Storage Management Software Market Overview

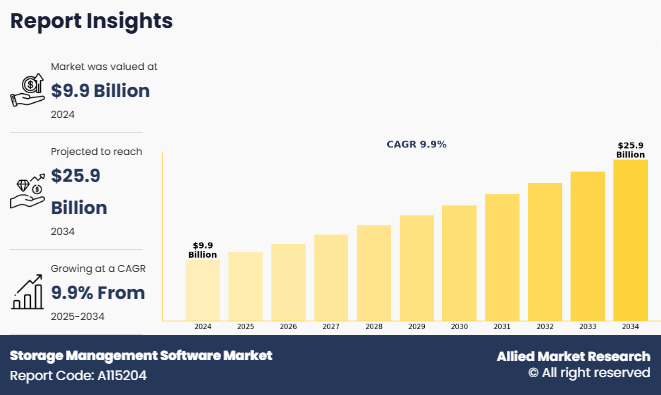

The global storage management software market size was valued at USD 9,850.15 million in 2024, and is projected to reach USD 25,853.66 million by 2034, growing at a CAGR of 9.9% from 2025 to 2034.

Storage management software is a specialized type of software that helps organizations manage their data storage systems more effectively. It includes a wide range of features such as storage allocation, performance monitoring, backup and recovery, data archiving, and security management. The software enables IT teams to deliver the right amount of storage to users and applications based on their needs, ensuring high performance and reliable access. It also helps in automating data backups, managing storage capacity, and implementing tiered storage systems that place data in the most suitable storage environment based on its usage. With built-in tools for data replication, encryption, access control, and reporting, storage management software enhances data security, ensures regulatory compliance, and helps prevent data loss.

Key Takeaways

By Deployment Mode, the cloud segment held the largest share in the storage management software market for 2024.

By Enterprise Size, the large enterprise segment held the largest share in the storage management software market for 2024

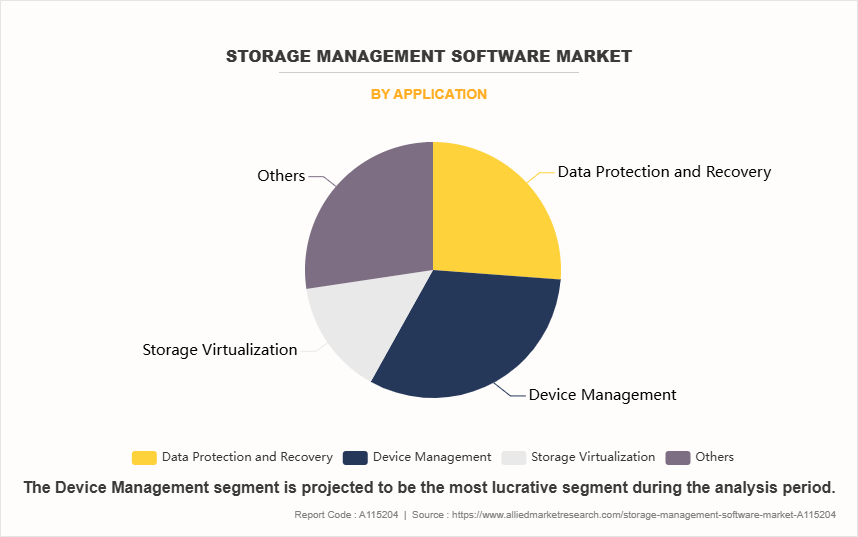

By Application, the device management segment held the largest share in the storage management software market for 2024.

