Toluene Diisocyanate Market Research, 2033

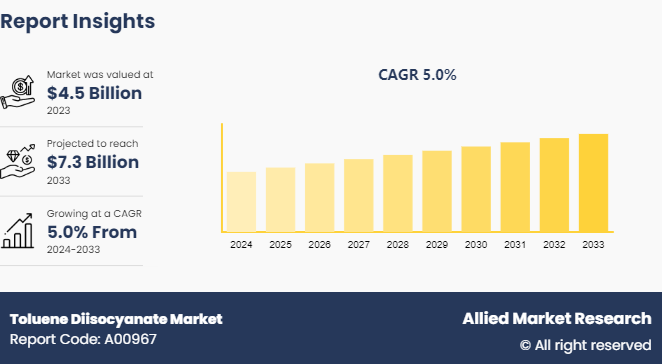

The global toluene diisocyanate market was valued at $4.5 billion in 2023, and is projected to reach $7.3 billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

Market Introduction and Definition

Toluene diisocyanate (TDI) is an organic compound used primarily in the production of polyurethanes, including flexible foams, coatings, adhesives, and elastomers. It exists mainly in two isomeric forms, 2, 4-TDI and 2, 6-TDI, which are typically used as a mixture in industrial applications. TDI is a volatile, colorless to pale yellow liquid with a pungent odor. It is highly reactive, particularly with compounds containing active hydrogen atoms such as water, alcohols, and amines, making it crucial in polymer chemistry.

The widespread applications of toluene diisocyanate in the production of polyurethane foams, coatings, and adhesives is driving the market’s growth. The demand is primarily driven by the construction, automotive, and furniture industries. Factors like urbanization, infrastructure development, and rising disposable incomes continue to propel growth. Strict handling procedures and protective equipment are mandatory when working with TDI to minimize exposure. Despite its hazards, TDI remains a critical component in numerous industrial processes due to its efficiency and effectiveness in creating durable, high-performance materials.

Key Takeaways

- The toluene diisocyanate market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major toluene diisocyanate industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The market for toluene diisocyanate is experiencing growth due to rise in demand for polyurethane foam. Toluene diisocyanate are the source of polyurethane foams, which find extensive use in the furniture, automotive, and construction sectors. Polyurethane foams have become increasingly popular due to the increased demand for energy-efficient buildings, lightweight automobile components, and comfortable furniture. This has led to an increase in the market for toluene diisocyanate. According to Polyurethane Foam Association, more than 1.5 billion pounds of flexible polyurethane foam are produced annually in North America. Because of their superior thermal insulation qualities, polyurethane foams are widely employed as insulation in the construction sector. The need for energy-saving materials such as polyurethane foams is anticipated to expand along with environmental concerns and energy efficiency laws, which will propel the toluene diisocyanate market. In addition, the need for lightweight materials has increased dramatically in the automotive sector in an effort to increase fuel efficiency.

The toxicity of toluene diisocyanate (TDI) presents a significant challenge to the growth of the TDI market. TDI is known to be highly toxic if inhaled, ingested, or absorbed through the skin, posing health risks to workers involved in its production, handling, and use. Strict safety measures are required to mitigate these risks, including personal protective equipment and ventilation systems, increasing operational costs for manufacturers. Moreover, concerns about worker safety and environmental impacts may lead to greater regulatory scrutiny and stricter compliance requirements, further adding to the operational burden. Additionally, public awareness of the health hazards associated with TDI could drive demand for alternative materials or technologies, diverting market growth away from TDI-based products. Overall, the toxicity of TDI creates barriers to market expansion, necessitating innovation and investment in safer alternatives to sustain growth in the chemical industry.

Expanding into the automotive sector presents a lucrative opportunity for the growth of the toluene diisocyanate (TDI) market. TDI is a crucial component in the production of polyurethane materials used in car interiors, including seating, dashboards, and insulation. As the automotive industry evolves with the rise of electric vehicles and increasing demand for lightweight materials to enhance fuel-efficiency, TDI-based polyurethanes offer significant advantages. These materials provide excellent durability, comfort, and noise reduction properties, meeting the stringent requirements of modern vehicle design. Furthermore, many automakers are concentrating on releasing new models with cutting-edge features, improved fuel-efficient models, and security measures due to the high demand for two-wheelers in India.

For instance, in January 2024, Ducati announced that it would be launching eight new motorcycle models in India. In 2024, the well-known Italian luxury motorbike manufacturer plans to open two new shops in India. The Multistrada V4 RS, DesertX Rally, Panigale V4 Racing Replica 2023, Diavel for Bentley, Monster 30° Anniversario, and Panigale V4 SP2 30° Anniversario 916 are some of the future Ducati products on display at the Ducati World Premiere 2024. In addition, the growing focus on sustainability in automotive manufacturing creates opportunities for TDI manufacturers to develop eco-friendly formulations that align with industry standards. By capitalizing on the expanding automotive sector, TDI producers can tap into a thriving market with sustained demand for high-performance materials, driving the growth of the TDI market.

