Tank Insulation Market Research, 2031

The global tank insulation market was valued at $5.3 billion in 2021, and is projected to reach $9.0 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

Tank insulation is a material or blend of materials that are used to add a protecting cover to industrial tanks and cuts the heat loss or heat gain from tank surfaces that are operating at temperatures above or below the surrounding temperature.

The growth of the global tank insulation industry is driven by increase in use of fiberglass tank insulation material. Fiberglass is preferred mostly for insulation of larger diameter tank. Moreover, it can be used for insulation of curved or irregular tank surfaces. High compression strength and rigidity of fiberglass makes it viable to be used for insulation of tanks and tank accessories such as ducts and pipes. Fiberglass insulation is cost effective and effective tank insulation material owing to its compression strength.

In addition, it helps effectively to stop the outflow of heat or cold from the tank surface, consequential in improved energy efficiency drives the demand for fiberglass tank insulation. In addition, cryogenic tank insulation is extremely important in order to prevent heat loss. Fiberglass being effective solution makes it viable to be used for insulation of cryogenic tanks is another considerable factor driving the demand of the global market. Fiberglass is considered as an effective tank insulation material making it widely opted material for insulation of tanks used across commercial industries. Also, some industries such as oil & gas and chemical industry handling ammonia requires proper insulation material. Fiberglass being effective solution makes it suitable be used for insulation of tanks that generally deals with hazardous chemicals. All these factors collectively drive the tank insulation market growth and anticipated to offer new growth opportunities in the forecast period. Coupled with versatility and longevity of fiberglass tend to make it suitable tank insulation products across niche industrial insulation applications.

However, risk associated with use of tank insulation products in interior tank systems is expected to hamper the market growth. For instance, capillary active insulation system (type of tank insulation) is widely preferred for tank insulation in oil and gas, chemical, and food industry. This tank insulation system is used mostly for thermal insulation of storage tanks and mixing tanks. However, interstitial condensation risk associated with tank insulation systems is anticipated to hamper the market growth.

Conversely, polyurethane is used widely for insulation of transportable tanks including tanks for transporting liquid CO2 gas. Usually, polyurethane tank insulation is used in combination with vapor screen and plate finishes that further improvises insulation characteristics. Polyurethane tank insulation is easy to install and can be installed on existing tank insulation. Cryogenic tanks that are generally installed on transport vehicles need insulation products that are lightweight. Polyurethane being lightweight tend to minimize the fuel costs in transport. Polyurethane insulation properties are superior as considered with other insulation materials. In addition, polyurethane insulation is suitable to be used with variety of tank surfaces such as pre-coated tanks, aluminum storage tanks, stainless steel tanks, and fiber-reinforced polymer tanks. In addition, rigid polyurethane foam is considered as an optimal insulation material across diverse tank insulation application. Moreover, production process of polyurethane insulation material makes it viable to be used with different tank surfaces that in turn offers effective insulation performance. Vertical thermal tanks are mainly used to store milk, whey and other products. Thus, polyurethane is widely used insulating material used on vertical tanks and is another considerable factor anticipated to offer new opportunities in the forecast period. The tank insulation market forecast is done based on various factors including the current market scenario, demand, and upcoming projects across various industries such as oil and gas, chemical among others in major countries across the globe.

