Suspension Control Unit Market Overview

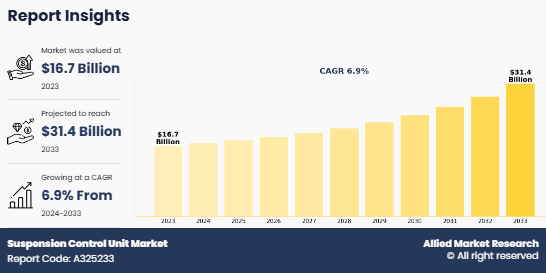

The global Suspension Control Unit Market Size was valued at USD 16.7 billion in 2023, and is projected to reach USD 31.4 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033. The suspension control unit market is growing due to rising demand for vehicle safety, comfort, and stability. Increasing adoption of electronic and air suspension systems further drives market expansion across passenger and commercial vehicles.

Key Market Insights

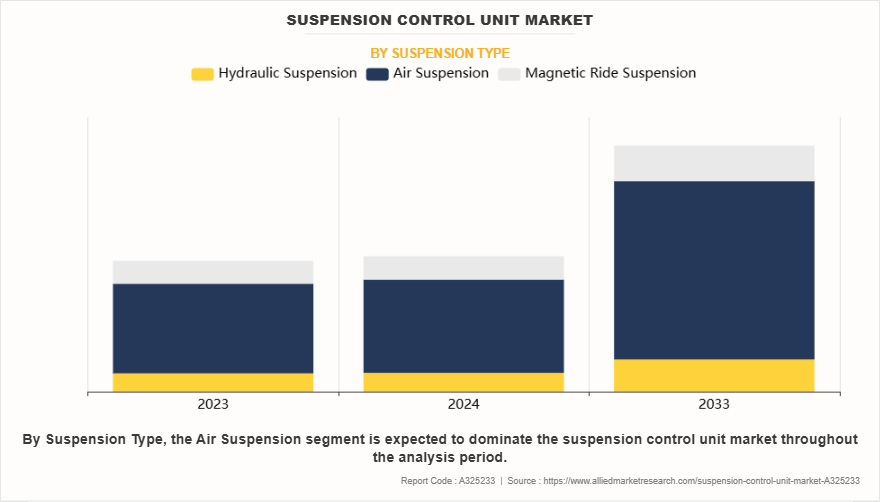

- Air suspension led the market in 2023 due to its comfort and adaptability benefits.

- Passenger cars dominated the market with high adoption of advanced suspension systems.

- ICE vehicles remained dominant, supported by strong demand in emerging economies.

- OEM segment led sales as automakers integrated advanced suspension in new models.

- North America held the highest market share, driven by demand for premium vehicles.

- Asia-Pacific is the fastest-growing region, fueled by EV adoption and automotive expansion.

Market Size & Forecast

- 2033 Projected Market Size: USD 31.4 Billion

- 2023 Market Size: USD 16.7 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 6.9%

Key Takeaways

- The Suspension Control Unit Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry Suspension Control Unit Market Insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global Suspension Control Unit Industry and to assist stakeholders in making educated decisions to achieve their most ambitious Suspension Control Unit Market Growth objectives.

What is an suspension control unit in automotive industry

A suspension control unit is an electronic component that manages a vehicles suspension system to improve ride comfort and handling. It continuously monitors road conditions, vehicle speed, and driving dynamics using sensors and adjusts the suspension settings accordingly. This system enhances stability by reducing body roll, improving traction, and adapting to different terrains

Market Dynamics

Suspension control units (SCUs) have become an integral part of modern vehicle dynamics, particularly as the automotive industry moves toward smarter, safer, and more comfortable transportation systems. These units are increasingly designed with sophisticated electronic control architectures that enable real-time monitoring and adjustment of suspension parameters. Modern SCUs are seamlessly integrated with a vehicle‐™s onboard electronic systems, allowing for automatic adjustments or driver-selected settings tailored to various driving conditions. Popular modes include comfort, sport, off-road, and eco, which alter the suspension response to either enhance ride softness or improve handling precision. This adaptability not only boosts performance in diverse terrains but also contributes significantly to passenger comfort, cargo stability, and vehicle safety.

