Surgical Clamps Market Synopsis - 2030

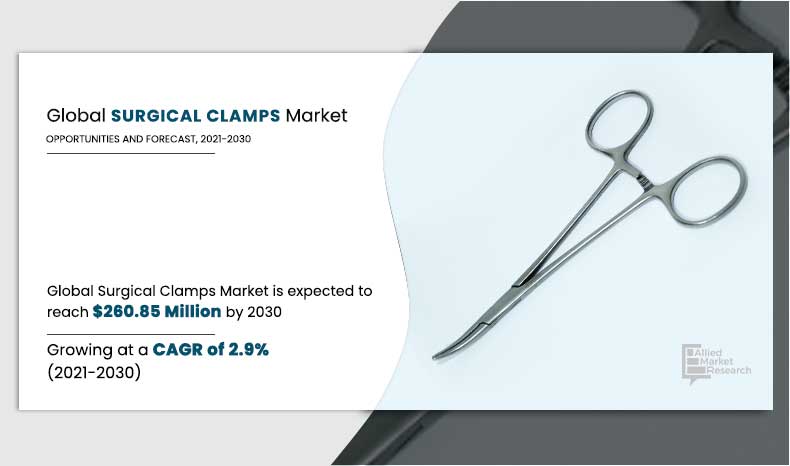

The surgical clamps market was valued at $194.15 million in 2020, and is estimated to reach $260.85 million by 2030, growing at a CAGR of 2.9% from 2021 to 2030.

Surgical clamps are instruments that are used in surgical procedures. Clamps are useful for gripping, dissecting, occluding and retracting. They are of different types such as hemostat clamps, aortic vascular clamp, bulldog forceps and needle holders. These clamps are mostly used to hold or grasp tissue or blood vessels during surgery. Hemostat is a small ratchet-locking clamp that is designed to grasp blood vessels before cutting. It may be curved, straight which is advantageous for fine dissection around the vessels. Hemostatic forceps are look like scissors.

Growth of the global surgical clamps market is majorly driven by increase in number of surgeries such as cosmetic surgery, laparoscopic surgery, cardiac surgery; increase in various types of cancer led to perform surgical procedures; development of new surgical instruments by large number of key players. According to the International Osteoporosis Foundation in 2019, approximately 200 million people were affected by osteoporosis related fractures worldwide. Thus, rise in burden of orthopedic disorders increases the demand for surgical clamps while performing surgeries, which is anticipated to foster the growth of the surgical clamps market. Furthermore, rise in geriatric population led to various types of diseases, increase in number of road accidents led to surge in surgical procedures are the factors that fuel the growth of the surgical clamps market.

According to World Health Organization approximately 235 million major surgical procedures are performed worldwide in 2019. According to the National Cancer Statistics in 2020, there were 1,806,590 new cases of cancer in the U.S. Therefore, the growing number of surgeries can be attributed to the rapidly increasing geriatric population who are more prone to having cardiac disorders is anticipated to boost the growth of the market. According to American Society of Plastic Surgeons, 15.6 million cosmetic surgeries were performed in 2020. Furthermore, increase in number of product approvals are expected to provide remunerative opportunities for the expansion of the global surgical clamps market during the forecast period.

What Is The Impact Of Covid-19 Pandemic On Surgical Clamps Market?

The COVID-19 outbreak is anticipated to have a positive impact to fuel the growth of the global surgical clamps market. According to National Library of Medicine, there were 1,307 cases of bariatric surgery were reported in India in 2020. Out of this 78% were performed prior to 31 March 2020 and 276 were performed after April 1, 2020. There were 87 patients found to positive who underwent bariatric surgery. Thus rise in number of bariatric surgery has increased the usage of surgical clamps during surgical procedure, which is anticipated to drive the surgical clamps market during the forecast period.

Thus, new innovations by key players and rise in number of product approvals propel the growth of the market. However, products recall by FDA is expected to restrict the market growth during the forecast period.

Surgical Clamps Market Segmentation

The surgical clamps market is segmented on the basis of type, usage, material, end user, and region. By type, the market is categorized into hemostat clamps, aortic vascular clamps, bulldog forceps, needle holders and others.

On the basis of usage, it is divided into disposable and reusable. On the basis of material, it is divided into stainless steel, titanium and others. Depending on end user, it is categorized into hospitals, ambulatory surgical centers, and others.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

Depending on type, the hemostat clamps segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to increase in R&D activities in the pharmaceutical & medical device industry, rise in demand for use in surgical procedure, and surge in adoption of surgical instruments. However, the needle holder segment is expected to witness considerable growth during the forecast period, owing to increase in number of surgeries and rise in number of key players for development of surgical clamps in the medical device industry.

