Train Seat Market Research, 2033

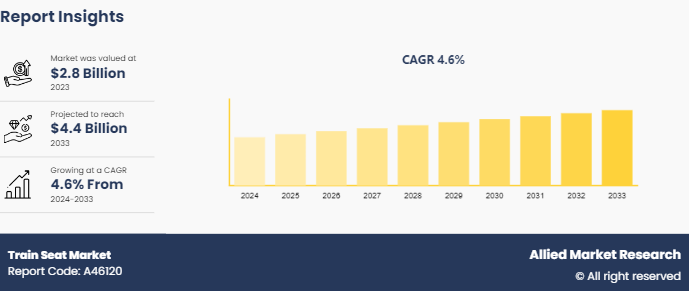

The global train seat market size was valued at $2.8 billion in 2023, and is projected to reach $4.4 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Market Introduction and Overview

Train seats are integral components of train that offer passenger comfort during railway travel. Train seats encompass a range of configurations from standard seating to luxurious options like private rooms and lounge-style arrangements. Each seat is meticulously designed to provide ergonomic support, featuring adjustable backrest angles to enhance individual comfort during the journey. Modern amenities such as USB sockets (1500mA) and electric outlets are standard, facilitating connectivity throughout the journey. Whether for short commutes or long-distance travel, train seats are crafted to combine functionality with aesthetic appeal, ensuring passengers enjoy a comfortable ride in a dynamic and evolving transportation landscape.

Key Takeaways

- The train seat market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major train seat market participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The train seat market is expected to witness rapid growth due to several key factors, reflecting both passenger expectations and regulatory imperatives. For instance, the emphasis on passenger comfort has become paramount in the design and procurement of train seating. As rail networks expand and modernize, there is a growing recognition that comfortable seating significantly enhances the overall passenger experience. This is particularly crucial for long-distance and high-speed services where journey durations can be substantial. The adoption of ergonomic standards and the introduction of seat comfort testing methodologies, such as those developed through projects like RSSB's T1140 are gaining huge popularity. In addition, regulatory frameworks and franchise agreements mandate specific standards for seating, ensuring compliance with safety, durability, and ergonomic requirements. For instance, stringent fire safety regulations and crashworthiness standards necessitate robust seat designs that prioritize both passenger safety and comfort. Such mandates not only drive technological innovation in seat materials and design but also ensure that seating solutions are fit for purpose across a range of operational contexts. These factors are anticipated to boost the train seat market share in the upcoming years.

However, the diverse passenger preferences pose challenges in seat design and procurement. Economic considerations also play a crucial role, as train operators seek cost-effective solutions without compromising on quality or safety. In addition, varying regulatory frameworks across regions require adaptable seating solutions, adding further complexity to standardization and procurement processes, which is estimated to hamper the train seat market growth in the upcoming years.

The train seat industry presents several opportunities driven by advancements in material technology and evolving passenger expectations. Opportunities lies in the development of eco-friendly materials such as recycled polyester and low-emission foams, which appeal to environmentally conscious operators and passengers. Innovations in cushioning materials, like gel-infused memory foams for optimal pressure relief, cater to long-distance travel needs, which are anticipated to have a positive impact on the train seat market forecast.

Analysis of the Train Seat Market

KIEL SITZE is a premier manufacturer specializing in seating systems for commercial vehicles and public transport across local, regional, and tourist sectors via bus and train. Renowned for advanced technology, modern design, and top-notch quality, the company offers comprehensive seating solutions tailored to individual customer needs.

Here is a tabular format summarizing the various train seats manufactured by KIEL SITZE:

Seat Model | Application | Description |

EDGELINE METRO | Local transport | Modular design, high modularity, suitable for trams and metros, attractive design, low weight |

CITOS | Urban transport | Lightweight, two-part shell for safety, crash-resistant, ergonomic design, suitable for trams and underground trains |

VIENNA | Trams, urban trains | Self-supporting wooden shell, lightweight per EN45545, durable, low maintenance |

LIFELINE | Local transit rail | Fireproof metal structure, lightweight, durable, crash-resistant, suitable for trams and underground trains |

EDGELINE REGIO | Regional trains | Modular seating system, available in WIDE and SLIM variants, suitable for 1st and 2nd class regional trains, ergonomic design |

MATCH G2 COM | Regional, long-distance | Modular design, high comfort, sophisticated ergonomics, suitable for regional and long-distance trains |

MATCH G2 ECO | Regional, long-distance | Modular design, high comfort, eco-friendly materials, suitable for regional and long-distance trains |

VARIO RELAX 3000 | Commuter, regional trains | Crash-safe aluminum structure, fireproof, durable, suitable for daily use in commuter and regional trains |

LIHOK | Long-distance trains | Natural wood material, luxurious design, high-end quality, ergonomic comfort |

COMFORTLINE | Long-distance trains | Sophisticated design, ergonomic shaping, luxurious comfort, suitable for long-distance travel |

METRO | Trams, underground trains | Lightweight, adaptable, durable, cushioned folding mechanism, meets fire and vandalism protection requirements, suitable for trams and underground trains |

Market Segmentation

The train seat market size is segmented into train type, seat type, railcar type, and region. On the basis of train type, the market is divided into high-speed train, passenger train, light train, tram, and monorail. On the basis of seat type, the market is classified into regular seat, recliner seat, folding seat, dining seat, and smart seat. On the basis of railcar type, the market is classified into overland, subway, long distance, and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional & Country Market Outlook

The train seat market is witnessing significant growth across different regions, driven by ambitious rail infrastructure developments across various countries. In China, the world's largest high-speed rail network has expanded exponentially in 2022, with plans to further increase to 50, 000 km by 2025. This expansion not only enhances mobility but also reduces oil dependency and promotes modal shift towards low-emission transport.

