Tax Preparation Software Market Overview

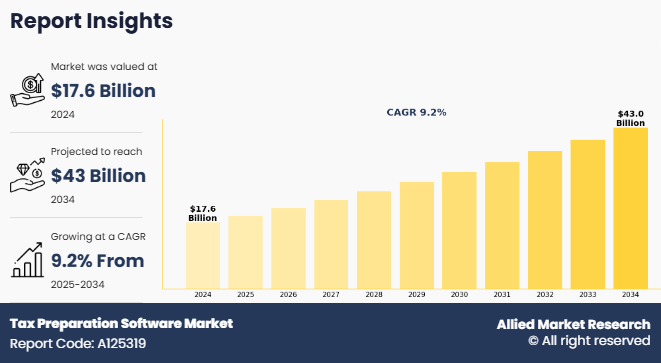

The tax preparation software market was valued at $17.6 billion in 2024 and is estimated to reach $43 billion by 2034, exhibiting a CAGR of 9.2% from 2025 to 2034.

Tax preparation software is a computer program or online tool that helps individuals and businesses prepare, file, and manage their tax returns. It guides users step-by-step through the tax filing process by asking questions about their income, expenses, deductions, and other financial details. The software then calculates how much tax is owed or how much refund is due. Many programs also help users e-file their taxes directly to the government. Some popular features include error checks, support for different tax forms, and automatic updates based on tax law changes. This software saves time, reduces mistakes, and often costs less than hiring a professional tax preparer. It is widely used by both individuals and small businesses. The tax preparation software market Trends highlight a shift toward cloud-based platforms, AI-driven automation, and enhanced security features to meet evolving compliance and user needs. The tax preparation software market outlook remains strong as the shift toward digital adoption continues to reshape the industry and create new tax preparation software market opportunity.

Key Takeaways:

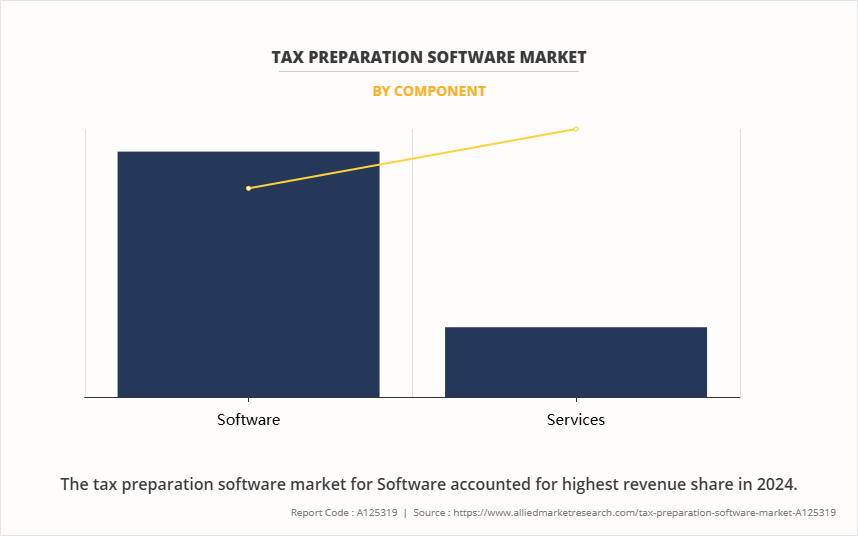

By component, the software segment held the largest share in the tax preparation software market for 2024.

By type, the direct tax segment held the largest share in the tax preparation software market for 2024.

By deployment Mode, the cloud segment held the largest share in the tax preparation software market for 2024.

