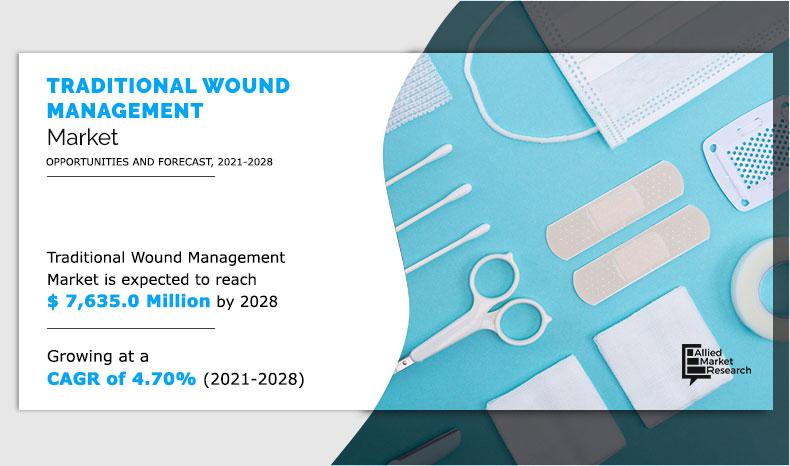

The global traditional wound management market was valued at $5,247.9 million in 2020 and is projected to reach $7,635.0 million by 2028 registering a CAGR of 4.70% from 2021 to 2028.

Traditional wound dressings are used as primary or secondary dressings to protect the wound from infection. Traditional wound management aids in wound healing by protecting wound fluids, preventing/managing infection, controlling mechanical influences, and influencing collagen maturation. It's especially useful for treating burns, trauma, and surgical wounds. Pressure ulcers, diabetic foot ulcers, venous leg ulcers, and arterial ulcers are among the chronic wounds that can be treated with it.

The increase in prevalence of acute wounds such as burns and trauma, as well as chronic wounds such as pressure ulcers, diabetic foot ulcers, venous leg ulcers, and arterial ulcers drives the growth of the traditional wound management market. In addition, the use of traditional wound care products in a variety of surgical wounds and increase in aging population are some other factors that boost the market growth.

However, growing production and acceptance of advanced wound care products restrains the market growth. Furthermore, improvements in regulatory frameworks in developed countries are expected to provide market players with lucrative growth opportunities.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. Moreover, there has also been a negative effect and decrease in demand for various medical services, including traditional wound products. According to an article published in the US National Library of Medicine National Institutes of Health, the ability to practice wound healing under normal conditions is limited during the COVID-19 pandemic. Patients with vascular leg ulcers are a particularly vulnerable group, with poor quality of life caused by pain that is proportional to the length of the ulcer and the size of the ulcer. If ischemic and venous wounds are not treated or handled properly, the consequences may be serious, including infections, sepsis, amputations, and even death. In addition, Hoffmann explained that wound care among the elderly has suffered during the pandemic when routine medical visits, including visits to wound clinics, were drastically reduced as this care was considered “nonessential.” Moreover, according to an article published in Wound Research, some hospitals closed their wound centers, either as they have misclassified the service as nonessential or they have limited visitors and outpatient from entering the hospital premises. According to the data of Tissue Analytics, a wound-specific electronic health record software company, there is 40% decrease in wound center visits from 2019 to 2020. In addition, according to Hartmann, the pandemic affects the wound care market as their fewer operations and visit to the doctors during covid.

Traditional Wound Management Market Segmentation

The global traditional wound management market is segmented on the basis of product, application, end user, and region. On the basis of product, the market is categorized into gauze, bandage, cotton, and others. By application, it is classified into acute wound and chronic wound. By end user, it is segmented into hospital & clinics, home healthcare, ambulatory surgical center, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

Based on product, the traditional wound management market is categorized into gauze, bandage, cotton, and others. The gauze segment currently dominates the global market, and is expected to continue the same during the forecast period. The increase in cases of acute wound and chronic wound are the key factors that boost the market growth.

By Product

Retinoids segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Based on application, the traditional wound management market is categorized into acute wound and chronic wound. The acute wound segment is expected to generate the most revenue during the forecast period, owing to increase in prevalence of trauma and burn cases across the globe.

Based on end user, the traditional wound management market is categorized into hospital & clinics, home healthcare, ambulatory surgical centers, and others. The others segment is further segmented into dispensaries, nursing homes, diagnostic centers, work places, and academic institute. The hospital segment accounted for the majority of market revenue in 2020, and is expected to maintain its dominance throughout the forecast period due to growing prevalence of diabetic foot ulcers and venous leg ulcers as well as rise in surgical wound cases due to rise in surgeries perform in hospital.

