Thin Wafer Processing And Dicing Equipment Market Research, 2031

The global thin wafer processing and dicing equipment market was valued at $643.8 million in 2021, and is projected to reach $1.2 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.A wafer is a thin slice of semiconductor material, and dicing is a process used to cut or groove semiconductors, glass crystals, and many other types of materials. The equipment used in this process is known as dicing equipment. Due to the increasing demand for thinner wafers and thicker chips, dicing technology is constantly evolving, which has a great impact on the dicing equipment industry. Grinding is also a process to reduce the thickness of wafers according to the requirements of various industries such as electronics, automobiles, and communication equipment.

The handling and processing of thin wafers are now done by temporarily bonding them to a rigid carrier wafer, which provides mechanical support during wafer thinning and backside processing. The thin wafer is separated from a carrier wafer after backside processing and affixed to dicing tape on the film frame. It is currently seen that the integration of microelectronics into several consumer electronics and smart cards needed for thinner wafers is increasing rapidly.

Segment Overview:

The market is segmented into Wafer Size, Equipment Type, and Application.

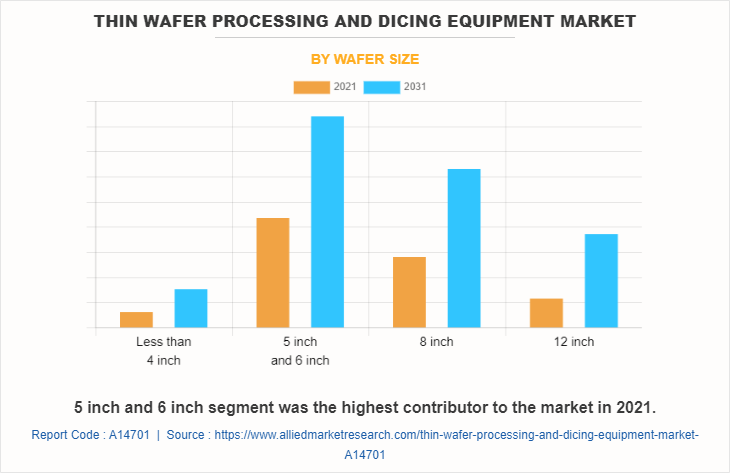

Based on wafer size, the market is divided into less than 4-inch, 5-inch and 6-inch, 8-inch, and 12-inch. The 5-inch and 6-inch segment was the highest revenue contributor in the thin wafer processing and dicing equipment market analysis.

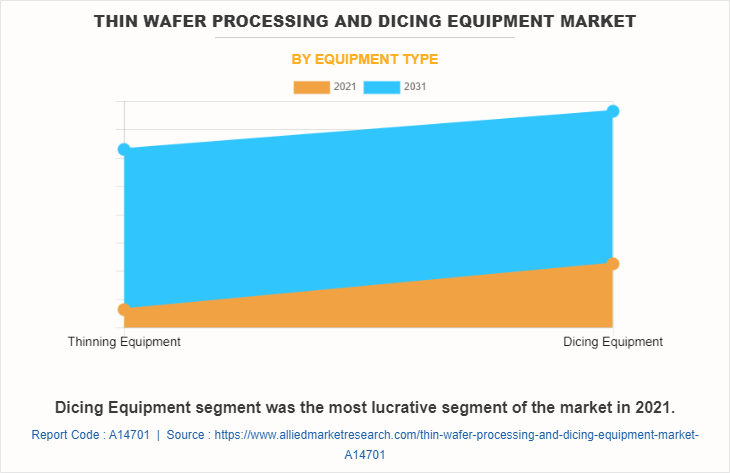

On the basis of equipment type, the market is divided into thinning equipment and dicing equipment. The dicing equipment segment was the highest revenue contributor to the market during the forest period.

