Thermal Spray Wire Market Research, 2029

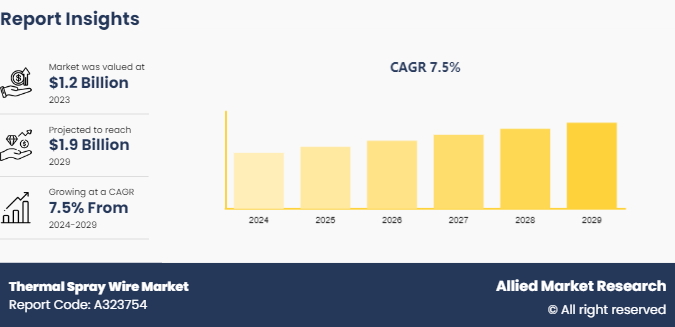

The global thermal spray wire market was valued at $1.2 billion in 2023, and is projected to reach $1.9 billion by 2029, growing at a CAGR of 7.5% from 2024 to 2029.

Market Introduction and Definition

Thermal spray wires are materials used in thermal spraying, a coating process in which melted (or heated) materials are sprayed onto a surface. These wires are typically composed of metals or alloys and are fed through a spray gun, where they are melted by an energy source such as an electric arc, plasma, or combustion flame. The molten droplets are then accelerated towards the target substrate to form a coating. This method allows for the deposition of thin, dense, and durable coatings that enhance surface properties such as wear resistance, corrosion protection, thermal insulation, and electrical conductivity.

Thermal spray wires find applications in various industries due to their versatility and effectiveness. In the aerospace industry, they are used to coat turbine blades, landing gear, and other components to protect them from extreme temperatures, oxidation, and wear. The automotive industry utilizes thermal spray wires to improve the durability and performance of engine components, such as pistons and cylinder heads, by reducing friction and wear. In the energy sector, thermal spray coatings are applied to oil and gas exploration equipment and power generation turbines to enhance their resistance to harsh operating conditions and extend their service life.

Key Takeaways:

The thermal spray wires industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period (2024-2029) .

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global thermal spray wires market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the thermal spray wires market size.

The thermal spray wires market share is highly fragmented, with several players including Astro Alloys Inc, THERMION, OC Oerlikon Management AG, Höganäs AB, Metallisation Limited, Polymet, Parat Tech, Flame Spray Technologies B.V., Praxair S.T. Technology, and Shanghai AlloTech Industrial Co., Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the thermal spray wires market growth.

Market Segmentation

The thermal spray wires market is segmented into material type, process type, end-use and region. By material type, the market is divided into nickel-based alloys, cobalt-based alloys, aluminum alloys, stainless steel, and others. As per process type, the market is categorized into flame spray, cold spray, arc spray, plasma spray, and others. On the basis of end-use the market is divided into aerospace, automotive, oil & gas, power generation, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

The market for thermal spray wires is experiencing substantial growth, propelled by the expanding influence of the aerospace and automotive industries. The automotive and aerospace sectors, known for their continuous innovation and demand for high-performance materials, are increasingly turning to thermal spray wires to enhance the durability, wear resistance, and overall performance of critical components. In the aerospace industry, where precision and reliability are paramount, thermal spray wires play a pivotal role in coating turbine blades, engine components, and various structural elements. These coatings provide a protective barrier against extreme temperatures, wear, and corrosive environments encountered during flight. According to the Aerospace Industries Association (AIA) , the aerospace and defense industry’s workforce generated $952 billion in combined sales in 2022, a 6.7 percent increase from the prior year. Additionally, the A&D industry generated $418 billion in economic value, which represented 1.65 percent of total nominal GDP in the U.S.

Moreover, the automotive industry focuses on lightweight materials, fuel efficiency, and durability. Thermal spray wires find extensive application in this sector, where they are utilized to coat engine components, exhaust systems, and various automotive parts exposed to harsh conditions. According to Invest India, India's automotive industry is worth around %222 billion, while the EV market in India is valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global research and development spending. Thus, the expansion of the aerospace and automotive industries further drives the growth of the thermal spray wires market.

