The Structured commodity trade finance market study provides a detailed analysis pertaining to the global market size & forecast, segmental splits, and further bifurcation into regional & country-level. In addition, it outlines the market dynamics & trends, Porters’ five force analysis, competitive landscape, and market share analysis.

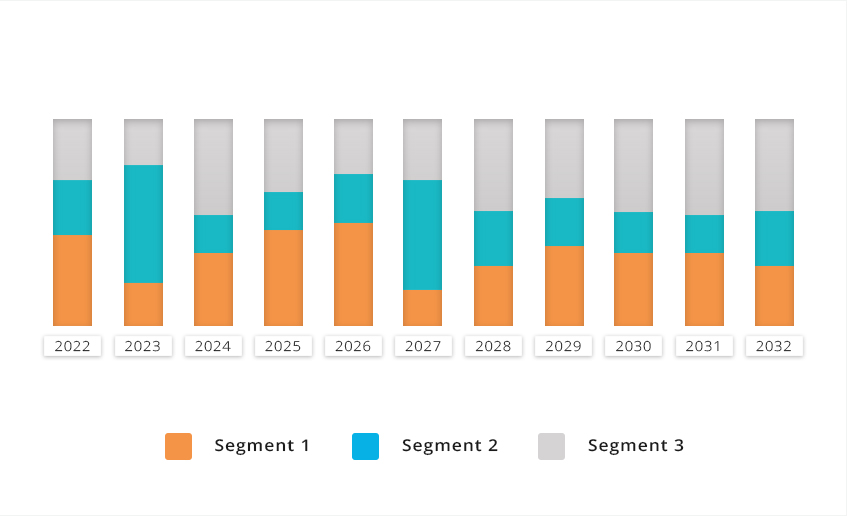

Structured commodity trade finance market Revenue ($Million), By Application, 2023 to 2032

Graph for representation purpose only

Segmental Outlook

The global Structured commodity trade finance market is segmented into by commodity trade finance products.

The segmental analysis includes real time and forecast in both quantitative and qualitative terms. This will assist clients to recognize the most lucrative segments for investors to capitalize in the market, based on a comprehensive backend analysis regarding the segmental performance, along with brief understanding of the operating companies in the market and their development activities in line with their products.

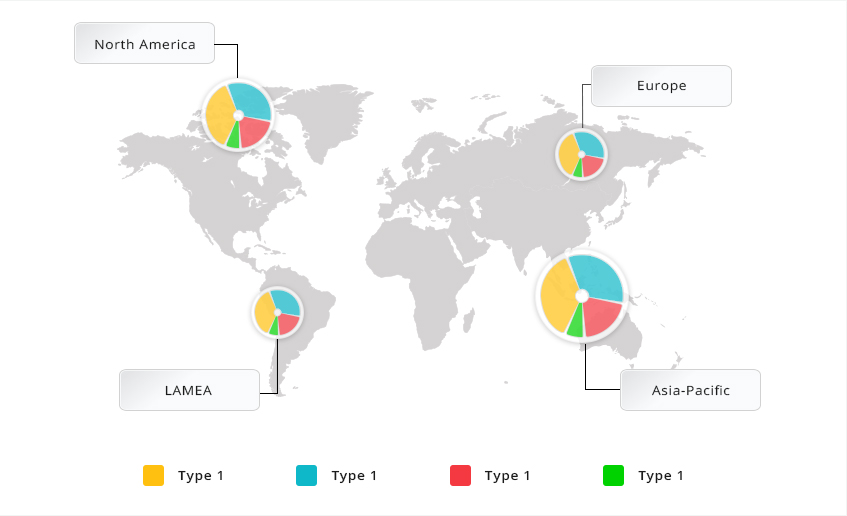

Structured commodity trade finance market Revenue ($Million), By Type, 2023 to 2032

Graph for representation purpose only

Competitive Scenario

The report profiles the top players operating across the globe, along with market share analysis, and an outlook on top player positioning. In addition, the study focuses on the developmental strategies such as product launch, mergers & acquisitions, and collaborations adopted by the market frontrunners to maintain a competitive edge in the marketspace.

Key companies identified in the report are Standard Chartered Bank, CitiBank, HSBC Bank, Deutsche Bank, BNP Paribas, ING Bank, ICBC, Barclays Bank, Société Générale, HSH Nordbank

Report Coverage

Market Size Projections: 2023 to 2032

Major Segments Covered: by commodity trade finance products

Market Dynamics and Trends

Competitive Landscape Reporting

Note

Apart from the list of countries and companies provided in the study, clients have the liberty to customize the list according to their stated requirements.

Given that AMR offers 20% free customization policy, clients can request AMR for a tailor-made report by considering their requirements. However, any kind of modification will be finalized post a quick feasibility check.

Structured Commodity Trade Finance Market Report Highlights

| Aspects | Details |

| By Commodity Trade Finance Products |

|

| By Region |

|

| Key Market Players | ING Bank, HSBC Bank, Deutsche Bank, Standard Chartered Bank, HSH Nordbank, BNP Paribas, Barclays Bank, CitiBank, ICBC, Société Générale |

Loading Table Of Content...