Storefront Glass Market Research, 2032

The Global Storefront Glass Market size was valued at USD 5.6 billion in 2020, and is projected to reach USD 13.3 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Storefront glass is a particular type of glass that is used to create the exterior facade of structures used for commerce and retail. The translucent or transparent barriers that glass used in storefronts is meant to produce are meant to let light into the building while enabling a view inside the business. Glass storefronts are a crucial component of commercial design because they give businesses a stunning display area while also making an appealing and eye-catching entrance.

Matket Dynamics

The market for storefront windows and doors is anticipated to grow as a result of the increase in the development of commercial and institutional buildings. Due to their huge metropolitan populations and high levels of disposable income, major nations including the U.S., China, Germany, and India are predicted to be prospective markets for the construction of commercial spaces. The World Bank estimates that 56% of people live in urban areas worldwide, and that number is predicted to rise to 70% by 2050. Buildings like retail stores, hotels, and other commercial real estate are expanding considerably and are giving the expanding urban population the infrastructure, they need.

Additionally, the IT sector and other service sector professions are in high demand in nations like China and India, which is a major factor in the development of commercial buildings used as offices. For instance, the demand for office space is forecast to increase in India, with urbanization in Delhi-NCR, Mumbai, and Bengaluru all expected to increase at the same time, according to the India Brand Equity Foundation (IBEF). Additionally, storefront glasses were necessary for this kind of commercial and institutional building in order to provide materials that were both aesthetically pleasing and robust. increasing number of construction projects as a result. Thus, such factors are helping in expansion of the storefront glass market.

However, storefront glass required regular cleaning and maintenance to keep it looking its best. The glass may become covered with dirt, dust, and other environmental factors, which could have an impact on how it appears. Additionally, the price of raw materials required in the manufacture of glass is increasing because storefront glasses are made with recycled waste, limestone, and sodium carbonate as ingredients. These are the primary factors that will restrict and impede the market's rate of growth.

By Type:

The market is bifurcated into safety/limited glass, insulated glass and other. Based on type, the insulated glass segment held the highest market share in 2020 and is estimated to maintain its leadership status throughout the forecast period. Increase use of insulated glass due to its various advantages such as it offers stable heating and cooling efficiency. In addition, insulated storefront glass helps in maintaining a stable indoor temperature, reducing the strain on HVAC (heating, ventilation, and air conditioning) system, and extending their lifespan. This is particularly appearing to the building on a seeking to optimize their HVAC- related expenses. Hence, such an advantage propels the growth of the market during forecast period. Increasing awareness regarding safety and security in commercial and retail spaces propelled the growth of safety laminated storefront glasses during forecast periods. In addition, laminated glasses segment is expected to grow at a highest CAGR as it offer wide range of advantage to building owners such as impact of resistance and shatterproof properties as businesses and property owners prioritized the protection of their assets, employers, and customers, laminated storefront glasses, with the impact of resistance and setup proof properties, become essentials.

Additionally, distinct building codes and regulations made the use of safety glasses, propeller demand for limited options. The desire for aesthetically pleasing design in storefront that also security further fuel adoption of laminated glass, making it preferable choice for both new construction and renovation. In addition, aging post tension structures face corrosion, deterioration, and structural deficiencies. Many builders, government, and asset owners are increasingly investing in repair and rehabilitation to ensure safety and functionality of crucial infrastructure.

Furthermore, as per the storefront glass market overview several commodities, including food items, oil, and gas, saw a surge in price due to the Russia-Ukraine conflict. With supply chain interruptions, there are more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has also increased the stock market volatility. Economic instability has risen due to the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all such factors have reduced export possibilities.

By Distribution Channel:

The market is segmented into online and offline. The online segment held the highest market share in 2020, and is estimated to maintain its leadership status throughout the forecast period. The demand for storefront glasses being purchased online has been steadily growing as the convenience of online shopping has transformed the way consumers shop for products, including storefront glasses and other construction materials. Customers can browse and compare a wide range of options from the comfort of their own homes, avoiding the need to visit multiple physical stores. This helps to save time and offers better range. In addition, the competitive pricing and discounts offered by online retailers can make purchasing storefront glass more cost-effective. Online sellers frequently have lower overhead costs and can pass these savings on to customers. Moreover, the convenience of doorstep delivery is another driving factor.