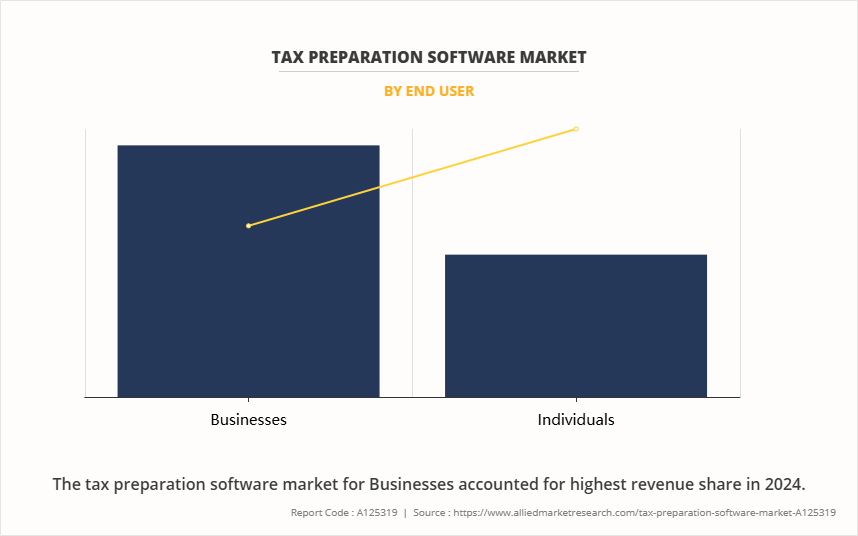

By end user, the business segment held the largest share in the tax preparation software market for 2024.

Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The tax preparation software industry is growing due to the increasing demand for fast, easy, and accurate tax filing solutions. More people and small businesses are choosing software instead of hiring expensive tax professionals. These tools save time, reduce mistakes, and often cost less. The shift toward digital and online tax filing is also driving the tax preparation market growth. Governments in many countries are encouraging e-filing, which makes tax software more popular. Moreover, the rise of mobile apps and cloud-based platforms lets users file taxes anytime, anywhere. In addition, features like automatic updates, secure storage, and step-by-step guidance make these tools user-friendly. As more people become financially aware and tech-savvy, the demand for tax preparation software is expected to rise even more in the coming years. However, limited internet access, low digital literacy, and lack of awareness in rural areas are slowing the adoption of tax preparation software industry, thereby hampering overall market growth in these regions. Nevertheless, the tax preparation software market is experiencing significant growth due to the rising adoption of digital solutions for efficient and accurate tax filing. The tax preparation software market is also driven by increasing regulatory complexity, prompting individuals and businesses to seek automated and compliant solutions.

Furthermore, the rising number of taxpayers globally is fueling the growth of the tax preparation software market. As more individuals enter the workforce and small businesses emerge, the need for efficient and reliable tax filing solutions increases. Tax software offers a convenient, accurate, and cost-effective way to manage tax returns, making it a preferred choice among new taxpayers. This growing user base continues to drive steady demand for such digital tools.

Segment Review

The tax preparation software market is segmented on the basis of component, type, deployment, end-user and region. By component, it is bifurcated into software and services. By type, it is classified into direct tax and indirect tax. By deployment mode, it is segmented into cloud and on-premises. By end-user, it is classified into business and individuals. by region, it is segmented into North America, Europe, Asia-Pacific and LAMEA.

On the basis of component, tax preparation software market is segmented into software and services. The global tax preparation software market share was dominated by the software segment in 2024, owing to the growing demand for automated and user-friendly tax filing solutions. Businesses and individuals prefer software that offers features like e-filing, real-time updates, error detection, and integration with accounting tools. Continuous enhancements in cloud capabilities, AI-driven tax insights, and mobile accessibility are further boosting the adoption of software-based solutions. However, the service segment is expected to register the highest CAGR during the forecast period. This is attributed to the increasing need for expert assistance in handling complex tax regulations and personalized support for both individuals and businesses. Demand for services such as tax advisory, audit support, software customization, and customer training is growing.

On the basis of end-user, it is classified into businesses and individuals. The business segment dominated the market share in 2024, owing to the increasing complexity of tax regulations, rising demand for accurate and timely filing, and the growing shift toward automation and digital compliance. Businesses, especially SME's, are adopting advanced software to reduce manual errors, ensure regulatory adherence, and streamline their financial processes efficiently through integrated tax solutions, thereby fueling tax preparation software market growth.

