Testing, Inspection And Certification Market Research, 2032

The global testing, inspection and certification market was valued at $226.8 billion in 2022, and is projected to reach $407.2 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032.

Testing, inspection, certification (TIC) are the services ranging from auditing and inspection, to testing, verification, quality assurance and certification of the product, equipment and more. These help in increasing efficiency of production to reduce error by minimizing risk. TIC services are applicable in oil & gas, food industry, pharmaceuticals, chemical industry, and other sectors. In the testing, inspection and certification market, electrical testing and inspection services play a pivotal role in verifying the compliance and safety of electrical systems, providing businesses with the assurance needed to meet stringent industry standards

Testing is a systematic way for evaluating an item or service in contrast to established standards. To determine if the item fulfils standards, it has to clear a series of inspections. Performance, dependability, durability, and safety are just a few of the aspects that might be covered by this. Products are put through rigorous tests in the manufacturing industry, for example, to identify defects while making sure they function as expected. Software, environmental factors, and even human performance are all suited for being tested in alongside physical products. Inspection is the process of carefully examining goods, procedures, or services to ensure that they adhere to rules and guidelines.

This stage guarantees that the product or service meets set standards for quality. From the raw materials to the finished product, inspections can take place at any point in the production process. They can include visual inspections, measurements, and other forms of evaluation. Inspections support the process of overall quality control by quickly detecting and correcting irregularities. The official acknowledgement that a system, service, or product satisfies certain requirements or standards is called certification. Certification procedures are frequently carried out by independent third-party organisations. Customers and other stakeholders may trust a certified good or service because of its dependability, safety, and quality. A wide range of topics, including product performance requirements, worker health and safety, and environmental sustainability, are covered by certifications.

Key Takeaways

The global testing, inspection and certification market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global testing, inspection and certification markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The testing, inspection and certification market is driven by increasing regulatory standards, especially in industries like healthcare, automotive, and manufacturing. Globalization and complex supply chains heighten the need for quality assurance and compliance. Growth in sectors such as pharmaceuticals, electronics, and renewable energy also boosts demand for TIC services.

However, challenges include regulatory differences across regions, high costs of certification, and testing, inspection and certification market fragmentation with many small players competing.

Despite challenges, there are future opportunities in digitalization and the adoption of AI and IoT to enhance testing processes. The rising emphasis on sustainability and cybersecurity also opens new avenues, particularly for sectors aiming to meet environmental and digital compliance standards.

Testing, Inspection And Certification Market Segment Review

The testing, inspection and certification market is segmented into Service Type, Sourcing Type, Application and Industry Vertical.

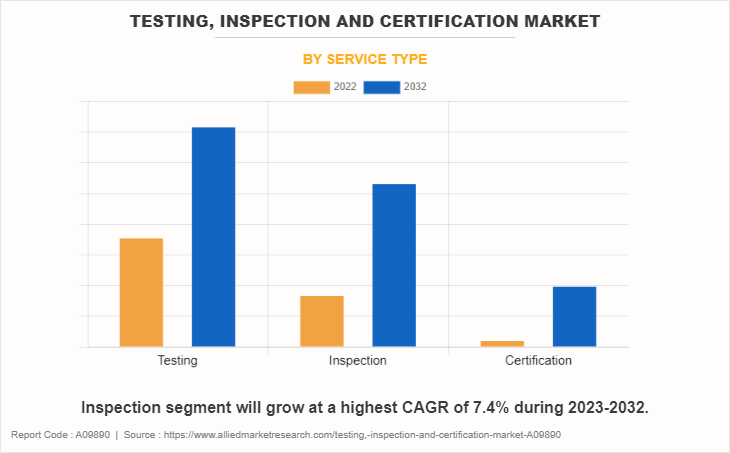

By service type, the testing, inspection and certification market is divided into testing, inspection, and certification.

