Textile Dyes Market Research, 2033

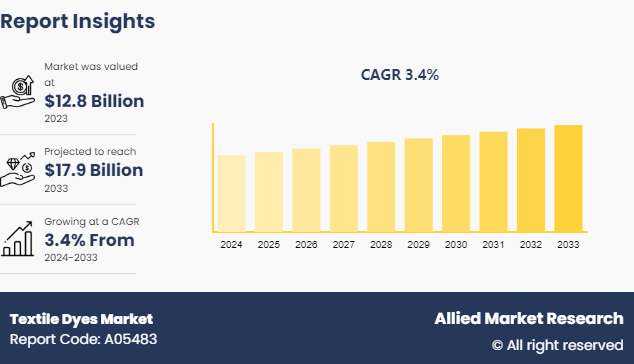

The global textile dyes market was valued at $12.8 billion in 2023, and is projected to reach $17.9 billion by 2033, growing at a CAGR of 3.4% from 2024 to 2033.

Market Introduction and Definition

Textile dyes are substances used to impart color to fabrics. These dyes are derived from natural sources, such as plants and insects, or created synthetically. They work by chemically bonding with the textile fibers, ensuring the color remains vibrant and durable through washing and wear. The application methods for textile dyes vary, including immersion, printing, and spraying. Different types of dyes, such as reactive, acid, direct, and disperse dyes, are used depending on the fiber type and desired effect. The development and use of eco-friendly dyes have become increasingly important due to environmental and health concerns associated with traditional dyeing processes, promoting sustainability within the textile industry.

Key Takeaways

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The textile dyes market is fragmented in nature among prominent companies such as Colourtex, Agrofert A.S., Jay Chemical Industries Ltd., Archroma, Kiri Industries Ltd., DuPont., Hollindia International B.V., Huntsman Corporation, Organic Dyes and Pigments (ORCO) , Chromatech Incorporated.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, and LAMEA regions.

Latest trends in global textile dyes market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 3, 500 textile dyes-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global textile dyes market.

Key Market Dynamics

Textile dyes market growth is driven by consumer demand for textiles in various applications. According to a report published by National Promotion and Facilitation Agency in 2023, the Indian textile and apparel market is projected to grow at a CAGR of $350 billion by 2030. Moreover, the lower cost of manufacturing owing to availability of raw material and labor at cheaper rates also drives textile dyes growth. The rise in environmental pollution caused by toxic substances such as lead, arsenic, and heavy metals in dyes, has negatively impacted the industry.

Furthermore, shifting consumer preferences play a crucial role in driving the textile dyes market expansion. The growing demand for sustainable fashion reflects a significant change in consumer behavior, with more individuals seeking eco-friendly and ethically produced clothing. This trend has led to an increased demand for textiles dyed using environmentally responsible methods. Transparency and traceability in supply chains have become important, prompting brands to adopt ethical dyeing practices. Additionally, the trend towards customization and personalization in fashion has driven the use of digital dyeing methods, enabling unique and tailored designs. Despite the rise of sustainability, the fast fashion sector continues to thrive, necessitating quick turnaround times and adaptable dyeing processes to keep up with rapid changes in fashion trends

However, market growth is hampered due to implementation of various health & environment regulations toward the use of textile dyes. Furthermore, textile dyeing processes consume huge amounts of water as a solvent leading to water wastage, which further acts as a restraint owing to scarcity of water.

On the contrary, the textile dyes market presents numerous opportunities, driven by advancements in technology, shifting consumer preferences towards sustainability, and evolving regulatory landscapes. One significant opportunity lies in the development and adoption of eco-friendly dyes. As environmental concerns rise, there is a growing demand for sustainable dyeing processes that minimize pollution and reduce the ecological footprint. Natural dyes, derived from plants, minerals, and insects, are gaining traction as they offer a biodegradable and non-toxic alternative to synthetic dyes. Similarly, the innovation of low-impact synthetic dyes that consume less water and energy is also expanding. Companies that invest in research and development of these sustainable dyes can position themselves as leaders in the eco-friendly segment of the market, appealing to environmentally conscious consumers and regulatory bodies alike.

