected to continue this trend during the sterility indicators market forecast period, owing to wide use of chemical indicators in steam sterilization process and ethylene oxide sterilization process and rise in the number of sterilization process. However, the biological indicators segment is expected to witness considerable growth during the forecast period, owing to wide range of application of biological indicators in different types of sterilization process and rise in the use of sterility indicators in hospitals, biotechnology and pharmaceutical companies, and research institutes.

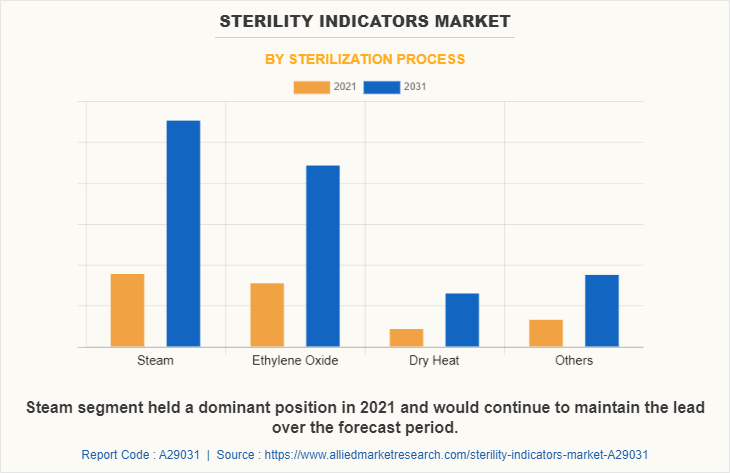

Sterility Indicators Market, By Sterilization Process

The steam segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to rise in the number of steam sterilization procedures in hospitals. However, the ethylene oxide segment is expected to witness considerable growth during the forecast period, as chemical sterility indicators are generally used in ethylene oxide sterilization technology, rise in the number of sterilization process in the hospitals, and increase in the number of surgical procedures.

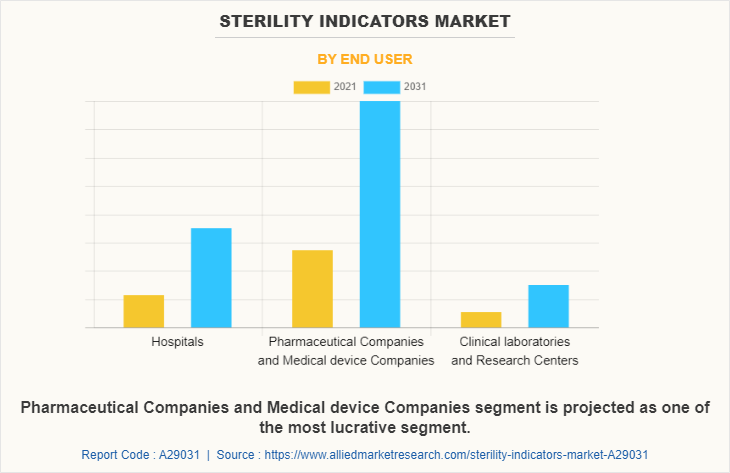

Sterility Indicators Market, By End User

The pharmaceutical companies and medical device companies segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to rise in the number of pharmaceutical companies and medical device companies and increase in the demand of medicines and medical devices. However, the hospitals segment is expected to witness considerable growth during the forecast period, owing to rise in the number of hospitals and increase in the number of surgical procedures.

Sterility Indicators Market, By Region

The North America market was dominant, in terms of revenue among other regions in 2021, owing to increase in number of root canal procedures, rise in number of sterility indicators industry who manufactures sterility indicators and developed healthcare infrastructure in North America. On the other hand, Asia-Pacific was the second-largest contributor in the market in 2021, and is expected to register fastest CAGR during the forecast period, owing to rise in the geriatric populations, rise in the awareness regarding usage of sterile products and devices, and rise in the number of chronic diseases.

Some of the major companies that operate in the global sterility indicators market share include, 3M Company, Anderson Products, Inc., Fortive Corporation, Cardinal, Crosstex International Inc., Getinge AB, gke-GmbH, Hu-Friedy Mfg. Co., LLC, Matachana Group, Mesa Labs, Inc., MMM Group, Nelson Laboratories, LLC, NOXILIZER INC, Propper Manufacturing Co., Inc., and STERIS plc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sterility indicators market analysis from 2021 to 2031 to identify the prevailing sterility indicators market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sterility indicators market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sterility indicators market trends, key players, market segments, application areas, and market growth strategies.

Sterility Indicators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.6 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 312 |

| By Type |

|

| By Sterilization Process |

|

| By End User |

|

| By Region |

|

| Key Market Players | 3M, Propper Manufacturing Co., Inc., MMM GROUP, STERIS plc, Crosstex International, Inc, Mesa Labs, Inc., STRYKER CORPORATION, Hu Friedy Mfg. Co., LLC, Anderson Products, Inc., Matachana Group, gke GmbH, Nelson Laboratories, LLC, Fortive Corporation, NOXILIZER INC, Sigma Aldrich, Cardinal Health Inc., Getinge AB |

Analyst Review

Sterilization indicators are instruments that support load monitoring, regular monitoring, and certification of sterilization processes. Rise in the number of surgical procedures, increase in sterilization procedures in pharmaceutical and biotechnology companies, rise in manufacturing of medical device and drugs, and increase in the number of product launch of sterility indicators drive the growth of the sterility indicator market.

Rise in adoption of key strategies, such as collaboration, acquisition, agreement, and partnership by key players of sterility indicators fuels the growth of the market. For instance, in April 2019, Fortive Corporation, a manufacturer of professional & engineered products, announced the acquisition of the advanced sterilization products (ASP) business from Ethicon Inc., a subsidiary of Johnson & Johnson. Moreover, in May 2020, Getinge AB, a medical equipment manufacturing company, announced the launch of Superfast 20 Biological Indicator. It is used in the central sterile supply department (CSSD) to release loads safely, ensuring that the sterile instruments can be in the right place, at the right time.

The top companies that hold the market share in sterility indicator market are 3M Company, Anderson Products, Inc., Fortive Corporation, Cardinal, Crosstex International Inc., Getinge AB, gke-GmbH, Hu-Friedy Mfg. Co., LLC, Matachana Group, Mesa Labs, Inc., MMM Group, Nelson Laboratories, LLC, NOXILIZER INC, Propper Manufacturing Co., Inc., and STERIS plc

Asia-Pacific is expected to register highest CAGR of 12.3% from 2022 to 2031, owing to rise in the geriatric populations, rise in the awareness regarding usage of sterile products and devices, and rise in the number of chronic diseases.

The key trends in the sterility indicator market are increase in R&D activities by the pharmaceutical industry, high prevalence of chronic diseases such as cancer, diabetes, arthritis, and cancer, and rising demand for medicines and medical devices.

The base year for the report is 2021.

Yes, sterility indicator market companies are profiled in the report

The total market value of sterility indicator market is $879.3 million in 2021.

The forecast period in the report is from 2022 to 2031

The market value of sterility indicator in 2022 was $978.0 million

Loading Table Of Content...