Tennis Shoes Market Summary, 2031

The global tennis shoes market size was valued at $2.5 billion in 2021, and is projected to reach $3.6 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031. Tennis shoes are a type of footwear with a flexible sole made of rubber or synthetic material. Tennis shoes are designed based on the different types of courts. A hard-court surface such as concrete requires durable shoes, therefore, these shoes are manufactured with more traction on the sole to make them adaptable to various surfaces. Tennis shoes are primarily designed for sports and offer proper grip to increase the performance of the athlete.

Tennis is a popular sport, and with the passage of years, it is gaining popularity among the global population. Tennis is one of the most prominent individual/non-team sports on the planet, and one of the most mainstream games on television. Tennis is also popular among people of all ages since it has a mild effect on joints and muscles, lowering the risk of injury. This makes it popular among the geriatric population as well. As a result, the engagement of individuals of all ages offers tennis shoe manufacturers a significant growth opportunity in the global market.

Playing tennis has a variety of health advantages, including better aerobic fitness, muscular fitness, anaerobic endurance, and flexibility. Tennis also aids in the development of cognitive skills such as concentration, eye-hand coordination, and anticipation. These advantages persuade parents to enroll their children in tennis lessons. All of these reasons are predicted to enhance global tennis involvement, and an increase in tennis participation is expected to fuel the expansion of the global market.

According to the Indian Shoe Federation in 2020, the global footwear demand was expected to fall by 27% in Europe, 21% in North America, and 20% in Asia-Pacific. Major markets such as Europe and North America were worst hit by the pandemic and their imports of tennis shoes and other sports footwear declined significantly. Key factors to be considered as a negative effect of COVID-19 on the global tennis shoes market include order cancellations, price reduction, liquidity crisis, currency risk, crisis management, and de-globalization. Strict restrictions by governments on the movement of goods and people from one country to another had a massive negative impact on exports and imports of athletic footwear globally.

Asia-Pacific is the production hub for sports footwear such as tennis shoes, baseball shoes, and gym shoes. Moreover, Asian countries such as Vietnam, Indonesia, China, and India are among the top exporters. Partial or full closure of production facilities along with acute shortage of labor and disruptions in raw material supply chain adversely affected the production of athletic footwear. According to the Fair Labor Association, around 82% of major footwear factories in Asia-Pacific suffered a reduction in orders during the first phase of 2020. The loss in production volumes was estimated to be 10% to 60% in the first 30 weeks of 2020.

Emerging markets show immense growth potential for players operating in the tennis shoes market. However, lack of awareness about different types of tennis shoes, such as hard court tennis shoes, grass court tennis shoes, and clay court tennis shoes, is impeding the growth of the global market, despite the fact that there are dedicated tennis shoes available in the market for the various types of courts. Lack of knowledge among people of emerging nations such as India, Brazil, and South Africa restricts the growth of the global market.

Furthermore, the availability of counterfeit products is a significant barrier impeding market expansion. China is the leading country that produces and sells counterfeit shoes in the market due to a deficit in the demand-supply balance. The shoes of popular brands such as Nike, Adidas, and others are copied and sold at low prices in the market. Hence, people have easy access to these cheaper counterfeit tennis shoes in the market, which restraints the growth of overall tennis shoes market share

The implementation of technology in sports shoes to monitor the progress of an athlete is expected to boost the popularity of the tennis shoes industry. Companies like Digitsole have introduced smart shoes in 2019, which provide personalized feedback regarding health, posture, fatigue, steps, and calories. Smart shoes have various features such as pressure sensors, navigation systems, ambient environmental sensors, and temperature controllers.

The launch of similar shoes in the form of tennis shoes is expected to entice the consumers and help them to monitor the statistics. In 2020, Nike announced to launch of its third generation of smart shoes named the HyperAdapt series. It is a self-lacing smart shoe installed with pressure sensors. These digital technologies play a vital role in the growth of the global market for tennis shoes. A few more instances of smart shoe companies include HVOR Phantom, Xiaomi MiJia smart shoes, and Altra Torin IQ. The use of technology in tennis shoes has good potential to take the market to new heights and can offer new opportunities for tennis shoes manufacturers in the future.

