Substation Monitoring System Market Research, 2034

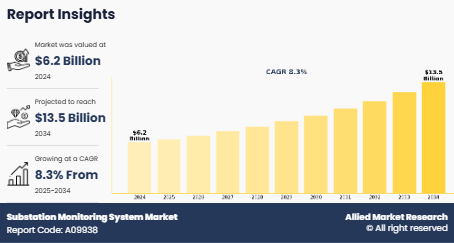

The global Substation Monitoring System Market was valued at $6.2 billion in 2024, and is projected to reach $13.5 billion by 2034, growing at a CAGR of 8.3% from 2025 to 2034.

A substation monitoring system (SMS) is an advanced technological solution designed to oversee and manage the operations of electrical substations. These systems play a crucial role in ensuring the reliability and efficiency of power distribution networks. An SMS can detect anomalies and potential faults in real time by continuously monitoring various parameters such as voltage, current, temperature, and equipment status. This proactive approach allows for timely maintenance and reduces the risk of unexpected outages.ss

Moreover, modern SMSs are equipped with sophisticated data analytics and communication capabilities, enabling remote monitoring and control. This enhances operational efficiency as well as improves safety by minimizing the need for on-site inspections. Overall, the implementation of a substation monitoring system is essential for maintaining the stability and resilience of the electrical grid, ultimately contributing to a more reliable power supply for consumers. The substation monitoring system market is witnessing a significant surge in demand in the year 2024, primarily fueled by the rise in demand for reliable, efficient, and uninterrupted power supply globally. A rise in urbanization and industrialization leads to an increase in the stability of power distribution networks thus propelling the need for advanced transmission and distribution system such as substation monitoring system. Substation monitoring systems (SMSs) provide real-time monitoring, diagnostics, and automation capabilities, which are essential in modern grid operations, a trend expected to drive the substation monitoring system market growth.

Moreover, with the surge in demand for the power infrastructure across developing regions is the prime factor driving the growth fot he market and also expected to fuel the future market growth. A significant number of existing substations were constructed decades ago and now face increased risks of failure and inefficiency. Integration of advanced SMSs enables utilities to detect faults early, optimize maintenance schedules, and extend asset lifecycles. This proactive approach enhances operational efficiency and reliability, which in turn strengthens the substation monitoring system market across both developed and developing economies.

In addition, the rise of Internet of Things (IoT) technologies, cloud computing, and real-time analytics is one of the prime factors driving the growth of the market. These technologies allow operators to gather and analyze large volumes of data, enabling faster, data-driven decisions. Moreover, the increasing integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies into substation infrastructure is a major driving factor for market growth. Moreover, the government initiatives and investments in smart grid projects are also key contributors to the growth of the market. Developing countries globally are investing heavily in grid modernization to reduce energy losses, improve energy management, and enable seamless integration of renewable energy sources. These strategic efforts are creating new substation monitoring system market opportunities, as SMSs play a pivotal role in maintaining grid stability and performance in these next-generation grids.

Furthermore, the rise in the adoption of renewable energy, including solar and wind, has increased the complexity of grid management due to the intermittent nature of these energy sources. Substation monitoring systems help address these challenges by providing continuous visibility and control over grid operations, enhancing flexibility and resilience, a prime factor driving the growth of the substation monitoring system market. However, high initial deployment costs and a rise in cybersecurity concerns are expected to restrain the substation monitoring system market growth. The substantial investment required for the deployment of wireless sensor networks and intelligent electronic devices (IEDs) in substations can be a barrier for some utilities, especially those with limited budgets. This financial burden can slow down the adoption rate of these advanced monitoring systems.

Segmental Overview

The substation monitoring system market is segmented into Communication Technology, Industry Application, Type, and Region.

