Thermoformed Plastics Market Research, 2031

The global thermoformed plastics market was valued at $40.5 billion in 2021, and is projected to reach $67.1 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

Thermoformed plastics are synthetic and semi-synthetic materials that are manufactured and processed using thermoforming processes. They are manufactured by heating sheets of acrylic, biodegradable polymers, polycarbonate, acrylonitrile butadiene styrene (ABS) and polyvinyl chloride (PVC) until they reach a pliable temperature and are further molded into the desired shape of the final product. and trimmed. Thermoformed plastics are also manufactured using vacuum snapback, plug assist molding, and thick and thin wall thermoforming techniques. They offer greater aesthetic and design flexibility, ease of manufacturing large-scale components, optimal use of raw materials, and reduced manufacturing costs. As a result, thermoformed plastics are widely used to manufacture automotive dashboards, seats, interior panels, air ducts and bumpers, lighting fixtures, and control panels.

Rising demand for effective packaging solutions across all industries is one of the key factors driving the market growth. Thermoformed plastics are commonly used to make clamshell packages, package blisters, mailer trays, and retail package liners. Moreover, the wide acceptance of the products in the food and beverage industry is fueling the market growth. Thermoformed plastics are often used for food sealing because they provide barrier properties against bacteria, odors and moisture particles. It is also used in the medical industry to manufacture pre-filled syringes, pharmaceutical bottles, capsules, tablets and electronic systems. In addition, increasing adoption of in-mold labeling (IML) technology, which adheres paper labels to the body of plastic containers, is also acting as another growth enabler. IML technology enables product manufacturers to develop aesthetically pleasing, intricately designed labels and deliver content information more clearly. Other factors, such as the proliferation of online retail platforms and multi-brand convenience stores, and rising general concerns about hygiene and product safety, are expected to boost the market growth.

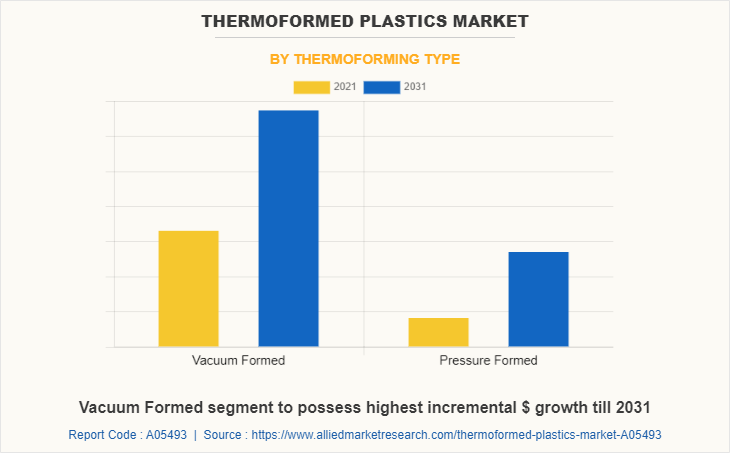

The thermoformed plastics market is segmented on the basis of product, thermoforming type, application, and region. On the basis of product, the market is classified into polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), polyethylene (PE), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), high impact polystyrene (HIPS), and others. On the basis of thermoforming type, the market is classified into vacuum formed and pressure formed. On the basis of application, the market is classified into food packaging, consumer goods & appliances, healthcare & medical, construction, electrical & electronics, automotive, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product, the polypropylene (PP) segment dominated the global thermoformed plastics market in 2021. The global thermoforming plastic market is dominated by the PP, in terms of value and volume. This is due to the widespread use of this plastic in packaging applications such as food, medical devices and the automotive industry. Excellent strength-to-weight ratio, excellent energy management, resilience, excellent chemical resistance, and durability make it ideal for packaging applications.

By thermoforming type, the vacuum formed segment accounted for the highest market share of around 65.4% in 2021 and is projected to maintain the same during the forecast period. Manufacturers use vacuum forming to create a number of pieces and parts in cars, buses, boats, and airplanes. In cars, everything from bumpers to floor mats, and even truck beds, are manufactured using vacuum forming.

By Application

Food Packaging to possess highest market share till 2031

By application, the food packaging segment held the largest share of the market in 2021 and is expected to remain dominant during the forecast period owing to huge demand for packaged and branded products. Using safe packaging materials, thermoforming plastic provides better protection during transportation, leading to their preference in the food packaging industry.

By region, North America accounted for the largest share in the global thermoforming plastic market in 2021. Technological advancements in the packaging industry primarily drive the market in this region. The demand for thermoformed plastics is driven by factors such as rising sales of electronic products, higher disposable incomes, increasing demand for packaged food, and changing demographics.