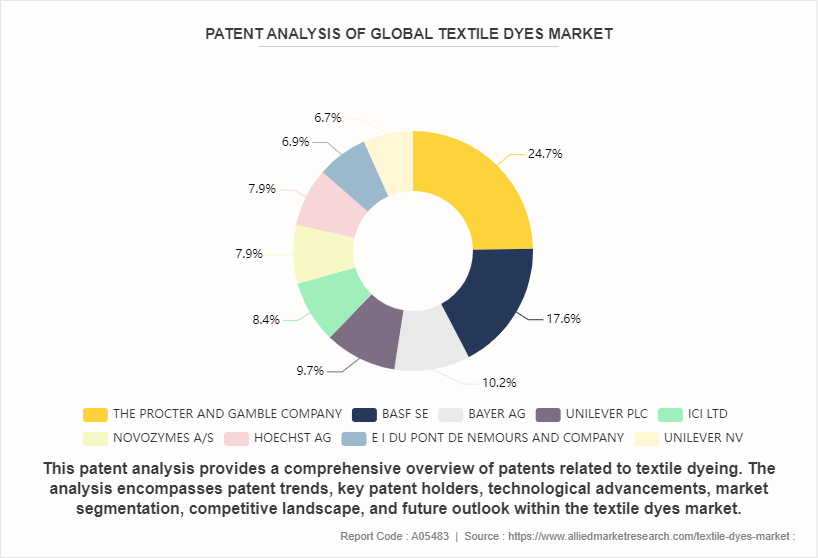

Patent filings related to textile dyeing have shown a steady increase over the past decade, indicating growing interest and investment in textile dyeing R&D. Key patent holders in the textile dyes market include textile companies, research institutions, universities, and chemical manufacturers. Companies such as THE PROCTER AND GAMBLE COMPANY, BASF SE, BAYER AG, UNILEVER PLC, ICI LTD, NOVOZYMES A/S, HOECHST AG, E I DU PONT DE NEMOURS AND COMPANY, and UNILEVER NV hold significant patent portfolios covering various aspects of textile dyeing production, formulation, and applications. Research institutions and universities contribute to patent filings related to novel uses and methods of textile dyeing.

Market Segmentation

The textile dyes market is segmented by dye type, fiber type, and region. By dye type, the market is classified into direct, reactive, VAT, basic acid, and disperse. By fiber type, the market is divided into wool, polyester, acrylic, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for textile dyes market, driven by the development in manufacturing sectors, increase in population in the continent, and improvement in economic conditions. Additional key factors that fuel the technical textile market include the growth in public infrastructure development, healthcare sector, and rapid urbanization. India and China are the top investment region for the global textile dyes market. Textile dyes producers are focusing on this area as it is the biggest market for textiles owing to high demand for apparel and clothing. The development is credited to the rising interest for textile and garments from the huge population. The key market players are expanding their textile dyes companies in APAC, particularly in China and India.

Competitive Landscape

The major players operating in the textile dyes market include Colourtex, Agrofert A.S., Jay Chemical Industries Ltd., Archroma, Kiri Industries Ltd., DuPont., Hollindia International B.V., Huntsman Corporation, Organic Dyes and Pigments (ORCO) , Chromatech Incorporated.

Other players in the textile dyes market include SUDEEP INDUSTRIES, Vipul Organics Ltd., Bodal Chemicals Ltd, Advent Dyestuffs and Chemicals Private Limited., DyStar Singapore Pte Ltd, Arlex Chemi Pvt. Ltd., TECHNO COLOR CORPORATION, Prima Chemicals, Chempro Group and so on.

Recent Key Strategies and Developments:

- In February 2023, Archromab Operations S.a.r.l. acquired textile and dyes chemical business of Hunstman Corporation. This strategic acquisition has enhanced the product portfolio of Archromab Operations S.a.r.l. for textile dyeing solutions.

