Surgical Retractor Market Research, 2026

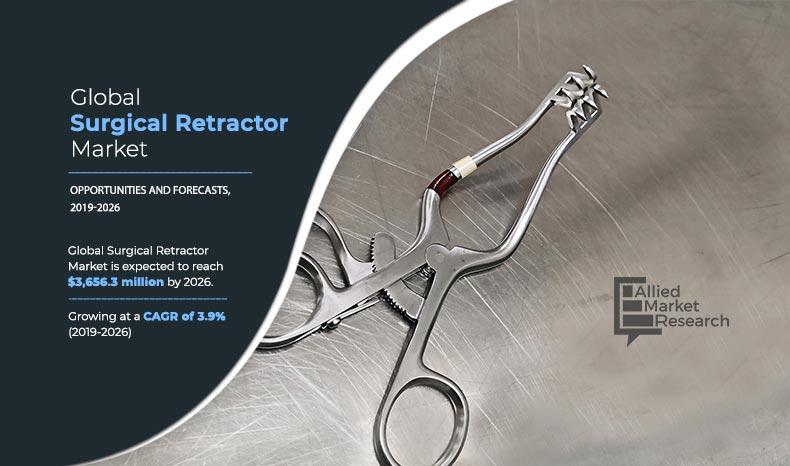

The surgical retractor market size was valued at $2,689 million in 2018, and is expected to reach $3,656 million by 2026, registering a CAGR of 3.9% from 2019 to 2026. A surgical retractor is a medical instrument, which is used during surgical procedures. The instrument is used to hold the edges of an incision to keep it open during the surgery. Furthermore, the instrument is used to draw back the sutures to keep them adjacent with the operative field. In addition, surgical retractors are used to enhance the visibility and access to an exposed area, which aids in conducting the surgical procedure. For instance, the instruments provide a clear view of the organs, which require operating. Thus, surgical retractors are employed in various surgeries such as abdominal surgeries, cardiothoracic surgeries, and orthopedic surgeries. Different types of surgical retractors used during surgical procedures include hand retractors, self-retaining retractors, and wire retractors.

The major factor that contributes to the growth of surgical retractor market include surge in number of surgical procedures across the globe. Furthermore, other factors such as rise in healthcare expenditure and surge in prevalence of chronic medical conditions that require surgical procedures for treatment fuel the growth of surgical retractor market. In addition, surge in geriatric population worldwide is another major factor that contributes to the growth of market. However, stringent regulations set by the FDA for the approval of surgical equipment restricts the growth of surgical retractor market. Conversely, high growth potential in developing economies is expected to offer lucrative opportunities during the forecast period.

Segments Overview

The surgical retractor market size is studied on the basis of product type, application, and region to provide a detailed assessment of the market. By product type, the market is segmented into hand retractor, self-retaining retractors, table-mounted retractors, wire retractors, and accessories. Depending on application, it is segregated into abdominal surgeries, cardiothoracic surgeries, orthopedic surgeries, obstetric & gynecological surgeries, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, and rest of LAMEA).

By Product Type

According to product type, the hand retractors occupied the largest share of surgical retractor market. The growth of this segment is attributed to the fact that these devices are often used in plastic surgeries and small bone & joint surgeries. Therefore, surge in number of plastic surgeries performed across the globe is a major factor that boosts the growth of the market. However, self-retaining retractors segment is anticipated to exhibit fastest growth rate during the forecast period, owing to the fact that the device has a locking system, which allows the surgeon to use both hands. Thus, this renders the surgery to be more convenient for the surgeon. In addition, other factors such as rise in awareness related to sue of self-retaining retractors and surge in healthcare expenditure boost the growth of the market.

By Product Type

Self Retaining retractors is projected as one of the most lucrative segment.

By Application

By application, the abdominal surgeries segment acquired the largest share of the market, owing to surge in number of abdominal surgeries performed worldwide. Abdominal surgeries require large surgical incisions to obtain a better view of the organs involved in the surgery. Therefore, the need of surgical retractors in the abdominal surgeries is higher, which boosts the growth of the market. On the contrary, the cardiothoracic surgeries segment is expected to exhibit fastest growth rate during the forecast period, owing to rise in the prevalence of cardiac disorders across the globe.

