Thermoform Packaging Market Research, 2033

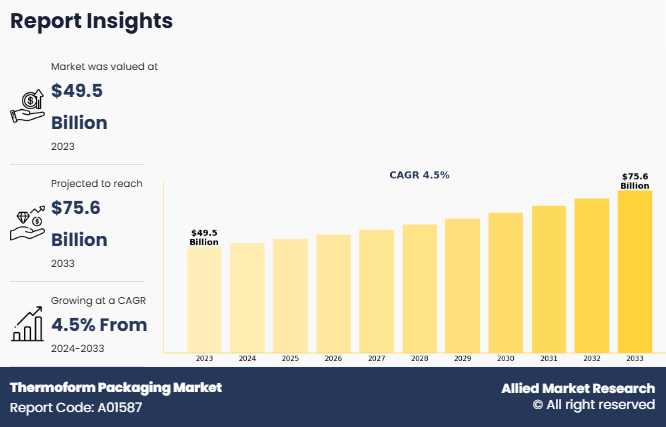

The global thermoform packaging market was valued at $49.5 billion in 2023, and is projected to reach $75.6 billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033. Increase in demand for convenient and lightweight packaging solutions, coupled with growth in pharmaceutical industry and medical device packaging drives the adoption of thermoform packaging. Consumers preference for user-friendly, portable, and protective packaging has encouraged industries to utilize thermoform solutions that offer enhanced functionality, ease of handling, and reduced product weight.

Introduction

Thermoform packaging refers to a manufacturing process where a plastic sheet is heated until it becomes pliable, then shaped into a specific form using a mold, and cooled to create a solid, finished structure. This process is widely used for creating a variety of packaging products such as trays, clamshells, blisters, and other container types. The packaging is a durable, lightweight, and transparent solution that protects and showcases the contents that makes it a preferable packaging material in sectors such as food and beverage, medical devices, electronics, and retail products. Moreover, thermoform packaging offers advantages such as cost-effectiveness, customizable design, and quick production turnaround.

Key Takeaways

- The global thermoform packaging market has been analyzed in terms of value. The analysis in the report is provided on the basis of material, type, heat sealing coating, end-use industry, 4 major regions, and more than 15 countries.

- The global thermoform packaging market report includes a detailed study covering underlying factors influencing industry opportunities and trends.

- The thermoform packaging market is fragmented in nature with few players such as Amcor Ltd., Placon Corporation, Display Pack Inc., Anchor Packaging Inc., Tamarack Packaging, Ltd., Sonoco Products Company, D&W Fine Pack LLC, Sinclair & Rush Inc., Berry Global Inc., and Winpak LTD.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global thermoform packaging market.

Market Dynamics

Thermoform packaging is lightweight, reducing the overall weight of products and facilitating better handling, transportation, and storage, which are particularly critical in sectors such as food and beverage, healthcare, and retail. Moreover, convenience-focused designs such as resealable trays, single-serve containers, and easy-peel blisters, cater to modern lifestyle needs while preserving product integrity. Thermoformed packages are customized to ensure optimal product fit and enhanced consumer experience, which help brands to differentiate themselves in competitive markets. This customization meets the demands of the growing e-commerce sector, where efficient, secure, and lightweight packaging is crucial for minimizing shipping costs and ensuring product protection during transit. All these factors are expected to drive the demand for the thermoform packaging market during the forecast period.

However, high initial tooling costs poses a significant challenge to the growth of the thermoform packaging market. The process of creating molds and tooling required for thermoforming involves substantial upfront investment. Custom molds are carefully designed and manufactured to ensure precision and consistency in the packaging's final form, which is costly for smaller companies or new market entrants. This financial burden limits the market growth and acts as a deterrent to companies with limited capital or fluctuating demand. All these factors hamper the thermoform packaging market growth.

Rise in advancements in thermoforming technology creates opportunities for the thermoform packaging industry by improving production efficiency, reducing costs, and enhancing the overall quality of packaging solutions. Technological innovations such as precision-controlled heating, high-speed forming, and advanced automation systems enable manufacturers to optimize material usage, minimize waste, and reduce energy consumption. These improvements result in cost savings and contribute to more sustainable and environmentally friendly packaging options, aligning with consumer and regulatory demands for greener solutions. All these factors are anticipated to offer new growth opportunities for the thermoform packaging market during the forecast period.