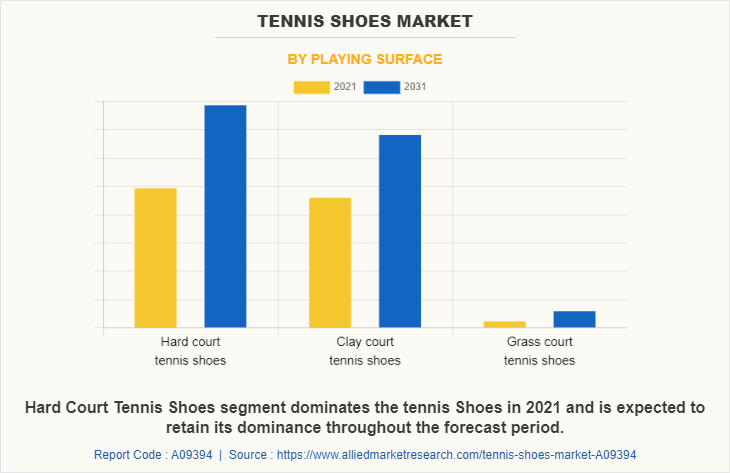

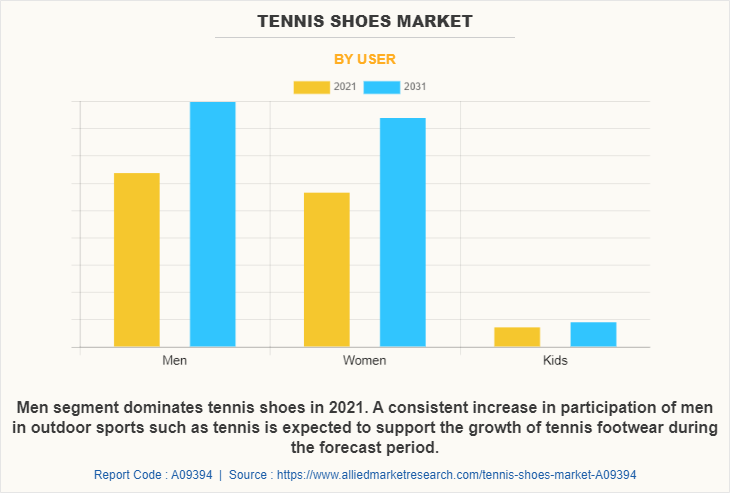

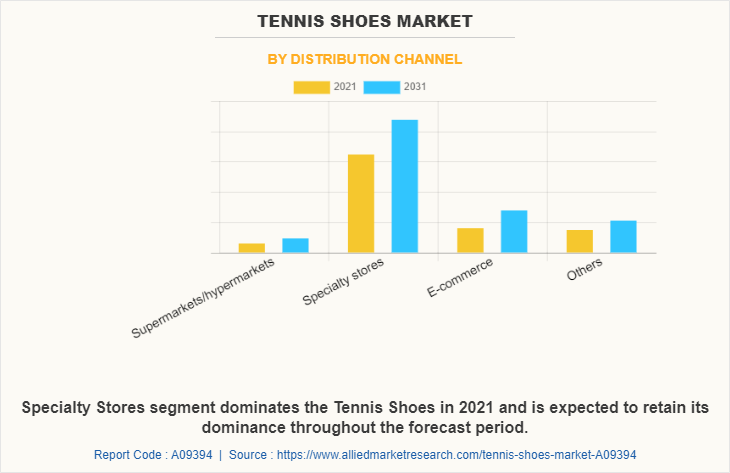

The tennis shoes market is segmented on the basis of playing surface, user, distribution channel, and region. On the basis of playing surface, it is segmented into hard court tennis shoes, clay court tennis shoes, and grass court tennis shoes. On the basis of user, it is segregated into men, women, and kids. On the basis of distribution channel, it is classified into supermarkets/hypermarkets, specialty stores, e-commerce, and others.

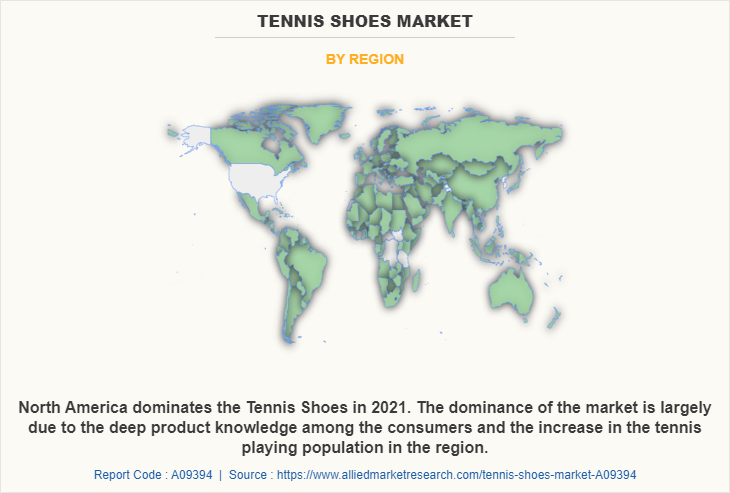

Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Russia, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, and rest of LAMEA).

On the basis of playing surface, the hard court tennis shoes segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period as the availability of hard tennis court is higher compare to other courts that fuels the requirement for hard court tennis shoes. In addition, the installation costs of these courts requires low cost. The U.S. has the maximum number of hard tennis courts. Growth in popularity and feasibility of hard courts propels sales of hard court tennis shoes among the tennis playing population across the globe.

According to tennis shoes market trends, on the basis of user, the men segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. A consistent increase in participation of men in outdoor sports such as tennis is expected to support the growth of tennis footwear during the forecast period. In addition, market players have been launching lightweight and comfortable footwear for men. These are made of flexible fabric materials & exhibit moisture-wicking feature, thereby increasing their adoption among men.

