Surety Market Research, 2031

The global surety market was valued at $16 billion in 2021, and is projected to reach $24.4 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031.

Surety refers to the guarantee that a person or party or company will pay off the loans of another party. They take responsibility in case the other fails to abide by the conditions of a bond. Surety bonds protect against false claims and serve as clear representation when claims occur.

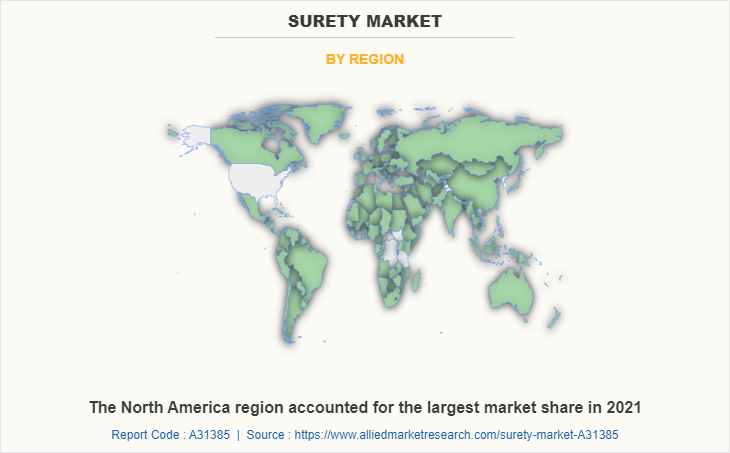

Surety bonds can lower interest rates for borrowers because they reduce risk for lenders. This factor drives the surety market growth. The market has traditionally been a local business based on local market knowledge. With increased globalization; however, large surety market players are establishing operations in developing markets. Global corporations, on the other hand, can compete in the market by hiring professional local underwriters. The adoption of markets in North American countries has been rapidly increasing over the years, and this trend is expected to continue. Rapidly developing countries are emphasizing urban development and, as a result, are investing heavily in the construction sector and increasing in adoption of surety service. This is driving up demand for surety bonds, which is propelling the market in the countries over the years.

The risk of a contracting party defaulting is shifted to a third party through the surety market. This is because if the contract that the surety guarantees is broken, the third party will be responsible for paying the obligation which leads to a surety challeng. According to the Insurance Regulatory and Development Authority of India (IRDAI), the maximum amount of the guarantee under contracts for surety insurance shall not be greater than 30% of the project's value.

Surety market outlook is positive as it is a means for companies to grow sustainably, which encourages small business owners to use surety insurance to secure funding and do business safely. Consequently, surety market opportunity are significantly increasing due to the rise in small and medium-sized enterprises looking to enter the global market.

The key surety companies profiled in this report include Crum & Forster, CNA Financial Corporation, American Financial Group, Inc., The Travelers Indemnity Company, Liberty Mutual Insurance Company, The Hartford, HCC Insurance Holdings Inc., Chubb, AmTrust Financial Services, and IFIC Security Group.

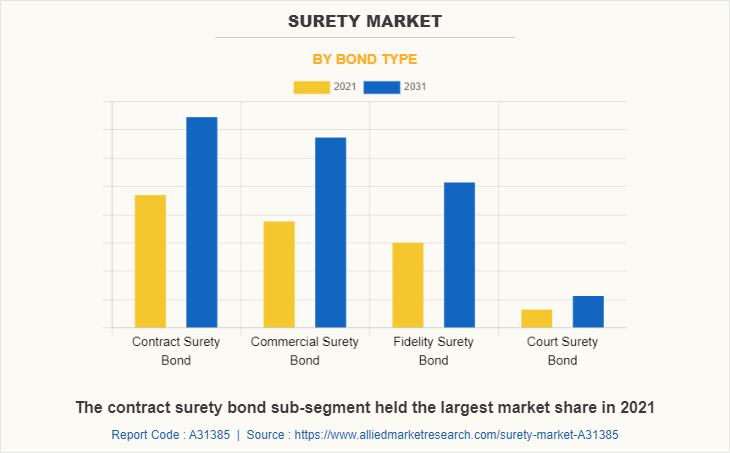

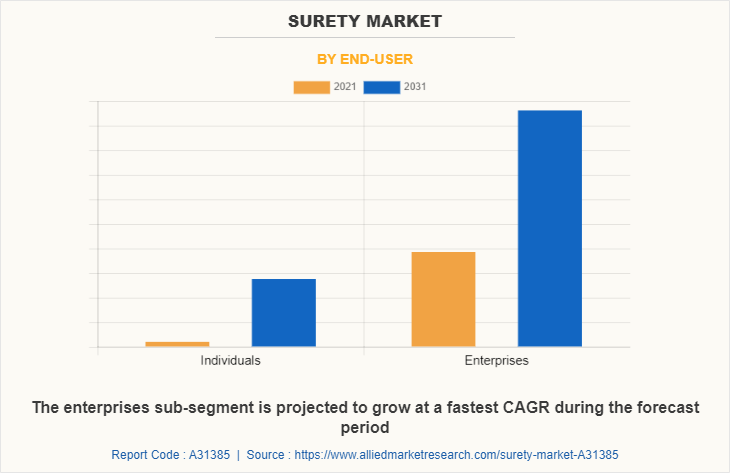

The surety market forecast report is segmented on the basis of bond type, end-user, and region. By bond type, the market is divided into contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. By end-user, the market is classified into individuals and enterprises. By region, the surety market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The surety market is segmented into Bond Type and End-User.

