Stop Loss Insurance Market Research, 2034

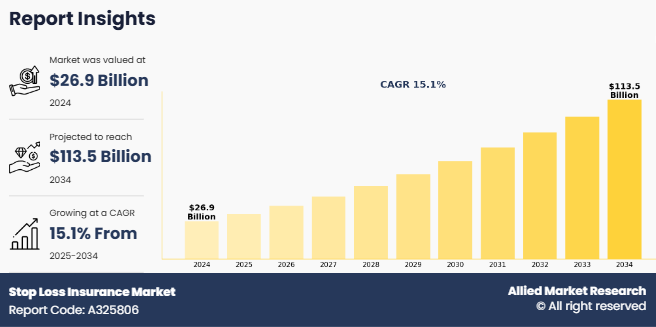

The stop loss insurance market was valued at $26.9 billion in 2024 and is estimated to reach $113.5 billion by 2034, exhibiting a CAGR of 15.1% from 2025 to 2034.

A Stop loss insurance is a type of insurance that protects companies that offer health benefits to their employees. When a company pays for its employees' medical claims directly, called self-funding, it can sometimes face very high costs if an employee has a serious illness or injury. Stop loss insurance helps cover the costs when medical claims exceed a certain limit. There are two types of stop loss insurance, individual stop loss, which protects against high claims from one person, and aggregate stop loss, which protects if total claims for all employees are too high. This insurance helps companies manage risk and avoid unexpected financial losses from large healthcare bills, making self-funded plans safer and more predictable.

Key Takeaways:

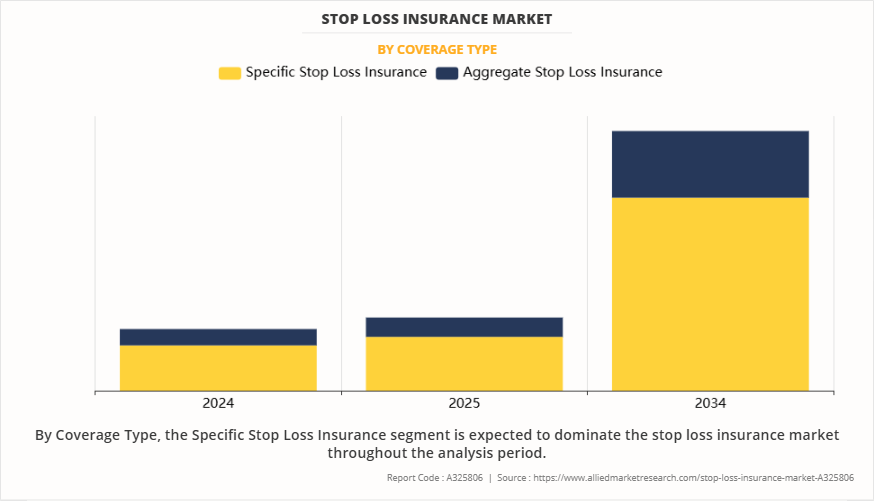

- By coverage type, the specific stop loss insurance segment held the largest share in the stop loss insurance market for 2024.

