Supply Chain Finance Market Research, 2031

The Global Supply Chain Finance Market was valued at $6 billion in 2021, and is projected to reach $13.4 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Suppliers who participate in supply chain finance can expect to get paid in advance for their invoices. It lessens the possibility of a disturbance in the supply chain and makes it possible for suppliers and customers to maximize their working capital. Moreover, the term "supply chain trade finance" is also frequently used to refer to a larger variety of supplier financing options, such as dynamic discounting, in which the buyer finances the program by allowing suppliers to get early payment on invoices in exchange for a discount.

Rise in need for safety and security of supplying activities and surge in adoption of supply chain finance by SMEs in developing countries is driving the supply chain finance market growth. In addition, increased competition and new agreements regarding supply chain finance is fueling the growth of the market. However, rise in trade wars and high implementation cost is restraining the growth of the market. On the contrary, integration of blockchain in online supply chain finance practices is expected to create lucrative opportunities for the market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the supply chain finance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the supply chain finance market outlook.

The supply chain finance market is segmented into Offering, Provider, Application and End User.

Segment Review

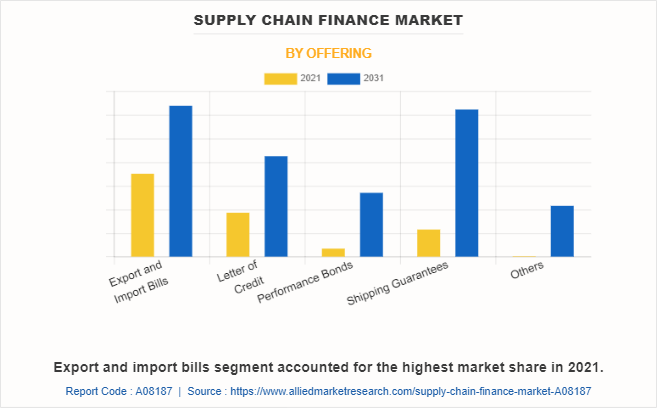

The market is segmented into offering, provider, application, end user and region. By offering, the market is differentiated into export and import bills, letter of credit, performance bonds, shipping guarantees and others. Depending on provider, it is fragmented into banks, trading finance house and others. The application segment is segregated into domestic and international. By end user, it is segmented into large enterprises and small and medium-sized enterprises. Region-wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By offering, the export and import bills segment attained the highest supply chain finance market share in supply chain finance market in 2021. This is attributed to banks facilitates documents movement and payments to suppliers. Moreover, an export bill for collection is a way of trade finance whereby an exporter approaches bank to control document movement and release them.

Region wise, Asia-Pacific dominated the supply chain finance market size in 2021. This was attributed to the that fact the governments in these countries have started to invest heavily in supply chain finance systems owing to the increased security concerns from financial institutions for trading activities. In addition, the supply chain finance is getting significant traction in the Asia-Pacific region owing to surge in number of cases of market abuse and frauds along with growing complexities of regulatory compliance requirements in banks, and financial institutions.

The key players that operate in the global market include as Asian Development Bank, BNP Paribas, Bank of America Corporation, Citigroup, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland Plc, and Standard Chartered. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Rise in need for Safety and Security of Supplying Activities

Rise in demand for supply chain finance on market manipulation such as losing investor confidence, damaging market integrity, fraud behavioral patterning, and insider business pressure on financial firms to invest in supply chain finance approaches that have less proliferation, ability to collate and monitor multiple structured & unstructured data sets together, and provide financial security in the form of payment risk and supply risk to an importer and exporter. In early days of international trade, many exporters were never sure whether, or when, the importer would pay them for their goods. Over time, exporters tried to find ways to reduce the non-payment risk from importers. On the other hand, the importers were also worried about making prior payments for goods, since they had no guarantee of whether the seller would actually ship the goods or not.

The growth of supply chain finance transactions is driven by increasing demand for efficient working capital solutions across industries, helping businesses optimize cash flow. The rise of digital platforms has further streamlined these transactions globally. Supply chain finance has evolved to address all of these risks by accelerating payments to exporters, and assuring importers that all the goods ordered have been shipped with letter of credit (LOC). Supply chain finance services are expanding as companies seek to improve their liquidity and enhance supplier relationships, with banks and fintechs offering innovative solutions tailored to diverse industries. Supply chain finance providers have increased the number of solutions to enhance the overall investor interface experience and to keep themselves ahead of their competitors in the market in the upcoming years. Thus, the rise in need for safety and security of supplying activities is propelling the growth of the market.