Segments Overview

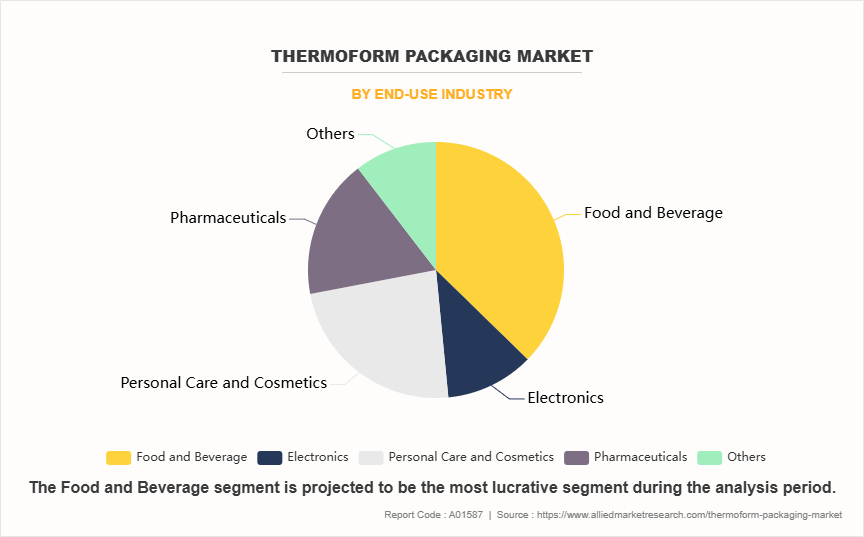

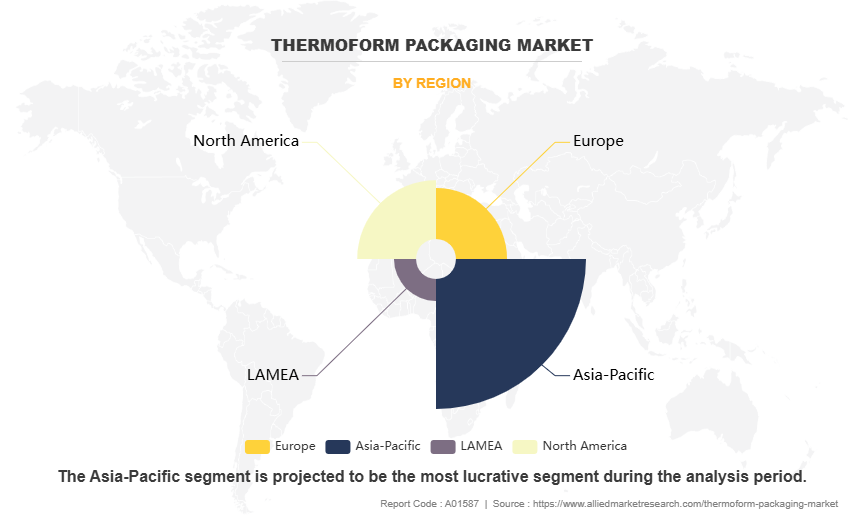

The thermoform packaging market is segmented on the basis of material, type, heat sealing coating, end-use industry, and region. On the basis of material, the market is classified into plastics, aluminum, and paper & paperboard. On the basis of type, the market is segmented into clamshell packaging, blister packaging, skin packaging, and others. On the basis of heat sealing coating, the market is classified into water-based, solvent-based, and hot melt-based. On the basis of end-use industry, the market is segmented into food & beverage, electronics, personal care & cosmetics, pharmaceuticals, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

