Tactical Communication Market Overview, 2031

The global tactical communication market was valued at $20.05 billion in 2021, and is projected to reach $46.55 billion by 2031, growing at a CAGR of 8.71% from 2022 to 2031. Tactical communication is military communication in which, by orders or codes, various types of information is transmitted from one person to another in different areas of the world. Tactical communication involves various verbal, visual, written, and auditory communications. The form of communication can be data transfer or voice-over communications. It is generally dependent on a diverse and complex network of hardware and protocols for transmitting information across people and regions. Also, the development of equipment and technological innovations such as ear canal earphones production, active and passive noise cancelation equipment, and enhanced communication technological advancements, are expected to fuel the demand in the tactical communication market.

At present, the rapid shift toward asymmetric warfare is forcing the militaries to develop their tactical communication capabilities. To improve combat effectiveness, the global armed forces are focusing on enhancing the network-based communication capabilities of their military platforms across the land, air, and sea domains, driving tactical communication industry growth. For instance, in January 2021, Thales announced that it has been awarded its third delivery order from the U.S. Army to provide the AN/PRC-148D Improved Multiband Inter/Intra Team Radio (IMBITR).

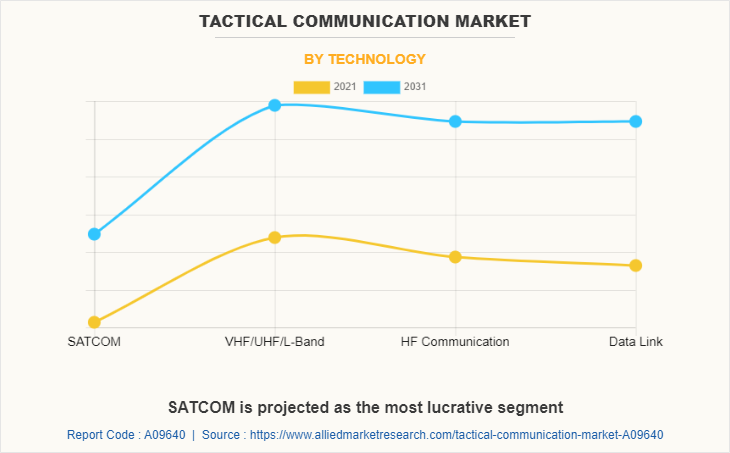

The factors such as integration of military SATCOM in military communication, technological advancements in network-centered warfare and satellite-based communication, and an increase in demand for land-based communication systems supplement the growth of the tactical communication market. However, limited bandwidth for communications and scarcity of semiconductors are the factors expected to hamper the growth of the tactical communication market. In addition, the integration of smartphones and software’s in the war field, and the rise in government expenditure for military applications are expected to create ample opportunities for the key players operating in the tactical communication industry.

