Traction Battery Market Overview

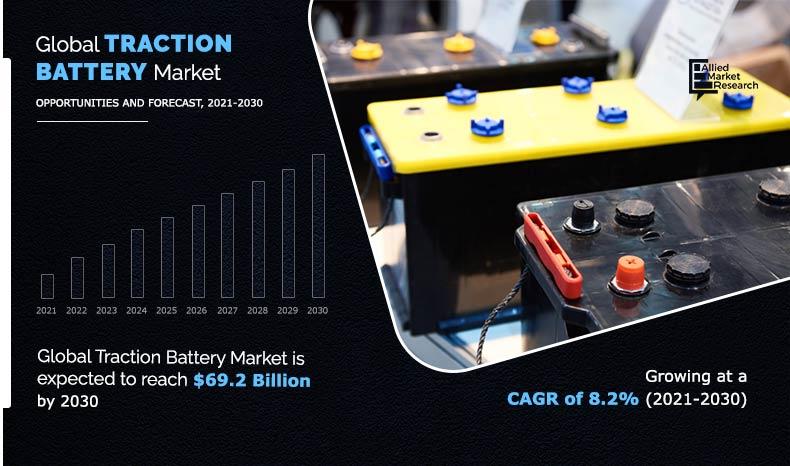

The global traction battery market size was valued at USD 31.6 billion in 2020, and is projected to reach USD 69.2 billion by 2030, growing at a CAGR of 8.2% from 2021 to 2030.

The increasing awareness of environment-friendly vehicles and rising volatility in fuel prices have surged the demand for electric vehicles. For instance, according to a report published by International Energy Agency (IEA) Global EV Outlook 2020, the global sales of electric cars in 2019 topped 2.1 million, registering a growth of 40% year-on-year. Moreover, factors, such as electrification of the transport sector and rising investments, will stimulate the growth of electric vehicles. Traction batteries being used for powering electric motors of electric or hybrid vehicles have registered an impressive growth, owing to increasing demand for electric vehicles. This may act as one of the key drivers answerable for the traction battery market growth. Moreover, characteristics, such as recyclability, low-cost, and eco-friendly, are providing an additional push to the growth of the market in the electric vehicle segment, thereby augmenting the market growth.

However, the transportation sector contributes around 28% of the U.S. total carbon emissions. The government is constantly engaged in increasing awareness for electric vehicles to reduce emission levels. However, the development of charging infrastructure for electric vehicles is a significant setback in many countries, owing to lack of space, investments, electrification, and others. This factor is expected to restrain the growth of the traction battery market during the forecast period.

On the contrary, the increasing demand for electric vehicles has surged the R&D activities for enhancing battery efficiencies by improving the charge cycle and reducing the unit consumption per charge. Moreover, the emergence of batteries with high energy density has increased the competition among the traction battery manufacturers for producing highly efficient traction batteries for electric and hybrid vehicles. All these factors are expected to offer future growth opportunities to the global traction battery market.

Traction battery is a type of electric vehicle battery that is designed to hold high ampere-hour capacity. Lead acid traction battery is mainly used in applications such as forklift trucks, locomotives, and mechanical handling equipment.

The traction battery market analysis is done on the basis of product type, capacity, application, and region. On the basis of product type, the market is categorized into lead acid based, nickel based, lithium-ion based, and others. Based on capacity, the global traction battery market is segmented into less than 100 Ah, 100 – 200 Ah, 200 – 300 Ah, 300 – 400 Ah, and 400 Ah & above. The applications covered in the study include electrical vehicle, industrial, locomotives, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

The global market analysis covers in-depth information of the major traction battery industry participants.

Traction Battery Market, by Region

The Asia-Pacific traction battery market is projected to grow at a CAGR of 8.9% during the forecast period and accounted for 54.5% of traction battery market share in 2020. The growing demand for consumer products has surged the growth of the industrial manufacturing sectors in countries, such as China, India, and others, where traction battery is used for powering industrial machinery systems. This may propel the growth of the traction battery market in Asia-Pacific. In addition, the growing environmental concerns and increasing government initiatives have pushed the growth of electric vehicles where traction batteries are widely used to power electric motors. For instance, according to an article published by the Business Standard, India's electric vehicles sale is predicted to increase by 26% from 2020 to 2023. This is anticipated to increase the sales of traction battery among the electric vehicle segment, thereby creating lucrative opportunities for the market.

By Region

Asia Pacific is the most lucrative region

Traction Battery Market, by Product Type

In 2020, the lead acid based segment was the largest revenue generator and is anticipated to grow at a CAGR of 7.2% during the forecast period. The increasing population has surged the growth of the automotive & transportation sector where lead acid-based traction batteries are widely used to power road vehicles, locomotives, industrial forklift trucks, and others. For instance, according to a report published by the Indian Ministry of Commerce and Industry, the transport sector in India is expected to grow at a CAGR of 5.9%, thereby becoming one of the fastest-growing sectors. This may positively drive the growth of the traction battery market for lead-acid type.