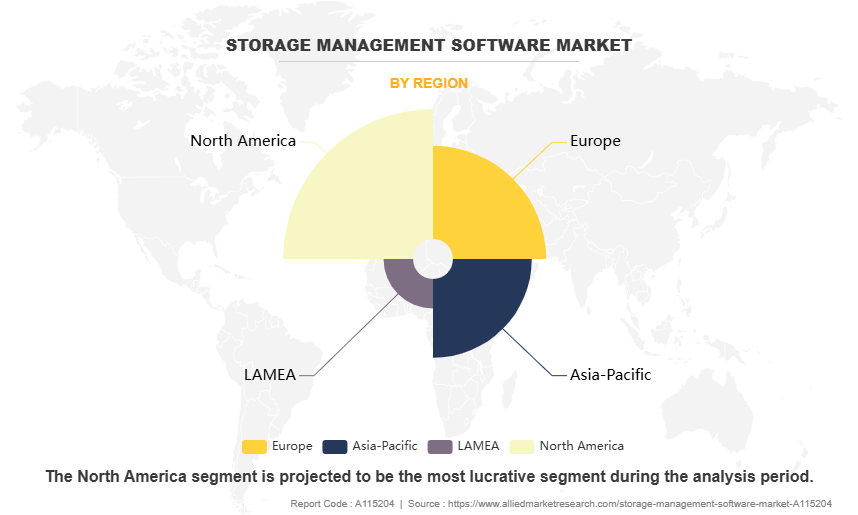

Region-wise, North America held the largest market share in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

The major factor driving the growth of the storage management software industry is the significant increase in data generation, driven by rise in the need for advanced storage solutions to manage vast amounts of information efficiently. The storage management software market size is expected to expand as more organizations embrace digital transformation, emphasizing the need for scalable, reliable, and secure storage systems. In addition, the widespread adoption of cloud computing offering scalability, flexibility, and cost-effectiveness, prompting businesses to invest in storage management software that supports cloud environments, positively impact the growth of the storage management software market demand. Furthermore, surge in the integration of AI and ML in storage optimization is expected to provide remunerative growth opportunities for the market during the storage management software market forecast period. Moreover, the upsurge in the adoption of edge computing, driven by IoT devices and real-time data needs, has boosted demand for storage solutions that manage distributed data. This is expected to create lucrative storage management software market opportunity for the growth.

Segment Review

The storage management software market is segmented into deployment mode, enterprise size, application, and region. On the basis of deployment mode, the market is divided into cloud and on-premises. By enterprise size, it is bifurcated into SMBs and large enterprises. Depending on application, it is segregated into data protection and recovery, device management, storage virtualization, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the global storage management software market share was dominated by the device management segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the growing demand for efficient storage optimization, real-time monitoring, and automation in enterprise IT infrastructure. In addition, there is growing emphasis on reducing operational costs and improving data security, further driving adoption. However, the storage virtualization segment is expected to experience the highest growth during the forecast period. This segment is experiencing increasing adoption due to its ability to enhance scalability, reduce hardware dependency, and streamline data center operations.

By region, North America dominated the market share in 2024, owing to an increase in the adoption of advanced technologies like cloud computing, AI-driven storage solutions, and stringent data compliance requirements, contributing significantly to the region’s storage management software market growth. However, LAMEA (Latin America, Middle East, and Africa) is expected to experience the fastest growth during the forecast period. The region is experiencing an increase in the digital transformation initiatives, expansion of data centers, and rise in investments in IT infrastructure, which is expected to provide lucrative growth opportunities for the market in this region.

Top Impacting Factors

Market Drivers

Increase in data volumes

The increase in volume of data generated across industries and the rise in adoption of digital transformation initiatives, driven by the demand for advanced storage management solutions, fuels the storage management software market growth. As organizations strive to efficiently and securely manage vast amounts of data, the demand for advanced storage management solutions is growing rapidly. Key industries, including Banking, Financial Services, and Insurance (BFSI), healthcare, retail, and manufacturing, are increasingly reliant on storage management software to ensure data availability, enhance operational efficiency, and optimize storage resources. These factors are expected to augment the market growth.

Furthermore, the surge in the emergence of 4K/8K video, VR/AR, gaming, and rich media content driven by upsurge in the demand for storage solutions, especially in the media & entertainment, education, and healthcare sectors, presents numerous opportunities for the market growth. In addition, the growth of online transactions, digital customer data, and personalized marketing campaigns are generating huge volumes of structured and unstructured data requiring efficient storage, processing, and management solutions. This explosion of data is pushing organizations to adopt advanced storage technologies such as cloud storage, hybrid storage systems, and AI-driven data management platforms.

For instance, in November 2023, DDN launched Infinia, a next-generation software-defined storage platform designed to meet the needs of enterprise AI and cloud environments. Infinia leverages DDN's extensive experience in file systems, data orchestration, and AI-based optimization to provide a highly efficient, secure, and scalable solution. Key features include multi-tenancy, containerization, and advanced security attributes, all aimed at simplifying data management and accelerating workflows. This is expected to significantly boost innovation in the storage management software market, enabling enterprises to handle increasingly complex and data-intensive workloads with greater agility and cost-efficiency.