Advancements in coating technologies are expected to drive the growth of the thermal spray wires market during the forecast period. High-velocity oxy-fuel (HVOF) technology is a thermal spray process that uses a high-velocity stream of gas to propel molten particles onto a substrate. This technology enables the deposition of dense, high-quality coatings with exceptional bond strength, wear resistance, and corrosion protection. The demand for thermal spray wires increases as HVOF processes become more widespread in industries such as aerospace, automotive, and oil & gas, where superior coating performance is critical. Plasma spraying involves a plasma torch to heat and accelerate coating materials, which are then deposited onto the substrate. This technology offers versatility in terms of coating materials and substrate compatibility, allowing for the deposition of a wide range of materials, including ceramics, metals, and composites. As plasma spraying techniques advance to achieve finer particle sizes, improved coating adhesion, and enhanced deposition efficiency, the demand for thermal spray wires grows to support these advanced applications.

However, high equipment and maintenance costs are expected to face a notable restraint in the thermal spray wires market during the forecast period. Thermal spray equipment, including spray guns, powder feeders, control systems, and auxiliary components, requires a substantial initial capital investment. Small and medium-sized enterprises (SMEs) find it challenging to allocate funds for purchasing or upgrading thermal spray equipment, especially if they have limited financial resources or competing investment priorities. In addition to the initial capital investment, SMEs must consider ongoing operational costs such as consumables (e.g., thermal spray wires, powders, gases) , energy consumption, and labor expenses. These operational costs add up over time, making thermal spray processes less cost-effective, particularly for low-volume production or occasional coating jobs.

Rise in demand for renewable energy is expected to represent a significant opportunity for the thermal spray wire market, opening new avenues for enhanced performance, efficiency, and application possibilities. Wind turbine components, including blades, towers, and nacelles, are subjected to harsh environmental conditions, such as wind, rain, and UV exposure. Thermal spray coatings applied using thermal spray wires can provide protection against corrosion, erosion, and wear, thereby extending the lifespan and enhancing the performance of these critical components. Additionally, thermal spray coatings can improve aerodynamic efficiency and reduce surface roughness, leading to increased energy generation and operational efficiency of wind turbines. In May 2022, Greenlane Renewables Inc. secured a contract worth $6.8 million for a project converting dairy manure into renewable natural gas (RNG) in the U.S. RNG facilities may have equipment exposed to corrosive environments, such as biogas reactors, pipes, or tanks. Thermal spray coatings provide corrosion protection by applying a layer of material resistant to chemical degradation.

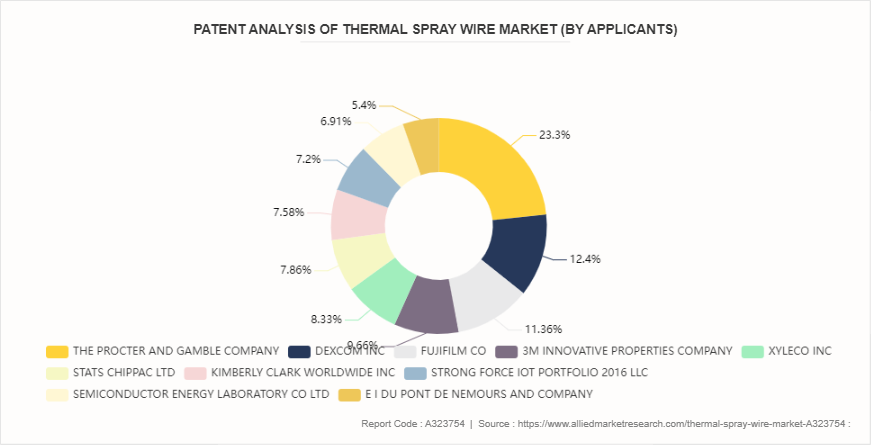

Patent Analysis of Global Thermal Spray Wire Market, By Applicants

The Procter and Gamble Company is leading the patents of thermal spray wire with a substantial 24.6% of patents filed. While primarily known for consumer goods, their involvement in the thermal spray wires market underscores the broad applicability of this technology, indicating research into coatings for packaging or manufacturing processes.

Dexcom Inc., is a prominent player in medical devices and continuous glucose monitoring systems. Their substantial presence in patent filings suggests a keen interest in leveraging thermal spray wire technologies for applications in the medical field, potentially for coatings on implantable devices or biomedical sensors.