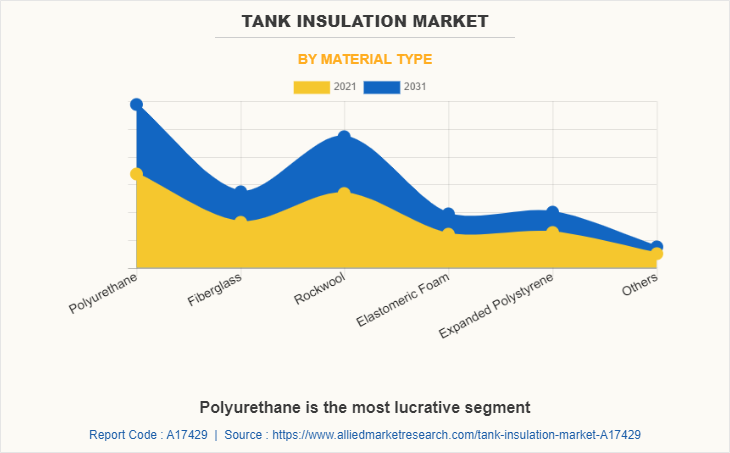

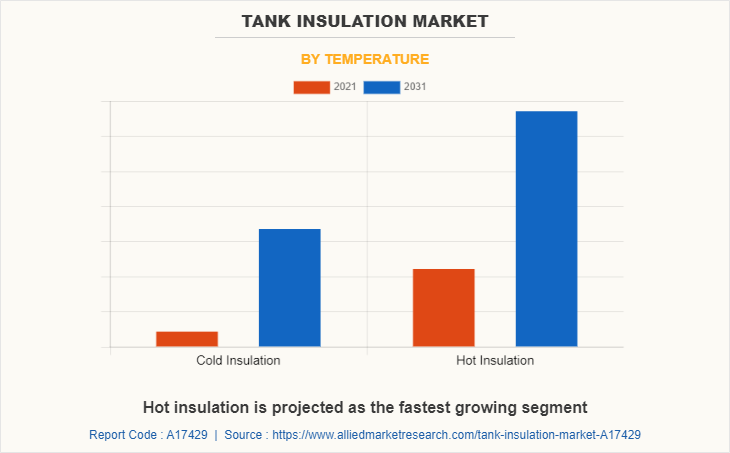

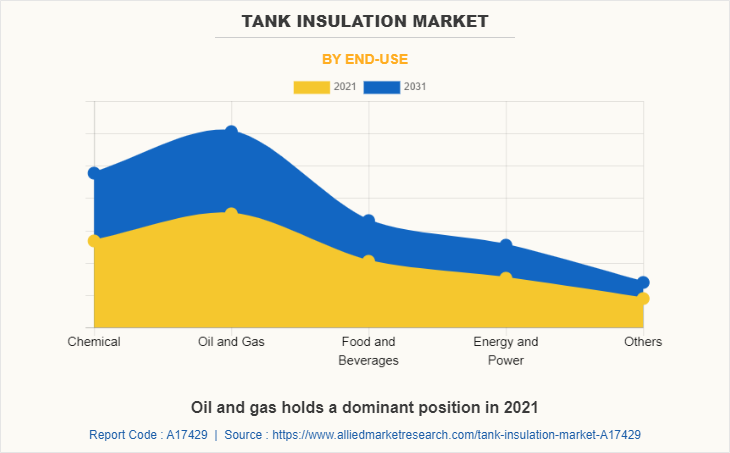

The tank insulation market is segmented into Material Type, Temperature and End-use and region. On the basis of material type, the market is categorized into polyurethane, fiberglass, rockwool, elastomeric foam, expanded polystyrene, and others. By temperature, the global tank insulation market is divided into cold insulation and hot insulation. The end-use industry covered in the report includes chemical, oil and gas, food and beverages, energy and power, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global tank insulation market include ROCKWOOL A/S, BASF SE, Armacell, Arch Tech, Gilsulate, Johns Manville, Kingspan, Omkar PUF, Isolatie Combinatie, and Cabot.

The Asia-Pacific tank insulation market size is projected to grow at the highest CAGR of 5.9% during the forecast period and accounted for 36.8% of the tank insulation market share in 2021. This is attributed to fact that elastomeric foam is capable of offering high insulation across cold insulation tanks is the key market trend. In addition, low water vapor permeability and closed cell structure of elastomeric foam makes it viable to be used for insulation of cryogenic tanks. Low thermal conductivity, thermal performance at elevated operating temperature makes its viable to be used for insulation of wide assortment of tanks drives the demand for the tank insulation market in Asia-Pacific. Light weight and environment friendly characteristics of glass wool makes it suitable to be used as tank insulation material is the key market trend. In addition, owing to high thermal insulation property further reduces negative environmental impact and improvises to save energy. Porous and elastic structure of glass wool offers effective acoustic attenuation property for insulated tanks that generally operates at temperature of 300°C.

In 2021, the polyurethane segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.7% during the forecast period. The polyurethane material type dominated the global market in terms of revenue in 2021, with over 30% of the total share. Polyurethane is used widely for insulation of transportable tanks including tanks for transporting liquid CO2 gas. Usually, polyurethane tank insulation is used in combination with vapor screen and plate finishes that further improvises insulation characteristics. Polyurethane tank insulation is easy to install and can be installed on existing tank insulation. Cryogenic tanks that are generally installed on transport vehicles need insulation products that are light weight. Polyurethane being lightweight tend to minimize the fuel costs in transport is the key market trend. Polyurethane insulation properties are superior as considered with other insulation materials. In addition, polyurethane insulation is suitable to be used with variety of tank surfaces such as pre-coated tanks, aluminum storage tanks, stainless steel tanks, and fiber reinforced polymer tanks.