In Europe, initiatives focus on modernizing existing rail networks and adopting stringent emission standards, prompting a shift from diesel-powered to electrified and hybrid trains. For instance, collaborations like the FrecciaRossa 1000 between Hitachi and Trenitalia, in 2021, have introduced advanced high-speed trains across Italy, France, and Spain, emphasizing Europe's commitment toward enhancing rail competitiveness and sustainability.

As of 2024, India's rapid electrification of railway tracks has nearly doubled its rate of rail electrification over the last five years and is aiming for Net Zero 2030, which will significantly reduce carbon emissions and enhance operational efficiency. This shift from diesel to electric trains not only supports environmental goals but also improves reliability and cost-effectiveness of public transport.

In East Africa, the Ethiopia-Djibouti railway, powered by hydro-generated electricity, exemplifies the region's leap towards modern electrified rail infrastructure. This project not only facilitates economic growth but also reduces road congestion and enhances freight transportation efficiency.

Overall, these developments highlights a rising demand for technologically advanced and environmentally sustainable train seats across regions, aligning with global efforts towards achieving net-zero emissions and enhancing rail transport infrastructure.

Competitive Landscape

The key players operating in the train seat market are Magna International Inc., Transcal Ltd., Saira Seats, Freedman Seating Company, Automotive Seating, Sears Manufacturing Co., C.E White Co., Fenix Group LLC, Camira Fabrics Ltd., USSC Group, and others.

Recent Key Strategies and Developments

- In July 2024, Thailand's State Railway (SRT) is set to enhance third-class train services with a $21.5 million (780 million baht) investment in air conditioning and new seats. The initial phase aims to upgrade 130 carriages by next year, with plans to renovate a total of 400 carriages by 2025.

In December 2023, San Francisco's Muni transit system has rolled out a new seat redesign for its light-rail fleet, reintroducing double-seating options for added comfort. The updated, costing $20 million, includes more transverse seating arrangements to allow passengers to face forward or backward. This follows a previous redesign in December 2021, with newer LRV4 vehicles now featuring structural enhancements to support double-seats. SFMTA aims to improve passenger experience while ensuring longevity through extended warranties on the new fleet.

Train Seat Industry Trends

- In May 2024, Pinnacle Industries expanded its manufacturing capabilities with a new facility in Pithampur, Madhya Pradesh, focusing on railway seating and interiors, ambulance conversions, and boosting exports. With an investment of $1, 000 million (INR 100 crore) , the facility, slated to open by Q4FY25, will include an R&D center. This move aims to meet rising demand, including supplying lightweight ventilated seats for the government's upcoming Vande Bharat trains. The initiative is set to create 500 jobs, with a significant focus on female employment.

In April 2024, California High-Speed Rail Authority unveiled preliminary interior design concepts for its upcoming trains, showcasing various seating options such as premium, cocoon, compartment, and comfort arrangements. These designs aim to enhance passenger comfort and accommodate diverse preferences. In addition, renderings for onboard amenities and accessibility features, including seating and restrooms, have been released. With Alstom or Siemens set to manufacture the high-speed electric trains, funded in part by a substantial federal grant, full electrified system testing is scheduled for completion by 2028, with service commencement by the decade's end.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the train seat market analysis from 2023 to 2033 to identify the prevailing train seat market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the train seat market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global train seat market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- UNIFE

- International Railway Summit

- Union Internationale des Transports Publics (UITP)

- UIC - International union of railways

- Freedman Seating Company

Train Seat Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.4 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Train Type |

|

| By Seat Type |

|

| By Railcar Type |

|

| By Region |

|

| Key Market Players | Fenix Group LLC, C.E White Co., sears manufacturing co., Automotive Seating, Saira Seats, Magna International Inc., Freedman Seating Company, USSC Group, Transcal Ltd., Camira Fabrics Ltd. |

Growing emphasis on designing seats that provide better comfort and support for passengers, including ergonomic designs are the upcoming trends in the global train seat market.

The smart seat sub-segment is anticipated to show the fastest growth in the train seat market.

Europe is the largest regional market for train seat.

The train seat market is estimated to reach $4.4 billion by 2033.

The top companies to hold the market share in the train seat market are Magna International Inc., Transcal Ltd., Saira Seats, Freedman Seating Company, Automotive Seating, Sears Manufacturing Co., C.E White Co., Fenix Group LLC, Camira Fabrics Ltd., and USSC Group.

Loading Table Of Content...