Glass products can be heavy and fragile, making traditional in-store purchases less appealing when compared to the ease of having them delivered to one's doorstep. Thus, such factors are expected to drive the demand for storefront glasses been purchased online. However, the offline segment is projected to manifest the highest CAGR of 7.7% from 2023 to 2032. The demand for storefront glasses being purchased offline, through traditional brick-and-mortar stores, is experiencing growth as some consumers prefer the tactile and hands-on experience that physical stores offer. They can see and touch the actual product, assess its quality, and measure how it might fit into their specific needs.

This level of interaction can be particularly important for items like storefront glass, where aesthetics and functionality are critical. In addition, the ability to inspect the glass for imperfections and ensure it meets quality standards is another reason for the growing demand in offline purchases. Customers can personally scrutinize the glass for any flaws or damage, reducing the risk of receiving damaged goods. Thus, such factors are maintaining the demand for storefront glasses purchased via stores and is expected to offer new storefront glass market opportunity.

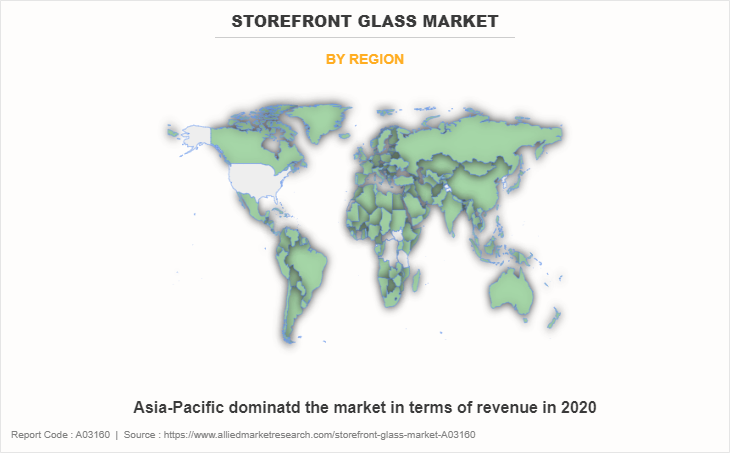

The storefront glass market is segmented into type, distribution channel, end user, and region. The type in the study includes safety/limited glass, insulated glass and others. By distribution channel, the market is bifurcated into online and offline. By end user, it is segmented into stores, showrooms, and others. By region, the storefront glass market analysis by across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

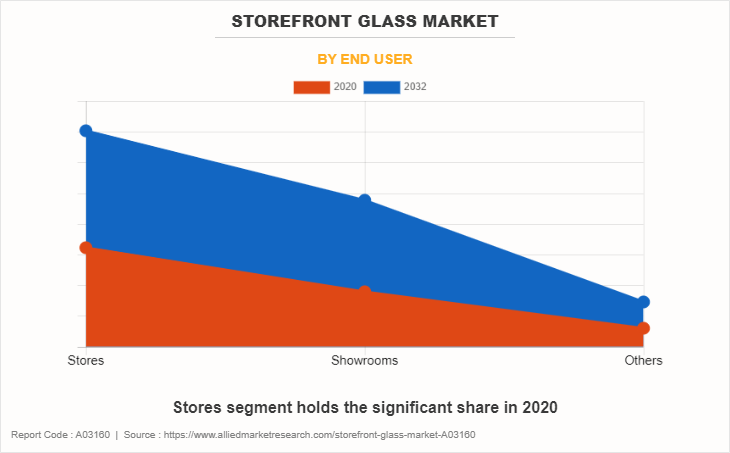

By End User:

The market is segmented into stores, showrooms, and others.The stores segment accounted for the largest share in 2020, and is projected to maintain its lead position during the forecast period. Systems for internal post-tensioning are robust, dependable, and corrosion-proof. Internal post-tensioning methods make bridge construction safer and more enduring. Companies that provide storefront glass, such DYWIDAG and VSL International Ltd., provide internal post-tensioning technology to build bridges, propelling the storefront glass market globally. However, the showrooms segment is expected to portray the largest CAGR of 8.3% from 2023 to 2032. Increase in adoption of storefront glass in showrooms due to it offers several benefits such as customizable storefront glass designs contribute to the overall aesthetic and branding of the showrooms. Decorative pattern, etching and logos can create an appealing and memorable facade that aligns with the showrooms image. In addition, energy efficient glass solutions help regulate indoors temperature, ensuring a comfortable environment for customers while reducing heating and cooling cost for the showrooms. Hence, such an advantage propels the growth of the market during the storefront glass market forecast period.