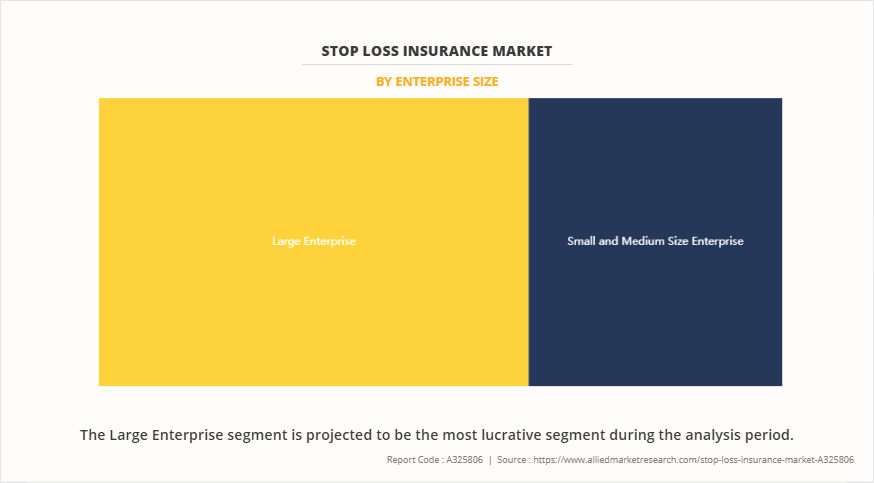

- By enterprise size, the large enterprise segment held the largest share in the stop loss insurance market for 2024.

- By industry vertical, the healthcare segment held the largest share in the stop loss insurance market for 2024.

- Region-wise, North America held the largest stop loss insurance market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The stop loss insurance market size is expanding as more businesses choose self-funded health plans to manage rising healthcare costs. In self-funded plans, employers pay employee medical claims directly, which can lead to large, unexpected expenses. To reduce this financial risk, companies are turning to stop loss insurance for protection. As healthcare needs grow and become more complex, especially with the increased use of technology and digital tools in healthcare, businesses need stronger safeguards. This shift is driving demand for flexible stop loss coverage that can be tailored to each employers needs. Employers also seek added value, like faster claims processing and support services. With the rise of technology in everyday operations, more companies are expected to adopt self-funded plans, fueling further growth in the stop loss insurance market. However, the high cost of stop loss insurance can discourage some small employers, especially when covering limited risks. For them, paying out-of-pocket may seem more affordable than buying coverage.

Furthermore, the increase in the cost of healthcare is driving the stop loss insurance market growth. As medical expenses continue to grow, employers offering self-funded health plans face the risk of high-cost claims. To manage these unexpected expenses, many turn to stop loss insurance for financial protection. This growing need to control healthcare spending is boosting the demand for stop loss coverage, helping the stop loss insurance market expand gradually across various industries.

Segment Review

The stop loss insurance market is segmented on the basis of coverage type, organization size, industry vertical and region. By coverage type, it is bifurcated into specific stop loss and aggregate stop loss. By organization size, it is classified into large enterprises, and small and medium-sized enterprises., By industry vertical, it is segmented into healthcare, manufacturing, retail and e-commerce, IT and telecommunication, BFSI, and others. By region, the stop loss insurance market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of enterprise size, it is segmented into large enterprise and small and medium size enterprise. The global stop loss insurance market share was dominated by the large enterprise segment in 2024, owing to the greater financial exposure and higher risk of large claims faced by these organizations. Large enterprises often opt for stop loss insurance to manage unpredictable healthcare costs and safeguard against catastrophic losses. Their ability to invest in comprehensive coverage also contributes to the sustained dominance of this segment in the stop loss insurance market.

However, the small and medium sized enterprise segment is expected to register the highest CAGR during the forecast period. This is attributed to the growing adoption of self-funded health plans among SMEs, driven by the need to manage healthcare costs effectively while maintaining employee benefits, along with increasing awareness of stop loss insurance solutions.

On the basis of coverage type, it is classified into specific stop loss insurance and aggregate stop loss insurance. The specific stop loss insurance segment dominated the stop loss insurance market share in 2024, This is attributed to the growing preference among self-funded employers to manage high-cost claims effectively while minimizing financial risk. Specific stop loss insurance protects against uncertain claims exceeding a predetermined threshold, offering predictability and budget stability.

However, the aggregate stop loss insurance segment is expected to register the highest CAGR during the forecast period, owing to the rise in healthcare costs and the increase in adoption of self-funded insurance plans by employers seeking cost control. Aggregate stop loss insurance provides broader protection against high cumulative claims, making it an attractive option for organizations aiming to mitigate financial risk and enhance budget predictability.

