Sexually transmitted diseases (STDs) are infections that are transmitted from one person to another through sexual contact. STDs affect individuals of all ages, however, according to CDC, age group of 15–24 accounts for half of all new STDs infections. Currently, STDs are the most common diseases in U.S., and as per CDC, about 19 million men and women are diagnosed with STDs each year. The disease is caused due to transmission of microbes (bacteria, virus, yeast, and parasites) during sexual intercourse. The disease is diagnosed using laboratory and point-of-care tests such as differential light scattering, ELISA, micro fluidics, and immunochromatographic test (ICTs).

However, stigma related to voluntary testing and critical regulatory compliance forms are the restraints for the market. However, global initiatives along with development in healthcare infrastructure are projected to provide platform for the market growth.

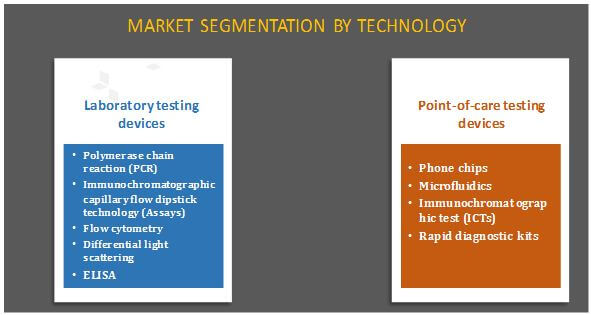

STDs testing market is segmented into laboratory and point-of-care testing devices. Based on laboratory testing devices, the market is divided into PCR, immunochromatographic capillary flow dipstick technology (assays), flow cytometry, differential light scattering, and enzyme-linked immunosorbent assay (ELISA). On the basis of point-of-care testing devices, the market is further segmented into rapid diagnostic kits, phone chips, microfluidics, and immunochromatographic tests. Currently, laboratories perform bulk of the tests, and are anticipated to continue to hold larger share of the market, both in terms of volume and revenue.

Flow cytometry is expected to grow fastest, owing to its cost-effectiveness and accuracy of these tests for the diagnosis of STDs in laboratories. However, trained personnel and expensive equipment are required for using this technology, which can be a prime cause of concern.

- The report provides an in-depth analysis of the market along with current trends and future estimations to elucidate the imminent investment pockets.

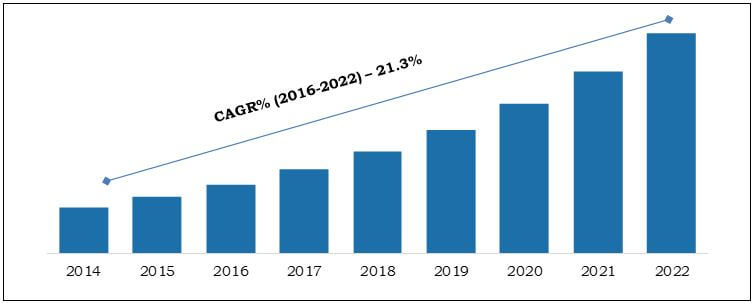

- The report provides a quantitative analysis for the period of 2014–2022 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on technology helps to understand the type of devices used to treat STDs.

- Extensive analysis of the market is conducted by following key technology positioning and by monitoring the top contenders within the market framework.

- Polymerase chain reaction (PCR)

- Immunochromatographic capillary flow dipstick technology (assay)

- Flow cytometry

- Differential light scattering

- Enzyme-linked immunosorbent assay (ELISA)

- Phone chips

- Microfluidics

- Immunochromatographic tests (ICTs)

- Rapid diagnostic kits

STD Reimbursement Scenario Analysis And Top Std Testing Technologies Report Highlights

| Aspects | Details |

| By TECHNOLOGY |

|

| By Region |

|

Analyst Review

The sexually transmitted diseases (STDs) testing market is growing at a remarkable pace globally, owing to rise in incidences of fatal STDs, increased implementation of service provider-initiated counseling and testing (PICT) & client-initiated counseling and testing (CICT), and development of novel technologies such as microfluidics and rapid diagnostics kits to test HIV at home. With the rise in prevalence of STDs, the diagnosis of the disease is also increasing. For instance, as per CDC, about 20 million new STD cases are diagnosed each year. The diagnosis of STDs is facilitated through laboratory and point-of-care testing devices.

Polymerase chain reaction (PCR) segment dominated the overall market with a share of more than half of the overall market in 2015, and is projected to continue to lead the market during the forecast period. This is attributed to effective detection offered by this technology and high adoption in developed economies. Moreover, flow cytometry is expected to grow fastest after microfluidics, owing to its cost-effectiveness and accuracy for the diagnosis of STDs in laboratories. However, trained personnel and expensive equipment are required to use these devices, which can be a prime cause of concern.

Favorable reimbursement policies for STD tests plays a vital role in the growth of the U.S. market. The tests that are used in the diagnosis of STDs (such as chlamydia, syphilis, gonorrhea, herpes simplex, human papilloma virus, and HIV) are reimbursed in the U.S. by the Centers for Medicare & Medicaid Services (CMS) through different CPT codes (as per ICD-10 that was implemented in October 2015). However, the tests for the diagnosis of chancroid are not covered by the CMS due to the unavailability of FDA-approved diagnostic tests for this disease in the U.S., as very few people are diagnosed in the country each year. Moreover, it is studied that most of the individuals in the U.S. who are diagnosed with this infection have traveled outside the country to areas where chancroid is more common.

Loading Table Of Content...