Transformers Market Research, 2031

The global transformers market was valued at $58.6 billion in 2021, and is projected to reach $103.0 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.Transformer is a device that is used to convert electrical energy from one alternating current to another circuit by using the principle of electromagnetic induction. Transformers are voltage control devices as they are used in the transmission and distribution of alternating current electricity.

The transformers market analysis report includes the information related to the growth prospects and restraints based on the regional analysis. The study includes patent analysis, Porter’s five forces analysis of the transformers industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth. The study also analyzes different market drivers, restraints, opportunities, and challenges in the anticipated time frame. In addition, rise in demand for power from manufacturing industries and residential sector are anticipated to fuel the growth of the global transformers market trends in the future.

The basic physical principle of transformers is still the same today as it was 130 years ago, however energy density, efficiency, costs, weight and dimensions have drastically improved. During the first decades of electrification, the main focus in transformer research and development was to increase power capacity. Furthermore, more effects concerning voltage transients became known which could endanger the transformer’s insulation. These include resonance effects in the coils which can be triggered by fast excitations such as the overvoltage impulse of a lightning strike. Transformers are the main current-limiting elements in case of short-circuit failures in the transmission system.

Transformers can either decrease AC voltage (Step-down transformer) or increase AC voltage (Step-up transformer). Transformers are essential pieces of electrical equipment which help to transmit and distribute electricity efficiently and reliably. Transformers help maintain power quality and control and facilitate electrical networks which contribute toward the transformer market growth. They consist of a wide range of applications such as boosting electric generator voltage to permit long-distance electricity transmission which is boosting the distribution transformers market size in near future.

"The new transformer technologies enable utility and industry customers to improve energy efficiency and lowering environmental impact. In addition, rise in demand for continuous flow of electricity in large industries to carried out a continuous manufacturing process is anticipated to fuel the growth of the global transformers market share in the future."

Increase in demand for smart transformers used in smart grids, surge in investment for large-scale renewable power plants projects, along with increase in the demand for electricity generated by renewable energy sources, has fueled the development are expected to be the key factors which drive the growth of the market during the forecast period. According to International Energy Association, the market for renewable energy is predicted to have grown with a growth rate of 10% in 2022. Also, it has been observed that there is decrease in carbon emission from power industry which is showing a promising growth towards renewable energy market. In addition, rapidly growing power generation industries are anticipated to create global transformers market opportunity during the forecast period.

As per transformers market forecast, increase in the investment by the government and favorable government policies for renewable energy projects is anticipated to boost the growth of the transformer market. In 2020, the utility-scale sector accounted for 36% of total U.S. end use energy consumption. Hence, rapid utility-industrialization across the region is projected to increase the demand for electricity. To fulfil the increase in demand for electricity, manufacturers are coming up with the development of green energy sources such as solar energy, and wind energy.

Rise in environmental concerns due to strict laws to reduce GHG emissions have forced companies to adopt effective energy conservation measures. In addition, implementation of stringent government regulations to control carbon footprints have encouraged industries to opt for integration with effective energy conservation method. This is expected to boost the growth of the transformers market during the forecast period.

However, risk associated with high DC voltages is expected to restrain the growth of the market in the coming years. On the contrary, growing electric vehicles charging stations globally are projected to create opportunities for key players operating in the market. The major industrialized and developed nations have set a variety of goals to achieve zero emissions by 2050, which is projected to boost the growth of the renewable energy and electric car sectors.

The need for transformer has increased due to a boom in the global energy sector. A surge in the investigation of new renewable energy sources has grown over the past five years, aside from the pandemic period. The report further outlines the details about the revenue generated through the sale of transformers across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the transformers market include ABB Ltd., Siemens AG, General Electric, Eaton., TOSHIBA CORPORATION, Schneider Electric, Mitsubishi Electric Corporation, CG Power & Industrial Solutions Ltd., VTC/GT, and SGB SMIT. These players have been adopting various strategies to gain higher share and to retain leading positions in the market. These players adopt numerous strategies, including acquisition, and agreement to stay competitive in the transformers market.

