Title Insurance Market Research, 2032

The global title insurance market was valued at $56.8 billion in 2022, and is projected to reach $161.6 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Title insurance is a form of insurance that provides protection against financial loss or legal issues related to the ownership and title of a property. It is commonly used in real estate transactions to safeguard the interests of property buyers, mortgage lenders, and investors.

Rising number of real estate transactions and increase in digital influence is boosting the growth of the global title insurance market. In addition, rising number of aggregators and digital brokers positively impacts the growth of the title insurance market. However, lack of awareness among customers and increase in security concerns are hampering the title insurance market growth. On the contrary, increase in adoption of digital solutions is expected to offer remunerative opportunities for expansion of the title insurance market during the forecast period.

Segment Review

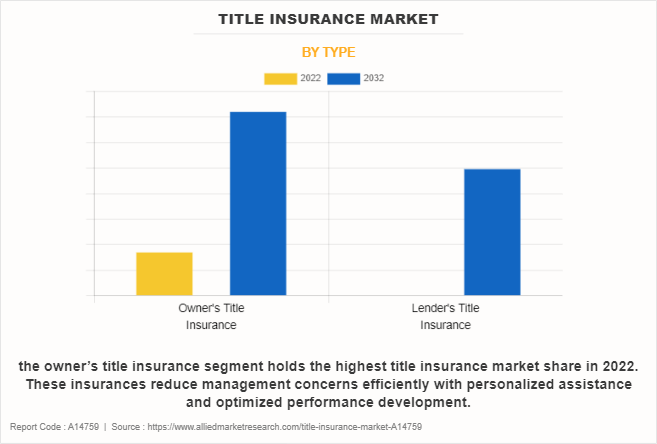

The title insurance market is segmented on the basis of type, distribution channel, end user, and region. On the basis of type, the market is categorized into owner's title insurance, and lender's title insurance. On the basis of distribution channel, the market is fragmented into direct channel, agents & brokers, and others. On the basis of end user, the market is bifurcated into enterprise, and personal. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of type, the owner’s title insurance segment holds the highest title insurance market share. These insurances reduce management concerns efficiently with personalized assistance and optimized performance development. However, the lender’s title insurance segment is expected to grow at the highest rate during the forecast period, owing to rising awareness about the benefits of title insurance policies to access a broader segment.

Region wise, the title insurance market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to rise in adoption of title insurance in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, as several insurers are adopting & heavily investing in digital insurance platform to boost business efficiency, lowering compliance risk exposure and improving claim settlement process in the region.

The key players that operate in the title insurance industry are Fidelity National Title, Allianz SE, Zurich Insurance Group, China life property and Casualty Insurance Company Limited, Chicago title insurance company, Commonwealth Land Title Insurance Company, Conestoga Title Insurance Co, Westcor Land Title Insurance Company, Inc., First American Financial Corporation, and Williston Financial Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the title insurance industry.

Competition Analysis

Recent Partnerships in the Title Insurance Market

June 05, 2023: Title Resources Group (TRG) partnered with HomeServices of America, a Berkshire Hathaway to expand its presence in the home title insurance and settlement services market. This strategic partnership provided several benefits and opportunities for both companies.

Recent Product Launches in the Title Insurance Market

In July 08, 2021, First American Title Insurance Company a leading provider of title insurance and settlement services and the largest subsidiary of First American Financial Corporation launched FirstAm IgniteRETM, an innovative, mobile-friendly technology platform designed to enhance the residential real estate transaction experience for real estate professionals and home buyers and sellers.

Recent Acquisition in the Title Insurance Market

On July 10, 2023, Essent Group Ltd, acquired Agents National Title Holding Company ("Agents National Title") and Boston National Holdings LLC ("Boston National Title") to expand its presence and capabilities in the title insurance and settlement services industry. The acquisition offered several strategic benefits. By acquiring both Agents National Title and Boston National Title, Essent Group expanded its footprint in the title insurance market, gaining access to a broader customer base.

Top Impacting Factors

Rise in Number of Real Estate Transactions

The rise in the number of real estate transactions including property sales, purchases, refinances, and investments, drives the demand for title insurance. As more properties change ownership or develop, the need for title insurance to protect against potential title defects and disputes grows. In addition, many lenders require title insurance as a condition for approving mortgage loans. As more people seek mortgage financing for their real estate purchases, the demand for lender's title insurance also grows. Lenders use title insurance to safeguard their interests and ensure that their collateral (the property) has a clear title. For instance, in October 2021, Realogy Holdings Corp collaborated with Centerbridge to accelerate growth of title insurance underwriter and enabled Realogy to invest in integration of core real estate transaction services across franchise, brokerage, title settlement and escrow, and mortgage. These development strategies are significantly contributing to the huge potential for the growth and development of the title insurance market.