Such advanced suspension features are primarily implemented in luxury sedans, sports cars, high-performance SUVs, and off-road vehicles, where the need for precision handling, comfort, and superior ride quality is paramount. These systems enable better grip, reduced body roll, and minimized vibration, leading to more controlled and responsive driving experiences. By enabling continuous damping adjustment and real-time load balancing, suspension control units contribute to a smoother ride, reduced driver fatigue, and optimized vehicle dynamics, even under challenging road or weather conditions. Their importance is especially evident in vehicles operating under dynamic loads or navigating complex terrains, where active or semi-active suspensions ensure safety and performance.

A key example of ongoing technological advancement in this area is the partnership between Peterbilt Motors Company and Hendrickson Truck Commercial Vehicle Systems, announced in August 2023. This collaboration focuses on increasing durability and performance in severe-service and heavy-haul applications, which are commonly found in the vocational and construction vehicle segments. Through this partnership, Peterbilt integrated the PRIMAA vocational air suspension system into its Models 567, 579, and 589, thereby enhancing vehicle handling, load-carrying capabilities, and ride stability. PRIMAAX EX is designed with optimized geometry and advanced elastomeric components, enabling it to provide a balanced blend of load-cushioning and roll-stability under demanding conditions. It also facilitates better articulation and performance in multi-axle configurations, crucial for vehicles operating on uneven or unstable surfaces.

In a similar stride toward innovation, Hendrickson announced the launch of its ROADMAAX rear air suspension system in May 2024. With a 46,000-pound capacity, ROADMAAX Z is not only engineered for durability but is also recognized as the lightest in its class, reflecting the industrys shift towards lightweight components for improved fuel efficiency and payload capacity. The suspension system is specifically designed for demanding on- and off-highway applications, and is approved for up to 25% off-highway use”making it a compelling solution for fleet operators and commercial vehicle OEMs alike. Additionally, the ROADMAAX Z is compatible with lift axles, enhancing vehicle versatility across variable load profiles and usage patterns.

A standout feature of the ROADMAAX Z is its incorporation of Zero Maintenance Damping (ZMD) ride technology, marking its first application in trucks and tractors. Unlike traditional shock absorbers, ZMD eliminates the need for conventional damper maintenance by integrating damping directly into the air spring. This results in consistent performance across the life of the component, especially under harsh duty cycles and extreme operational environments. By reducing the need for regular replacements and minimizing wear-related downtimes, the ZMD technology contributes to enhanced fleet uptime, lower total cost of ownership, and long-term durability.

These innovations underscore the rising adoption of air and electronic suspension systems across luxury and commercial vehicle segments. With OEMs increasingly prioritizing ride comfort, handling stability, and adaptive suspension behavior, SCUs are gaining widespread traction. These systems provide a critical interface between the vehicle‐™s chassis and advanced electronics, adjusting suspension stiffness and damping in real-time based on road surface conditions, vehicle speed, and driving behavior. Furthermore, as automotive technologies converge toward intelligent safety systems and autonomous driving platforms, the integration of smart suspension units becomes essential for ensuring passenger protection and optimal vehicle control.

However, despite the growing advantages and Suspension Control Unit Industry acceptance, several challenges persist. One of the primary limitations is the high cost associated with advanced SCUs. These systems involve precision-engineered components, control algorithms, and sensor integrations, which collectively drive up the cost of manufacturing and implementation. As a result, their adoption is largely restricted to premium vehicles and commercial fleets with high-performance requirements. For mid-range and budget vehicles, the incremental cost of adding advanced SCUs can significantly affect vehicle pricing, making it harder for manufacturers to justify the investment in cost-sensitive markets.

Moreover, the complexity involved in integrating SCUs with existing vehicle architectures”especially in legacy ICE platforms”acts as another deterrent. Customizing these systems for diverse suspension geometries, electronic control units (ECUs), and braking systems requires additional engineering effort and calibration, which can be time- and cost-intensive. In regions where aftermarket support and technician expertise are limited, these challenges are further magnified, affecting the long-term reliability and serviceability of the systems.

On the other hand, the expansion of the electric vehicle (EV) and autonomous vehicle (AV) markets presents a significant opportunity for the suspension control unit market. EVs are characterized by lower center of gravity, reduced NVH (noise, vibration, harshness), and instant torque delivery, all of which necessitate advanced suspension management to maintain control and comfort. Similarly, AVs require predictive and responsive suspension systems to ensure a smooth, safe, and comfortable ride”especially in scenarios where driver intervention is absent. SCUs play a pivotal role in achieving this, as they can interact with vehicle sensors and AI modules to anticipate and respond to driving inputs autonomously.