By Region:

The storefront glass market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2020, Asia-Pacific held the highest market share. The major share of market is held by China and Japan. However, other countries such as India, Singapore, and Taiwan have been recognized as important markets, owing to upsurge in construction activities in these countries. Key player initiatives in China in expanding construction sector are expected to provide growth opportunity in this country. Additionally, China's low labor and material costs enable manufacturers to build post-tensioning systems and their component parts for the best feasible prices. For instance, in October 2022, China State Construction Engineering Corporation (China State Construction), a state-owned company, has acquired several significant infrastructure and housing development projects.

The ten projects are worth a combined $4.89 billion. Hence, such projects are expected to drive the growth of the market during the forecast period. However, LAMEA is expected to witness the fastest CAGR of 9.8% from 2023 to 2032. In LAMEA region, the market is being driven by factors such as the expansion of the construction sector, growing urbanization, and technological advances. Furthermore, by 2050, the urban population is expected to increase; also, an increase in lifestyle, particularly in emerging nations, encourages the development of renovation projects. For instance, according to the International Trade Administration, in January 2021, the Brazil government invested $14 billion through Public-Private Partnership (PPP) for infrastructure and urbanization development. Hence, such development activities need installation of post-tensioning systems, which is anticipated to drive the storefront glass market growth in LAMEA during the forecast period.

Competition Analysis

The key companies having significant storefront glass market share profiled in the report include Asahi Glass, Nippon Sheet Glass Co., Ltd, Promat International, PPG Industries, Tubelite, Alcoa, C.R. Laurence, Guardian Industries Corporation, Compagnie de Saint-Gobain and Sisecam Group. Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the storefront glass market analysis from 2020 to 2032 to identify the prevailing storefront glass market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the storefront glass market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global storefront glass market trends, key players, market segments, application areas, and market growth strategies.

Storefront Glass Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.3 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2020 - 2032 |

| Report Pages | 187 |

| By Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | Asahi Glass, Alcoa Corp, Sisecam Group, C.R. Laurence, Promat International, PPG Industries, Tubelite, Nippon Sheet Glass Co., Ltd, Compagnie de Saint-Gobain, Guardian Industries |

Analyst Review

Growth in economic development and urbanization lead to increased construction of commercial and retail buildings, driving the demand for storefront glasses. In addition, the increase in adoption of storefront glass in architecture sector for transparent and visually appealing designs of commercial structures creates opportunity for innovative storefront glass solutions. Moreover, high quality storefront glasses and related framing systems can be relatively expensive. This cost factor can limit adoption, especially for small businesses or in reason with budget limited. Furthermore, the integration of smart glasses technology, like switchable glasses and dynamic grazing, presenting growth opportunity for a storefront glasses manufacturer.

The Storefront Glass market was valued for $5,606.80 million in 2020 and is estimated to reach $13,278.80 million by 2032, exhibiting a CAGR of 7.3% from 2023 to 2032.?

The forecast period considered for the Storefront glass market is 2023 to 2032, wherein, 2022 is the base year and 2032 is the forecast year.

The latest version of Storefront glass market report can be obtained on demand from the website.

The base year considered in the Storefront glass market report is 2022.

The major players profiled in the storefront glass market include Asahi Glass, Nippon Sheet Glass Co., Ltd, Promat International, PPG Industries, Tubelite, Alcoa, C.R. Laurence, Guardian Industries Corporation, Compagnie de Saint-Gobain and Sisecam Group.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance, various strategies and recent developments.

By end user, the stores segment was the largest revenue generator in 2020.

Loading Table Of Content...

Loading Research Methodology...