By Type

Lithium-ion based is the fastest growing segment

Traction Battery Market, by Capacity

In 2020, the less than 100 Ah segment was the largest revenue generator and is anticipated to grow at a CAGR of 8.5% during the forecast period. The proliferating demand for hybrid electric power devices in small-scale industries where traction battery with less than 100 Ah capacity is widely used for powering small industrial machinery systems may boost the market growth. Moreover, factors, such as increased lifespan and maximum charge cycles, make them highly suitable for use as a secondary rechargeable battery in non-plug-in hybrid cars such as Honda Civic hybrid, and others. This may propel the growth of the traction battery market for less than 100 Ah capacity.

By Capacity

Less than 100 Ah is the most lucrative segment

Traction Battery Market, by Application

By application, the electrical vehicle segment acquired the top position of the global market in 2020 and is anticipated to grow at a CAGR of 8.5% during the forecast period. The rising concern associated with environmental pollution has surged the growth of electric vehicles where traction batteries are widely employed for powering electric motor of battery electric vehicles and hybrid electric vehicles. For instance, according to a report published by International Energy Agency's Global EV Outlook 2021, the global electric car stock hit the 10 million mark with 43% increase in 2019.

By End-use Sector

Electric vehicle is the fastest growing segment

Key Benefits for Stakeholders

Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

It outlines the current traction battery market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

The profiles of key players and their key strategic developments are enlisted in the report.

Traction Battery Market Report Highlights

| Aspects | Details |

| By Type |

|

| By CAPACITY |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | ECOVOLTA, Exide Industries Ltd., HOPPECKE Carl Zoellner & Sohn GmbH, BAE Batteries GmbH, INTILION GmbH, GS Yuasa International Ltd., Banner Batteries (GB) Ltd., Leoch International Technology Limited Inc, Inci Aku, Toshiba Corporation |

Analyst Review

The global traction battery market is expected to exhibit high growth potential, owing to its use in battery electrical vehicles, hybrid electric vehicles, mechanical handling equipment, locomotives, and forklifts. The rising concern associated with environmental pollution has boosted the growth of electric vehicles where traction batteries are widely employed for powering electric motor of battery electric vehicles and hybrid electric vehicles. For instance, according to a report published by International Energy Agency's Global EV Outlook 2021, the global electric car stock hit the 10 million mark with 43% increase in 2019. This may act as one of the key drivers responsible for the growth of the traction battery market for electric vehicles. Furthermore, increasing fuel prices, owing to several geopolitical issues led the customers to become more linear toward purchasing electric vehicles, which, in turn, may provide an additional push to the growth of the traction battery market for electric vehicles. In addition, attractive government incentive provided on the purchase of electric vehicles is predicted to offer lucrative growth opportunities in the future.

The proliferating demand for hybrid electric power devices in small scale industries where traction battery with less than 100 Ah capacity is widely used for powering small industrial machinery systems may boost the market growth. Moreover, factors, such as increased lifespan and maximum charge cycles, make them highly suitable for use as a secondary rechargeable battery in non-plug-in hybrid cars. This may propel the growth of the traction battery market. In addition, traction battery with less than 100 Ah capacity offers easy swapping and removing, low price, less space requirement, and lightweight, making the key automotive manufacturers use small capacity traction batteries for reducing the overall weight of the vehicle, thereby improving the mileage. This is anticipated to increase the sales of less than 100 Ah traction batteries, thereby creating remunerative opportunities for the market.

Product launch and acquisition are the key growth strategies of Traction Battery Market players.

Asia-Pacific region will provide more business opportunities for Traction Battery in future.

To get latest version of traction battery market report can be obtained on demand from the website.

By product type, the lead acid based segment holds the maximum share of the Traction Battery Market.

Electric vehicle are the potential customers of Traction Battery industry.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Escalating demand for electric vehicles and attractive government policies & tax incentives are the driving factors. While, enhanced battery capacity and reducing cost are opportunities in the Traction Battery Market.

Exide Industries Ltd., ECOVOLTA, GS Yuasa International Ltd., HOPPECKE Carl Zoellner & Sohn GmbH, Banner Batteries (GB) Ltd., BAE Batteries GmbH, Toshiba Corporation, INTILION GmbH, Leoch International Technology Limited Inc., and Inci GS Yuasa are the leading global players in the Traction Battery Market.

the increasing demand for electric vehicles has surged the R&D activities for enhancing battery efficiencies by improving the charge cycle and reducing the unit consumption per charge. Moreover, the emergence of batteries with high energy density has increased the competition among the traction battery manufacturers for producing highly efficient traction batteries for electric and hybrid vehicles. It is the current trends will influence the Traction Battery Market in the next few years.

Battery Electrical Vehicles, plug-in hybrid electrical vehicles, and hybrid electrical vehicle applications are expected to drive the adoption of Traction Battery.

Loading Table Of Content...