However, the individual segment is expected to register the highest CAGR during the forecast period. This is attributed to the growing awareness about e-filing benefits, increasing availability of user-friendly and affordable tax software, and the rise in freelance and gig economy workers who require simple, accurate tools to manage their taxes independently and stay compliant with government regulations.

Competition Analysis

The report analyzes the profiles of key players operating in the tax preparation software market such as Intuit Inc., Wolters Kluwer N.V, THOMSON REUTERS, TaxSlayer LLC, Federal Direct, HRB Digital LLC., Jackson Hewitt Inc., Datalog Italia Srl, TaxAct Inc., Drake Software, LLC, TaxHawk, Inc., E-file.com LLC., Greatland Corporation, Caseware International Inc., and IRIS Software Group Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the tax preparation software market.

Recent Key Developments in the Tax Preparation Software Market

In January 2025, TaxAct, a leading provider of tax filing software, introduced several new enhancements to its tax preparation software, focusing on improving the experience for individual, joint, and free filers. These updates aim to make the filing process more streamlined for users. In addition, the company has expanded its Xpert Assist service, offering more options to meet the needs of both consumer and business filers.

In July 2024, Wolters Kluwer introduced the CCH Tagetik Tax Provision & Reporting solution, aiming to bridge the gap between financial and tax reporting for multinational corporations. This innovative tool is designed to streamline group tax provision and accounting processes by integrating them with financial reporting systems.

Top Impacting Factors

Driver

Cost-Effective Alternative to Professionals

A key driver of the tax preparation software market is its affordability compared to hiring tax professionals. Traditional tax preparation services, such as accountants or tax advisors, can be expensive, particularly for individuals, freelancers, and small businesses with limited financial resources. Tax preparation software offers an affordable solution by allowing users to prepare and file their taxes independently, often at a fraction of the cost of professional services. These software tools are designed to be user-friendly, guiding individuals step-by-step through the tax filing process, making them accessible even to those without prior tax knowledge. Many platforms offer tiered pricing models, including free versions for simple returns and reasonably priced options for more complex filings, further broadening their appeal.

In addition, tax preparation software reduces indirect costs such as time spent on appointments or collecting paperwork for an accountant. Real-time updates, automated calculations, and built-in error checks help ensure accuracy and compliance with the latest tax laws. Some software also includes audit support and customer assistance, adding further value. As consumers and businesses seek more economical and convenient tax solutions, the demand for tax preparation software continues to grow as a practical substitute for professional tax services.

Restraints

Data Privacy and Cybersecurity Risks

Data privacy and cybersecurity risks are major challenges that are hampering the growth of the tax preparation software market. These tools deal with very sensitive personal and financial information, including income details, bank account numbers, and social security numbers. If this data is not properly protected, it can be targeted by hackers and cybercriminals. A data breach can lead to identity theft, financial loss, and legal trouble for both users and software providers. Many people are still hesitant to use tax software because they worry their private information might be stolen or misused. This fear can prevent individuals and businesses from switching to digital tax solutions, especially in regions where awareness about cybersecurity is low. In addition, smaller software providers may lack strong security systems, making their platforms more vulnerable to attacks. To build trust and grow the market, software companies must invest in strong security features like encryption, two-factor authentication, and regular system updates. They also need to educate users on how to keep their information safe. Until these concerns are fully addressed, worries about data privacy and cybersecurity will continue to be a barrier to wider adoption of tax preparation software, especially among cautious or first-time users.

Opportunity

Partnerships with Financial Institutions

Partnerships with financial institutions present a significant opportunity in the tax preparation software market. Banks, credit unions, and other financial service providers already have strong relationships with individuals and businesses, making them ideal partners for tax software companies. By working together, tax software providers can offer their services directly through these institutions, expanding their reach and gaining access to a large, trust-based customer base. For financial institutions, offering integrated tax solutions adds value to their services and enhances customer loyalty. Moreover, these partnerships also enable useful features, such as pre-filled financial data, faster refunds through direct deposit, and access to financial advice during tax season. The tax preparation software market forecast shows that more people are using digital tools to file taxes, which drives the market growth. In addition, joint marketing efforts between financial institutions and tax software providers can help attract new users and increase adoption. As digital banking and personal finance management tools continue to grow, collaboration between tax preparation software companies and financial institutions offers strong potential to expand market presence and improve the overall tax filing experience.