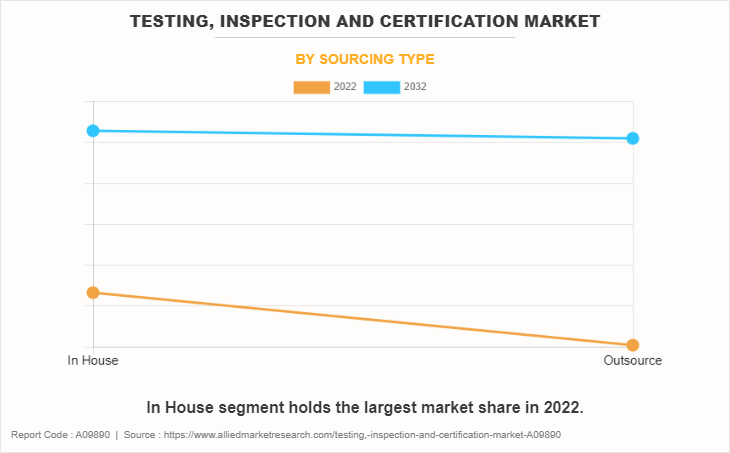

By sourcing type, the market is bifurcated into in-house, and outsource.

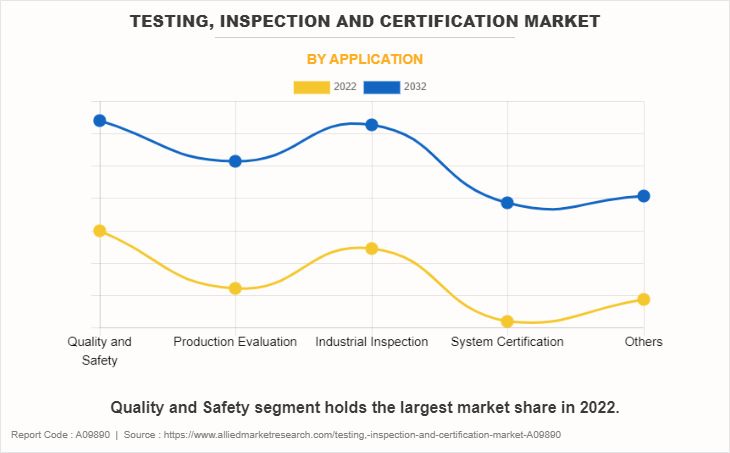

By application, the testing, inspection and certification market is divided into quality and safety, production evaluation, industrial inspection, system certification, and others.

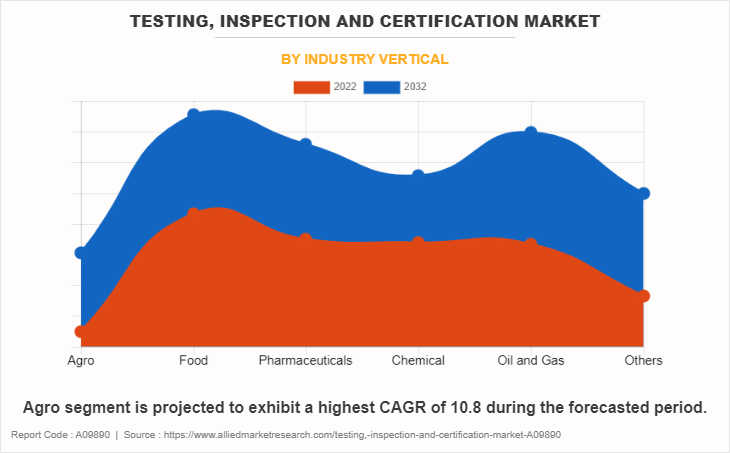

By industry vertical, the market is analyzed across agro, food, pharmaceuticals, chemical, oil and gas, and others.

Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA along with their prominent countries.

Increasing focus of manufacturing companies to improve customer retention by offering quality products and surging demand for interoperability testing for connected devices and IoT drive the growth of the testing, inspection and certification market size. However, high cost of TIC services due to diverse standards and regulations across different geographies is expected to pose major threats for the testing, inspection and certification market. Furthermore, digital transformation of customer services and rapid adoption of breakthrough technologies are expected to offer lucrative opportunities for the growth of the global testing, inspection and certification market. Increase in competition and low awareness among small scale manufactures are the key factors hampering the growth of the market. Rise in awareness for need of testing, inspection and certification and surge in need of safety are the factors that are opportunistic for the testing, inspection and certification market growth.