According to the tennis shoes market analysis, on the basis of distribution channel, the specialty stores segment accounted for around 63% of the global tennis shoes market size in 2021 and is expected to sustain its share during the forecast period. Specialty stores offer a convenient experience of diverse shopping under a single roof to the consumers. Specialty stores provide consumers a premium advantage, i.e., higher availability of tennis shoe products at discounts, the assistance of sales representatives, and easy checkouts. These advantages are expected to drive the tennis shoes market growth during the forecast period.

On the basis of region, North America dominated the tennis shoes market in 2021 and is expected to remain dominant during the tennis shoes market forecast period. The dominance of the market is largely due to the deep product knowledge among the consumers and the increase in the tennis playing population in the region. North America is characterized by high disposable income, growing health consciousness, the immense popularity of tennis, and demand for high-quality products. All these factors boost the demand for tennis shoes among the population.

Moreover, people are aware of various health benefits of playing tennis such as improved aerobic fitness, muscular fitness, anaerobic endurance, and flexibility. Tennis is promoted through schools and colleges in the form of tournaments in North America. Therefore, the tennis shoe market in North America is expected to grow at a significant rate and sustain its leading position in the global market during the forecast period.

The players operating in the global tennis shoes market have adopted various developmental strategies to expand their tennis shoes market share, exploit the market opportunity, and increase profitability in the market. The key players profiled in this report include ADIDAS Group, Anta Sports Products Limited, ASICS Corporation, Babolat, FILA Holdings Corp., Lotto Sport Italia S.p.A., New Balance, Inc., Nike, Inc., PUMA SE, and Xtep International Holdings Limited.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tennis shoes market analysis from 2021 to 2031 to identify the prevailing tennis shoes market opportunities.

The market research is offered along with information related to key drivers, restraints, and tennis shoes market opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the tennis shoes market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global tennis shoes industry.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tennis shoes market trends, key players, market segments, application areas, and market growth strategies.

Tennis Shoes Market Report Highlights

| Aspects | Details |

| By Playing surface |

|

| By User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | PUMA SE, Nike, Inc., Babolat, Adidas group, ANTA SPORTS PRODUCTS LIMITED, New Balance, Inc., Lotto Sport Italia Spa, XTEP International Holdings Limited, ASICS Corporation, FILA Holdings Corp |

Analyst Review

Based on insights of various CXOs of leading companies, various initiatives for increasing tennis participation propels the participation rate of tennis along with the growth of the global tennis shoes market. International Federation of Tennis (ITF), Grand Slam Development Fund (GSDF), Olympic Solidarity, and International Tennis Hall of Fame together have worked for the development and growth of the tennis industry. Further, the government of Australia presented a budget of $12 million for the period 2019–2020 to increase participation in tennis and aimed to increase opportunities for women in tennis. In addition, schools and colleges in many nations organize tennis tournaments that encourage the participation of kids in tennis.

These initiatives to increase the participation rate of tennis propels the growth of the global tennis shoes market. Furthermore, emerging markets such as Asia-Pacific and Latin America offer lucrative growth opportunities for key players operating in the global tennis shoes market. The tennis playing population is growing along with the popularity of tennis in these emerging markets. According to the International Tennis Federation, Asia-Pacific has the highest tennis playing population. Further, the rise in disposable income, desire for a healthy lifestyle, and demand for comfortable tennis footwear are the few factors propelling the demand for tennis shoes in the emerging markets.

Moreover, CXOs further added that a major threat to the tennis shoes market is imposed by the exponentially growing popularity of eSports among the global youth. Digital games such as Counter-Strike, Overwatch, and Dota 2 are the most popular games in the eSports category. People are even adopting eSports as their career, hobby, and source of entertainment. This growth of eSports is anticipated to hamper and drastically reduce the participation of youth in outdoor sports such as tennis. Therefore, the surge in popularity of eSports is expected to adversely affect the growth of the tennis shoes market.

The tennis shoes market was valued at $2,539.8 million in 2021 and is estimated to reach $3,643.2 million by 2031, registering a CAGR of 3.3% from 2022 to 2031.

The global tennis shoes market registered a CAGR of 3.3% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the tennis shoes market report is from 2022 to 2031.

The top companies that hold the market share in the tennis shoes market include ADIDAS Group, ASICS Corporation, FILA Holdings Corp., Lotto Sport Italia S.p.A., New Balance, Inc., Nike, Inc., and PUMA SE.

The tennis shoes market report has 3 segments. The segments are playing surface, user, and distribution channel.

The emerging countries in the tennis shoes market are likely to grow at a CAGR of more than 6% from 2022 to 2031.

Post COVID-19, the vaccination drive and the fall of COVID-19 cases around the globe have helped to normalize the situation. Governments have lifted the lockdown which has eased the difficulties in the supply chain. The tennis shoes market is witnessing new heights of growth and is expected to recover its losses in the next 1-2 years. The increasing involvement of individuals in sports activities is expected to provide great returns.

North America will dominate the tennis shoes market by the end of 2031.

Loading Table Of Content...