By temperature, the hot insulation segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 5.6% during the forecast period. This is attributed to the fact that hot insulation further reduces fuel consumption, operational cost, minimizes capacity requirements, and reduces requirement for heating. Key players in the tank insulation market are offering diverse portfolio of insulation products for hot tank insulation that in turn has eased the consumers to choose appropriate insulation material. In addition, tank insulation manufacturers are emphasizing more on production of effective hot insulation products that are suited to be used with larger area tanks and vessels drives the growth of the global market.

By end-use industry, oil and gas end-user dominated the global market in terms of revenue in 2021, with over 32% of the total share. Use of tank insulation products in oil and gas industry eases processing of oil, gas and other process fluids. In addition, it increases sustainability, improvise safe working environment, and cuts down maintenance cost of oil and gas storage tanks as these tanks tend to corrode under harsh environmental conditions without use of insulation products. All these factors have further escalated the use and demand for tank insulation materials. Moreover, low thermal conductivity of tank insulation materials maximizes energy efficiency in oil and gas industry; thereby improving product yield and profit associated in the industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tank insulation market analysis from 2021 to 2031 to identify the prevailing tank insulation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tank insulation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tank insulation market trends, key players, market segments, application areas, and market growth strategies.

Tank Insulation Market Report Highlights

| Aspects | Details |

| By Material Type |

|

| By Temperature |

|

| By End-use |

|

| By Region |

|

| Key Market Players | johns manville, Kingspan Group plc, Armacell, Cabot Corporation, Omkar Puf Insulation Pvt.Ltd., BASF SE, Arch-Tech Building Systems, ROCKWOOL A/S, Isolatie Combinatie Beverwijk B.V., Gilsulate International |

Analyst Review

According to CXOs of leading companies, the global tank insulation market is expected to exhibit high growth owing to its use in oil and gas, chemical, food and beverages end-use industry. Chemical industry deals with storage, handling, processing, and mixing of several cold and hot fluids and chemical intermediates. Use of tank insulation reduces problems associated with heat loss and heat gain across chillers and heaters that in turn helps to maintain consistent operating temperatures. Industrial tanks that are used in the chemical industry needs to be insulated that further helps to maintain consistent operating temperatures that in turn escalates optimal processing. In addition, insulating chemical industrial tanks minimizes heating & cooling cost, regulates appropriate temperature for optimal handling of chemicals, and minimizes condensation issues as the reaction tanks tend to pose frequent temperature variations is the key market trend.

Tank insulation is utmost important in oil and gas industry as it helps to provide improved safety, reliability, minimizes energy consumption and CO2 emissions. Oil and gas industry that handles liquification, storage, and transportation of cryogenic products such as LNG and LPG require efficient tank insulation is the key market trend. In addition, liquid oxygen storage tanks in oil and gas industry requires proper insulation cladding that should be free from grease as presence of grease in insulation system tend to increase the risk associated with spontaneous ignition. Thus, there is growing demand for tank insulation materials across oil and gas industry. This factor is anticipated to drive the growth of the global market. Flexible elastomeric foam, polystyrene, cellular glass, and closed cell phenolic foam are types of tank insulation materials used in food and beverage industry. These tank insulation products or materials offer rational water vapor transmission rate and low water absorption characteristics making them widely used tank insulation materials is the key market trend. In addition, use of proper tank insulation material in food industry aids to maintain hygienic working and storage conditions. Moreover, use of appropriate insulation material in beverage industry helps to maintain the integrity of product during storage and handling. This factor is expected to drive the demand of the global market.

The lightweight and environment-friendly characteristics of glass wool make it suitable to be used as a tank insulation material is the key market trend.

The major application of tank insulation is found in oil and gas sector, wherein it eases the processing of oil, gas and other process fluids. In addition, it increases sustainability, improvises a safe working environment, and cuts down maintenance cost of oil and gas storage tanks as these tanks tend to corrode under harsh environmental conditions without use of insulation products.

The Asia-Pacific tank insulation market size is projected to grow at the highest CAGR of 5.9% during the forecast period and accounted for the largest share of the tank insulation market share in 2021.

The global tank insulation market is projected to reach $9.0 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

The major companies profiled in this report include BASF Corporation, Hdwool Ltd., Invista Textiles, 3M Company, Polartec, LLC, Polybond Insulation Private Limited, Remmers, Stoney Creek Limited, Toray Industries, Inc., and W.L. Gore & Associates.

Loading Table Of Content...