Patent Analysis of Global Toluene diisocyanate Market

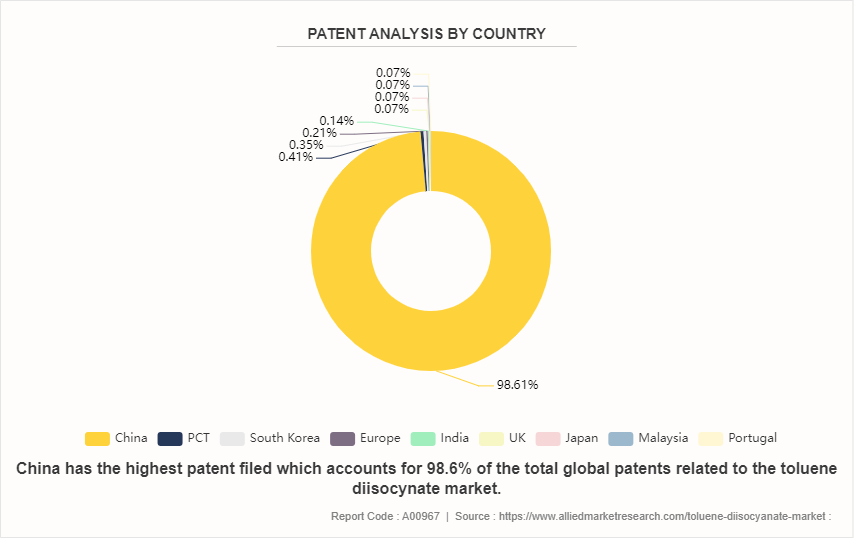

Patent activity in the Toluene Diisocyanate sector is mostly focused on China, which accounts for 98.62% of the patents issued. This highlights China's significant investment in R&D within the TDI sector, establishing it as a world leader. The Patent Cooperation Treaty (PCT) follows distantly with 0.41%, indicating a tiny level of worldwide patent applications, implying some stage of global activity and collaborative invention initiatives. The Republic of Korea follows with 0.35% of patents, demonstrating its participation and commitment to improvements in the TDI market. The European Patent Office (EPO) owes 0.21%, which reflects Europe's standing in patent filings and technological contributions. India, the United Kingdom, Japan, Malaysia, and Portugal all contribute lower amounts: 0.14%, 0.07%, 0.07%, and 0.07%, respectively. These results show a more restricted yet widespread international involvement in TDI-related patent activity. Overall, while China leads the patent landscape in the TDI market, there is significant, albeit modest, foreign activity and participation in the continued development and innovation within this area.

Market Segmentation

The toluene diisocyanate market is segmented into form, application, and region. By form, the market is classified into 2, 4 toluene diisocyanate and 2, 6 toluene diisocyanate. By application, the market is divided into foams, coatings, elastomers, adhesive & sealants and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the toluene diisocyanate market include BASF SE, Covestro AG, Dow Inc., Wanhua, Tosoh Corporation, Evonik Industries AG, Tokyo Chemical Industry Co., Cangzhou Dahua Group Co., Ltd., SABIC, and Merck KGaA. Other players in the toluene diisocyanate market include LANXESS, KH Chemicals, Hanwha Solutions Chemical Division., Mitsui Chemicals, Inc., TSE Industries, Inc.

Recent Key Strategies and Developments

- In April 2023, Wanhua Chemical reported that it has got approval from the State Administration of Market Supervision and Administration to acquire shares of Yantai Juli Fine Chemical Co., Ltd. It is a major supplier of toluene diisocyanate in China. Through this transaction, Wanhua Chemical's TDI capacity in China will expand from 35-40% to 45-50%.

- In March 2023, Covestro AG announced that its Baytown, Texas, production site, which produces a variety of products including toluene diisocyanate, has received ISCC (International Sustainability and Carbon Certification) PLUS certification. It will help to broaden its product portfolio's reach for the circular economy.

- In March 2023, Mitsui Chemicals, Inc. has announced plans to increase the output capacity of its Omuta Works toluene diisocyanate (TDI) plant by July 2025. TDI is a raw ingredient used in the polyurethane synthesis process.

- In May 2022, Huntsman International LLC collaborated with BRUGG pipes to develop a next-generation polyurethane foam system with excellent insulation properties. This system can be used to create highly flexible, thermally efficient, pre-insulated pipes for connecting ground source heat pumps and local heating units to residential and commercial buildings.

- In March 2022, Covestro expanded its renewable toluene diisocyanate (TDI) product line and now serves customers in many locations. This TDI can be used as a raw ingredient to create flexible polyurethane foam.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The construction industry has witnessed a surge in demand for TDI-based goods like foams and coatings due to the growing industrialization and urbanization of countries such as China and India. Furthermore, the automotive industry in the region is expanding rapidly, and TDI is a key component in the production of car interior and seating components. The Asia-Pacific region's growing furniture and bedding sectors also play a part in the growing demand for TDI-based flexible foams. Additionally, the demand for TDI is fueled by its adaptability in a variety of applications, including adhesives, sealants, and elastomers, across a wide range of sectors in the region.