Regional/Country Market Outlook

The global testing, inspection and certification market share is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the testing, inspection and certification market, propelled by stringent regulatory standards, especially in industries like healthcare, aerospace, and automotive. The region's focus on product safety, environmental compliance, and advanced technologies, including AI and automation in testing processes, further drives demand. The presence of key market players and technological innovation solidifies North America's dominant position. Further, The Asia Pacific TIC market is witnessing rapid growth due to increasing industrialization, expanding manufacturing sectors, and stricter regulatory standards across countries like China and India. Rising exports, advancements in technology, and growing consumer awareness of product quality and safety also fuel demand for testing, inspection, and certification services in the region.

Competitive Analysis

The key players profiled in the report include ABS, ALS Limited, ASTM International, BSI, Bureau Veritas S.A., DEKRA, DNV, Intertek Group PLC, ISO, Lloyds Register Group Limited (LR), SGS S.A., and TUV SUD AG. Testing, inspection and certification market players have adopted various strategies such as product launch, collaboration, partnership, agreement, expansion, and acquisition to expand their foothold in the Testing, Inspection and Certification industry.

Top Impacting Factors

The testing, inspection and certification market is expected to witness notable growth owing to increase in focus of manufacturing companies to improve customer retention by offering quality products, surge in demand for interoperability testing for connected devices and IOT and technological advancements and digitalization. Moreover, digital transformation of customer services is expected to provide lucrative opportunity for the growth of the testing, inspection and certification market during the forecast period. On the contrary, the high cost of TIC services due to diverse standards and regulations across different geographies limits the growth of the testing, inspection, and certification market demand.

Historical Data & Information

The global Testing, Inspection and Certification market is highly competitive, owing to the strong presence of existing vendors. Vendors in the TIC market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this testing, inspection and certificationmarket is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Report Coverage & Deliverables

This report delivers in-depth insights into the testing, inspection and certification market covering service, sourcing, application and industry vertical employed by major players. It offers detailed market forecasts and emerging trends.

Service Insights

Testing segment dominates the testing, inspection and certification market, driven by demand for quality assurance in various industries. Inspection services are crucial for compliance and safety, particularly in manufacturing and construction. Certification services ensure adherence to regulatory standards, enhancing product credibility. Together, these services play a vital role in maintaining industry standards and consumer trust.

Sourcing Type Insights

In-house testing, inspection, and certification allow companies to maintain control and ensure compliance with internal standards. However, outsourcing offers access to specialized expertise, advanced technologies, and cost efficiencies. Many organizations opt for a hybrid approach, leveraging both strategies to optimize operations and enhance overall quality assurance efforts.

Application Insights

Quality and Safety segment leads the testing, inspection and certification market, ensuring products meet stringent standards. Production Evaluation focuses on process efficiency and compliance during manufacturing. Industrial Inspection is critical for infrastructure and machinery reliability, while System Certification ensures organizations meet regulatory and quality benchmarks. The Others category encompasses diverse applications, including environmental and cybersecurity assessments, reflecting growing market complexity.

Industry Vertical Insights

The Pharmaceuticals sector drives significant demand for TIC services, ensuring drug safety and regulatory compliance. The Food industry prioritizes quality assurance to meet safety standards, while Oil and Gas relies on inspection services for operational integrity. The Chemical sector emphasizes compliance with environmental regulations. The Agro and Others categories include diverse applications, reflecting the growing need for quality and safety across various industries.

Regional Insights

Regional insights highlight that North America leads the testing, inspection and certification market, driven by stringent regulations and advanced technology. Europe follows closely, emphasizing safety and quality in manufacturing. The Asia Pacific region exhibits rapid growth due to industrialization and regulatory developments. Meanwhile, Latin America and the Middle East are emerging markets, focusing on compliance and quality assurance across various sectors.

Key Developments/ Strategies

ABS, ALS Limited, ASTM International, BSI, Bureau Veritas S.A., DEKRA, DNV, Intertek Group PLC, ISO, Lloyds Register Group Limited (LR), SGS S.A., and TUV SUD AG are the top companies holding a prime testing, inspection and certification market share. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others to expand their foothold in the Testing, Inspection and Certification market.

- In August 2023, SGS expanded its Textile Exchange product certification services to India, offering one-stop certification for manufacturers, retailers, and buyers in the textile and footwear industry. This expansion includes certifications for recycled content (RCS), organic content (OCS), and responsible sourcing of down (RDS) and animal fibers (RAF). With strategically located laboratories across India, SGS is now better positioned to help organizations achieve their sustainable sourcing goals.

