Sulphur Recovery Market Research, 2033

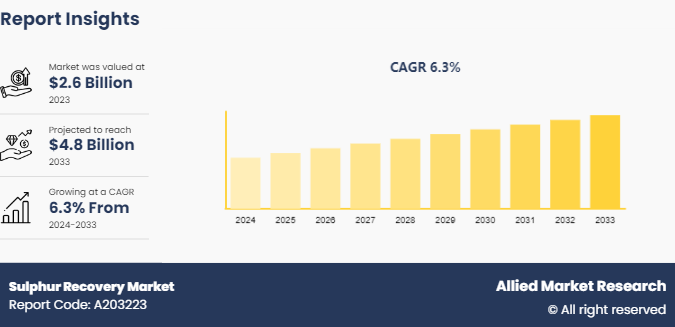

The global sulphur recovery market was valued at $2.6 billion in 2023, and is projected to reach $4.8 Billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Market Introduction and Definition

Sulfur recovery is the process of capturing and converting elemental sulfur from various sources of hydrogen sulfide (H2S) , a compound commonly found in natural gas, crude oil, and other industrial processes. This process is vital for environmental protection, as it prevents sulfur emissions, which can contribute to air pollution and acid rain. In the oil and gas industry, sulfur recovery is crucial for processing sour natural gas and sour crude oil, which contain high levels of H2S. Sulfur recovery units (SRUs) are used in refineries and gas processing plants to convert H2S into elemental sulfur or other usable forms such as sulfuric acid. This ensures compliance with environmental regulations and maximizes the value of hydrocarbon resources by recovering sulfur for further industrial use.

Sulfur is a key raw material in the chemical industry, with applications in the production of fertilizers, sulfuric acid, and various specialty chemicals. Sulfur recovery enables chemical manufacturers to recycle and utilize sulfur obtained from refinery processes or natural gas streams, reducing dependency on external sulfur sources and minimizing production costs.

Key Takeaways:

- The sulfur recovery industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global sulfur recovery market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the sulfur recovery market size.

- The sulfur recovery market share is highly fragmented, with several players including Jacobs, Chiyoda Corporation, John Wood Group PLC, TechnipFMC plc, Worley Parsons, Linde plc, Fluor Corporation, KT-Kinetics Technology SpA, Bechtel Corporation, and Honeywell International Inc. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the sulfur recovery market growth.

Segment Overview

The sulfur recovery market is segmented into technology, feedstock, application, end-use industry, and region. On the basis of technology, it is classified into Claus process, Claus tail gas treatment (TGT) , and others. On the basis of feedstock, the market is categorized into crude oil, natural gas, coal, biomass, and others. On the basis of application, the market is fragmented into refineries, gas processing plants, petrochemical plants, and others. On the basis of end-use industry, it is divided into oil and gas, chemical industry, mining, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