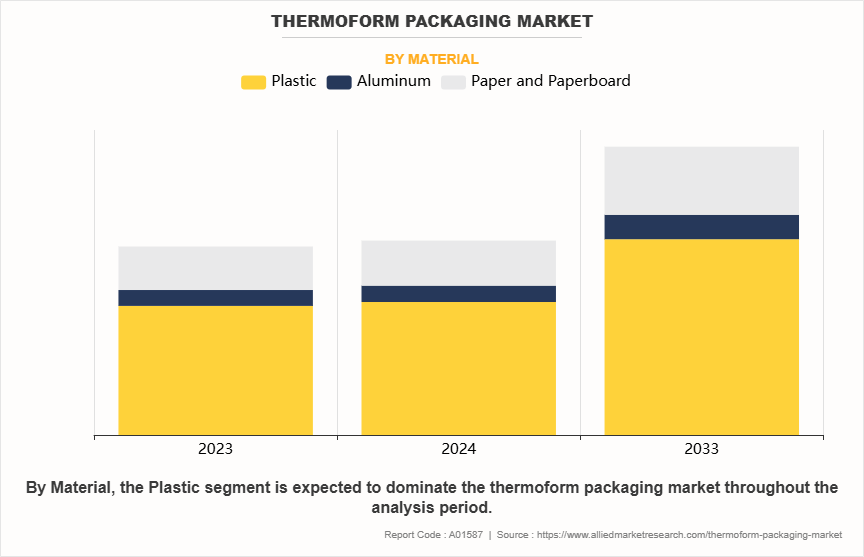

On the basis of material, the market is classified into plastics, aluminum, and paper & paperboard. The plastic segment accounted for more than two-thirds of global thermoform packaging market share in 2023 and is expected to maintain its dominance during the forecast period. Plastics provide excellent barrier properties that protect products from moisture, light, oxygen, and contaminants, thus extending shelf life, particularly for perishable items. This is especially significant for food packaging, where maintaining freshness and safety is paramount. In addition, plastic thermoform packaging is lightweight, reducing transportation costs and overall carbon emissions during distribution. All these factors are expected to drive the demand for plastics segment in thermoform packaging market.

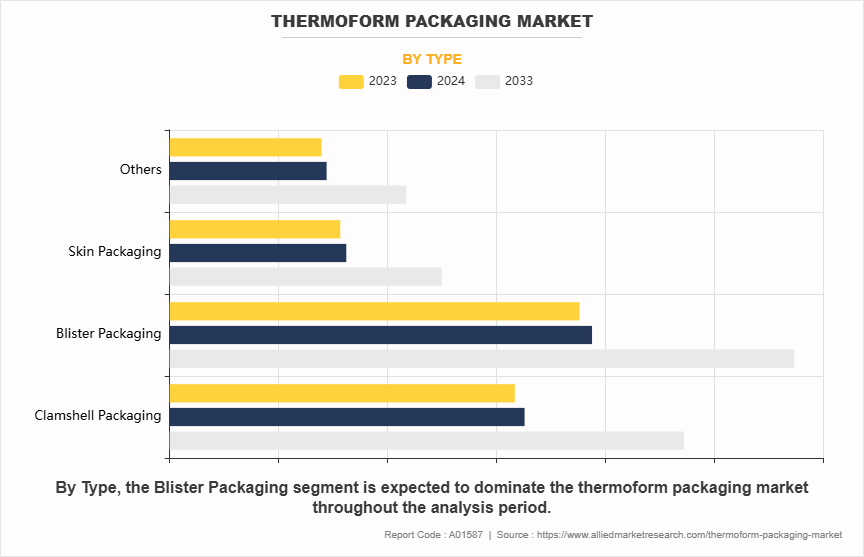

On the basis of type, the market is segmented into clamshell packaging, blister packaging, skin packaging, and others. The blister packaging segment accounted for less than two-fifths of global thermoform packaging market share in 2023 and is expected to maintain its dominance during the forecast period. Blister packaging has emerged as a critical component in the thermoform packaging market due to its unique ability to offer product protection, extended shelf life, and enhanced visibility for various industries, particularly pharmaceuticals, consumer goods, and electronics. In the pharmaceutical sector, regulatory demands for secure packaging to maintain drug integrity and prevent contamination are stringent. Blister packs help meet these requirements by offering a sealed environment, protecting medicines from moisture, light, and other environmental factors, thus extending the shelf life and efficacy of the products.

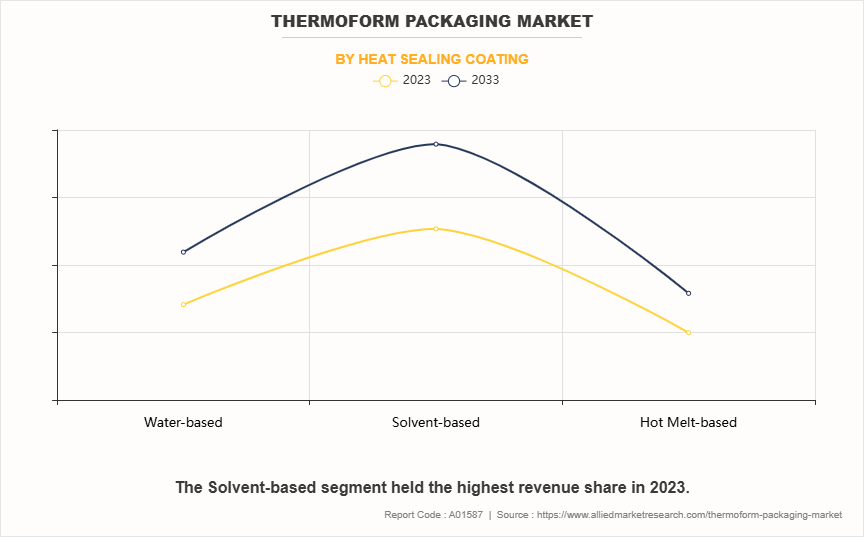

On the basis of heat sealing coating, the market is classified into water-based, solvent-based, and hot melt-based. The solvent-based segment accounted for more than half of global thermoform packaging market share in 2023 and is expected to maintain its dominance during the forecast period. Advancements in packaging technology are boosting the demand for high-performance coatings. Thermoform packaging is used across multiple industries such as food, pharmaceuticals, electronics, and consumer goods, where reliable and secure seals are essential. The high adhesion and heat resistance properties of solvent-based heat sealing coatings make them ideal for such diverse applications, providing flexibility to manufacturers in designing complex packaging shapes and ensuring optimal performance across various environments.