- In April 2023, Intertek acquired Controle Analítico, a Brazilian environmental testing firm specializing in water analysis. This move expands Intertek's environmental testing capabilities in Brazil, complementing its existing food and agri-business services, and aligns with its commitment to quality, safety, and sustainability.

- In March 2023, TÜV SÜD, partnered with Applied DNA Sciences (ADNAS) to provide enhanced product traceability solutions. ADNAS's CertainTR. platform, which utilizes DNA-based molecular tagging, will complement TÜV SÜD's existing traceability services. This collaboration will offer clients a comprehensive suite of solutions for ensuring the authenticity and origin of their products, including factory audits, supply chain mapping, product verification at various stages of the supply chain, and cotton source verification.

- In December 2023, ALS acquires the ExplorTech Division of Earthlabs Inc, formerly GoldSpot Discoveries Corp. This acquisition strengthens ALS's position in the environmental testing and consulting sector. ExplorTech's expertise in geochemistry, metallurgy, and environmental analysis complements ALS's existing capabilities. The move is expected to enhance ALS's ability to provide comprehensive services to clients in industries such as mining, energy, and environmental management

- In November 2021, BSI launched a new identification technology for products to drive safety across the built environment industry's supply chain. BSI Identify harnesses Digital Object Identifier (DOI) technology to deliver a unique, constant, and interoperable identifier, called a BSI UPIN. It can be assigned to products to help UK manufacturers to directly manage information about their products in the supply chain.

- In September 2021, Lloyd's Register Group Limited released ISO/SAE 21434 standard, which helps in managing cybersecurity risks in relation to electrical and electronic (E/E) systems in road vehicles.

Key Benefits For Stakeholders

- This testing, inspection and certification market forecast report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the testing, inspection and certification market analysis from 2022 to 2032 to identify the prevailing testing, inspection and certification market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the testing, inspection and certification market segmentation assists to determine the prevailing testing, inspection and certification market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the testing, inspection and certification industry players.

- The report includes the analysis of the regional as well as global testing, inspection and certification market trends, key players, market segments, application areas, and testing, inspection and certification market growth strategies.

Testing, Inspection and Certification Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 407.2 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 311 |

| By Service Type |

|

| By Sourcing Type |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Bureau Veritas S.A., Lloyd's Register Group Limited (LR), BSI, ASTM International, Dekra, DNV, SGS S.A., ABS, ALS Limted, TUV SUD AG., ISO, Intertek Group plc |

Analyst Review

The TIC market is competitive, owing to the strong presence of existing vendors. TIC companies that have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by firms.?

The TIC market holds a substantial scope for growth on a global scale. Its contribution to the market is anticipated to increase significantly during the forecast period. Recent discoveries and innovations have created vast opportunities for numerous players to step in the TIC market. Moreover, TIC services ensure quality assurance, verification of the safety, security, and performance of a product, service, or process, higher level of cost control improvement, and faster improvement of various processes.?

Rise in focus of manufacturing companies to improve customer retention by offering quality products and surge in demand for interoperability testing for connected devices & IoT drive the market growth. High cost of TIC services due to diverse standards and regulations across different regions is the biggest limitation for market growth.?

The surge in competition and reduced awareness among small scale manufactures are the key factors that hamper the growth of the market. Increase in awareness of the need for TIC and rise in concern for safety & quality are the factors opportunistic for market growth.?

The global TIC market was valued at $226.8 billion in 2022 and is projected to reach $407.2 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032.

The TIC market encompasses services such as auditing, inspection, testing, verification, quality assurance, and certification of products and equipment across various industries to enhance production efficiency and minimize risks.

Prominent companies in the TIC market include ABS, ALS Limited, ASTM International, BSI, Bureau Veritas S.A., DEKRA, DNV, Intertek Group PLC, ISO, Lloyds Register Group Limited (LR), SGS S.A., and TUV SUD AG.

North America leads the TIC market, driven by stringent regulatory standards in industries like healthcare, aerospace, and automotive, along with a focus on product safety and environmental compliance.

Key drivers include the increasing focus of manufacturing companies on improving customer retention by offering quality products and the surging demand for interoperability testing for connected devices and IoT.

Challenges include the high cost of TIC services due to diverse standards and regulations across different geographies, which can pose significant threats to market growth.

Loading Table Of Content...

Loading Research Methodology...