Restraints

Rising threat of cyber attacks

The major challenge for the growth of storage management software market is due to rise in cybersecurity concerns, which pose a challenge to the adoption and growth of storage solutions. The growing trend towards cloud-based and decentralized systems has led to increase in the risk of cyberattacks and unauthorized access to sensitive information. Organizations are increasingly concerned regarding the risks of breaches, ransomware, and data theft, which can jeopardize operations and erode customer trust. The integration of multiple systems and networks in storage management software expands the attack surface, making it more susceptible to cybercriminal exploitation.

Moreover, adhering to data protection regulations adds another layer of complexity, requiring organizations to ensure their storage solutions are secure and comply with strict privacy standards. The continuous evolution of cybersecurity threats makes it challenging for storage management software providers to offer solutions that guarantee complete protection. This uncertainty causes businesses, especially small and medium enterprises, to hesitate in fully adopting these technologies due to the potential risks and costs associated with security breaches. As a result, cybersecurity concerns significantly impede the growth and widespread adoption of storage management software. To address these challenges, storage management software providers are increasingly investing in advanced security features such as end-to-end encryption, zero-trust architectures, AI-driven threat detection, and compliance automation tools, which helps to drive the market growth.

Opportunity

AI and ML in storage optimization

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in storage management software presents significant opportunities for storage management software market to enhance operational efficiency, reduce costs, and deliver smarter, automated solutions for data storage. AI and ML algorithms help to analyze historical data usage patterns to predict future storage needs, enabling proactive resource planning, proactive capacity planning, helping organizations to avoid costly over-provisioning or under-provisioning. In addition, the increase in use of ML models helps to identify anomalies, detect inefficiencies, and suggest real-time corrective actions to enhance performance and resource utilization.

Furthermore, AI-driven storage systems automatically classify data by usage frequency and business relevance, keeping hot data on high-performance storage and moving cold data to cost-effective archival solutions. This boosts performance and significantly cuts storage costs. These advanced technologies offer businesses a competitive edge by enabling smarter decision-making, streamlined storage operations, and improved scalability.

Moreover, in complex hybrid and multi-cloud environments, AI and ML help to optimize storage across diverse platforms by providing centralized visibility, intelligent data placement, and automated workload balancing. In addition, vendors are increasingly investing in AI/ML capabilities that offer high-value solutions to meet evolving enterprise needs, creating significant opportunities for innovation and growth in AI-powered storage technologies.

For instance, in October 2024, NetApp launched its ONTAP Data Platform for AI, designed to enhance data management in AI applications. This platform leverages a disaggregated compute/storage architecture, providing high-speed, low-latency access to data. It supports file, block, and object storage, and includes advanced features like dynamic workload balancing and NVMe SSD storage. This is expected to strengthen NetApp’s position in the AI-driven storage market and set a benchmark for intelligent data infrastructure solutions. By integrating advanced AI capabilities into its ONTAP Data Platform, NetApp addresses the growing demand for agile, scalable, and high-performance storage systems tailored to AI and ML workloads. Such innovations are set to drive wider use of AI-powered storage solutions and boost market growth.

Recent Developments in the Storage Management Software Market

In January 2025, Broadcom launched the Emulex Secure Fibre Channel Host Bus Adapters (HBA), which offer quantum-resistant network encryption. This innovation is designed to protect data in transit between servers and storage, addressing the increasing threat of ransomware and complying with new government regulations. The solution provides real-time ransomware detection and maintains storage array services like deduplication and compression, which are often compromised by application-based encryption.

In October 2024, Vodafone and Google announced a significant expansion of their strategic partnership with a ten-year, billion-dollar deal. This collaboration aims to bring new AI-powered devices and services to millions of Vodafone's customers across Europe and Africa. Key highlights include the introduction of Google’s generative AI models, enhanced access to Google’s Pixel devices via Vodafone’s 5G network, and the development of new cloud-native security services using Google Cloud’s Security Operations platform. This partnership is set to enhance customer experiences and drive innovation in the telecommunications sector.

In September 2024, Pure Storage partnered with Rubrik to offer a comprehensive cyber resilience solution, combining the strengths of Rubrik Security Cloud and Pure Storage's platform. This collaboration aims to protect data and minimize downtime by providing a modern solution architecture for both short- and long-term data storage and protection. The partnership ensures that organizations' critical data is secure and quickly recoverable, addressing the challenges of exponential data growth and increasing cyber threats.