Competition Analysis

The report analyzes the profiles of key players operating in the stop loss insurance market such as HM Insurance Group, Berkshire Hathaway Specialty Insurance, Nationwide Mutual Insurance Company, Sun Life Assurance Company of Canada, Tokio Marine HCC, BCS Financial Corporation, Swiss Re., Voya Financial , Liberty Mutual Insurance Company, Cigna Healthcare, Berkley Accident and Health, QBE Holdings, Inc., Mercer LLC., Everest Group, Ltd., Lakeshore Benefit Group, LLC., VÄlenz Health, Amwins, Avant Specialty Benefits, Zurich North America. These players have adopted various strategies to increase their market penetration and strengthen their position in the stop loss insurance market.

Recent Key Developments in the Stop Loss Insurance market

- In January 2025, Nationwide announced its agreement to purchase Allstate's employer stop-loss segment for $1.25 billion. This strategic acquisition aims to expand Nationwide Financial's portfolio and better serve small businesses. The deal is expected to close in the second half of 2025, pending regulatory approvals.

- In September 2024, Prudential Financial introduced a new stop-loss insurance product tailored for self-funded employer health plans. The offering emphasises competitive rates, flexible policy options, and a consultative approach to address complex stop-loss challenges. This launch signifies Prudential's commitment to expanding its presence in the stop-loss market.

Top Impacting Factors

Driver

Rising Healthcare Costs

Healthcare expenses have been increasing rapidly, causing financial challenges for many employers who pay for their employees medical bills. In self-funded health plans, employers cover these costs directly instead of buying traditional health insurance. While this approach can save money, it also means employers face the risk of very high medical bills if an employee has a serious illness or injury. Stop loss insurance helps by protecting employers from these unexpectedly large costs. When medical claims go above a set limit, the stop loss insurance covers the extra amount. This protection gives employers confidence to offer self-funded plans without worrying about huge financial losses.

Moreover, as the healthcare costs keep rising due to expensive treatments, new drugs, and longer care periods, many employers are choosing medical stop loss insurance to manage their risks. It especially appeals to medium and large companies that want to control their health benefit expenses but need a safety net for high claims. This growing concern about unpredictable and high healthcare spending is pushing the stop loss insurance market to expand steadily. As medical costs continue to rise, more employers see stop loss insurance as essential to protect their budgets while providing health benefits to employees. This trend is expected to strengthen the market in the coming years.

Restraints

High Premiums for Small Employers

High premiums are a major hurdle limiting the growth of stop loss insurance among small employers. Compared to larger companies, small businesses often face much higher costs per employee for stop loss coverage. This is because insurers spread the risk over a smaller group, which increases the chances of large claims and raises premiums. As a result, many small employers find these insurance costs difficult to manage within their budgets. Small businesses usually have limited financial resources and often prioritize essential expenses, making expensive stop loss premiums less affordable. This leads many to avoid self-funding health plans or purchasing stop loss insurance, even if these options could offer better long-term savings and risk protection. The high premium costs act as a barrier, preventing many small employers from benefiting from stop loss coverage. Insurers also tend to offer less flexible terms to small employers, as their smaller size means less predictable claims experience. This contributes to higher costs and sometimes restrictive policy conditions. Without tailored, affordable solutions for smaller businesses, the stop loss insurance market will continue to see slow adoption in this segment due to premium challenges.

Opportunity

Digital Transformation and Automation

Digital transformation and automation are creating new possibilities in the stop loss insurance market. Insurance companies are adopting advanced technologies like artificial intelligence (AI), machine learning, and data analytics to improve how they assess risk and process claims. These technologies help insurers analyze large amounts of healthcare data quickly and accurately, leading to better pricing and customized coverage for clients. Automation also speeds up administrative tasks such as underwriting, policy issuance, and claims management. This reduces human errors and cuts down the time needed to handle complex stop loss policies. Faster processing improves customer experience by making it easier for employers and brokers to buy and manage insurance.

