Telehealth Market Overview

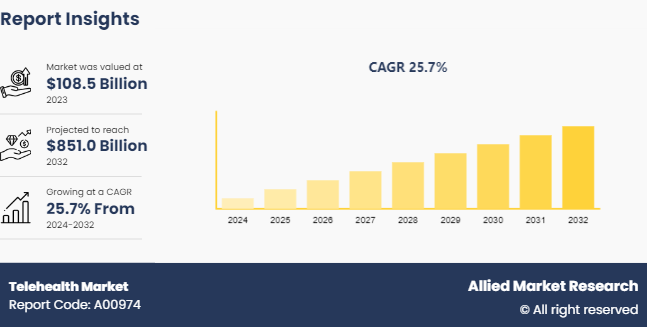

The global telehealth market size was valued at USD 108.5 billion in 2023, and is projected to reach USD 851.0 billion by 2032, growing at a CAGR of 25.7% from 2024 to 2032.

Key Takeaways

The telehealth industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major telehealth industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

How to Describe Telehealth?

Telehealth is defined as the delivery and facilitation of health and health-related services including medical care, provider and patient education, health information services, and self-care via telecommunications and digital communication technologies. In addition, live video conferencing, mobile health apps, “store and forward” electronic transmission, and remote patient monitoring (RPM) are examples of technologies used in telehealth.

Key Telehealth Market Dynamics:

The global telehealth market growth is significantly rising due to several factors such as the growing use of web and cloud-based platforms and the increase in healthcare digitalization activities and government initiatives are some of the main factors anticipated to propel the growth of the market. However, lack of knowledge or training acts as a restraint for the Telehealth market. In addition, the launch of the web and cloud-based platforms will provide ample opportunities for the market's development during the forecast period.

Demographic Insights:

Telehealth solutions have shown varying levels of adoption and impact across different demographic groups, influenced by factors such as age, geographic location, socioeconomic status, and digital literacy According to Getstream.io., in March 2023, nearly 80% of consumers have used telemedicine at least once. 76% of people over the age of 55 have used telemedicine and 74% of millennials prefer telehealth visits to in-person doctor exams. 73% of people who live in rural areas use telemedicine and 98% of transgender patients say they have used telemedicine. These factors are further expected to fuel the growth of the global market.

Telehealth Market Segmentation:

The telehealth market size is segmented on the basis of component, delivery mode, application, end user, and region. On the basis of component, the market is categorized into hardware, software, and service. On the basis of delivery mode, the market is divided into on-premise, and cloud. On the basis application, the market is segregated into teleconsultation, telestroke, teleradiology, telepsychiatry, teledermatology, and others. On the basis of end user, it is divided into healthcare providers, payers, patients, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Telehealth Market Regional/Country Outlook

The global telehealth market is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in smart technologies, and stringent safety regulations that encourage the integration of advanced telehealth solutions. Europe follows closely, with countries like Germany and the UK at the forefront, leveraging telehealth solutions. In the Asia-Pacific region, rapid digitalization and increasing awareness of smart health solutions are driving the adoption of telehealth solutions, particularly in China and Japan, where government initiatives support technological advancements.

In October 2023, the Government of Canada invested more than $26 million to advance integrated health care in Canada. This investment supports 13 implementation science teams and a knowledge mobilization and impact hub that addresses high-priority health care challenges in Canada.

In February 2022, the Department of Health and Human Services (HHS), through the Health Resources and Services Administration (HRSA), awarded nearly $55 million to 29 HRSA-funded health centers to increase healthcare access and quality for underserved populations through virtual care such as telehealth, remote patient monitoring, digital patient tools, and health information technology platforms.

Telehealth Industry Trends

Government initiatives have played a crucial role in accelerating the adoption of telehealth solutions during the pandemic. In January 2022, the FCC established a $200 million COVID-19 Telehealth Program to help healthcare providers provide connected care services to patients at their homes or mobile locations in response to the pandemic.

Key Telehealth Companies:

The following are the leading companies in the telehealth market.

Cerner Corporation (Oracle)

GE Healthcare

Medtronic

Teladoc Health, Inc.

CareCloud, Inc.

MDLIVE

Siemens Healthcare Private Limited

Koninklijke Philips N.V.

GlobalMedia Group

LLC

American Well Corporation.

Recent Key Strategies and Developments

In January 2024, Eli Lilly and Company launched LillyDirect, a new digital healthcare experience for patients in the U.S. living with obesity, migraine, and diabetes. LillyDirect offers disease management resources, including access to independent healthcare providers, tailored support, and direct home delivery of select Lilly medicines through third-party pharmacy dispensing services.

In March 2023, Royal Philips launched a comprehensive portfolio of flexible solutions and services to help health systems, providers, payers, and employer groups more meaningfully motivate and deeply connect with patients from virtually anywhere.

In September 2022, RxDefine launched RxTelehealth, its telehealth solution for life sciences brands. RxDefine's mission is to ethically empower people to navigate their own health decisions, and the launch of RxTelehealth is a critical step toward living this mission.

Key Sources Referred

Telehealth.org

American Heart Association, Inc.

IEEE

AAP.org

Key Benefits for Stakeholders

This report provides a quantitative analysis of the telehealth market forecast segments, current trends, estimations, and dynamics of the telehealth market analysis from 2023 to 2032 to identify the prevailing telehealth market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the telehealth market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global telehealth market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global telehealth market trends, key players, market segments, application areas, and market growth strategies.

Telehealth Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 851.0 Billion |

| Growth Rate | CAGR of 25.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Component |

|

| By Delivery Mode |

|

| By Application |

|

| By End Users |

|

| By Region |

|

| Key Market Players | CareCloud, Inc., Medtronic, MDLIVE, Koninklijke Philips N.V., Teladoc Health, Inc., GlobalMedia Group, LLC, Cerner Corporation (Oracle), Siemens Healthcare Private Limited, American Well Corporation, GE Healthcare |

The global telehealth market size was valued at USD 108.5 billion in 2023, and is projected to reach USD 851.0 billion by 2032

The telehealth market is projected to grow at a compound annual growth rate of 25.7% from 2024-2032 reach USD 851.0 billion by 2032

Cerner Corporation (Oracle), GE Healthcare, Medtronic, Teladoc Health, Inc., CareCloud, Inc., MDLIVE, Siemens Healthcare Private Limited, Koninklijke Philips N.V., GlobalMedia Group, LLC, American Well Corporation. are the top companies to hold the market share in Telehealth.

North America is the largest regional market for Telehealth in 2023.

The upcoming trends in the global telehealth market reflect advancements in technology, changing healthcare delivery models, and the increasing demand for remote healthcare solutions.

Loading Table Of Content...

Loading Research Methodology...