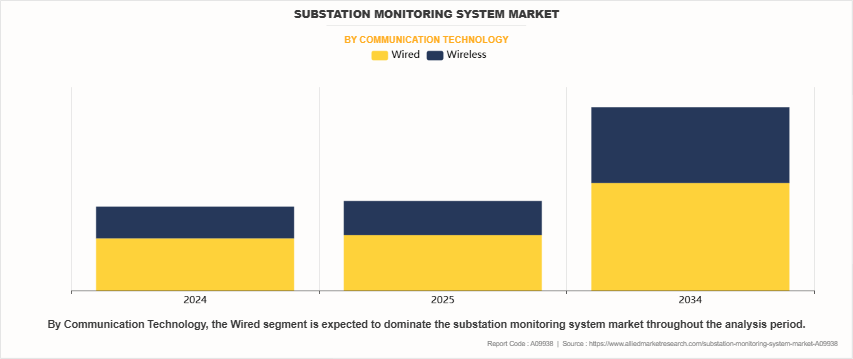

By communication technology, the market is analyzed across wired and wireless.

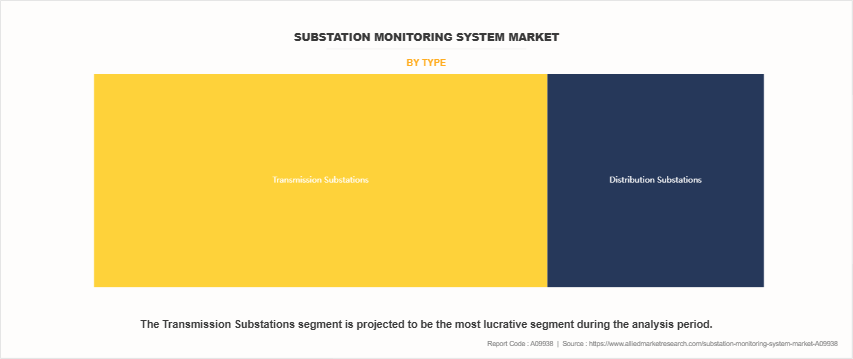

Based on the type, the Substation monitoring system market is evaluated across transmission and distribution.

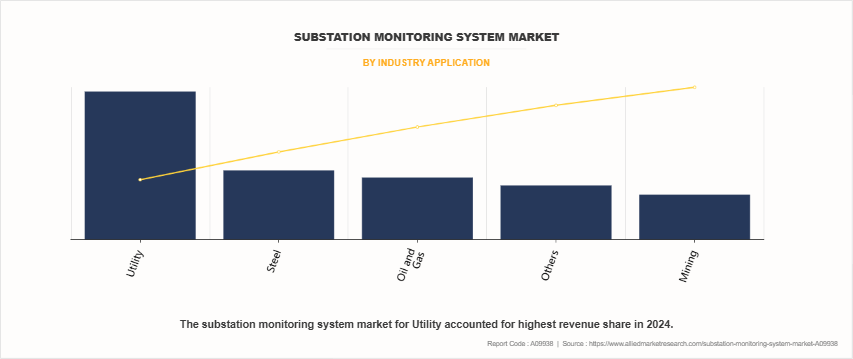

Based on industry application, the market is divided into utility, mining, steel, oil and gas, and transportation.

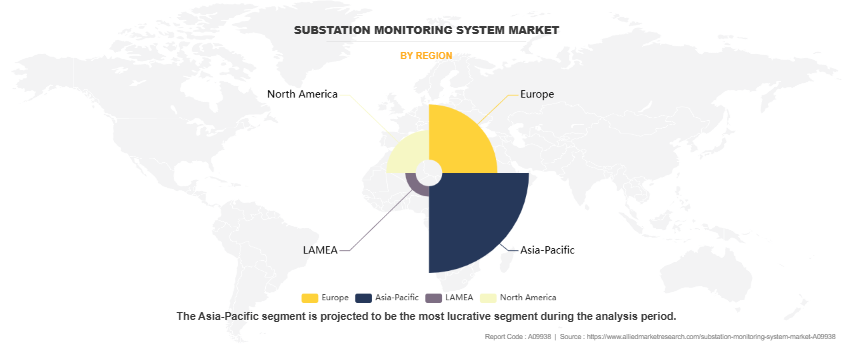

Region-wise, the Substation Monitoring System market is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competative Analysis

Competitive analysis and profiles of the major market players, such as Emerson Electric Co., Sentient Energy, Inc., Eaton Corporation PLC, Honeywell International Inc., Schneider Electric, ABB Ltd., NovaTech Corporation, Crompton Greaves Consumer Electricals Ltd, GE Vernova, and Siemens are provided in this report. Product launch, partnership, and acquisition business strategies were adopted by the major market players in 2024.