Competition Analysis

The report analyzes the profiles of key players operating in the storage management software market are Zoho Corporation Pvt. Ltd., SolarWinds Worldwide, LLC, Microsoft Corporation, Hitachi Vantara LLC., Tiger Technology AD, Broadcom, Inc., NetApp, IBM Corporation, Amazon Web Services, Inc., Arcserve, LLC, Cohesity, Inc., Pure Storage, Inc., Alphabet, Dell Technologies, and Veritas Technologies LLC. These players have adopted various strategies such as mergers and acquisitions, product innovation, strategic partnerships, and expansion into emerging markets to enhance their technological capabilities and global reach in the storage management software industry.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the storage management software market analysis from 2024 to 2034 to identify the prevailing storage management software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the storage management software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global storage management software market trends, key players, market segments, application areas, and market growth strategies.

Storage Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 25.9 billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Arcserve, LLC, Dell Technologies Inc., Tiger Technology AD, Broadcom, Inc., Alphabet Inc., SolarWinds Worldwide, LLC, Zoho Corporation Pvt. Ltd., Cohesity, Inc., Amazon Web Services, Inc., IBM Corporation, Microsoft Corporation, Veritas Technologies LLC, NetApp, Hitachi Vantara LLC, Pure Storage, Inc. |

Analyst Review

The storage management software market is experiencing robust growth, fueled by the escalating need for efficient data handling and the exponential rise in digital data volumes. As enterprises increasingly adopt cloud computing, hybrid IT environments, and edge computing, storage management solutions are becoming essential for optimizing storage resources, ensuring data availability, and reducing operational complexities. Innovations such as AI-driven automation, predictive analytics, software-defined storage (SDS), and unified storage management platforms are revolutionizing traditional data storage strategies. In addition, the growing emphasis on data security, compliance requirements, and business continuity is driving demand for more intelligent and scalable storage solutions. With increasing investments from enterprises, support from government digital transformation initiatives, and the proliferation of data-intensive technologies like IoT and big data, the market for storage management software is poised for significant expansion in both developed and emerging economies.

Furthermore, technological advancements in cloud infrastructure, AI-driven analytics, and IoT-enabled storage solutions are significantly propelling the growth of the storage management software market. Modern storage management platforms now offer enhanced capabilities such as real-time data monitoring, predictive storage optimization, automated backup and recovery, and seamless integration with multi-cloud and mobile environments, enabling organizations to manage data more efficiently and securely. The surge in storage-centric startups, along with increasing collaboration between enterprise IT departments, cloud service providers, and cybersecurity firms, presents numerous opportunities for stakeholders to leverage the expanding demand for intelligent and scalable storage solutions.

Moreover, government policies and regulations promoting digital transformation and data security are significantly driving the growth of the storage management software market. Governments worldwide are encouraging the adoption of advanced data management solutions to enhance cybersecurity, support digital infrastructure, and ensure regulatory compliance in sectors such as healthcare, finance, and public services. Initiatives such as IT modernization funding, tax incentives for cloud and data security solutions, and data sovereignty frameworks are accelerating market adoption. However, challenges persist, including evolving compliance requirements, managing data across hybrid environments, and the need for standardized protocols. Ensuring the security and privacy of sensitive data while maintaining accessibility and cost-efficiency is a key concern for enterprises. Despite these challenges, the storage management software market is poised for continued growth, especially in emerging markets where digital infrastructure is rapidly developing, driven by the demand for intelligent data solutions.

The storage management software market is projected to reach $25,853.66 million by 2034.

The storage management software market is estimated to grow at a CAGR of 9.9% from 2025 to 2034.

The storage management software market is expected to witness notable growth due to a rise in data volumes and an increase in the adoption of cloud storage solutions.

The key players profiled in the report include Zoho Corporation Pvt. Ltd., SolarWinds Worldwide, LLC, Microsoft Corporation, Hitachi Vantara LLC., Tiger Technology AD, Broadcom, Inc., NetApp, IBM Corporation, Amazon Web Services, Inc., Arcserve, LLC, Cohesity, Inc., Pure Storage, Inc., Alphabet, Dell Technologies, and Veritas Technologies LLC.

The key growth strategies of storage management software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...