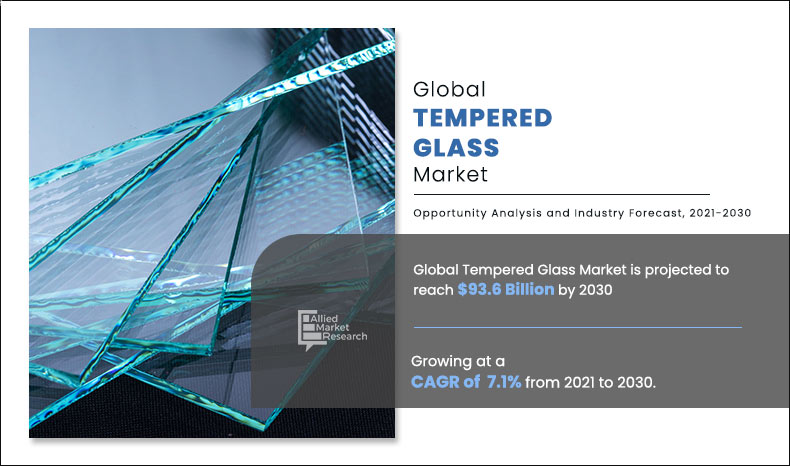

Tempered Glass Market Outlook – 2030

The global tempered glass market size was valued at $46.9 billion in 2020, and is projected to reach $93.6 billion by 2030, growing at a CAGR of 7.1% from 2021 to 2030. The growing use of tempered glass in automotive applications is a significant driver for the growth of the tempered glass market. As safety regulations become more stringent, automotive manufacturers are increasingly incorporating tempered glass for side and rear windows to enhance passenger safety and vehicle durability.

Introduction

Tempered glass is a type of safety glass that is processed through controlled thermal or chemical treatments to increase its strength as compared to normal glass. The tempering process involves heating the glass to a high temperature and then rapidly cooling it, creating internal stress that makes the glass much more resistant to breakage. When broken, tempered glass shatters into small, blunt pieces rather than sharp, dangerous shards, which significantly reduces the risk of injury. It is commonly used in applications where safety, strength, and heat resistance are crucial, such as in automotive windows, shower doors, and architectural buildings.

Key Market Dynamics

Tempered glass, also known as toughened glass, is known to be four times stronger than simple annealed glass. Tempered glass is produced by heating the silica mix up to 600°C and then rapidly cooling the molten silica. Tempered glass is widely used in automotive window panes, building windows, furniture, and interior activities of buildings. Factors, such as increase in disposable income, technological upgrades, new product developments, and the spurring rise in the original equipment manufacturers (OEMs) and aftermarkets have led the automobile sector to witness a significant growth where tempered glass are widely used in rear view windows, side windows, sunroofs, and other places. For instance, according to a report published by the National Promotion and Facilitation Agency of India, India’s passenger vehicle industry is expected to rise between 22%-25% in 2022. This may act as one of the key drivers responsible for the growth of the tempered glass market. In addition, the building & construction sector is growing rapidly in both, developed and developing economies, owing to increase in demand for commercial space, such as offices, hotels, malls, industrial corridors, and others where tempered glass are widely used in doors and window panels.

Furthermore, increase in investments in building infrastructure in countries, such as the U.S., China, Japan, Mexico, India, and others have led the building & construction sector to witness a significant growth. For instance, according to a report published by the National Investment Promotion and Facilitation Agency, infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021. All these factors are expected to boost the growth of the tempered glass market during the forecast period.

However, the process of manufacturing tempered glass involves a series of steps that require specialized equipment and significant energy consumption. During production, the glass must be heated to very high temperatures, typically around 600-700°C, and then rapidly cooled through a process known as quenching. This requires advanced furnaces, high-energy consumption, and precise cooling systems to ensure the strength and safety properties that make tempered glass desirable. These factors contribute to a higher production cost as compared to standard annealed glass, making it less competitive, particularly in price-sensitive markets. All these factors hamper the growth of the tempered glass market during the forecast period.

On the contrary, rapid digitalization coupled with the increasing penetration of smart consumer electronics such as laptops, smartphones, tablets, and others have surged the popularity of tempered glass used as a screen protector glass in a wide range of consumer electronic products. For instance, according to an article published by the Economic Times, the smartphone industry has witnessed an 11% year-on year growth rate with shipments rose from 150 billion in 2020 to 168 billion in 2021. All these factors are anticipated to increase the sales of tempered glass in the growing consumer electronics sector thus creating lucrative opportunities for the tempered glass market.