By Application

Topical Medication Segment is projected as one of the most lucrative segment.

Snapshot of Asia-Pacific traditional wound management market

Asia-Pacific is expected to exhibit the fastest market growth during the forecast period, owing to increase in prevalence of acute wound such as burns, trauma as well as increase in cases of chronic wounds. In addition, increased prevalence of chronic diseases, particularly diabetes due to obesity and unhealthy lifestyle, is expected to drive the market growth during the forecast period. According to the American Diabetes Association, Type 2 diabetes (T2D) in China increased rapidly in 2018 and has become one of the country's leading public health concerns. As a result, such an occurrence is expected to drive the demand for traditional wound management product and boost the market growth. Moreover, improving and expanding healthcare infrastructure and economic development in Asia-Pacific are expected to exhibit the fastest market growth during the forecast period.

The key market players profiled in the report include B. Braun Melsungen AG, BSN Medical, Cardinal Health, Derma Sciences Inc., Johnson & Johnson Pvt. Ltd., Medtronic PLC, Medline Industries, Inc., Mölnlycke Health Care AB, PAUL HARTMANN AG, Smith & Nephew.

By Region

Asia Pacific region would exhibit the highest CAGR of 5.5% during 2021-2028.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global traditional wound management market along with the current trends and future estimations to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2028 is provided to enable the stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and products of traditional wound management used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the market.

Key Market Segments

By Product

- Gauze

- Bandages

- Cotton

- Others

By Application

- Acute Wound

- Chronic Wound

By End User

- Hospitals & Clinics

- Home Healthcare

- Ambulatory Surgical Centers

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Traditional Wound Management Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Medline Industries Inc., JOHNSON & JOHNSON, MEDTRONIC PLC. (COVIDIEN), CARDINAL HEALTH, PAUL HARTMANN AG, MÖLNLYCKE HEALTH CARE AB, B. BRAUN MELSUNGEN AG, INTEGRA LIFESCIENCES HOLDINGS CORPORATION (DERMA SCIENCES), ESSITY AB (BSN MEDICAL GMBH), SMITH & NEPHEW PLC |

Analyst Review

Traditional wound management products are the basic products intended for the management of non-severe and acute wounds. These products are generally used to absorb exudate, seize bleeding, close the open trauma & surgical wounds, and dry the wound to help it heal faster.

Increase in cases of patients suffering from diabetes as well as rise in prevalence of chronic wounds such as pressure ulcer, diabetic foot ulcers, venous leg ulcers, and arterial ulcers further boost the market growth.

Furthermore, increase in number of patients undergoing surgeries and rise in geriatric population are expected to drive the growth of the traditional wound management market. Moreover, improving regulatory scenarios in developing countries is expected to provide lucrative opportunities for traditional wound product adoption. Additionally, surge in development and adoption of advanced wound care products may hamper the market growth of traditional wound management during the forecast period.

The gauze segment is expected to remain dominant during the forecast period, owing to increase in demand for traditional wound management product due to increase in acute and chronic wounds. In addition, acute wound segment is expected to account for the largest revenue during forecast period, owing to growing cases of trauma globally. Moreover, North America is expected to offer lucrative opportunities to the key players during the forecast period, due to growing geriatric population and rise in prevalence of acute and chronic wound in the region, and presence of developed infrastructure in the healthcare industry.

The total market value of Traditional wound management market is $5,247.9 million in 2020.

The forcast period for traditional wound management market is 2021 to 2028

The market value of Traditional wound management market in 2021 is $5,523.40 million.

The base year is 2020 in Traditional wound management market

Top companies such as B.Braun Melsungen AG, BSN Medical, Cardinal Health, Derma Sciences Inc., Johnson & Johnson Pvt. Ltd., Medtronic PLC, Medline Industries, Inc., Mölnlycke Health Care AB, PAUL HARTMANN AG, Smith & Nephew held a high market position in 2020.

Gauze segment is the most influencing segment owing to increasing prevalence of acute wound and chronic wound.

Increase in prevalence of acute wound and chronic wound, increasing incidence of accidents and surge in ambulatory surgical centers.

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to growing geriatric population and the rising prevalence of diabetes in this region.

Traditional wound management products that are dry and used as primary or secondary dressings to protect the wound from infection

Traditional wound management market products are used to treat It is used in the chronic wound treatment such as pressure ulcers, diabetic foot ulcers, venous leg ulcers, arterial ulcers. Its application also includes its use for major surgeries to treat surgical wounds as well as various acute wounds such as burns and trauma.

Loading Table Of Content...