Fujifilm Co, a powerhouse in imaging and photography, brings its expertise to the thermal spray wires arena, capturing 12.0% of patents filed. Their involvement signifies exploration into novel coatings for imaging components or industrial printing applications, where precision and durability are paramount.

Meanwhile, 3M Innovative Properties Company, renowned for its diverse portfolio of adhesives, abrasives, and protective materials, holds a notable 10.2% share of patents filed. Their interest in thermal spray wires suggests endeavors to enhance the performance and longevity of their existing product lines through advanced coatings and surface treatments.

Other significant contributors include Xyleco Inc., Stats ChipPAC Ltd, and Kimberly Clark Worldwide Inc., each bringing unique perspectives and expertise to the thermal spray wires landscape. Additionally, smaller entities like Strong Force IoT Portfolio 2016 LLC and Semiconductor Energy Laboratory Co Ltd demonstrate that innovation in this field is not limited to industry giants, with startups and research institutions playing integral roles in driving progress.

Competitive Analysis

Key market players in the thermal spray wires market include Astro Alloys Inc, THERMION, OC Oerlikon Management AG, Höganäs AB, Metallisation Limited, Polymet, Parat Tech, Flame Spray Technologies B.V., Praxair S.T. Technology, and Shanghai AlloTech Industrial Co., Ltd.

Regional Market Outlook

Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America, particularly the U.S., has a significant market for thermal spray coatings due to its robust manufacturing sector, aerospace industry, and the presence of key players in the thermal spray technology domain. Thermal spray wire is commonly used in various applications such as aerospace, automotive, and energy sectors. The Asia-Pacific region is witnessing rapid industrialization and infrastructure development, which fuels the demand for thermal spray coatings. Countries such as China, Japan, South Korea, and India are major consumers of thermal spray technology. The automotive, aerospace, and electronics industries are significant users of thermal spray coatings in this region.

Industry Trends

The Federal Aviation Administration (FAA) projects that the total commercial aircraft fleet in the U.S. will reach 8, 270 by 2037, driven by the growth in air cargo. Additionally, the mainline carrier fleet in the U.S. is expected to expand by 54 aircraft annually, due to the aging of the current fleet. Thus, the growing popularity for thermal spray coatings in turbine blades, vanes, and other engine components is expected to boost the growth of thermal spray wires market.

According to the Civil Aviation Administration of China (CAAC) , China ranks among the top global aircraft manufacturers and serves as a major market for domestic air passengers. The country's aircraft parts and assembly manufacturing sector are experiencing rapid growth, with more than 200 small aircraft parts manufacturers operating in the market. Additionally, Chinese airlines are projected to acquire approximately 7, 690 new aircraft over the next two decades, an investment estimated at around $1.2 trillion. This substantial expansion is anticipated to significantly boost demand in the thermal spray wires market.

According to the Indian Brand Equity Foundation (IBEF) , the Indian passenger car market was valued at $32.70 billion in 2021. It is projected to grow at a compound annual growth rate (CAGR) of over 9% from 2022 to 2027, reaching an estimated value of $54.84 billion by 2027. Thermal spray coatings can be applied to cylinder liners and pistons to improve wear resistance, reduce friction, and enhance the overall performance and longevity of the car engine.

Key Source Referred

U.S. Department of Health & Human Services

State of California

U.S. Department of Energy

The Laurens Country Advertiser

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thermal spray wire market analysis from 2024 to 2029 to identify the prevailing thermal spray wire market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the thermal spray wire market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global thermal spray wire market trends, key players, market segments, application areas, and market growth strategies.

Thermal Spray Wire Market Report Highlights

| Aspects | Details |

| Market Size By 2029 | USD 1.9 Billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2024 - 2029 |

| Report Pages | 300 |

| By Material Type |

|

| By Process Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Polymet, Flame Spray Technologies B.V., OC Oerlikon Management AG, Shanghai AlloTech Industrial Co., Ltd, Metallisation Limited, Astro Alloys Inc, Praxair S.T. Technology, THERMION, Höganäs AB, Parat Tech |

Loading Table Of Content...