Market Segmentation

The tempered glass market analysis is done on the basis of end-use industry and region. On the basis of end-use industry, it is fragmented into automotive, construction, consumer electronics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific would exhibit highest growth rate during the forecast period

Tempered Glass Market, By Region

The Asia-Pacific tempered glass market size is projected to grow at the highest CAGR of 7.5% during the forecast period, and accounted for 57.5% of the tempered glass market share in 2020. This is attributed to increase in demand for tempered glass in building & construction, automotive, consumer electronics industries in Asia-Pacific. China’s consumer electronics sector is growing at a rapid pace, which in turn has led the tempered glass manufacturers to produce high-quality tempered glass for a wide range of electronic gadgets. Furthermore, manufacturers across the globe find Asia-Pacific as an attractive market, owing to cheap labor cost, low cost of setting up manufacturing units, and low cost of tempered glass. These factors drive the tempered glass market growth in this region.

By End User

Automotive is the most lucrative segment

Tempered Glass Market, By End-Use Industry

By end-use industry, the construction segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 7.0% during the forecast period. This is attributed to factors such as sustained economic growth coupled with rise in foreign direct investment (FDI) inflow in construction sector where tempered glass is widely employed as toughened glass in mirrors frames, doors, and others. For instance, according to the data released by Department for Promotion of Industry and Internal Trade (DPIIT), industry attracted foreign direct investment (FDI) worth $25.38 billion from April 2000 to June 2021. This is expected to propel the growth of the construction segment in the global tempered glass market.

Competitive Landscape

The major companies profiled in this report include, Abrisa Technology, AGC Inc., Asahi India Glass Ltd., Cardinal Glass Industries, Gentex Corporation, Koch Industries Inc., NorthGlass, Press Glass Holding SA., Saint Gobain, and Vitro.

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current tempered glass market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and tempered glass market opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Tempered Glass Market Report Highlights

| Aspects | Details |

| By End-use Industry |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The global tempered glass market is expected to exhibit high growth potential. Rise in demand from end users, especially from developing countries, and continuous technological advancements are the key driving factors of the global tempered glass market. However, the emission of silicon dioxide during the production of tempered glass is expected to hinder the market growth. Asia-Pacific is projected to register significant growth as compared to the markets of North America and Europe.

In addition, tempered glass possesses excellent significant properties, such as high thermal resistance, shock resistance, and chemical stability that make it four to five times stronger than annealed glass of the same size and thickness against impact. This factor has surged the popularity of tempered glass as a protective glass in various end-use sectors. Furthermore, increase in building & construction activities based on modern-theme architecture has surged the demand for tempered glass, primarily in North America and European regions.

Sustained economic growth and development of the automotive sector surge the popularity of tempered glass in the global market.

The growth of automobile industry, increase in demand from construction sector, and the use of tempered glass as a protective glass in consumer electronics are the key factors boosting the tempered glass market growth.

The global tempered glass market was valued at $46.9 billion in 2020, and is projected to reach $93.6 billion by 2030, growing at a CAGR of 7.1% from 2021 to 2030.

Abrisa Technology, AGC Inc., Asahi India Glass Ltd., Cardinal Glass Industries, Gentex Corporation, Koch Industries Inc., NorthGlass, Press Glass Holding SA., Saint Gobain, and Vitro are the leading players in tempered glass market.

Automotive, construction, and consumer electronics industries are projected to increase the demand for tempered glass market.

The tempered glass market analysis is done on the basis of end-use industry and region. On the basis of end-use industry, it is fragmented into automotive, construction, consumer electronics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Escalating demand from automotive sector and increase in demand from construction sector are the main drivers of the tempered glass market.

Automobile, construction, and consumer electronics are expected to drive the adoption of tempered glass during the forecast period.

The tempered glass market has been negatively impacted due to the wake of the COVID-19 pandemic owing to its dependence on automobile, building & construction, consumer electronics, aerospace, and other sectors. In 2022, tempered prices are expected to be higher in Asia-Pacific. The price rise will be due to continued regional demand trends and tight product availability. Firm downstream demand for tempered glass and stronger upstream costs are expected to sustain the price gain.

Loading Table Of Content...