Telecommunication Insurance Market Research, 2031

The global telecommunication insurance market was valued at $8.5 billion in 2021, and is projected to reach $41.6 billion by 2031, growing at a CAGR of 17.5% from 2022 to 2031.

Insurance for telecommunication industry protects against business distractions and interruptions and helps telecom companies focus on providing service to their customers without interruption. The insurance coverage protects buildings, towers, equipment and antennas against physical damage such as lightning strikes, protects telecom businesses from liability exposures, such as independent contractors and completed operations. In addition, it provides additional security in the event of a catastrophic liability claim and covers medical expenses and compensation for lost wages of telecommunications workers injured on the job.

The telecommunication sector has grown rapidly across the globe in the recent years. There is an increase in the demand for telecommunication insurance, with the growth of the sector. Furthermore, telecom insurance plays a unique role in the telecommunications business, mainly because telecom contractors and firms face a unique set of risks in the course of their everyday work. This is in addition to the normal risks that businesses face over the course of time. In addition, there are various risks associated with the telecommunication industry such as property damage, cyber thefts, and workers compensation.

Moreover, there is a growing risk of liability claims in the insurance for telecommunications companies and telecommunication insurance protects telecom businesses from liability exposures, such as independent contractors and completed operations. Therefore, these are some of the major factors propelling the growth of the telecommunication insurance market growth. However, high insurance premium for the telecommunication insurance is a major factor limiting the growth of the market. On the contrary, advances in technology and adoption of 5G in the telecommunication industry is expected to provide lucrative growth opportunities in the coming years.

The report focuses on growth prospects, restraints, and trends of the telecommunication insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the telecommunication insurance industry.

The telecommunication insurance market is segmented into Application, Coverages and Enterprise Size.

Segment Review

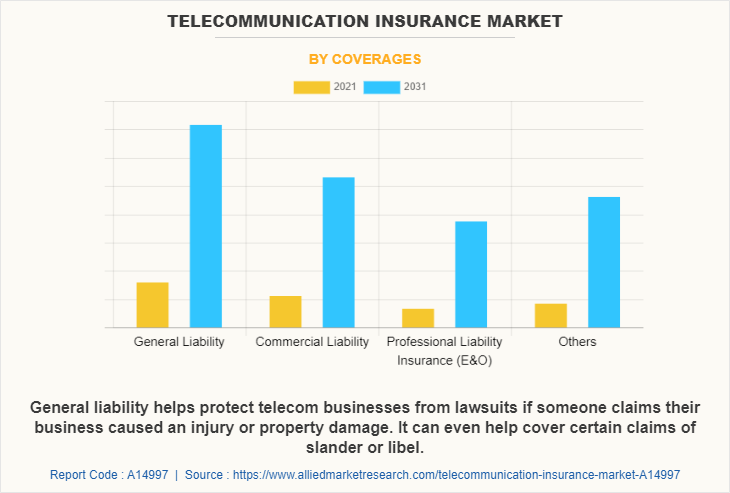

The telecommunication insurance market overview is segmented on the basis of coverage, enterprise size, application, and region. By coverage, it is segmented into general liability, commercial liability, professional liability insurance (E&O), and others. The professional liability insurance (E&O) is further divided into lawyer liability insurance and medical liability insurance. The lawyer liability insurance is further bifurcated into D & O insurance, and E & O insurance. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. Based on application, the telecommunication insurance market is bifurcated into equipment manufacturer, service provider, and consultant. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By coverage, the general liability segment attained the highest growth in 2021. This is attributed to the fact that general Liability helps protect telecom businesses from lawsuits if someone claims their business caused an injury or property damage. It can even help cover certain claims of slander or libel. Moreover, it protects telecom businesses from liability exposures, such as independent contractors and completed operations. In addition, this type of policy could include coverage for property damage, medical expenses, legal costs and more.

By region, North America attained the highest growth in 2021. This is attributed to the rise in the exponential growth of telecommunication industry across the North America. Moreover, the communication industry is driven by massive developments in telecommunicates industry as a result of increasing deployment of 4G and LTE networks. In addition, the market is expected to grow due to an increase in number of cellular stations and the demand for insuring the next generation ready network equipment brought on by introduction of 5G networks.

The report analyzes the profiles of key players operating in the telecommunication insurance market such as Allianz, ANDERSON LLOYD INTERNATIONAL, Aon plc., Bluestone Insurance Services Ltd. , CapriCMW Insurance Services Ltd., Chubb, Employers Mutual Casualty Company, Farmers Union Insurance, Arthur J. Gallagher & Co., The Hartford, Insureon, McGriff Insurance Services, Inc., Sompo International Holdings Ltd., Tower Street Insurance, The Travelers Indemnity Company, CoverWallet, and TechInsurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the telecommunication insurance market share.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the telecommunication insurance market size as the call centers were closed due to lockdown restrictions, the employees were working from home. Therefore, to help employees with their medication needs and hospitalization fees, telecommunication businesses provided them with worker’s compensation from the telecommunication insurance coverage. Furthermore, there were cases of data breaches, cyber thefts in the telecommunication industries for which the businesses took the insurance to provide coverage for such risks. In addition, the internet users increased during the pandemic which resulted in installment of mobile towers in various places for which the businesses undertook tower insurance under the telecommunication insurance. Therefore, the pandemic had a positive impact on the telecommunication insurance market.

