Stockbroking Market Research, 2031

The global stockbroking market was valued at $38.5 billion in 2021, and is projected to reach $112.7 billion by 2031, growing at a CAGR of 11.7% from 2022 to 2031.

A stockbroker is a financial expert who places trades for clients in the market. A stockbroker can also be referred to as an investment advisor or a registered representative (RR). In additional, majority of stock brokers work for brokerage firms and conduct businesses with several individuals and institutional clients. Although the methods of compensation vary by employer, commission-based payments are frequently made to stock broker advisor.

Factors such as rise in demand for reliable, fast, and effective order execution; emergence of favorable government regulations; and need for market surveillance primarily drive growth of the global stockbroking market. In addition, rise in demand for prevention of losses fuel demand for stockbroking. However, insufficient risk valuation capabilities may hamper the market growth to some extent. On the other hand, emergence of AI and algorithms in the financial services is expected to provide lucrative opportunities for the market growth during the forecast period. In addition, rise in demand for cloud-based solutions is anticipated to be opportunistic for the market growth during the forecast period.

The report focuses on growth prospects, restraints, and trends of the stockbroking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the stockbroking market outlook.

The stockbroking market is segmented into Services, Type of Broker, Mode, Trading Type and End User.

Segment Review

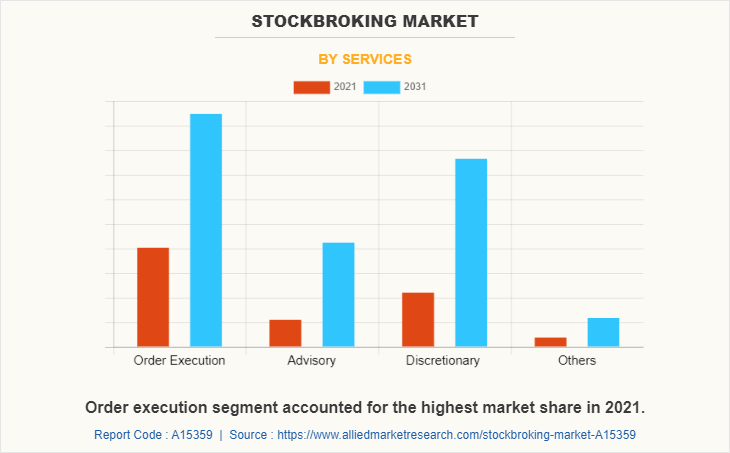

The stockbroking market is segmented into service, type of broker, mode, trading type, end user, and region. By service, the market is differentiated into order execution, advisory, discretionary, and others. The advisory segment is further divided into portfolio management, investment advisory, financial planning, and others. The portfolio management is further segregated into active portfolio management and passive portfolio management. Depending on type of broker, it is fragmented into full-service brokers, discount brokers and robo-advisors. By mode, the market is segregated into online and offline. By trading type, it is segmented into short-term trading and long-term trading. By end user, the market is segmented into retail investor and institutional investor. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By services, the order execution segment attained the highest stockbroking market share in stockbroking market in 2021. This is attributed to the fact that popularity of online stockbrokers has significantly decreased cost of buying and selling of stocks. Moreover, if a customer executes a specific number of transactions or trades with a particular dollar amount each month, many brokers offer them a commission refund.

Region wise, North America dominated the stockbroking market size in 2021. This was attributed to a number of factors including huge investments in trading technologies and increase in government support for global trading. In addition, extensive presence of stock market trading vendors in the region propels the growth of the market.

The key players that operate in the global stockbroking market include as Angel One Limited, Axis Direct, Charles Schwab & Co., Inc., E-Trade, FMR LLC, ICICI Securities Ltd., InfoReach, Inc., Interactive Brokers LLC, MetaQuotes Ltd, NinjaTrader, Tethys Technology, Upstox, VIRTU Financial Inc., ZacksTrade, Zerodha Broking Ltd., Myalgomate Technologies LLP, and Tridge. These players have adopted various strategies to increase their market penetration and strengthen their position in the stockbroking market.

COVID-19 Impact Analysis

The COVID-19 outbreak has low impact on growth of the stockbroking industry as adoption of stock market trading solutions has increased in the face of unprecedented circumstances. Moreover, software development witnessed a considerable increase in the fluctuating demands for cybersecurity during pandemic. As a result, the stockbroking industry started using various technologies such as AI and ML for predicting the stocks behavior. This, in, turn, boosted the growth of stockbroking industry during the pandemic.