On the basis of end-use industry, the market is segmented into food & beverage, electronics, personal care & cosmetics, pharmaceuticals, and others. The food & beverage segment accounted for less than two-fifths of global thermoform packaging market share in 2023 and is expected to maintain its dominance during the forecast period. Consumer demand for environmentally friendly solutions creates opportunities for manufacturers to adopt recyclable and biodegradable thermoform materials, which help reduce the carbon footprint of packaging. Thermoforming techniques offer efficient material usage and reduce waste during production, aligning with broader sustainability goals. Moreover, government regulations promoting the use of eco-friendly materials in food packaging that increase the use of thermoforming solutions which enhance their appeal in a competitive market.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for less than half of the global thermoform packaging market share in 2023 and is expected to maintain its dominance during the forecast period. Rise in food and beverage industry in the Asia-Pacific is increasingly adopting thermoform packaging to meet consumer demands for convenience, portability, and freshness. Thermoformed trays, clamshells, and cups are commonly used for fresh produce, ready-to-eat meals, and snacks. The ability to extend shelf life through vacuum sealing and tamper-evident features makes thermoform packaging especially appealing in the food and beverage industry. Moreover, rise in disposable packaging due to busy lifestyles and changing eating habits further accelerates the demand for thermoform solutions.

Competitive Analysis

Key players in the thermoform packaging market include Amcor Ltd., Placon Corporation, Display Pack Inc., Anchor Packaging Inc., Tamarack Packaging, Ltd., Sonoco Products Company, D&W Fine Pack LLC, Sinclair & Rush Inc., Berry Global Inc., and Winpak LTD.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thermoform packaging market analysis from 2023 to 2033 to identify the prevailing thermoform packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the thermoform packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thermoform packaging market trends, key players, market segments, application areas, and market growth strategies.

Thermoform Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 75.6 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 420 |

| By Material |

|

| By Type |

|

| By Heat Sealing Coating |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Display Pack Inc., Tamarack Packaging, Ltd., Berry Global Inc., Placon Corporation, Amcor Ltd., Winpak Ltd., Sinclair & Rush Inc., Anchor Packaging Inc., Sonoco Products Company, D&W Fine Pack LLC |

Analyst Review

According to the opinions of various CXOs of leading companies, the thermoform packaging market is expected to witness growth during the forecast period owing to increase in demand for convenient and lightweight packaging solutions and growth in pharmaceutical industry and medical device packaging. Consumers are increasingly seeking products that prioritize convenience and ease of use, reflecting their fast-paced, on-the-go lifestyles. Thermoform packaging excels in meeting these demands through its lightweight design, portability, and user-friendly features, such as easy-open blister packs, resealable trays, and single-serve containers. These attributes make it ideal for sectors such as food and beverage, where convenience and product freshness are critical, and for e-commerce applications where weight and durability play a pivotal role in minimizing shipping costs and protecting products during transit.

In addition, the versatility of thermoform packaging allows manufacturers to customize solutions that meet the specific needs of pharmaceuticals and medical devices such as incorporating child-resistant features, providing extended shelf life, and ensuring barrier protection against moisture, light, and air. All these factors align with the complex demands of these industries and drive the market growth by offering effective and innovative packaging solutions.

The global thermoform packaging market was valued at $49.5 billion in 2023, and is projected to reach $75.6 billion by 2033, growing at a CAGR of 4.5% from 2024 to 2033.

Asia-Pacific is the largest regional market for Thermoform Packaging.

Food & beverage is the leading application of Thermoform Packaging Market

Advancements in thermoforming technologies are the upcoming trends of Thermoform Packaging Market in the globe.

Key players in the thermoform packaging market include Amcor Ltd., Placon Corporation, Display Pack Inc., Anchor Packaging Inc., Tamarack Packaging, Ltd., Sonoco Products Company, D&W Fine Pack LLC, Sinclair & Rush Inc., Berry Global Inc., and Winpak LTD.

Loading Table Of Content...

Loading Research Methodology...