By Application

Abdominal surgeries holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

By Region

By region, North America accounted for the major surgical retractor market share in 2018, and is expected to continue this trend, owing to easy availability of surgical retractors. Moreover, surge in prevalence of various chronic conditions, which require surgeries for treatment is another major reason that contributes to the growth of this market. Conversely, Asia-Pacific is expected to register the fastest growth during the forecast period attributed to increase in awareness regarding the use of surgical retractors. In addition, the constantly evolving life science industry drives the growth of the market in the developing economies such as India, China, and Malaysia.

By Geography

Asia-Pacific region would exhibit the highest CAGR of 5.0% during 2019-2026.

The global surgical retractor market is highly competitive and the prominent players in the market have adopted various strategies to garner maximum market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include Baxter International Inc., B. Braun Melsungen AG, Becton, Dickinson and Company, Henry Schein, Inc., Henke-Sass Wolf, Integra Lifesciences Holdings Corporation, Novo Nordisk A/S, Johnson & Johnson, Medline Industries, Inc., Medtronic Plc., Teleflex Incorporated, Terumo Corporation, and The Cooper Companies, Inc.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis along with the current global surgical retractor market trends from 2018 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The surgical retractor market forecast is studied from 2019 to 2026.

- The market size and estimations are based on a comprehensive analysis of key developments in the surgical retractor industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the surgical retractor market.

Surgical Retractor Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Johnson & Johnson, Henry Schein, Inc., Medtronic Plc., The Cooper Companies, Inc., Terumo Corporation, B Braun Melsungen Ag, Medline Industries, Inc., Teleflex Incorporated, Integra Lifesciences Holdings Corporation, Becton, Dickinson and Company |

Analyst Review

The utilization of surgical retractors has witnessed a significant growth, owing to surge in number of surgical procedures worldwide. Moreover, increase in geriatric population, rise in prevalence of chronic conditions and upsurge in the healthcare expenditure boost the growth of the market.

A surgical is a medical tool which is utilized during a surgical procedure. The tool is employed to keep an incision open which provides a better view of the surgical site. Furthermore, there are different types of surgical retractors available in the market. For instance, handheld retractors are manual handled by surgeons or medical staff. In addition, table mounted surgical retractors are placed on a table during a surgical procedure. Furthermore, the factors which drive the growth of the market include surge in number of minimally invasive surgeries which require the use of surgical retractors, rise in awareness related to use of surgical retractors fuel the growth of the market.

The total market value of surgical retractor market is $2,689.40 million in 2018.

The forcast period for surgical retractor market is 2019 to 2026

The market value of surgical retractor market in 2019 is $2,792.90 million.

The base year is 2018 in surgical retractor market

Top companies such as, B Braun Melsungen AG, Integra Lifesciences Holdings Corporation, Becton, Dickinson and Company, Medtronic Plc., and Johnson & Johnson held a high market position in 2018. These key players held a high market postion owing to the strong geographical foothold in different regions.

Hand retractors segment is the most influencing segment owing to surge in number of surgical procedures across the globe. Moreover, these devices are often used in plastic surgeries and small bone & joint surgeries thus, rise in number of plastic surgeries performed boost the growth of the market.

The major factor that fuels the growth of the global surgical retractor market includes growth in geriatric population which lead to rise in demand for surgeries. Moreover, plastic & reconstructive surgeries, performed for aesthetic/cosmetic purposes, have gained increasing popularity in the recent years.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 5.0%. This is due to surge in prevalence of chronic disorders, which require surgical treatment and rise in awareness related to the use of surgical retractors among surgeons.

Surgical retractors are medical instruments, which are employed in keeping a surgical incision open during a medical procedure. Furthermore, surgical retractors are used to draw back the sutures, keeping them adjacent with the operative field.

Surgical retractor are employed to achieve a better view of the surgical site, and keep other organs away from the major organ to be operated.

Loading Table Of Content...