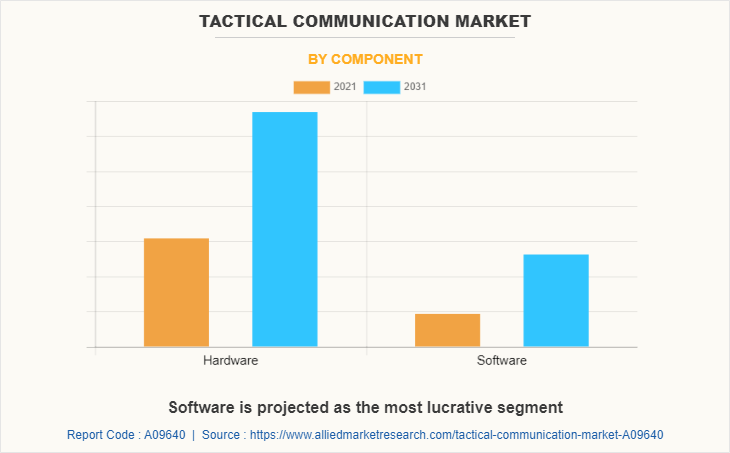

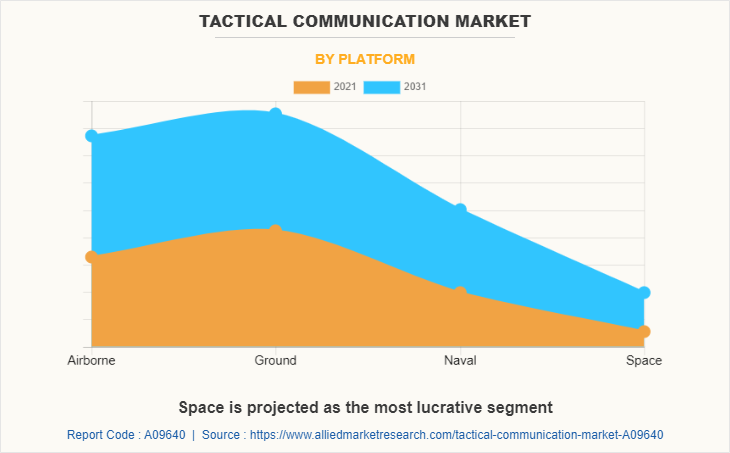

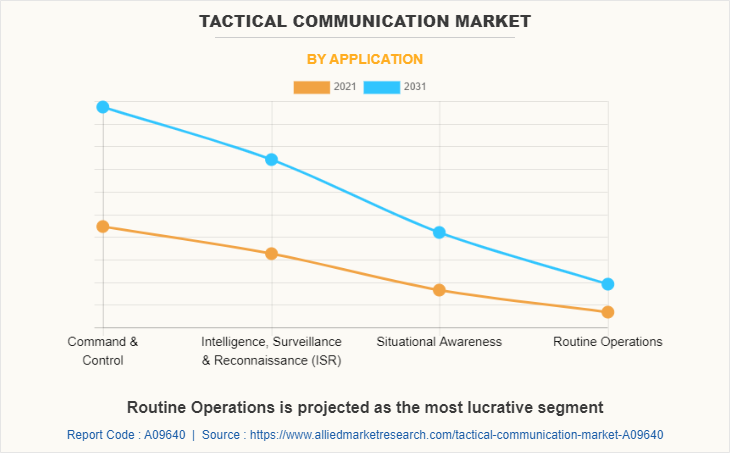

The tactical communication market is segmented into component, technology, platform, application, and region. By component, the tactical communication market is divided into hardware and software. By technology, it is categorized into SATCOM, VHF/UHF/L-Band, HF communication, and data link. By platform, it is fragmented into airborne, ground, naval, and space. By application, it is categorized into command & control, intelligence, surveillance, and reconnaissance (ISR), situational awareness, and routine operations. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Players

The leading players operating in the tactical communication market are ASELSAN A.S., BAE Systems Plc., Cobham Ltd., Curtiss-Wright, Datron World Communications, General Dynamics Corporation, Hanwha Group, Huneed Technologies, Iridium Communications Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rohde & Schwarz, Thales Group, Ultra, and Viasat, Inc.

Integration of military SATCOM in military communication avionics

Satellite communication (SATCOM) is key for military operations, as it provides beyond line-of-sight communications, which can cover around one-third of the earth on a single satellite. Satellite communications enable an aircraft to communicate through satellite with air traffic control and other ground-based facilities while in the air. It can include voice and ground service. With the arrival of internet protocol (IP)-based applications and new data-hungry cockpits, SATCOM delivers critical safety data as well as improves operational performance for present military aircraft fleets. The potential to enhance safety and efficiency of air travel is exhaustive. As military forces increasingly use space-based assets to fulfil their missions, SATCOM technologies have become vital for communications networks. For instance, in April 2021, Northrop Grumman Corporation entered into partnership with the U.S. Space Force’s (USSF) Space and Missile Systems Center (SMC) to proceed with its ongoing Protected Tactical SATCOM (PTS) Rapid Prototype program, with a flight demonstration of the company’s PTS payload set to occur in 2024.

Moreover, in Europe, the European Union Agency for the Space Program’s (EUSPA) Government Satellite Communications (GOVSATCOM) initiative is anticipated to accelerate research and innovation in the EU’s Common Security and Defense Policy (CSDP). For instance, in December 2021, Airbus and One Web signed a distribution partner agreement to provide low Earth orbit (LEO) satellite communication services for military and government use to European and UK armed forces, and civil protection and security forces. Hence, the adoption of satellite communication (SATCOM) in military communication avionics is expected to drive the tactical communication market.

Increase in demand for land-based communication systems

Land-based communication systems are becoming increasingly sophisticated, allowing ground-based forces to leverage advanced wireless technology and smartphones while actively moving in ground vehicles or as dismounted infantry. Meanwhile, military across the world is strengthening its land-based mission capabilities as land-based forces are the largest in terms of personnel strength and operate the highest number of vehicles. For instance, in April 2021, L3Harris Technologies announced that its Falcon III AN/PRC-117G manpack radios were selected by the German Ministry of Defense for the German Army. Thus, growth in demand for secure communication for land-based forces on the move has given rise to communication solutions in a smaller form factor that enhances mobility like the manpack radios. In June 2020, Airbus unveiled a land-based communication solution that offers units in operation a secure satellite-based broadband connection with high availability to exchange videos, voice, and operational flows in fast-moving circumstances. The solution, named OTM-T (On-The-Move Terre), is compact, weighs less than 60 kg, and can easily be integrated into any armored vehicle. Hence, such technologies lead to the increase in demand for land-based communication systems, thereby propels the tactical communication market.