The transformers market is segmented into type, power rating, cooling type, insulation, number of phases, application, and region.

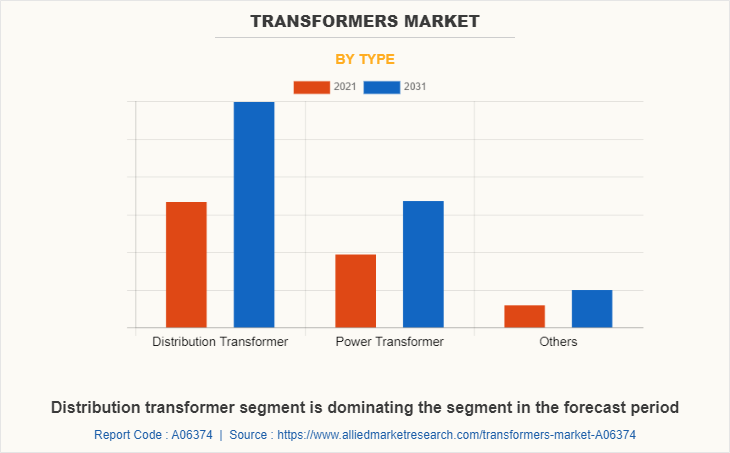

Based on type, the market is classified into distribution transformer, power transformer, and others. In 2021, the distribution transformer segment dominated the market as the demand for power increases in both rural and urban areas. Distribution transformers are highly beneficial to distribute power from large transformers to small transformers with the least amount of power loss.

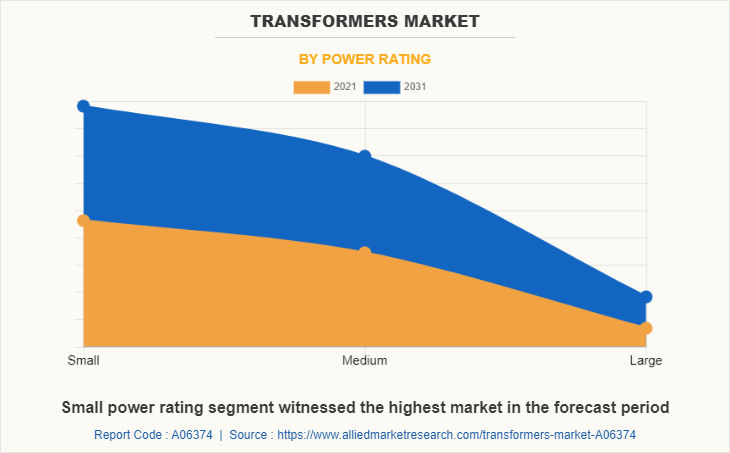

Based on power rating, the market is classified into small, medium and large. In 2021, the small segment dominated the market as increase in number of renewable energy installations in the residential sector. Small transformers are highly efficient in the distribution of power.

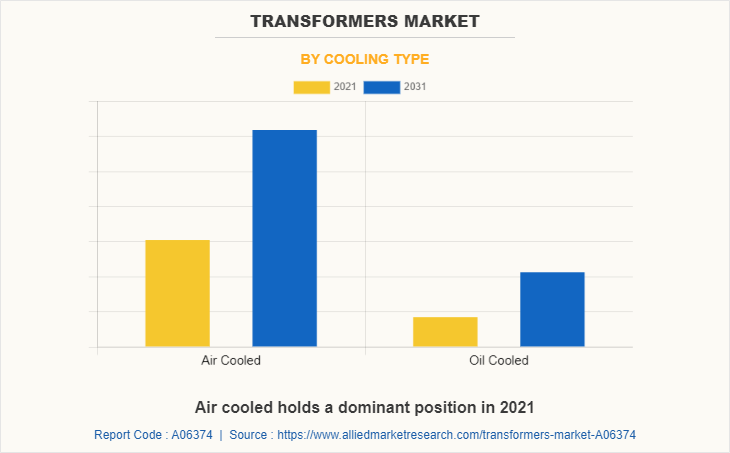

Based on cooling type, the market is classified into oil cooled, and air cooled. In 2021, the air-cooled segment dominated the regional market as air-cooled transformers act better in power services and enhances energy security. Air-cooled transformers cool down quickly and easily, which is crucial for a long transformer life.