Recent Product Launches in the Market

- In October 2024, Schneider Electric launched new smart grid solutions at Enlit Europe 2024, including advancements in virtual substations and digital grid capabilities. These innovations aim to strengthen grid resiliency and flexibility, helping utilities manage extreme weather events and integrate distributed energy resources more efficiently.

Recent Project Implementation / Deployment in the Market

- In May 2024, ABB Ltd. supported a Swedish utility in future-proofing their substations with innovative earth-fault protection. This project enhances power reliability and safety, ensuring a stable power supply even during faults.

- In April 2022, NovaTech's Orion Substation Automation Platform was implemented in 41 substations by Carroll Electric Cooperative. This rollout enhances remote monitoring and control, improving operational efficiency and reliability.

Recent Partnerships in the Market

- In August 2024, GE Vernova signed an MoU with Systems With Intelligence to develop advanced substation monitoring solutions. This collaboration integrates technologies like gas sensing and infrared thermography, aiming to enhance diagnostic intelligence and asset management for utilities.

Market Landscape and Trends

The substation monitoring system industry is undergoing rapid transformation due to increasing demand for grid modernization and digitalization across the global utility sector. Electrical substation monitoring have become essential for ensuring real-time visibility, condition-based maintenance, and operational efficiency in transmission and distribution networks. These systems monitor critical parameters such as voltage, current, insulation, temperature, and equipment health, enabling predictive diagnostics and early fault detection.

A significant trend is the integration of advanced technologies like artificial intelligence (AI), edge computing, and IoT within SMS platforms. These technologies enable utilities to collect, analyze, and respond to data in real time, thereby improving grid stability and reducing downtime. For instance, in October 2024, Schneider Electric launched next-generation smart grid solutions that include virtual substations and enhanced digital grid capabilities to help utilities better manage distributed energy resources and improve resiliency during extreme weather events.

In addition, the rising adoption of renewable energy sources such as solar and wind is driving the need for dynamic grid monitoring. Substation monitoring systems help utilities address the intermittency and variability associated with renewables by offering real-time control, fault diagnostics, and seamless integration of energy sources. Governments and utilities are investing heavily in smart infrastructure upgrades, with SMS playing a central role in ensuring coordination and communication between legacy and modern assets. These trends collectively indicate a strong growth trajectory for the substation monitoring system industry .

Top Impacting Factors

Substation Monitoring System Market Opportunity

The ongoing global transition toward smart grids and renewable energy integration presents substantial growth opportunities for the substation monitoring system market. With rising energy demand, governments and utilities are heavily investing in grid infrastructure upgrades. Substation monitoring systems (SMS) are critical to this transformation, providing real-time visibility and control necessary for managing modern power networks. These systems enable proactive maintenance, load balancing, and seamless integration of intermittent renewable sources like solar and wind. Additionally, increased public-private partnerships and international funding, particularly in developing nations, are expanding market access for SMS vendors. As utilities seek to optimize asset performance while ensuring regulatory compliance and cost efficiency, the demand for intelligent monitoring systems continues to grow.

Substation Monitoring System Market Outlook

The outlook for the substation monitoring system market remains highly positive, driven by a confluence of technological advancement and policy-level support. The growing integration of IoT, edge computing, and AI technologies in SMS platforms is revolutionizing grid management by enabling predictive maintenance, real-time diagnostics, and enhanced remote access. These digital innovations improve grid reliability and reduce operational costs, making SMS an indispensable component of modern power infrastructure. Moreover, increased regulatory emphasis on grid modernization, safety, and emissions control is pushing utilities to adopt advanced monitoring tools. With utilities worldwide aiming to digitize their infrastructure, the substation monitoring market is positioned as a key enabler of this transition.

- Substation Monitoring System Market Forecast

The substation monitoring system market is projected to witness robust growth over the forecast period, with steady adoption across both developed and emerging economies. Factors such as increasing electricity demand, renewable integration, and aging infrastructure are expected to fuel market expansion. North America and Europe are anticipated to lead in terms of adoption due to existing smart grid initiatives and strong regulatory frameworks. However, Asia-Pacific is emerging as the fastest-growing region, backed by rapid urbanization, industrial expansion, and substantial government investments in power infrastructure. As utilities aim for greater operational efficiency and reliability, the demand for scalable and cost-effective monitoring solutions will further accelerate market growth.