By bond type, the contract surety bond sub-segment dominated the market in 2021. A contract surety bond guarantees the company owner will conform to the terms of the agreement and complete the tasks outlined in the contract. Also, the bond protects against inconveniences or monetary loss brought on by a contractor's inability to finish a project or conform to project requirements. These are predicted to be the major factors affecting the surety market size during the forecast period.

By end-user, the enterprises sub-segment dominated the global surety market share in 2021. The growth of the sub-segment is expected to be attributed to the use of surety for agreement which involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Claiming their bonds will protect consumers from losing money to dishonest enterprises. The outbreak of COVID-19 has led the construction industry players to temporarily call off their current projects. Due to the unpredictable impact of COVID-19 and uncertainty in the economic conditions of both developed and developing countries, the demand for surety insurance among enterprises has increased in the market.

By region, North America dominated the global market in 2021 and is projected to remain the fastest growing region during the forecast period. North American industrialization has been steadily increasing over the years. Year after year, the number of small businesses in the United States and Canada increases in adoption of surety policy.. The countries' strong economies and government support enable several start-ups to establish themselves. Surety bonds make it easier for small businesses to get contracts by assuring the customer that the specified work will be completed on time. Surety bonds, which are provided by surety companies, are required for a number of public and private contracts. The ever-increasing number of small businesses in the North American construction in surety industry, combined with the availability of a large number of market participants in the United States and Canada, is expected to drive the surety market.

Report Coverage & Deliverables

Type Insights

Based on bond type, the market has been divided into contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. Among these, the contract surety bond sub-segment accounted for the highest market share in 2021, whereas the commercial surety bond sub-segment is estimated to witness the fastest growth during the forecast period.

Technology Insights

Analysis of surety growth driven by technological advancements in risk assessment, data analytics, and digital platforms. This includes the adoption of innovative technologies that enhance underwriting accuracy and streamline claims processing.

Application Insights

Evaluation of surety share across various applications, such as construction bonds, court bonds, and license and permit bonds. The focus is on identifying key areas where surety bonds are increasingly utilized and emerging trends within different sectors.

Regional Insights

Overview of surety value across different regions, providing a detailed assessment of market dynamics, surety adoption rates and regional variations in the demand for surety bonds. This includes insights into how regional economic conditions impact the surety market.

Key Companies & Market Share Insights

Profile of major players in the surety market, including their market share, competitive strategies, and positioning. This offers a comprehensive view of the market structure, highlighting leading surety companies and their influence on the surety industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surety market analysis from 2021 to 2031 to identify the prevailing surety market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surety market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surety market trends, key players, market segments, application areas, and market growth strategies.

Surety Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 24.4 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Bond Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | crum & forster, liberty mutual insurance company (u.k.) limited, the hartford, Chubb Limited, IFIC Security Group, American Financial Group, Inc., The Travelers Indemnity Company, CNA Financial Corporation, HCC Insurance Holdings Inc., AmTrust Financial Services |

Analyst Review

Surety market boosts surety insurance sales by giving customers favorable credit terms, safeguards against customer default or insolvency, reduces concentration worries, facilitates bank financing, and other benefits. Additionally, it helps businesses avoid financial uncertainty from receivables that run the risk of not being paid. The main factors limiting the growth of the surety market include lower surety insurance premium standards, lack of knowledge about surety insurance distribution in comparison to other lines of insurance, and lower broker investment in surety business. Furthermore, the market development is projected to be hampered by the fact that industry standards are not fully defined and that different authorities impose different rules and restrictions on retailers. Small and medium-sized enterprises (SMEs) and service providers are covered by surety insurance against customer lack of payment. In addition, several firms are seeking innovative ways to trade to increase their market share and grow internationally. Additionally, surety insurance is becoming more popular as a means for these companies to grow sustainably, which encourages small company owners to use it as a secure means of obtaining funding. Therefore, the market is expanding due to the rise in small and medium-sized firms looking to enter the global market as well as the various advantages provided by surety insurance.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by 2031, followed by Asia-Pacific, Europe, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for the leading position of North America and Asia-Pacific in the global surety market.

Surety offers many advantages such as the owner has assurance that the project will be completed however, many factors can cause contractors to default, and in that case, the surety bond protects the owner from financial loss. If the contractor asks for assistance, the surety may provide technical, managerial, or financial assistance and is estimated to generate excellent opportunities in the surety market.

The major growth strategies adopted by the surety market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global surety market in the future.

Crum & Forster, CNA Financial Corporation, American Financial Group, Inc., The Travelers Indemnity Company, Liberty Mutual Insurance Company, The Hartford, HCC Insurance Holdings Inc., Chubb, AmTrust Financial Services, and IFIC Security Group are the leading market players active in the surety market.

The Enterprises sub-segment of the end user acquired the maximum share of the global surety market in 2021.

Individual industry leaders and enterprises are the major customers in the global surety market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global surety market from 2021 to 2031 to determine the prevailing opportunities.

Growing bond type of Surty market in the contract surety bond ensures that, if the bonded party (the contractor) fails to fulfill the terms of a contract, they will assume financial responsibility is anticipated to boost the surety market in the upcoming years.

Loading Table Of Content...