Tennis Wear Market Research, 2034

Market Introduction and Definition

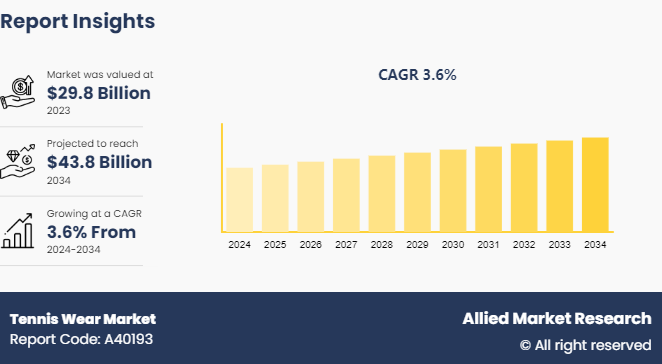

The global tennis wear market was valued at $29.8 billion in 2023, and is projected to reach $43.8 billion by 2034, growing at a CAGR of 3.6% from 2024 to 2034. Tennis wear refers to specialized clothing designed for comfort, performance, and style on the court. It includes moisture-wicking shirts and tops that manage sweat, ensuring players stay dry and comfortable. Shorts or skirts with built-in shorts offer flexibility and ease of movement to players. Tennis shoes, featuring durable soles with optimal grip, support quick lateral movements and prevent slipping. Additional items such as headbands, wristbands, and socks help manage sweat and enhance grip. For women, tennis dresses or rompers provide a streamlined option that combines functionality with fashion. The materials used are lightweight, breathable, and often incorporate stretch for a full range of motion. Overall, tennis wear combines practicality with a sense of sport-specific aesthetics to support optimal performance during matches.

Key Takeaways

The tennis wear market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major tennis wear industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Advancements in fabric technology significantly boost demand in the tennis wear market by enhancing performance, comfort, and functionality. Modern fabrics, such as moisture-wicking materials and breathable textiles, keep players dry and regulate body temperature, which leads to improved on-court performance. Innovations such as antimicrobial coatings reduce odor and extended life of the apparel, while lightweight, stretchable materials allow for greater flexibility and range of motion. In addition, the integration of UV protection into fabrics helps safeguard players from sun damage during outdoor matches. These technological improvements cater to both amateur and professional athletes seeking high-performance gear, thus driving the tennis wear market growth. As manufacturers continue to develop and incorporate these advanced materials, consumers are increasingly drawn to products that offer superior comfort and functionality, contributing to surge in the tennis wear market size.

However, the high cost of premium tennis wear restrains its demand by limiting accessibility for a broader consumer base. High-priced products often target only a niche segment of affluent or dedicated tennis players, leaving a significant portion of potential customers unable or unwilling to invest in expensive gear. The price barrier is anticipated to deter casual or budget-conscious players from purchasing premium items, thereby constraining the overall market growth. In addition, high costs can lead to perceptions of exclusivity that may isolate potential buyers who prefer more affordable options. As a result, the market is expected to experience slower expansion as compared to market with more accessible pricing during the tennis wear market forecast.

Increase in professional tennis tournaments creates significant opportunities for the tennis wear market by driving higher demand for specialized apparel. With more tournaments taking place, players, and teams seek high-performance tennis wear to meet the rigorous demands of competitive play. Enhanced visibility and media coverage from these events boost brand exposure and increase consumer interest, leading to higher sales of tennis wear products. Professional tennis players often endorse specific brands, influencing fans and aspiring athletes to purchase tennis wear from different brands, thus driving sales. Moreover, a larger number of tournaments stimulates demand for officially branded merchandise and limited-edition collections, which expands market reach and encourages innovation in the tennis wear industry. Frequent global tournaments enhance brand visibility and attract a broader consumer base, fostering growth and investment in advanced apparel technologies and design, which is expected to boost the tennis wear market share in the coming years.

Value Chain of Global Tennis Wear Market

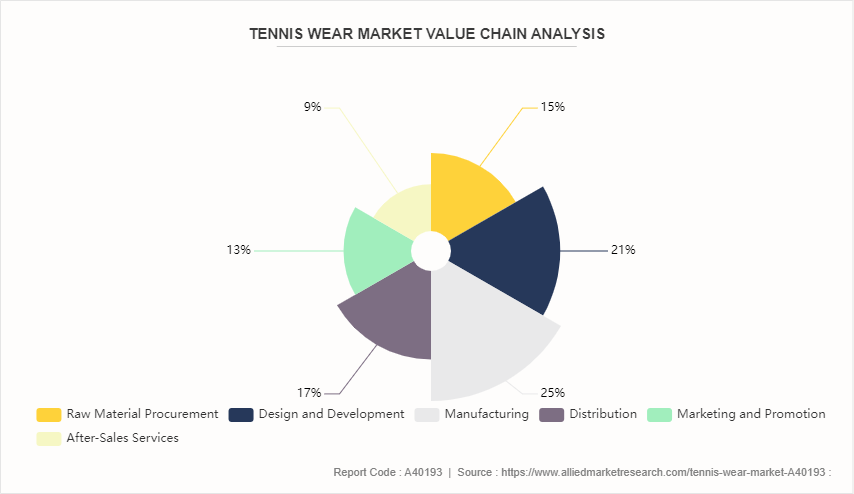

The value chain of tennis wear includes several key stages, such as raw material procurement, including fabrics such as moisture-wicking polyester and stretchable elastane. The next stage involves design and development, where functional and aesthetic aspects are integrated to create high-performance apparel. In the manufacturing stage, textiles are cut, sewn, and assembled into finished products. The distribution phase then delivers these products to retailers and directly to consumers through online and offline channels. Marketing and promotion activities enhance brand visibility and drive consumer demand. After-sales services, including customer support and returns, ensure customer satisfaction. Each stage contributes to the overall value of tennis wear, from raw materials to the end-user experience, which ensures quality and performance throughout the supply chain.