Increase in Digital Influence

The digital explosion in the insurance sector is driven by the need to build direct bridges with the end consumer through the smartphone in order to survive in an era where the customer is using the phone as the primary medium of communication. The trend has been fast paced driven partly due to the large base of phone users and partly due to the lesser weight of legacy systems. Digitalization drives the growth of the market share and profitability for insurers. It also urges insurers to apply digital technologies in new ways and offer tangible value to customers. Moreover, it presents the possible opportunities for digitalization for insurers & customers as the adoption of digital solutions for insurance policies will keep increasing in the future. Moreover, these are the factors influencing the growth of the market in the upcoming years.

Restraints

Lack of Awareness Among Customers

Lack of awareness among customers regarding insurance offers and benefits is hindering the growth of the market. In addition, concerns regarding the security of data and payments are rising due to the increasing amount of data being generated and online transactions being executed in the insurance industry. For instance, in November 2021, according to The Insurance Bureau of Canada, due to a lack of insurance awareness, around 10% Canadian homes are currently uninsurable due to flooding. Furthermore, many service providers have limited knowledge and understanding of the rights of people with their health needs and have inadequate training and professional development about requirements, which is the major factor hampering the growth of the market.

Increase in Security Concerns

Security and privacy of online insurance coverage policies may provide companies with protection from losses resulting from a data breach or the loss of electronically stored confidential information. In addition, security and privacy of online insurance coverage policies can protect companies from losses that result from data breaches or confidential data loss. Purchasing security and privacy insurance coverage can help a business recover from the financial and regulatory burdens that security breaches can create. Moreover, cyber and privacy insurance is a type of insurance coverage that primarily applies to businesses that run secure computer networks as part of their business. Cyber and privacy insurance covers businesses against losses stemming from computer hacks, which can affect ongoing operations and entail legal and regulatory ramifications.

Opportunities

Increase in Adoption of Digital Solutions

The digital transformation solutions in the online insurance industry have led to efficiencies in its operations through Artificial Intelligence (AI), machine learning, and predictive analysis. Claims can now be processed through the ease of a mobile app instantly, which has helped insurers reduce the time spent on policy writing.

Companies operating in the title insurance market are adopting new technologies to sustain their position in the market. For instance, in January 2023, Peppercorn, a UK-based Insurtech start-up, launched a conversational AI assistant. This technology, along with the company's counter-fraud technologies and pre-inception underwriting decisions, eliminates the need for a real call center thereby offering an enhanced purchase experience to its customers and reducing operating costs and expense ratio.

In addition, use of the internet and mobile phones has witnessed tremendous growth in both India and across the world. The insurance industry is not far behind when it comes to harnessing digital technology to scale their business model and strive to offer a hassle-free experience. Digitization in the insurance industry is beginning to gather pace and is expected to be one of the mainstays of title insurance industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the title insurance market analysis from 2023 to 2032 to identify the prevailing title insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the title insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global title insurance market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the title insurance market outlook.

- The report includes the analysis of the regional as well as global title insurance market trends, key players, market segments, application areas, and market growth strategies.

Title insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 161.6 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Distribution Channel |

|

| By Type |

|

| By End User |

|

| By Region |

|

Analyst Review

Insurance such as car, life, health, and other, protects against potential future events and is paid for with monthly or annual premiums. A title insurance policy insures against events that occurred in the past of the real estate property and the people who owned it, for a one-time premium paid at the close of the escrow.

Key providers in the title insurance market are Westcor Land Title Insurance, Chicago Title Insurance, Investors Title, and Stewart Title Guaranty. With the growth in demand for title insurance solutions, various companies have established acquisition strategies to increase their solutions. For instance, in July 2023, Essent acquired Title Insurance Operations as it has historically shown low and stable loss ratios. This buyout allows Essent to capitalize on its capital position, extensive lender network, and operational expertise to drive growth in the adjacent real estate sector. Further, such strategies drive market growth.

In addition, with the surge in demand for title insurance, several companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in July 2023, CFC, the specialist insurance provider expanded its suite of transaction liability products with the launch of a new solution to cover title to shares risks (TTS insurance).

For instance, in February 2023, Dye & Durham partnered with Chicago, to increase access to title insurance offerings for real estate transactions via Canada's most trusted conveyancing platforms

The title insurance market is evolving, with several emerging trends that are likely to shape the industry's future, such as digital transformation, Cybersecurity and Data Protection, and Customer Experience Enhancement.

Residential Property Purchases, and mortgage lending are the leading application of Title insurance Market.

North America is the largest regional market for Title insurance.

$161,555.15 million is the estimated industry size of Title insurance.

The key players that operate in the title insurance market are Fidelity National Title, Allianz SE, Zurich Insurance Group, China life property and Casualty Insurance Company Limited, Chicago title insurance company, Commonwealth Land Title Insurance Company, Conestoga Title Insurance Co, Westcor Land Title Insurance Company, Inc., First American Financial Corporation, and Williston Financial Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...