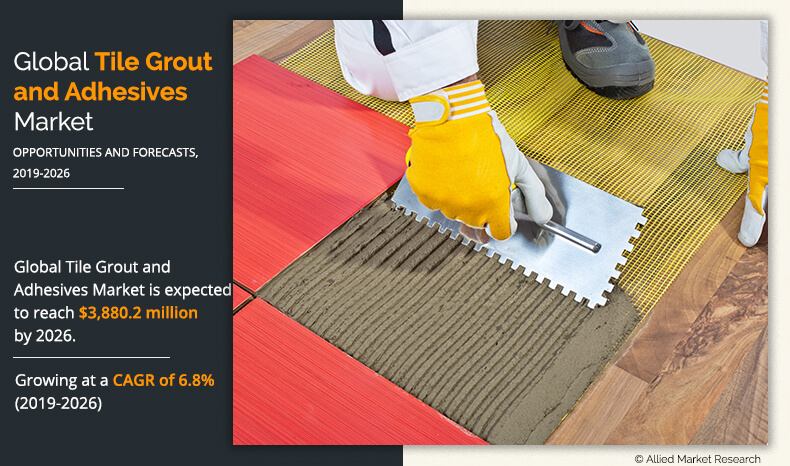

Tile Grout and Adhesives Market Outlook - 2026

The global tile grout and adhesives market size was valued at $2,244.0 million in 2018, and is projected to reach $3,880.2 million by 2026, growing at a CAGR of 6.8% from 2019 to 2026. Tile grout and adhesive are special kind of glue utilized to fix tiles. It is a ready-made mixture that includes polymers, Portland cement, epoxy, and aggregate particles. In addition, it is used for laying tiles in connecting sections of pre-cast concrete, masonry walls, and sealing joints in flooring. The sealing of tiles with adhesive and grout makes it water-resistant to avoid discoloration. Moreover, these grout and adhesives eliminate the threat of mold and mildew caused due to moisture by restricting water enter through the gaps between the tiles. .

Outdoor entertainment areas such as porches, patio, and backyards has gained significant popularity, owing to its functional utility for small gatherings and semi-natural ambiance. As a result, people are increasingly opting for outdoor entertainment areas in their residential and commercial building. Moreover, rise in demand for outdoor flooring among residential buildings such as bungalows, condos, townhouses, and row houses with attractive outdoor flooring solutions fuels the market growth.

However, utilization of mortar instead of grout and adhesive may hamper the tile grout and adhesives market growth. Mortar is one of the most commonly used material to attach tiles to flooring and drywall. The cost of mortar is low as compare to grout and adhesive; hence, in developing countries of Asia-Pacific and LAMEA, mortar remains the popular choice for installation of tiles. Furthermore, lack of awareness regarding grout and adhesive also increase the utilization of mortar. Laying tiles using mortar requires less amount of cement. Around 15 kg of cement can be used to lay tiles on the average area of 5 square meter, on other hand, 25 kg of tile adhesive is required for the installation of tiles. In addition, shortage of skilled tile fixers who can use grout and adhesive effectively restrains the growth of the tile grout and adhesives market.

Furthermore, increase in emphasis toward utilization of low VOC grout and adhesive is anticipated to create lucrative business opportunities for the market players in tile grout and adhesives market. The VOC compounds emit gases that are extremely harmful and can cause both adverse short-term and long-term health effects. Thus, the low VOC and non-toxic grout and adhesive for wall and flooring materials have been widely introduced to the construction industry to reduce indoor pollutant concentrations.

By Type

Grout segment is projected to grow at a significant CAGR

There is a rise in trend toward the adoption of thermally treated tiles, owing to their increasing popularity among residential and commercial end users. In addition, installation of ceramic flooring in outdoor spaces raised the value perception among the individuals due to its antique features. Thus, the growing adoption of such tiles is anticipated to drive the growth of the market during the forecast period.

By Application

Residential segment holds dominant position in 2018

The global tile grout and adhesives market is segmented on the basis of type, application, and region. Based on type, the market is segmented into adhesive and grout. By application, it is divided into residential, commercial, and industrial. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific holds a dominant position in 2018, and LAMEA is expected to grow at a highest rate during the forecast period.

Competition Analysis

The key market players profiled in the tile grout and adhesives market report include Ardex GmbH, Arkema Group, BASF, Dow, Henkel, Laticrete International Inc., Pidilite Industries Limited, Saint-Gobain Group, Schomburg GmbH & Co. KG, and Sika AG.

The major players operating in the global market have adopted key strategies such as acquisition, and product development to strengthen their market outreach and sustain the stiff competition in the market. For instance, in October 2018, Sika AG launched the SikaCeram adhesive range in the Indian market. These adhesives can be used for tile and stone applications. Similarly, in May 2019, Sika AG acquired the company Parex. Parex is a global manufacturer of tile adhesives, façade mortars, and waterproofing mortars. The acquisition has created opportunities for Sika AG to gain a strong foothold in Parex’s distribution channels and open new business opportunities.

In November 2017, Bostik, a brand of Arkema acquired XL Brands company assets. The company is based in the U.S. and is a leader in the manufacturing of adhesives for resilient and soft flooring. The acquisition has assisted Bostik to improve its product portfolio and gain a strong foothold in the U.S.

Key Benefits for Tile Grout and Adhesives Market :

- The report provides an extensive analysis of the current and emerging tile grout and adhesives market trends and dynamics.

- In-depth tile grout and adhesives market analysis is conducted by constructing estimations for the key segments between 2018 and 2026.

- Extensive analysis of the tile grout and adhesives market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global tile grout and adhesives market forecast analysis from 2018 to 2026 is included in the report.

- The key market players operating in the global tile grout and adhesives market are profiled in this report, and their strategies are analyzed thoroughly, which help understand the competitive outlook of the tile grout and adhesives industry.

Global Tile Grout and Adhesives Market Segments:

By Type

- Adhesives

- Grout

By Application

- Commercial

- Industrial

- Residential

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Russia

- Rest of Europe

- Asia-Pacific

- China

- India

- Vietnam

- Indonesia

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- Ardex GmbH

- Arkema Group

- BASF

- Dow

- Henkel

- Laticrete International Inc.

- Pidilite Industries Limited

- Saint-Gobain Group

- Schomburg GmbH & Co. KG

- Sika AG.

Tile Grout and Adhesives Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Henkel AG & Co. KGaA, The Dow Chemical Company, Saint-Gobain Group, SCHOMBURG GmbH & Co. KG, Ardex GmbH, BASF SE, Arkema Group, Pidilite Industries Limited, Sika AG, LATICRETE International, Inc. |

Analyst Review

The market has witnessed significant growth over the past decade, owing to rise in advantage of grout and adhesives such as better bonding strength. Moreover, increase in the investment in commercial and residential construction activities is expected to drive the growth of the global grout and adhesives market. In addition, new innovation such as development of low VOC grout and adhesive is further expected to accelerate the growth of the global market. Therefore, the leading players in the market are developing affordable and efficient grout and adhesives to cater to a large customer base.

However, rise in trend of adoption of mortar for tile fixing is anticipated to restrain the growth of the global market. Moreover, growth in adoption of non-toxic grout and adhesives is expected to provide lucrative growth opportunities for the tile grout and adhesives market. Market players are also acquiring other companies and enhancing their product portfolios to increase their market potential in terms of geographic and customer base expansion.

Among the analyzed geographical regions, Asia-Pacific is expected to account for the highest CAGR in the global market throughout the forecast period.

Loading Table Of Content...