- Enhancing Grid Reliability and Operational Efficiency

Substation monitoring systems improve grid performance by enabling early fault detection, asset condition monitoring, and remote diagnostics. These capabilities reduce unplanned outages, enhance power quality, and extend equipment lifespan. In high-demand environments, SMS helps utilities maintain grid stability and avoid service disruptions. The ability to monitor critical equipment like transformers and circuit breakers in real time leads to reduced maintenance costs and improved safety.

Opportunity

Expanding Investments in Smart Grids and Renewable Integration

One of the most promising opportunities lies in the increasing investments in smart grid projects and the integration of renewable energy sources. As global economies transition toward decarbonization, substations are being upgraded to support variable energy inputs. Substation monitoring systems are central to this shift, as they ensure grid flexibility and help utilities manage the unpredictability of renewables. Public-private partnerships, international funding, and government-led initiatives are further propelling demand. For example, the U.S. Department of Energy’s recent $2 billion investment in strengthening the grid underscores the urgency for adopting advanced substation technologies.

Furthermore, with developing nations in Asia-Pacific and Latin America focusing on expanding and modernizing their power networks, there is a growing demand for cost-effective and scalable monitoring solutions. This creates ample opportunity for substation monitoring system vendors to expand their footprint and offer customizable solutions suited to emerging market needs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the substation monitoring system market analysis from 2024 to 2034 to identify the prevailing substation monitoring system market opportunities.

- The substation monitoring system market size and research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the substation monitoring system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global substation monitoring system market trends, key players, market segments, application areas, and market growth strategies.

Substation Monitoring System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 13.5 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 321 |

| By Communication Technology |

|

| By Industry Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Schneider Electric, Emerson Electric Co., GE Vernova, Novatech, ABB Ltd., Honeywell International Inc., Crompton Greaves Consumer Electricals Ltd, Sentient Energy, Inc., Siemens AG, Eaton Corporation PLC |

Analyst Review

According to the CXO perspective, Substation monitoring systems have become indispensable components in the power transmission and distribution sector, playing a critical role in maintaining grid reliability, efficiency, and operational safety. Operating on the core principle of real-time data acquisition and analysis, these systems monitor key parameters such as voltage, current, temperature, and equipment status to ensure optimal functioning of substations and timely identification of potential faults.

Substation monitoring systems are widely implemented across utilities, industrial complexes, and renewable energy plants. These systems enhance asset management by enabling condition-based maintenance, minimizing downtime, and extending the operational life of critical components like transformers, circuit breakers, and switchgear. With the increasing integration of renewable energy sources and distributed energy generation, substation monitoring systems are vital in maintaining power quality and balancing fluctuating loads on the grid.

The accelerating adoption of smart grid technologies and IoT-based solutions further fuels the demand for advanced substation monitoring systems. Emerging applications in remote substations and unmanned grid infrastructure open new avenues for system deployment. As the global energy landscape evolves, the continued innovation in substation monitoring systems is crucial in enabling data-driven grid modernization and enhancing resilience against outages and cyber threats.

The global substation monitoring system market is highly competitive, characterized by the presence of leading players with substantial technological and financial capabilities. These companies are well-positioned to meet the dynamic demands of utilities and grid operators through advanced analytics, modular system designs, and cloud-integrated solutions. The competitive intensity in this market is expected to rise with ongoing technological advancements, strategic partnerships, and increased investments in digital grid infrastructure.

Asia-Pacific holds the largest share, driven by rapid industrialization and energy infrastructure investments.

Integration of AI, IoT, wireless technologies, and cybersecurity in substation monitoring systems is gaining momentum globally.

The global substation monitoring system market was valued at $6.2 billion in 2024, and is projected to reach $13.5 billion by 2034,

The utility sector leads the market due to its focus on grid modernization and reliability.

Major players include ABB Ltd., Siemens, Schneider Electric, GE Vernova, and Emerson Electric Co.

Loading Table Of Content...

Loading Research Methodology...