Moreover, digital tools allow insurers to offer online portals and mobile apps that give clients real-time access to their policies, claims status, and important documents. This transparency builds trust and encourages more employers to choose self-funded plans backed by stop loss insurance. In addition, predictive analytics can help insurers identify high-cost claims early and manage risks proactively. This leads to better cost control and improved financial outcomes for both insurers and employers. As the stop loss insurance market outlook becomes increasingly shaped by technological innovation, companies that invest in digital solutions and automation are expected to stand out by offering more efficient, flexible, and customer-friendly services. This digital shift is helping the stop loss insurance market forecast to project continued growth, driven by rising adoption of tech-enabled insurance processes and improved operational efficiency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the stop loss insurance industry segments, current trends, estimations, and dynamics of the stop loss insurance market analysis from 2024 to 2034 to identify the prevailing stop loss insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stop loss insurance industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stop loss insurance market trends, key players, market segments, application areas, and market growth strategies.

Stop Loss Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 113.5 billion |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 194 |

| By Coverage Type |

|

| By Industry Vertical |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Nationwide Mutual Insurance Company, Mercer LLC, Lakeshore Benefit Group, LLC, Zurich Insurance Group Ltd., HM Insurance Group, Swiss Re, Cigna Healthcare, QBE Insurance Group Limited, Tokio Marine HCC, V?lenz Health, Liberty Mutual Insurance Company, Everest Group, Ltd. , Amwins, Voya Financial, Inc., Berkshire Hathaway Specialty Insurance, Berkley Accident and Health, Avant Specialty Benefits, BCS Financial Corporation , Sun Life Assurance Company of Canada |

Analyst Review

As the stop loss insurance market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The stop loss insurance market is experiencing significant growth, driven by the increasing demand for financial protection against high-cost medical claims. As healthcare costs continue to rise, employers, particularly those with self-funded health plans, are turning to stop loss insurance to limit their exposure to large, unexpected expenses. This type of insurance helps safeguard organizations from catastrophic losses by covering claims that exceed a predefined threshold. The growing need for cost control and risk management in employee health benefits is fueling market demand. In addition, the rise of data-driven healthcare management and third-party administrators (TPAs) is making it easier for employers to integrate stop loss coverage into their benefit plans. The convenience of bundling stop loss policies with other administrative services allows for streamlined claims processing and better financial planning. Moreover, insurers are offering more flexible and customizable policies that cater to various business sizes and risk levels, making stop loss insurance more accessible and attractive. As businesses continue to seek ways to protect their bottom line while offering competitive benefits, the demand for stop loss insurance is expected to grow steadily.

Moreover, the growth of self-funded employer health plans is driving demand in the stop loss insurance market. Organizations are increasingly seeking financial protection against unpredictable, high-cost medical claims, making stop loss coverage essential for risk management. This insurance allows employers to take advantage of the flexibility and cost-saving potential of self-funding while safeguarding their budgets from catastrophic losses. A key trend is the rising use of level-funded plans by small and mid-sized employers, offering fixed monthly payments with the protection of stop loss coverage. However, challenges remain, including rising healthcare costs, policy complexity, and the need for better integration with third-party administrators. Despite these challenges, the stop loss insurance market is poised for continued growth as more employers seek cost-effective and sustainable ways to manage employee healthcare expenses.

The integration of AI and predictive analytics for risk management and the rising adoption of self-funded health plans among employers the upcoming trends of Stop Loss Insurance Market in the globe.

Specfic stop loss insurance is the leading coverage type of the Stop Loss Insurance Market.

North America is the largest regional market for Stop Loss Insurance.

$113.5 billion is the estimated industry size of Stop Loss Insurance

HM Insurance Group, Berkshire Hathaway Specialty Insurance, Nationwide Mutual Insurance Company, Sun Life Assurance Company of Canada, Tokio Marine HCC, BCS Financial Corporation, Swiss Re., Voya Financial, Liberty Mutual Insurance Company, Cigna Healthcare, Berkley Accident and Health, QBE Holdings, Inc., Mercer LLC., Everest Group, Ltd., Lakeshore Benefit Group, LLC., V?lenz Health, Amwins, Avant Specialty Benefits, and Zurich North America. are the top companies to hold the market share in Stop Loss Insurance.

Loading Table Of Content...

Loading Research Methodology...