Top Impacting Factors

Growth in the Telecommunication Sector

The telecommunication sector has grown rapidly in the recent years and it is going under massive structural change. They are turning their customer channels, content, and communication services digital, resulting in a whole new ecosystem of value, interconnected market, and technology shift. The providers are trying to adopt high-performing networks to provide what customers need and want in this digital era. However, with such rapid development, they are exposed to several risks for which the telecommunication insurance is an ideal option. Thus, telecom businesses take the insurance policy to cover any risk factors that arises with the growth of the market. Therefore, this is one of the major driving factor of the telecommunication insurance industry.

High Insurance Premium for Telecommunication Insurance

The insurance premium rates for the telecom insurance is generally high as it offers various coverage under one insurance. However, it is difficult for the small and medium sized telecom businesses to take telecommunication insurance as they are not capable of paying the high insurance premium. Moreover, as the premium is higher, businesses chose to ignore the insurance policy. Therefore, the high insurance premium is a major factor hampering the growth of the market.

Technological Advancement in the Field of Telecommunication

There are 3 billion internet users around the globe. Billions of these users prefer smartphones as their primary internet access point. With smartphones helping consumers manage important tasks in their lives, the consumers are looking for high-capacity networks that promise faster access to applications and richer services. This can be enabled by 5G and wireless broadband, allowing 100 times faster data transfer than 4G, high speed, and low latency. Moreover, telecom companies are expanding into all sorts of sectors by automating online customers. Its practical applications extend to industries such as transportation, medicine, agriculture, public services, and others. 5G network, with its whole set of technologies, is coming together to make this telecommunications bigger and better. Therefore, with such technological growth in the telecom industry, the demand for telecommunication insurance is projected to grow to provide coverage from various risks associated with the market. Thus, this factor will offer major lucrative opportunities for the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the telecommunication insurance market forecast from 2021 to 2031 to identify the prevailing telecommunication insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the telecommunication insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the telecommunication insurance market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global telecommunication insurance market trends, key players, market segments, application areas, and market growth strategies.

Telecommunication Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 41.6 billion |

| Growth Rate | CAGR of 17.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Application |

|

| By Coverages |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | ANDERSON LLOYD INTERNATIONAL, Aon plc., Chubb, Allianz, Travelers, Hartford, Sompo International, Bluestone Insurance Services Ltd., CapriCMW Insurance Services Ltd., Insureon, Farmers Union Insurance, McGriff Insurance Services, Inc., Gallagher, Tower Street Insurance, EMC |

Analyst Review

The telecommunication sector has grown rapidly across the globe in the recent years, and with the growth of the sector, the demand for telecommunication insurance has also grown. Furthermore, telecom insurance plays a unique role in the telecommunications business, mainly because telecom contractors and firms face a unique set of risks in the course of their everyday work. This is in addition to the normal risks that businesses face over the course of time. Furthermore, there were cases of data breaches, cyber thefts in the telecommunication industries for which the businesses took the insurance to provide coverage for such risks. In addition, the internet users increased during the pandemic which resulted in installment of mobile towers in various places for which the businesses undertook tower insurance under the telecommunication insurance. Moreover, telecommunication companies are open to a wide range of risks, including damage, theft or vandalism of equipment, damage to customers’ property, mistakes in specification or installation, and accidents or injury to employees who carry out installation and maintenance of equipment. Moreover, liability claims can lead to significant financial damage, from legal costs and compensation to reputational damage which can be far reaching. Having adequate telecom insurance in place can offer protection in the event of such claims.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on August 2021, South Africa’s biggest mobile phone network provider, MTN, entered into a partnership with the UK-based fintech Sanlam to offer the telco’s subscribers low-cost insurance products. The partnership offers people across the continent with easier access to these services, particularly those sectors of the population that have typically been unable to access traditional distribution channels for such products. These strategies will provide major lucrative opportunities for the growth of the telecommunication market.

Some of the key players profiled in the report include Allianz, ANDERSON LLOYD INTERNATIONAL, Aon plc., Bluestone Insurance Services Ltd., CapriCMW Insurance Services Ltd., Chubb, Employers Mutual Casualty Company, Farmers Union Insurance, Arthur J. Gallagher & Co., The Hartford, Insureon, McGriff Insurance Services, Inc., Sompo International Holdings Ltd., Tower Street Insurance, The Travelers Indemnity Company, CoverWallet, and TechInsurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The telecommunication sector has grown rapidly across the globe in the recent years. There is an increase in the demand for telecommunication insurance, with the growth of the sector. Furthermore, telecom insurance plays a unique role in the telecommunications business, mainly because telecom contractors and firms face a unique set of risks in the course of their everyday work. This is in addition to the normal risks that businesses face over the course of time. In addition, there are various risks associated with the telecommunication industry such as property damage, cyber thefts, and workers compensation. Moreover, there is a growing risk of liability claims in the telecommunication business and telecommunication insurance protects telecom businesses from liability exposures, such as independent contractors and completed operations. Therefore, these are some of the major factors propelling the growth of the telecommunication insurance market growth

The Telecommunication Insurance Market will expand at a CAGR of 17.5% from 2021-2031

North America is the largest regional market for the Telecommunication Insurance

The estimated industry size of Telecommunication Insurance Market is $41,620.51 million.

The report analyzes the profiles of key players operating in the telecommunication insurance market such as Allianz, ANDERSON LLOYD INTERNATIONAL, Aon plc., Bluestone Insurance Services Ltd. , CapriCMW Insurance Services Ltd., Chubb, Employers Mutual Casualty Company, Farmers Union Insurance, Arthur J. Gallagher & Co., The Hartford, Insureon, McGriff Insurance Services, Inc., Sompo International Holdings Ltd., Tower Street Insurance, The Travelers Indemnity Company, CoverWallet, and TechInsurance.

Loading Table Of Content...