Market Segmentation

The tennis wear market is segmented on the basis of product type, price range, end user, distribution channel, and region. By product type, the market is fragmented into apparel, footwear, and accessories. By price range, the market is categorized into premium and economy. By end user, the market is segmented into men, women, and children. On the basis of distribution channel, it is divided into B2B, specialty stores, department stores, online sales channel, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. tennis wear market has experienced robust performance, primarily owing to high participation rates in tennis and extensive grassroots programs that stimulate tennis wear market demand. The strong presence of major brands, supported by a well-developed retail network including physical stores and e-commerce platforms, enhances market accessibility. The trend of athleisure wear has integrated tennis apparel into everyday fashion, driving additional consumer interest in tennis wear products. Higher disposable incomes and consumer preference for premium, performance-oriented gear further fuel the tennis wear market growth in the U.S. In addition, partnerships with top athletes and endorsements from professional players increase brand credibility and appeal, reinforcing both performance-driven and fashion-focused purchases in the U.S. tennis wear market.

The tennis wear market in the Asia-Pacific region is poised for substantial growth due to several key opportunities. Increase in participation in tennis, driven by rise in health consciousness and sports enthusiasm, expands the consumer base in Asia-Pacific. Growing urbanization and higher disposable incomes in countries such as China, India, and Japan further boost demand for premium and branded tennis wear. In addition, rise in popularity of tennis as a recreational and competitive sport, supported by more local and international tournaments, fuels the tennis wear market expansion in the region. Moreover, innovations in product design and technology, coupled with the growth of e-commerce, have made tennis wear more accessible to a broader audience in recent years. Furthermore, investments in marketing and partnerships with local athletes and sports organizations also enhance brand visibility and consumer engagement in the Asia-Pacific region.

Industry Trends:

One of the major trends in the tennis wear market is the shift toward sustainability and eco-friendly materials. Manufacturers have responded by integrating recycled fibers, such as recycled polyester and nylon, which are sourced from post-consumer waste like plastic bottles and old garments. The use of organic cotton also helps reduce the environmental impact associated with conventional cotton farming. Innovations include biodegradable materials and eco-friendly dyeing processes that reduce water and chemical use. Moreover, manufacturers are focusing on waste reduction through improved production techniques and offering take-back programs for used apparel. Furthermore, transparency about sustainability practices has become a priority, aligning with consumer expectations for environmentally responsible products while maintaining high performance and quality.

Collaborations with professional athletes and teams have set a significant trend in the tennis wear market by enhancing brand credibility and appeal. The partnerships often result in exclusive, high-performance collections that feature endorsements from well-known players, driving consumer interest and sales. Athletes' influence extends beyond product design, as their personal branding and visibility in major tournaments strengthen the reach and desirability of the apparel. Such collaborations also allow manufacturers to leverage athletes' feedback to refine product features and performance, which ensures that the gear meets the demands of both professionals and recreational players. These strategic alliances boost market presence and helps reinforce the association between quality tennis wear and professional-level performance.

Competitive Landscape

The major players operating in the tennis wear market include Nike, Inc., Adidas AG, Wilson Sporting Goods Co., Under Armour, Inc., Puma SE, Babolat, Asics Corporation, Fila Holdings Corp., Lacoste S.A., and K-Swiss Inc.

Other players in the tennis wear market include Head Sports GmbH, Prince Sports Inc., Joma Sport S.A., New Balance Athletic Shoe, Inc., Ellesse, Yonex Co., Ltd., Diadora S.p.A., Tonic Activewear, Decathlon S.A., Ralph Lauren Corporation, and so on.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tennis wear market analysis from 2024 to 2034 to identify the prevailing tennis wear market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tennis wear market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tennis wear market trends, key players, market segments, application areas, and market growth strategies.

Tennis Wear Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 43.8 Billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 306 |

| By Type |

|

| By Price Range |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Fila Holdings Corp., K-Swiss Inc., ASICS Corporation, Nike, Inc., Puma SE, Groupe Lacoste S.A., Under Armour, Inc., Wilson Sporting Goods Co., Babolat., Adidas AG |

Upcoming trends in the global tennis wear market include increased use of sustainable materials, smart textiles with performance-enhancing features, and stylish, customizable designs that combine functionality with fashion.

The leading application of tennis wear is for competitive play, providing comfort, performance enhancement, and protection during tennis matches.

North America held the highest market share in terms of revenue in 2023.

The global tennis wear market was valued at $29.8 billion in 2023.

The major players operating in the tennis wear market include Nike, Inc., Adidas AG, Wilson Sporting Goods Co., Under Armour, Inc., Puma SE, Babolat, Asics Corporation, Fila Holdings Corp., Lacoste S.A., and K-Swiss Inc.

Loading Table Of Content...