Additionally, governments and OEMs are investing heavily in smart mobility ecosystems, which include connected cars, electrification infrastructure, and vehicle-to-everything (V2X) communication. These developments create new use cases for SCUs, where suspension systems could eventually communicate with road infrastructure or other vehicles to dynamically adapt suspension settings in advance. For instance, if an upcoming road anomaly or traffic slowdown is detected via V2X, the SCU can preemptively adjust damping to ensure minimal disruption and improved safety.

Market Segment Review

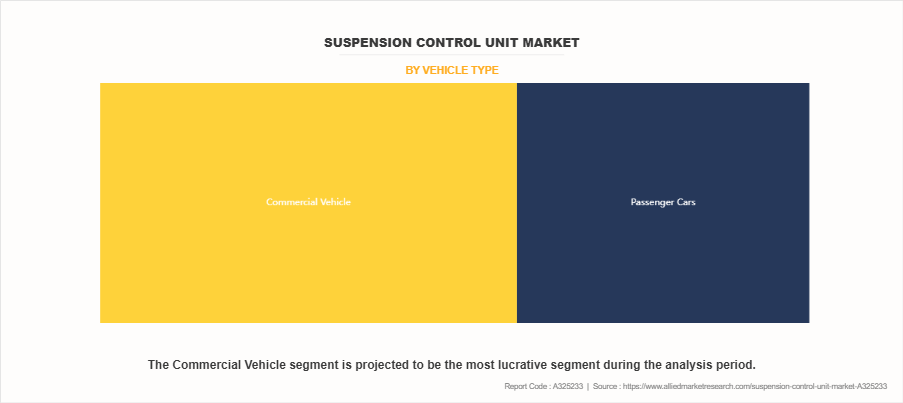

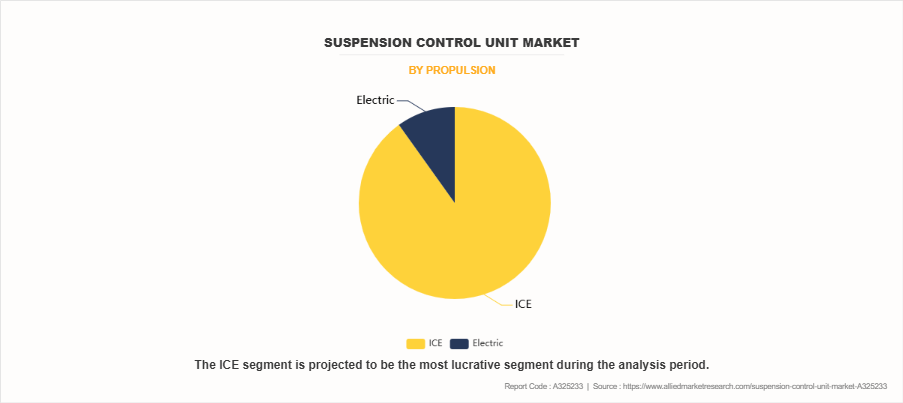

The global suspension control unit market is segmented on the basis of suspension type, vehicle type, propulsion, sales channel, and region. On the basis of suspension type, the market is divided into hydraulic suspension, air suspension, and magnetic ride suspension. By vehicle type, the market is segmented into commercial vehicle and passenger cars. On the basis of propulsion, the market is segmented into ICE, and Electric. By sales channel, the market is segmented into OEM , and Aftermarket. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Suspension Type

On the basis of suspension type, the air suspension segment attained the highest market Suspension Control Unit Market Share in 2023 in the suspension control unit market. This is due to its widespread adoption in luxury, commercial, and high-performance vehicles. Air suspension systems offer superior ride comfort, load adaptability, and enhanced stability by automatically adjusting to road conditions. They are increasingly integrated with electronic control units to optimize handling and fuel efficiency, making them a preferred choice for premium and heavy-duty applications. The growing demand for electric and autonomous vehicles, which require advanced suspension technologies, further boosts the adoption of air suspension systems, solidifying their dominance in the market.