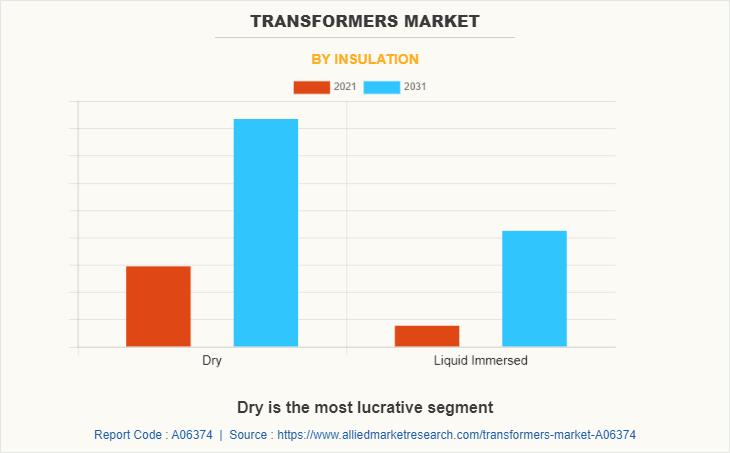

Based on insulation, the market is classified into dry and liquid immersed insulation. In 2021, dry segment dominated the market as dry transforms are the safest and eco-friendly transformers. The installation of dry transforms is easy and can be installed indoor and outdoor location which expected to fuel the growth of dry segment in global transformer market during the forecast period.

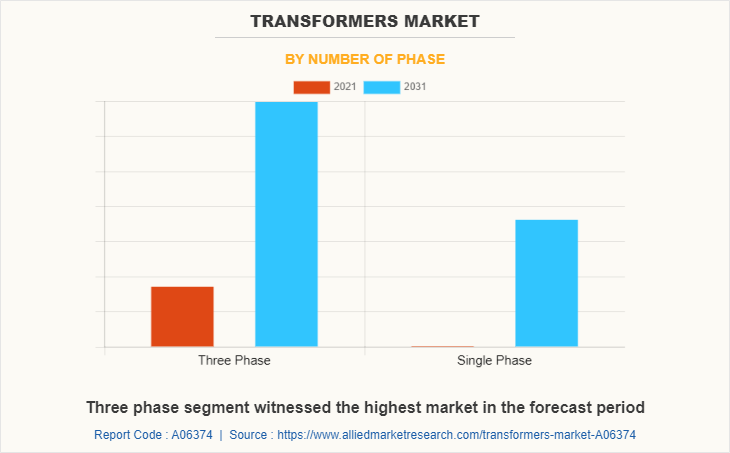

Based on number of phase, the market is classified into single phase and three phase. In 2021, the three phase segment dominated the market as the usage of three phase transformers is more in the utility and power generation plant. Three phase transformers are more used in the transmission of high power from one grid to another which expected to fuel the growth of three phase segment in the global transformer market during the forecast period.

Based on application, the market is classified into commercial, and residential sector, utility, and industrial sector. The utility segment dominated the market in 2021 due to increase in usage of various power rating transformers for a variety of purposes in the utility sector. Utility sector acts as a middleman for power producer and consumer in different sectors which is expected to fuel the growth of the utility segment in the global transformer market during the forecast period.

Based on region, the market is classified into North America, Europe, Asia-Pacific and LAMEA. In 2021, Asia-Pacific dominated the market as demand for energy increased in the developing countries. Increase in industrialization and urbanization in the countries boost the demand for transformers in the region. In addition, LAMEA is projected to grow at the highest CAGR due to the adoption of renewable energy and the establishment of new facilities in the countries which contribute toward the growth of the LAMEA transformer market. .