Top Impacting Factors

Stockbroking Services aid in Monitoring Investments in Real Time

Utilizing an internet stockbroking platform makes real-time monitoring of investments much more convenient. Users have access to a strong set of tools and resources made available by various online trading organizations. These resources offer users with information that can be used to make their trading transactions more successful. In addition, users of online trading platforms have the ability to easily monitor performance of their assets, owing to real-time stock data and trade data that are provided by these platforms. Using internet portals, traders can keep track of how well their investments are performing. Moreover, it gives traders the ability to determine what changes are necessary to improve their outcomes. People get information about factors that have an effect on the market and companies also make the required shifts in the market circumstances available to them so that the results they get are as accurate as possible to the market situation.

Furthermore, many online trading applications provide real-time capabilities for analyzing currency pairs in depth, shifting currency pairs, and simplifying trend analysis. In addition, traders can generate fresh and real-time trading notifications to optimize the strategy. Software trading helps record keeping by storing and making trading records searchable. Through digital data, traders can study their previous businesses, learn from their failures, and find the best past practices. Thus, this factor drives the stockbroking market growth.

Rise in Demand for Reliable, Fast, and Effective Order Execution

Stockbroking is rapidly being used by big brokerage houses as well as institutional investors to cut down on costs associated with trading. This is attributed to the fact that stockbroking enables easier and faster execution of orders, making it attractive for exchanges. In addition, it enables investors and traders to quickly book profits off small changes in price. Hence, rise in demand for effective trade drives growth of the stockbroking market, as it enables users to quickly execute trades.

Need for Market Surveillance

Stock market surveillance or trade surveillance includes capturing trade data and then analyzing and monitoring it to detect potential market abuse as well as other forms of financial crime, such as rogue trading. Legal definition of trade surveillance varies by country. For instance, in the UK, it includes insider dealing, market manipulation, unlawful disclosure, and attempted manipulation. In addition, increase in high-frequency related incidences has raised global concerns about market stability and integrity. Hence, there is a rise in need for market surveillance, which fuels demand for stockbroking solutions with market surveillance capabilities, driving growth of the market. For instance, Software AG offers a trade surveillance solution based on Complex Event Processing (CEP) engine that processes vast volumes of information, including both historical and live streaming data to detect positive and negative trading patterns.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market analysis from 2021 to 2031 to identify the prevailing stockbroking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the stockbroking market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stockbroking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stockbroking market trends, key players, market segments, application areas, and market growth strategies.

Stockbroking Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 112.7 billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 416 |

| By Services |

|

| By Type of Broker |

|

| By Mode |

|

| By Trading Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Axis Direct, FMR LLC, E-Trade, ZacksTrade, Zerodha Broking Ltd., InfoReach, Inc., Angel One Limited, Myalgomate Technologies LLP, Interactive Brokers LLC, VIRTU Financial Inc., Charles Schwab & Co., Inc., Tridge, Upstox, ICICI Securities Ltd., MetaQuotes Ltd, NinjaTrader, Tethys Technology |

Analyst Review

The market for stockbroking is witnessing a rise, owing to increase in demand for automated trading strategies, growth in internet of things (IoT) & cloud-based service use, and increase in acceptance of these technologies by brokers. In addition, growth in preference of people to hire stockbrokers for trading and to prevent huge money losses fuel growth of the market. Furthermore, integration of AI has assisted brokers to monitor their portfolio in a convenient way. These factors are expected to create lucrative opportunities for the market growth in upcoming years.

The COVID-19 outbreak has a positive impact on the stockbroking market. Moreover, the pandemic has led to a huge demand for trading activities, owing to increase in awareness regarding stock market, especially among millennials. Moreover, rise in technological development such as predictive analytics and digital record keeping has led to growth of the market.

The stockbroking market is fragmented with the presence of regional vendors such as Angel One Limited, Axis Direct, Charles Schwab & Co., Inc., E-Trade, FMR LLC, ICICI Securities Ltd., InfoReach, Inc., Interactive Brokers LLC, MetaQuotes Ltd, NinjaTrader, Tethys Technology, Upstox, VIRTU Financial Inc., ZacksTrade, Zerodha Broking Ltd., Myalgomate Technologies LLP, and Tridge. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with increase in awareness & demand for stockbroking across the globe

The stockbroking market is estimated to grow at a CAGR of 11.7% from 2022 to 2031.

The stockbroking market is projected to reach $112.66 billion by 2031.

The fact that stockbroking services aids in monitoring the investment in real time, rise in demand for reliable, fast, and effective order execution and the need for market surveillance majorly contribute toward the growth of the market.

The key players profiled in the report include Angel One Limited, Axis Direct, Charles Schwab & Co., Inc., E-Trade, FMR LLC, ICICI Securities Ltd., InfoReach, Inc., Interactive Brokers LLC, MetaQuotes Ltd, NinjaTrader, Tethys Technology, Upstox, VIRTU Financial Inc., ZacksTrade, Zerodha Broking Ltd., Myalgomate Technologies LLP, and Tridge.

The key growth strategies of stockbroking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...