By Vehicle Type

On the basis of vehicle type, the passenger cars segment attained the highest market share in 2023 in the suspension control unit market. This is due to the rising adoption of advanced suspension technologies in luxury and high-performance vehicles. Modern passenger cars, especially premium and electric models, increasingly integrate air and electronic suspension systems to enhance ride comfort, handling, and safety. Growing consumer demand for smooth driving experiences and vehicle stability has driven automakers to incorporate intelligent suspension control units. While commercial vehicles also utilize advanced suspension for load management, the sheer volume of passenger car production and technological advancements contribute to its market dominance.

By propulsion

On the basis of propulsion type, the ICE segment dominated the global market in the year 2024 and is likely to remain dominant during the Suspension Control Unit Market Forecast period owing to the continued reliance on internal combustion engine vehicles, especially in emerging economies where EV infrastructure is still developing. The widespread availability of fuel established servicing networks, and lower initial costs of ICE vehicles contribute to their sustained demand. However, gradual shifts toward electrification may influence future market dynamics.

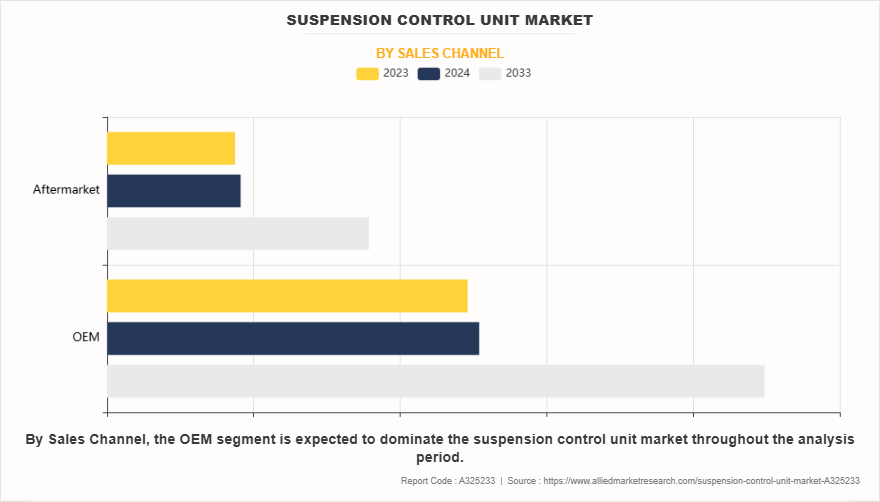

By Sales channel

On the basis of sales channel, the OEM segment dominated the global market in the year 2024 and is likely to remain dominant during the forecast period, due to the increasing integration of advanced suspension control units by vehicle manufacturers during the production phase. Automakers are equipping new vehicle model ”especially luxury, commercial, and electric variants with factory-fitted suspension control technologies to meet rising consumer expectations for comfort, safety, and performance. This trend ensures strong demand through OEM channels.

By Region

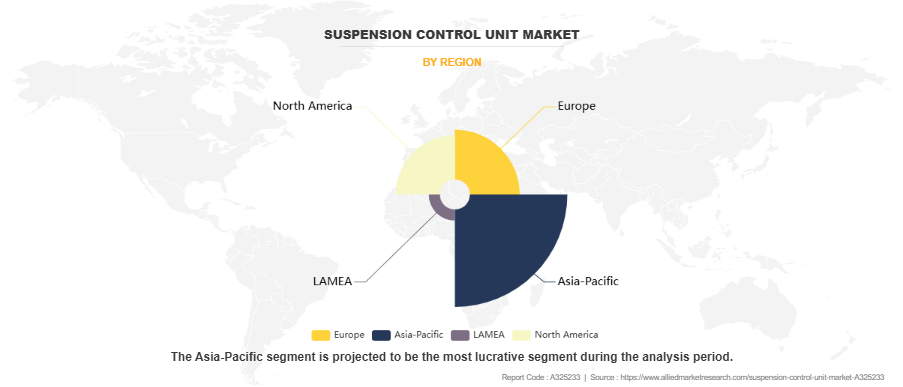

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the suspension control unit market. This is due to the strong presence of luxury and high-performance vehicle manufacturers, increasing adoption of advanced suspension technologies, and growing demand for electric and autonomous vehicles. The region's well-established automotive industry, coupled with consumer preference for enhanced ride comfort and vehicle stability, has driven the integration of intelligent suspension systems. Additionally, investments in research and development, along with regulatory standards promoting vehicle safety and performance, have further accelerated market growth. The expansion of premium SUVs and commercial vehicles also contributed to North America's market dominance.