- In April 2023, Appex Dyestuff Industries recently acquired Associated Dyestuff Pvt Ltd. This strategic acquisition has enhanced the product offering of Appex Dyestuff for liquid dyes.

Industry Trends

- In 2022, ZAITEX, a leading textile dyes manufacturer has launched a project named ZaitexFashion for the development of eco-friendly new processes for garment dyeing and finishing. The products offered by using the process are Global Organic Textile Standard (GOTS) and Zero Discharge of Hazardous Chemicals (ZDHC) approved.

- According to an article published by National Institute of Health in 2023, researchers from India have developed various strategies including physical, chemical, and biological to reduce the amount of dye pollution in environment. The study claims that the dye content in water gets removed by 75-80%, making it harmless for the environment.

- According to an article published by Industrial Research and Consultancy Centre, a new supercritical CO2 textile dyeing technology (SCFTD) has been developed to relatively lessen the amount of energy and solvents used in textile dyeing process. The new process may benefit the textile dyeing manufacturers by enhancing the efficiency of textile dyeing process.

Key Sources Referred

National Promotion and Facilitation Agency

Global Organic Textile Standard (GOTS)

Zero Discharge of Hazardous Chemicals (ZDHC) Certification and Testing Programs

National Institute of Health

Industrial Research and Consultancy Centre

U.S. Development Authority

Science Direct

Invest In India

Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the textile dyes market analysis from 2024 to 2033 to identify the prevailing textile dyes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the textile dyes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global textile dyes market trends, key players, market segments, application areas, and market growth strategies.

Textile Dyes Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.9 Billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Dye Type |

|

| By Fiber Type |

|

| By Region |

|

| Key Market Players | Huntsman Corporation, DuPont., Organic Dyes and Pigments (ORCO), Chromatech Incorporated, Agrofert A.S., Colourtex, Kiri Industries Ltd., Jay Chemical Industries Ltd., Archroma, Hollindia International B.V. |

Textile dyes market growth is driven by consumer demand for textiles in various applications. Moreover, the lower cost of manufacturing owing to availability of raw material and labor at cheaper rates also drives textile dyes growth.

The global textile dyes market was valued at $ 9.4 billion in 2018 and is projected to reach $15.5 billion by 2026, growing at a CAGR of 6.3% from 2019 to 2026.

There is a significant increase in the demand for non-woven fabrics in the healthcare end-use industry, owing to rise in health concerns among consumers. Moreover, rise in product use in the automotive end-use industry is expected to increase the product demand. Due to the advent of rapid technological advancements, the non-woven fabric materials have increased a large application base in multiple end-use industries, including construction and agriculture, which, in turn, boost the demand for the growth of the fabrics dyes.

Asia-Pacific was the highest revenue contributor in the global textile dyes market. The growth in these regions is driven by the development in manufacturing sectors, increase in population in the continent, and improvement in economic conditions. Additional key factors that fuel the technical textile market include the growth in public infrastructure development, healthcare sector, and rapid urbanization.

Product launch is the key growth strategies of textile dyes market players. Dupont Advanced Printing, a unit of Dupont. launched new products DuPont Artistri Xite S2500 (medium viscosity) and S3500 (high viscosity) dye sublimation inks at SGIA (Specialty Graphic Imaging Association) show held in New Orleans. With this new addition of products Dupont. enhanced its product portfolio.

Key players operating in the global textile dyes market share include Agrofert S.A., Archroma, Chromatech Incorporated, Colourtex, DuPont., Hollindia International B.V., Huntsman Corporation, Jay Chemicals Industries Ltd., Kiri Industries Ltd. (Kiri), and Organic Dyes and Pigments

Polyester gained a significant market share in the market and is expected to maintain its growth throughout the analysis period. This is attributed to its numerous advantages such as high strength, weather-resistant, high elasticity, and others. It is one of the most preferred fibers in the textiles industry owing to its excellent physical properties, cheap price, versatility, recyclability, and others.

Loading Table Of Content...