The major players operating in the industry include, Amcor PLC., Anchor Packaging, Berry Global Inc., Brentwood industries, Inc, Dart Container Corporation, DISPLAY PACK, D&W Fine Pack LLC, Fabri-Kal Corp, Genpak LLC, Greiner packaging, Pactiv LLC, Productive Plastics, Inc., Ray Products Company Inc., Sabert Corporation, Sonoco Products Company. These players have adopted product launch, acquisition, and business expansion as their key strategies to increase their market shares.

Impact of COVID-19 outburst on the thermoformed plastics market

- Research shows that the COVID-19 outbreak has caused a significant drop in commodity production in 2020 as operations have halted in several countries around the world. However, the COVID-19 pandemic has increased the demand for packaging around the world. For example, recent insights into flexible packaging show that the food packaging industry saw a surge in demand during the pandemic as many consumers switched to online shopping for groceries. Supermarkets have seen a surge in demand for packaging materials for packaging groceries and other foodstuffs.

- In addition, the increasing demand for surgical masks as the primary medium of protection during the pandemic has created a golden opportunity for the packaging industry to continue. According to a recent report by UNICEF, about 301.3 million surgical masks and 22.2 million N95 ventilators were distributed in 2020, reaching about 127 countries. As such, the steady increase in manufacturing, production and distribution activities will also require the use of thermoformed plastics in the packaging of these commodities and consumables, leading to a slow and steady recovery in the market over the next few years.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thermoformed plastics market analysis from 2021 to 2031 to identify the prevailing thermoformed plastics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the thermoformed plastics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thermoformed plastics market trends, key players, market segments, application areas, and market growth strategies.

Thermoformed Plastics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 67.1 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 517 |

| By Product |

|

| By Thermoforming Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Genpak LLC, Dongguan Ditai Plastic Products Co., Ltd, Anchor Packaging, Dart Container Corp., Berry Global Inc., Sonoco Products Company, Amcor Ltd., Pactiv LLC , Fabri-Kal Corp., DISPLAY PACK, Palram Americas Ltd., CM Packaging, Greiner Packaging, Sabert Corporation, D&W Fine Pack LLC |

Analyst Review

According to CXOs, thermoformed plastics are utilized during the thermoforming process, where a plastic sheet is heated to get a bendable form to be molded into the desired shape. It is later cooled to produce a ready-to-use final product. Several plastic thermoforming processes are available on the market including thick and thin wall thermoforming, vacuum snapback and plug assist molding. Thermoforming plastics are widely used and inexpensive, which has contributed greatly to the recent market expansion.

Increasing use of thermoformed plastics in various food packaging products such as trays, cups, sandwich wraps, disposable plates, glasses, microwaveable containers, etc. is supporting the demand for thermoformed plastics and boosting the growth of the market. Thermoformed plastic protects against odors, moisture and bacteria. This can extend the shelf life of packaged products and is also cost effective. Due to these factors, the demand for thermoformed plastic materials is expected to increase during the forecast period.

Increase in demand from the medical industry and Growth in demand from the packaging industry are the key factors boosting the Thermoformed plastics market growth.

The market value of Thermoformed plastics in 2031 is expected to be $67.1 billion

Amcor PLC., Anchor Packaging, Berry Global Inc., Brentwood industries, Inc, Dart Container Corporation, DISPLAY PACK, D&W Fine Pack LLC, Fabri-Kal Corp, Genpak LLC, Greiner packaging, Pactiv LLC, Productive Plastics, Inc., Ray Products Company Inc., Sabert Corporation, Sonoco Products Company.

Food and beverage industry is projected to increase the demand for Thermoformed plastics Market

The thermoformed plastics market is segmented on the basis of product, thermoforming type, application, and region. On the basis of product, the market is classified into polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), polyethylene (PE), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), high impact polystyrene (HIPS), and others. On the basis of thermoforming type, the market is classified into vacuum formed and pressure formed. On the basis of application, the market is classified into food packaging, consumer goods & appliances, healthcare & medical, construction, electrical & electronics, automotive, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Rise in demand in healthcare and medical industry is the Main Driver of Thermoformed plastics Market.

The increasing demand for surgical masks as the primary medium of protection during the pandemic has created a golden opportunity for the packaging industry to continue. According to a recent report by UNICEF, about 301.3 million surgical masks and 22.2 million N95 ventilators were distributed in 2020, reaching about 127 countries. As such, the steady increase in manufacturing, production and distribution activities will also require the use of thermoformed plastics in the packaging of these commodities and consumables, leading to a slow and steady recovery in the market over the next few years.

Loading Table Of Content...