Why is Asia-Pacific Seen as an Opportune Region?

Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to the rapid expansion of the automotive industry, increasing demand for luxury and electric vehicles, and advancements in suspension technologies. Countries such as China, Japan, and South Korea are leading in vehicle production and technological innovation, driving the adoption of intelligent suspension systems. Rise in disposable incomes and urbanization have increased consumer demand for enhanced ride comfort and vehicle safety. Government initiatives promoting electric and autonomous vehicles further fuel market expansion. The presence of major automakers and component manufacturers strengthens Asia-Pacifics position as the fastest-growing region.

Which are the Top Suspension Control Unit companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the suspension control unit industry.

Continental AG

ZF Friedrichshafen AG

Robert Bosch GmbH

Denso Corporation

Infineon Technologies AG

River Engineering Pvt Ltd.

Transtron Inc

Stesalit Limited

APR LLC.

Murata Manufacturing Co., Ltd.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the suspension control unit market analysis from 2023 to 2033 to identify the prevailing suspension control unit market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the suspension control unit market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global suspension control unit market trends, key players, market segments, application areas, and market growth strategies.

Suspension Control Unit Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 31.4 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Suspension Type |

|

| By Vehicle Type |

|

| By Propulsion |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Transtron Inc., StesaLIT Limited, Continental AG, APR LLC, Hitachi, Ltd., Infineon Technologies AG, Pektron Group Ltd, Robert Bosch GmbH, ZF Friedrichshafen AG, Murata Manufacturing Co., Ltd. |

Analyst Review

As per CXO perspective the growing demand for the suspension control unit market is experiencing steady growth, driven by advancements in vehicle technology and increasing demand for enhanced ride comfort and stability. Automakers are incorporating advanced suspension systems, including electronic and air suspension, to improve vehicle performance across various road conditions. The rise in production of luxury and high-performance vehicles, which rely heavily on intelligent suspension control units, is further fueling market expansion. For instance, in May 2022, Tenneco Inc. launched the Mercedes-AMG SL-Class luxury roadsters featuring advanced suspension technologies from its Monroe Intelligent Suspension portfolio. These models were equipped with either the CVSA2 semi-active suspension or the integrated CVSA2/Kinetic suspension, enhancing ride comfort, handling, and stability. This integration aimed to improve driving dynamics, offering a more responsive and controlled driving experience.

Moreover, the growing adoption of electric and autonomous vehicles is also a key factor contributing to market growth. These vehicles require sophisticated suspension systems to ensure smooth operation, compensate for battery weight distribution, and enhance passenger comfort. As the shift toward smart mobility accelerates, the demand for intelligent and adaptive suspension technologies continues to rise. For instance, 2023, ClearMotion, a leading suspension technology provider, has partnered with NIO to supply advanced suspension technology for the upcoming ET9 electric vehicle. This collaboration aims to enhance ride comfort and driving dynamics, providing a smoother and more stable experience for NIO customers. By integrating its innovative suspension solutions, ClearMotion strengthens its presence in the expanding EV market while supporting NIO’s commitment to premium vehicle performance.

In addition, regulatory standards focusing on vehicle safety and stability are pushing manufacturers to integrate advanced suspension control units into their models. These units help reduce body roll, improve traction, and enhance braking efficiency, making them essential for modern vehicles. For instance, in August 2023, BWI Group partnered with ClearMotion to advance high-volume active suspension systems, enhancing vehicle safety by improving ride stability, road handling, and passenger comfort. This partnership aims to integrate intelligent suspension technology that actively adapts to road conditions, reducing body roll and enhancing overall driving control for safer and more responsive vehicles.

Some of the key players profiled in the report include Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation, Infineon Technologies AG, River Engineering Pvt Ltd., Transtron Inc, Stesalit Limited, APR LLC., and Murata Manufacturing Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in suspension control unit.

The global suspension control unit market was valued at $17,983.3 million in 2023, and is projected to reach $33,836.3 million by 2033, registering a CAGR of 6.9% from 2024 to 2033.

From 2024-2034 would be forecast period in the market report.

$18612.7 million is the market value of Suspension control unit market in 2025.

2024 is base year calculated in the Suspension control unit market report.

Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation, Infineon Technologies AG, River Engineering Pvt Ltd., Transtron Inc, Stesalit Limited are the top companies hold the market share in Suspension control unit market.

Loading Table Of Content...

Loading Research Methodology...