- According to the World Paint & Coating market Association, the Asia-Pacific paints and coatings market was worth $63 billion by 2022. China dominates the region's market, which is expanding at a CAGR of 5.8%. In 2022, the Chinese market increased by 5.7%. Based on current trends, China's total paint and coatings sales will exceed $45 billion in 2022. In East Asia, the country has the biggest market share (78%) .

- In accordance with the Chinese Association of Automotive Manufacturers, China's automotive output increased by approximately 3.4% in 2022 over the previous year. In 2022, roughly 27 million automobiles were manufactured, compared to 26.08 million units in 2021.

- According to the Japan Electronics and Information Technology Industries Association (JEITA) , the Japanese electronics industry's total production value is expected to exceed ~$88.18 billion (JPY 9.8 trillion) in November 2023, representing approximately 97.2% of the previous year.

- According to Invest India, the construction Industry in India is expected to reach $1.4 Tn by 2025.

Industry Trends:

- The growing construction sector fuels demand for toluene diisocyanate (TDI) , a key component in polyurethane foam used for insulation, furniture, and coatings. TDI's versatility in enhancing material properties makes it vital for meeting the rising demands of infrastructure development, thereby amplifying its market growth. According to Invest India, the Indian construction industry, in value terms, recorded a CAGR of 15.7% and reached $738.5 billion by 2022.

- China’s 14th five-year plan emphasizes new infrastructure projects in transportation, energy, water systems, and new urbanization. According to the International Trade Administration, overall investment in new infrastructure during the 14th five-year plan period (2021-2025) is expected to reach $4.2 trillion.

- Toluene diisocyanate, or TDI, is becoming more widely used in industries other than just polyurethane foams. The market is growing as a result of the electronics industry's growing demand for TDI to make printed circuit boards and encapsulants. Moreover, TDI is increasingly being utilized in the automobile industry to create elastomeric foams and sealants.

- Technological advancements in TDI production and processing are boosting output, reducing costs, and improving the quality of the finished product. The development of high-yield manufacturing techniques and catalysts is optimizing TDI production, while advancements in separation and purification technologies are boosting product purity. Moreover, automation and control system integration improve safety, reduce downtime, and streamline TDI manufacturing. These advancements are expected to strengthen the supply chain and increase the competitiveness of TDI producers.

Government Regulations of Global Toluene diisocyanate Market

- According to the Environmental Protection Agency (EPA) , under the Toxic Substance Control Act (TSCA) , the EPA has proposed a significant new use rule (SNUR) for 2, 4-toluene diisocyanate, 2, 6-toluene diisocyanate, toluene diisocyanate unspecified isomers, and related compounds identified in this proposed rule. The proposed substantial new application includes any use in a consumer product, except the use of chemical compounds in coatings, elastomers, adhesives, binders, and sealants, which results in less than or equal to 0.1% by weight of TDI. Persons subject to the SNUR would be mandated to notify the EPA at least 90 days before starting any production or processing.

- The European Chemicals Agency (ECHA) governs toluene diisocyanate under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) framework. Toluene diisocyanate is designated as a substance of very high concern (SVHC) because of its potential health risks, such as respiratory and skin irritation. To reduce occupational and environmental risks, companies must follow specific criteria for its use, handling, and disposal.?

- The Occupational Safety and Health Administration (OSHA) has established a legal airborne acceptable exposure limit (PEL) of 0.02 ppm for TDI, which cannot be exceeded at any time. The American Conference of Governmental Industrial Hygienists (ACGIH) established a threshold limit value (TLV) of 0.001 ppm averaged over an 8-hour work shift and 0.003 ppm as a short-term exposure limit.

Key Sources Referred

- OSHA

- ECHA

- New Jersy Department of Health

- World Paint & Coating Industry Association

- Japan Electronics and Information Technology Industries Association (JEITA)

- Chinese Association of Automotive Manufacturers

- Invest India

- Polyurethane Foam Association

- International Cement Review

- International Trade Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the toluene diisocyanate market analysisto identify the prevailing toluene diisocyanate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the toluene diisocyanate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as toluene diisocyanate market trends, key players, market segments, application areas, and market growth strategies.

Toluene Diisocyanate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 7.3 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Tosoh Corporation., Tokyo Chemical Industry Co, Dow Inc., Merck KGaA, Wanhua, Evonik Industries AG, BASF SE, Covestro AG., Cangzhou Dahua Group Co., Ltd., SABIC |

| Other Key Market Players | Tosoh Corporation, SIMEL Chemical Industry Co., Ltd., TSE Industries, Inc., Sigma-Aldrich, Chematur Engineering AB, KH Chemicals, Chemex Chemicals, Redox, Vencorex, Shell Chemicals |

Loading Table Of Content...