Surge in Adoption of Supply Chain Finance by SMEs in Developing Countries

Increase in investments in supply chain finance tools for monitoring pre trade, post trade, and examination of cross asset and cross-market trades among small number of organizations drives the growth of the market. In addition, various fintech organizations are adopting supply chain finance system to drive their revenue growth opportunity and to improve service efficiencies, which fuels the adoption of supply chain finance.

Smaller businesses often have very limited access to loans and other forms of interim financing to cover the cost of goods they plan to buy or sell. Supply chain finance bridged the financial gap between importers and exporters and provided short to medium-term working capital, which provides security of the stock or service being exported or imported with supporting products or structures that allow risk mitigation. Furthermore, supply chain finance mitigates the credit, payment risks or default risk that suppliers hold with banks or financial institutions and provide additional security that assures that larger orders can be fulfilled. Therefore, small businesses can operate with larger inventory volumes more easily as they work with a stronger credit of end customers. Supply chain finance providers are playing a critical role in bridging the financial gap between suppliers and buyers by offering flexible financing options that support global supply chains. Hence, resolving business constraints such as detect anomalous behavior, enable risk-based discovery, and others due to emerging importance of supply system boosts the market growth.

Increased Competition and new Agreements

New agreements between cross-border countries provide major opportunities and driving forces in terms of productivity of labor, permits a greater use of machinery, overcomes technical support, stimulates innovations, and enables countries to enhance their economic development. Moreover, increased competition in foreign trade also drives niche opportunities for the market. The supply chain finance worldwide market is growing rapidly, fueled by globalization, digitalization, and increased participation from banks, fintech firms, and other financial institutions in emerging markets. Such agreements improve local credit, by lowering the cost of borrowing or financing expansion and empowering domestic and small & medium-sized enterprises in the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market analysis from 2021 to 2031 to identify the prevailing supply chain finance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the supply chain finance market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the supply chain finance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global supply chain finance market trends, key players, market segments, application areas, and market growth strategies.

Supply Chain Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13.4 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 301 |

| By Offering |

|

| By Provider |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Standard Chartered, Asian Development Bank, Royal Bank of Scotland plc, BANK OF AMERICA CORPORATION, Citigroup, Inc., Mitsubishi UFJ Financial Group, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMORGAN CHASE & CO., BNP Paribas |

Analyst Review

In accordance to several interviews conducted, the supply chain finance market is expected to witness a significant growth in the market considering the launch of technologically advanced solutions to help clients streamline the trade activities ranging from purchase order to payments. In addition, increase in economic strength of the developing nations such as China and India are expected to provide lucrative opportunities for the market growth. Asia-Pacific is expected to hold a dominant position in the supply chain finance system market globally, several large enterprise organizations in this region are actively evaluating advanced supply chain finance solution to strengthen their technology infrastructure for overcoming from long-standing issues of high transaction and processing costs, and mitigate the huge supply chain finance gap.

During pandemic, technological advances such as machine learning block chain, AI, IoT, and others propelled the growth of the market. Moreover, emerging countries in Asia-Pacific and Latin America were offering significant growth opportunities during the forecast period. The global players focused on product development to increase their geographical presence, owing to increase in competition among local vendors, in terms of features, quality, and price.

The supply chain finance market is fragmented with the presence of regional vendors such as Asian Development Bank, BNP Paribas, Bank of America Corporation, Citigroup, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland Plc, and Standard Chartered. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with increase in awareness & demand for supply chain finance across the globe

The supply chain finance market is estimated to grow at a CAGR of 10.0% from 2022 to 2031.

The supply chain finance market is projected to reach $13.35 billion by 2031.

Rise in need for safety and security of supplying activities, surge in adoption of supply chain finance by SMEs in developing countries and wearables and increased competition and new agreements majorly contribute toward the growth of the market.

The key players profiled in the report include Asian Development Bank, BNP Paribas, Bank of America Corporation, Citigroup, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland Plc, and Standard Chartered.

The key growth strategies of supply chain finance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...