By usage, the disposable segment was the major contributor in 2020, and is expected to maintain its lead during the forecast period, owing to increase in number of cosmetic surgeries, rise in number of cardiac disorders, and increase in demand surgical clamps for performing surgeries. However, the reusable is expected to witness considerable growth during the forecast period, due to increase in number of cancer cases, rise in use during surgical procedure and development of new surgical instruments in the hospital.

By Product Type

Hemostat Clamps segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

By material, the stainless steel segment was the major contributor in 2020, and is expected to maintain its lead during the forecast period, owing to increase in number of laparoscopic surgeries, rise in the number of cardiac disorders, and increase in demand surgical clamps for performing surgeries. However, the titanium is expected to witness considerable growth during the forecast period due to increase in number of vascular surgeries, rise in use during surgical procedure and development of new surgical instruments.

On the basis of end user, the ambulatory surgical centers segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to large number of key players offering surgical clamps instruments, increase in demand during surgical procedures, development of novel & innovative surgical instruments, and advancement in R&D activities. However, the hospitals segment is expected to witness considerable growth during the forecast period, owing to increase in cardiovascular surgeries, and surge in usage of surgical clamps to perform surgeries.

By Usage

Disposable segment is projected as one of the most lucrative segment.

North America garnered the major share in the surgical clamps market in 2020, and is expected to continue to dominate during the forecast period, owing to rise in number of surgeries, presence of key players, development of the healthcare sector, and presence of new innovative surgical clamps instruments in the region. However, Asia-Pacific is expected to register the highest CAGR of 3.4% from 2021 to 2030, owing to increase in prevalence of chronic diseases led to increase number of surgeries, and development of healthcare infrastructure.

The key players that operate in the global surgical clamps market include B. Braun Melsungen AG, Becton Dickinson and Company, Integra Life-Sciences, Mercian Surgical, Microline Surgical, Silex Medical, Sklar Surgical Corporation, Teleflex Incorporated, and Thermo-fisher Scientific.

By Region

Asia-Pacific is expected to experience growth at the highest rate, registering a CAGR of 3.4% during the forecast period.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the surgical clamps market, and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the market.

Surgical Clamps Market Report Highlights

| Aspects | Details |

| By End User |

|

| By Region |

|

| By Key Market Players |

|

| By Type |

|

| By Usage |

|

| By Material |

|

Analyst Review

This section provides opinions of top level CXOs in the surgical clamps market. According to the insights of CXOs, increase in number of cosmetic surgeries, cardiac surgeries and laparoscopic surgeries, increase in incidences of vascular surgeries, and advancements in new device launches are all attributed to propel growth of the surgical clamps market.

CXOs further added greater consumer awareness and demand for preventive healthcare services, escalating demand for healthcare services from overall population, and new advancements are predicted to broaden surgical clamps devices clinical applications and increase the number of product approvals. Furthermore, emergency use of surgical clamps for performing surgeries contributes toward growth of the market.

The market gains interest of healthcare companies, owing to focus on preventive facilities provided to patients who are undergoing critical thoracic surgeries, which are more complex than other health conditions.

This leads to increase in utilization for surgical clamps; thus is a great opportunity that further propels growth of the market.

North America is expected to witness highest growth, in terms of revenue, owing to rise in geriatric population, presence of key players, and advancements in healthcare investments. Asia-Pacific was the second largest contributor to the market in 2020, and is expected to register fastest CAGR during the forecast period, owing to increase in number of cosmetic surgeries and unmet needs for advanced surgical clamps devices. However, product recalls by food and drug administration restrain the market growth during the forecast period.

The total market value of Surgical Clamps market is $194.15 million in 2020.

The forecast period for Surgical Clamps market is 2021 to 2030

The market value ofSurgical Clamps market in 2021 is $200.17 million.

The base year is 2020 in Surgical Clamps market

Top companies such as B.Braun Melsungen AG, Becton Dickinson and Company, Integra Life-Sciences, Mercian Surgical, Microline Surgical, Silex Medical, Sklar Surgical Corporation, Teleflex Incorporated, and Thermo-fisher Scientificheld a high market position in 2020.

Hemostat Clamps segment dominated the global market in 2020, and expected to continue this trend throughout the forecast period due to the technological advancements and new product launch and thus is expected to drive the segment

Increase in usage to perform surgical procedures , advanced infrastructure for research & development and investments in healthcare is anticipated to drive the market in the forecast period.

North America is projected to account for a major share of the global surgical clamps market during the forecast period. U.S. dominated the North America rise in investments for newSurgical Clamps system launch in the R & D sector due to presence of key players across the country.

Surgical clamps are devices for holding materials together during medical procedure

Surgical Clamps are used while performing surgical procedures.

Loading Table Of Content...