The conflict between Russia and Ukraine has a significant impact on the energy sector. The cost of production of transformer and batteries will be thus facing rising production costs and significant supply chain challenges. Russia's invasion of Ukraine has created shock waves in global energy markets, leading to price volatility, supply shortages, security issues. The war can significantly slow the renewable energy transition of the Europe. The Russia-Ukraine war has had a major impact on the global solar industry. To minimize the possibility of an interruption in Russian, transformer company must collaborate with governments.

In longer term, the power sector needs to increase its adaptability and relevance in a rapidly evolving energy environment. The scenario brought about by the conflict between Russia and Ukraine influences the transformer market as well. Many projects that were previously underway in the nations are now on hold, and new projects are being delayed, which has slowed the market expansion in recent years. Several companies are engaged in investing, doing business expansion, new product launches and agreement which boosting the transformer market. For example,

- In April 2022, Siemens Energy company decided to launch an innovative dry-type single-phase transformer named CAREPOLE for pole applications. The product is designed for the technological requirements according to American grid. The new cast-resin distribution transformer product is reliable and sustainable alternative to oil-filled transformers. This development helps the company to increase its market share in America region

- In November 2018, ABB company has decided to launch the world’s first dry-type (oil free) digital transformer, named the ABB AbilityTM TXpertTM Dry, and another innovative product called TXpandTM at ABB Customer World (ACW) event in Xiamen, China. This development helped the company to increase its transformer product portfolio

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the transformers market analysis from 2021 to 2031 to identify the prevailing transformers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the transformers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global transformers market trends, key players, market segments, application areas, and market growth strategies.

Transformers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 103 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 756 |

| By Type |

|

| By Power Rating |

|

| By Cooling Type |

|

| By Insulation |

|

| By Number of Phase |

|

| By Application |

|

| By Region |

|

| Key Market Players | Siemens AG, TOSHIBA CORPORATION, Eaton Corporation, CG Power and Industrial Solutions Ltd, SGB-SMIT, schnieder electric, General Electric, ABB Ltd., Mitsubishi Electric Corporation, VTC/GT. |

Analyst Review

According to the insights of CXOs of leading companies, Urbanization, and growth of the commercial and residential sectors are the key factors attributed to the leading position of Asia-Pacific in the transformers market.. The demand for transformer is anticipated to increase throughout the projected period due to the surge in demand for renewable energy sources and the increase in investment in developing power generation infrastructure.

The transformers market has a lot of potential for global expansion. However, the market for transformers is anticipated to experience growth due to an increase in the sales of electric vehicles. The market for transformers also witnessed a significant uptick due to growing usage of power transformers in data centers to prevent data loss in numerous industries. High DC voltage that comes with a high level of danger which is one of the major risks related to transformers. This restricts market expansion.

The global transformers market is analyzed across North America, Europe, Asia-Pacific and LAMEA. Among the analyzed regions, Asia-Pacific is likely to account for the fastest-growing market throughout the forecast period, followed by North America. The presence of a huge population and rapid industrialization in these countries has increased the demand for electricity from renewable resources. The presence of demand for renewable energy in this region and government initiatives and investment to develop the smart grids plants in this region have led to the presence of significant importance of the transformers market.

Increase in demand for smart transformers in smart grids and rise in demand for electricity from commercial and utility-sector are the upcoming trends of Transformers Market

Utility is the leading application of transformer market

ABB Ltd., Siemens AG, General Electric, Eaton., TOSHIBA CORPORATION, Schneider Electric, Mitsubishi Electric Corporation, CG Power & Industrial Solutions Ltd., VTC/GT, and SGB SMIT are the top companies to hold the market share in Transformers

By 2031, the estimated industry size of transformers is around $103 Billion.

Asia-Pacific is the largest region in the transformers market

Loading Table Of Content...