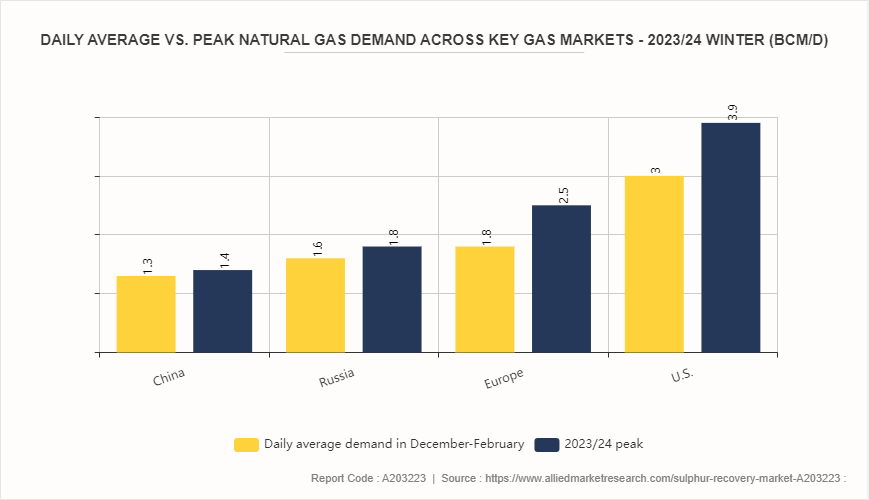

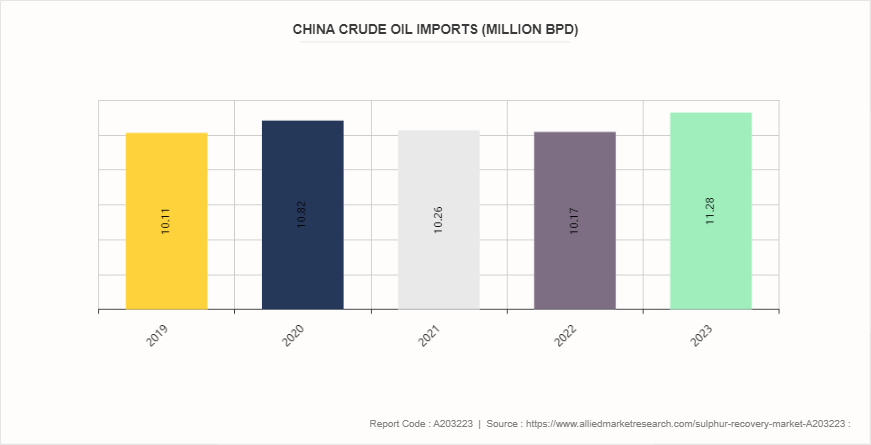

Increase in demand for energy in oil and gas is expected to drive the growth of sulfur recovery market during the forecast period. The surge in energy demand necessitates higher production levels in oil refineries and natural gas processing plants, where large quantities of sulfur-containing by-products, primarily hydrogen sulfide (H?S) , are generated. Oil and gas companies are ramping up their extraction and refining activities. This increase in production inevitably leads to a higher volume of by-products, including H?S, which must be effectively managed to prevent environmental harm. Sulfur recovery processes are crucial in this context, as they convert H?S into elemental sulfur, a valuable commodity used in various industries such as fertilizers, chemicals, and pharmaceuticals. As per the International Energy Agency, oil use increased by an estimated 1.6 million barrels per day (mb/d) year-on-year in the first quarter of 2024, down from 1.9 mb/d in the fourth quarter of 2023 and over 3 mb/d in mid-2023. In 2023, nearly two-thirds of the global oil demand growth was driven by China, where the GDP increased at an average annual rate of 6%. Economic growth in China is expected to decrease to between 4% and 5% in 2024 and 2025.

The Claus process, which has been the cornerstone of sulfur recovery, has seen significant enhancements to improve its efficiency and effectiveness. In addition, tail gas treatment units (TGTU) have been developed to further reduce sulfur emissions. These technological advancements enable refineries and gas plants to recover higher percentages of sulfur from their by-products, aligning with environmental regulations and contributing to operational efficiency. As per the Sulfur Recovery Engineering, approximately 90% to 95% of recovered sulfur is produced by the Claus process. The Claus process typically recovers 95% to 98% of the hydrogen sulfide feedstream. The gas processing plants and oil refineries are required to recover between 95% and 99.99% of the total sulfur introduced to the Sulfur Recovery Unit (SRU) .

However, fluctuating crude oil prices are expected to restrain the growth of sulfur recovery market during the forecast period. The sulfur recovery market, intrinsically linked to the oil and gas industries, faces significant challenges due to the volatility of crude oil prices. These fluctuations can profoundly impact the profitability of refineries and gas processing plants, directly influencing their capacity and willingness to invest in sulfur recovery technologies.

Crude oil prices are highly volatile, affected by geopolitical events, fluctuations in supply and demand, natural disasters, and policy changes. This economic uncertainty often leads to a tightening of budgets, where investments in non-essential or long-term projects, such as upgrading sulfur recovery units, are postponed or scaled back. According to Reuters, crude oil fell by over 10% in 2023 amid a volatile trading year influenced by geopolitical instability and uncertainties about the production levels of major global oil producers. Lower crude oil prices also force refineries and gas processing plants to re-evaluate their operational costs. Sulfur recovery processes, while critical for environmental compliance, can be expensive to implement and maintain. The high initial capital expenditure, coupled with ongoing operational costs, can be a significant burden during periods of reduced profitability. As a result, companies might opt for minimal compliance rather than investing in state-of-the-art sulfur recovery systems, thereby limiting the market growth.