For instance, in November 2024, Bloomberg Tax & Accounting introduced a strategic partner program with leading tax software providers. This collaboration focuses on automating common tax processes, extending the value of Bloomberg Tax's suite of solutions, and providing customers with a more robust set of tools to address critical tax workflow challenges.

Key Benefits for Stakeholders

The study provides an in-depth tax preparation software market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, & opportunities, and their impact analysis on the tax preparation software market size is provided in the report.

The Porter's five forces analysis illustrates the potency of buyers and suppliers operating in the cybersecurity industry.

The quantitative analysis of the global tax preparation software market for the period 2024-2034 is provided to determine the tax preparation software market potential.

Tax Preparation Software Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 43 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 205 |

| By Component |

|

| By Type |

|

| By Deployment Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Intuit Inc., Caseware International Inc., IRIS Software Group Ltd., Federal Direct, Greatland Corporation, HRB Digital LLC, TaxSlayer LLC, TaxHawk, Inc., E-file.com LLC, Datalog Italia Srl, TaxAct, Inc., Wolters Kluwer N.V., Jackson Hewitt Inc., Drake Software, LLC, THOMSON REUTERS |

Analyst Review

As the tax preparation software market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The tax preparation software market is experiencing significant growth, mainly driven by its time-saving features. These software tools help users complete their tax returns faster by automating many steps. Instead of going through complicated forms, users can simply answer guided questions, and the software fills out the forms automatically. It also imports data from previous years or other financial tools, saving even more time. Many programs include built-in calculators and error checks, which reduce the need to double-check everything manually. This is especially helpful for people with busy schedules or small businesses that don’t have dedicated accountants. With the rise of cloud-based and mobile tax apps, users can now work on their taxes from anywhere, at any time. These factors are fueling the tax preparation market growth.

Furthermore, the growing adoption of tax preparation software among small and medium-sized enterprises is significantly driving market growth. SMEs often operate with limited resources and staff, making it essential to use tools that improve efficiency and reduce costs. Tax software offers an affordable, user-friendly solution that simplifies complex tax processes, helps avoid errors, and ensures timely compliance with tax laws. As more SMEs become digitally aware and seek to automate financial tasks, the demand for reliable tax preparation tools continues to rise, driving market growth.

Moreover, the increase in awareness and financial literacy is playing a vital role in fueling the growth of the tax preparation software market. As more individuals and business owners gain a better understanding of financial management and tax compliance, they are actively seeking tools that help them file taxes accurately and efficiently. Financial literacy programs, online resources, and educational content have empowered people to take charge of their finances, reducing their reliance on professional tax services. Tax software offers a practical solution with features like guided assistance, error detection, and up-to-date tax regulation support. Users now recognize the benefits of filing taxes on time and avoiding penalties, which encourages them to adopt digital solutions. This growing awareness, combined with an increase in confidence to handle tax responsibilities independently, is pushing more users toward tax preparation software, thus boosting the market’s growth across various regions.

Increased adoption of AI for automated tax filing, real-time error detection, and personalized recommendations is the upcoming trend of the Tax Preparation Software Market in the globe.

Software is the leading component of the Tax Preparation Software Market.

North America is the largest regional market for Tax Preparation Software.

$43 billion is the estimated industry size of Tax Preparation Software in 2034.

include Intuit Inc., Wolters Kluwer N.V, THOMSON REUTERS, TaxSlayer LLC, Federal Direct, HRB Digital LLC., Jackson Hewitt Inc., Datalog Italia Srl, TaxAct Inc., Drake Software, LLC, TaxHawk, Inc., E-file.com LLC., Greatland Corporation, Caseware International Inc., and IRIS Software Group Ltd. are the top companies to hold the market share in Tax Preparation Software.

Loading Table Of Content...

Loading Research Methodology...