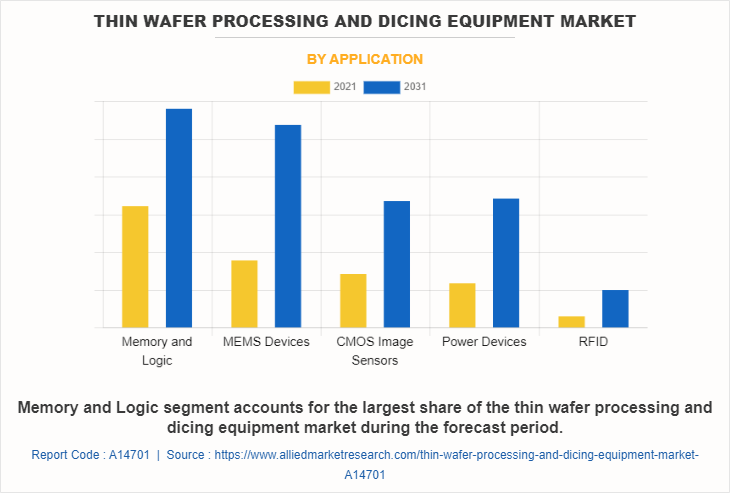

By application, it is divided into memory and logic Through Silicon Via (TSV), Micro Electro Mechanical Systems (MEMS) devices, power devices, CMOS image sensors, and Radio Frequency Identification (RFID). The memory and logic segment was the highest revenue contributor in the thin wafer processing and dicing equipment market forecast.

Region-wise, the thin wafer processing and dicing equipment market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific China, Japan, India, South Korea, and the rest of Asia-Pacific), anLAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically the rest of Asia-Pacific region, remains a significant participant in the global thin wafer processing and dicing equipment industry.

Technologies such as Radio Frequency Identification (RFID), Micro Electro Mechanical Systems (MEMS) devices, and power devices are considered to be the main source of demand for such thin wafers. Along with grinding operations, numerous new processes like chemical mechanical polishing (CMP) are increasingly being incorporated into the processing phase.

An increase in demand for 3D integrated circuits, which are widely used in various miniature semiconductor devices, is one of the key factors expected to boost the demand for thin wafer processing and dicing equipment in the coming years.

3D integrated circuits are increasingly used in a variety of space-constrained applications, including portable consumer electronics, sensors, MEMS systems, and industrial products because they improve overall product performance in terms of speed, durability, low power consumption, lightweight, and memory.

In addition, the use of a three-dimensional integrated circuit makes it possible to significantly cut costs while simultaneously reducing the amount of space consumed on a printed circuit board. A thin wafer with a thickness of 20 um to 50 um is an integral part of three-dimensional integrated circuit technology. As a result, the demand for thin wafer processing equipment is expected to rise during the forecast period in response to the anticipated rising demand for three-dimensional integrated circuits.

Country-wise, the U.S. acquired a prime share in the market in the North American region and is expected to grow at a significant CAGR during the forecast period of 2019-2031. The U.S., holds a dominant position in the thin wafer processing and dicing equipment market, owing to the rise in investment by prime vendors to boost the thin wafer processing and dicing equipment for consumer electronics and IT & telecom applications.

In Europe, the UK, dominated the thin wafer processing and dicing equipment industry, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's thin wafer processing and dicing equipment with a notable CAGR, due to advancement in the automotive industry which drives the usage of microelectronics in the country and thus creates lucrative growth opportunities for the thin wafer processing and dicing equipment market in Germany.

In Asia-Pacific, the rest of Asia-Pacific is expected to emerge as a significant market for the thin wafer processing and dicing equipment industry, owing to new product developments and a significant rise in investment by prime players and government institutions. For example, DISCO Corporation, one of the major key players in the Asia-Pacific region on 5 December 2022, developed two types of grinding wheels, the Poligrind PW21 Series for Si wafers including memory ICs and logic ICs, and the GFSC Series for SiC wafers.

In LAMEA region, the Latin America country garner significant market share in 2021 due to the adoption of new technologies, digital transformation and connectivity are reshaping the future of automotive and the consumer electronics industry in Latin America.

Moreover, the Middle East region is expected to grow at a significant CAGR from 2022 to 2031, owing to shifts in artificial intelligence, industry 4.0, and smart technological changes in recent years, which is expected to reshape the growth of the thin wafer processing and dicing equipment in the Middle East.

Top Impacting Factors

Factors such as the developments in semiconductor technology, growing demand for high-performance integrated circuits and developments in semiconductor technology and the increasing adoption of Radio Frequency Identification (RFID) tags, impact the growth of the thin wafer processing and dicing equipment market share owing to the need for miniaturization of the components.

In addition, High maintenance costs are restraining the growth of the thin wafer processing and cutting equipment market. The development of such devices requires great precision, so their production is limited. Furthermore, the wafers' high-quality flat surface is the primary reason for their increasing integration into processing. Investment in wafer enhancement is projected to provide profitable opportunities for market growth.