Competitive Analysis

Key market players in the sulfur recovery market include Jacobs, Chiyoda Corporation, John Wood Group PLC, TechnipFMC plc, Worley Parsons, Linde plc, Fluor Corporation, KT-Kinetics Technology SpA, Bechtel Corporation, and Honeywell International Inc.

Regional Market Outlook

Based on region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. In North America, sulfur recovery is primarily driven by the oil and gas industry, especially in regions with significant petroleum refining and natural gas processing activities. The U.S. and Canada are among the top producers of elemental sulfur globally. The stringent environmental regulations in this region also necessitate effective sulfur recovery processes to minimize sulfur dioxide emissions. The Asia-Pacific region is a major consumer of energy and has a rapidly growing industrial sector, particularly in countries such as China, India, and Japan. These countries have significant refining and processing capacities, leading to substantial sulfur recovery requirements.

Industry Trends

- In July 2022, PetroChina initiated a $4.52 billion project to enhance a subsidiary refinery in southern China, transforming it into a comprehensive petrochemicals complex. Despite maintaining current crude oil refining capacity at the Guangxi Petrochemical plant, the expansion entails incorporating 14 significant petrochemical units. This investment is anticipated to drive the demand for sulfur recovery technologies in the foreseeable future.

- In September 2022, the Indian Union Minister of State for Petroleum and Natural Gas inaugurated a new $68.75 million sulfur recovery unit at the Chennai Petroleum Corporation Ltd (CPCL) refinery. This unit will convert Hydrogen Sulfide gas produced by the refinery into elemental sulfur, thereby reducing the release of sulfur compounds into the atmosphere.

- In May 2023, Rosneft, the Russian energy company, revealed intentions to team up with Indian state-owned refiners for constructing a new refinery in India. This move comes after adjustments were made to the proposed $44 billion refinery project on India's western coast by the country's state-run refiners.

- In August 2022, PetroVietnam, a subsidiary of Vietnam Oil and Gas Group, announced plans to build an oil refinery in Ba Ria, Vung Tau province, southern Vietnam. The refinery will have a crude oil processing capacity of 24 to 26 million tons per year, divided into two phases. The first phase is estimated to cost $13.5 billion, while the second phase will cost $5 billion.

Historical Trends of the Sulphur Recovery Market

- In 1910, the development of the Claus process was named after its inventor Carl Friedrich Claus. This process revolutionized sulfur recovery by allowing for the conversion of hydrogen sulfide (H2S) into elemental sulfur. The Claus process became the dominant method for sulfur recovery.

- In the 1940s the demand for sulfur increased significantly due to its use in various industrial processes, including the manufacture of sulfuric acid and fertilizers. This period witnessed further refinements and improvements in sulfur recovery technologies, making the process more efficient and cost-effective.

- In the 1970s, the increase in awareness of environmental issues and the implementation of stricter regulations regarding air quality prompted industries to prioritize sulfur recovery efforts. Governments around the world began to enact legislation aimed at reducing air pollution, particularly emissions of sulfur dioxide (SO2) and other harmful pollutants. These regulations imposed limits on sulfur emissions from industrial sources, including refineries, natural gas processing plants, and power plants.

- In the 1990s advances in catalyst technology played a crucial role in enhancing sulfur recovery efficiency. New catalyst formulations and manufacturing techniques were developed to improve sulfur conversion rates and extend catalyst lifespan. These improved catalysts allowed sulfur recovery units (SRUs) to operate more effectively and with greater reliability.

Key Sources Referred

- U.S. Energy Information Administration

- Department of Climate Change, Energy, the Environment and Water

- U.S. Environmental Protection Agency

- U.S. Department of Agriculture

- California Energy Commission

- U.S. Geological Survey

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sulphur recovery market analysis from 2024 to 2033 to identify the prevailing sulphur recovery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sulphur recovery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sulphur recovery market trends, key players, market segments, application areas, and market growth strategies.

Sulphur Recovery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.8 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Technology |

|

| By Feedstock |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | TechnipFMC plc, Honeywell International Inc., Fluor Corporation, Jacobs, Bechtel Corporation, Chiyoda Corporation, KT-Kinetics Technology SpA, John Wood Group PLC, Worley Parsons, Linde plc |

Loading Table Of Content...