Scarcity of Semiconductors

Semiconductors play a vital role in defining business opportunities within the military tactical communication market. With increase in demand for satellite communication and data driven operations, the need of electronics chips and semiconductors within the tactical communication industry has increased over the past few years. Also, sudden rise in demand for consumer electronics on the commercial front in 2020, followed by global trade and travel restrictions, owing to the COVID-19 pandemic led to a global scarcity of semiconductors, impacting manufacturing operations of tactical communication systems. Moreover, degrading trade and geopolitical relation between the U.S. and China is disrupting global supply chain of the semiconductors industry, impacting manufacturing side of the tactical communications equipment such as ear canal earphones production active and passive noise cancelation equipment, thereby hinders the tactical communication market growth.

Rise in government expenditure for military applications

Governments of countries such as Russia, the U.S., China, India, and others, are increasing investment in armed forces to establish dominance on the battlefield. According to Stockholm International Peace Research Institute (SIPRI), total global military expenditure increased to $1,981 billion in 2020, an increase of 2.6% from 2019. Moreover, governments of developed and developing countries such as India, China, Russia, the U.S., and others, are significantly spending on military modernization programs to improve their command & control, communications, and combat systems and to maintain intelligence & communication capabilities. For instance, in January 2021, Thales announced that it has been awarded its third delivery order from the U.S. Army to provide the AN/PRC-148D Improved Multiband Inter/Intra Team Radio (IMBITR). This latest award brings the total IMBITR radio orders to more than 6,000. Similarly, Canada also has plans to invest significantly in the procurement of portable communication systems in the coming years. Such modernization plans to enhance the capabilities of the armed forces in the region are expected to create tactical communication industry opportunity for tactical communication systems during the forecast period.

Key Benefits For Stakeholders

This study presents analytical depiction of the global tactical communication market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall tactical communication market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global tactical communication market with a detailed impact analysis.

- The current tactical communication market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Tactical Communication Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Technology |

|

| By Platform |

|

| By Application |

|

| By Region |

|

| Key Market Players | BAE Systems PLC, Viasat Inc., Hanwha Corp, Raytheon Technologies Inc., Iridium Communications Inc., Rohde & Schwarz, Northrop Grumman Corporation, Cobham PLC, Ultra Electronics, Thales Group, ASELSAN A.S., Lockheed Martin Corporation, Huneed Technologies (Key Innovators), Datron World Communications (Key Innovators), General Dynamics Corporation, Tactical Communications Group LLC., L3Harris Technologies, Inc. |

Analyst Review

This section provides the opinions of various top-level CXOs in the global tactical communication market. The market is expected to witness a significant growth due to technological advancements in the communication equipment such as the development of ear canal earphones, active & passive noise cancelling devices, and the improvement of connectivity technologies. Moreover, governments of developed and developing countries such as India, China, Russia, the U.S., and others, are significantly spending on military modernization programs to improve their command & control, communications, and combat systems and to maintain intelligence & communication capabilities. According to SIPRI, global military spending witnessed an increase of 2.6% in 2020, despite the fall in the global GDP. Nevertheless, defense spending is expected to decrease in the near future, due to the global economic turndown triggered by the pandemic. This can challenge the growth of the market during the forecast period.

Furthermore, adoption of LTE technology in professional mobile radios (PMR) systems and improvement of connectivity technologies has allowed real time data interchange and the transmission of complex video and voice data. For instance, in May 2021, L3Harris Technologies, Inc. launched its XL product line with the XL Connect™ 95 Portable Radio – a flexible single-band, P25 radio for local government, public safety, utilities, education, transportation and other agencies needing affordable and secure communications. It delivers secure critical communications connections across 700/800 MHz and features Wi-Fi-enabled voice and device management, so users can communicate beyond their LMR system. Also, miniaturization of the equipment and increase in number of companies in the market are anticipated to drive the market growth.

The market growth is supplemented by factors such as integration of military SATCOM in military communication, technological advancements in network-centered warfare & satellite-based communication, and an increase in demand for land-based communication systems supplement the growth of the tactical communication market. However, limited bandwidth for communications and scarcity of semiconductors are the factors expected to hamper the growth of the tactical communication market. In addition, integration of smartphones and software in the war field, and rise in government expenditure for military applications are expected to create ample opportunities for the key players operating in the tactical communication market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Asia-Pacific, Europe, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period, due to increase in defense budget across Asia-Pacific countries.

Increased application in Defense sector is the upcoming trends of Tactical Communication Market in the world

Intelligence, Surveillance & Reconnaissance (ISR) and Situaional Awareness are the leading application of Tactical Communication Market

North America is the largest regional market for Tactical Communication

The global tactical communication market was valued at $20.05 billion in 2021, and is projected to reach $46.55 billion by 2031, registering a CAGR of 8.7% from 2022 to 2031

The leading players operating in the tactical communication market are ASELSAN A.S., BAE Systems Plc., Cobham Ltd, Curtiss-Wright, Datron World Communications, General Dynamics Corporation, Hanwha Group, Huneed Technologies, Iridium Communications Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rohde & Schwarz, Thales Group, Ultra, and Viasat, Inc

Loading Table Of Content...