Competitive Analysis

The global thin wafer processing and dicing equipment market is highly competitive, owing to the strong presence of existing vendors. Vendors of the thin wafer processing and dicing equipment market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Suzhou Delphi Laser Co. Ltd., Synova, UTAC Holding, Ltd., Plasma-Therm, Disco Corporation, Neon Tech Co. Ltd., Panasonic System Solutions, EV Group (EVG), Lam Research Corporation, SPTS Technologies Ltd. are the key players of the thin wafer processing and dicing equipment market.

Top market players have adopted various strategies, such as acquisition, agreement, business development, business expansion, collaboration, product launch, innovation, and product expansion to expand their foothold in the thin wafer processing and dicing equipment market.

In December 2022, DISCO Corporation developed DFG8541, a fully automatic grinder that can process Si (silicon) and SiC (silicon carbide) wafers up to a maximum size of 8 inches.

In January 2021, UTAC Holdings Ltd. completed the acquisition of Singapore Wafer Bumping Assets from Powertech Technology (Singapore) Pte. Ltd. In order to facilitate the smooth transfer of the wafer bumping-related operations to UTAC, UTAC has entered into a number of ancillary agreements with Powertech Technology Inc. as part of the transaction. These agreements include a Transitional Services Agreement and License Agreement.

Key Benefits For Stakeholders

This study comprises an analytical depiction of the thin wafer processing and dicing equipment market size along with the current trends and future estimations to depict the imminent investment pockets.

The overall thin wafer processing and dicing equipment market overview is determined to understand the profitable trends to gain a stronger foothold.

The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

The thin wafer processing and dicing equipment market growth is quantitatively analyzed from 2022 to 2031 to benchmark financial competency.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart display.

The report includes the share of key vendors and market trends.

Thin Wafer Processing and Dicing Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.2 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 233 |

| By Equipment Type |

|

| By Application |

|

| By Wafer Size |

|

| By Region |

|

| Key Market Players | SPTS Technologies Ltd., Synova SA, Disco Corporation, Plasma-Therm, EV Group (EVG), Panasonic, Suzhou Delphi Laser Co., Ltd., Lam Research Corp., Neon Tech Co. Ltd., UTAC Holding, Ltd |

Analyst Review

The thin wafer processing and dicing equipment market is expected to grow at a significant rate owing to the rise in consumer electronics demand and the trend toward smaller electronic devices during the projected period. In addition, the market is witnessing chances for growth due to the increase in demand for three-dimensional integrated circuits as they are being employed majorly in semiconductor devices such as Micro Electro Mechanical Systems (MEMS). The market for thin wafer processing and dicing equipment is expanding as a result of the surge in demand for thinner wafers and more robust chips. Furthermore, the rise in applications of Logic and Memory, Power Devices, Radio Frequency Identification (RFID), and CMOS Image Sensors across industry verticals boost the demand for dicing technologies such as blade dicing, laser dicing, plasma dicing, and others. These aforementioned factors are projected to positively influence the Thin Wafer Processing & Dicing Equipment industry outlook during the forecast period.

Apart from thin wafer equipment manufacturing companies operating in the market, service providers are also key participants and contribute toward the growth of the overall thin wafer processing and dicing equipment market. Service providers use different technologies and materials to provide customized products. Key players profiled in the report include Suzhou Delphi Laser Co. Ltd., Synova, UTAC Holding, Ltd., Plasma-Therm, Disco Corporation, Neon Tech Co. Ltd., Panasonic System Solutions, EV Group (EVG), Lam Research Corporation, SPTS Technologies Ltd.

The Thin Wafer Processing and Dicing Equipment market is expected to grow at a CAGR of 6.67% from 2022-2031.

Memory and Logic is the leading application of the Thin Wafer Processing and Dicing Equipment Market.

Asia-Pacific is the largest regional market for Thin Wafer Processing and Dicing Equipment.

The industry size of Thin Wafer Processing and Dicing Equipment is estimated to be $643.78 million in 2021.

Disco Corporation, Lam Research Corp., Panasonic System Solutions, Suzhou Delphi Laser Co., Ltd., EV Group (EVG) are the top companies to hold the market share in the Thin Wafer Processing and Dicing Equipment Market.

Loading Table Of Content...

Loading Research Methodology...