Transmission Line Market Research, 2032

The global transmission line market was valued at $41.5 billion in 2022, and is projected to reach $80.9 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032. The global transmission lines market is poised for significant growth driven by the increasing demand for renewable energy and surge in interconnection projects.

Introduction

Transmission line is a conductive pathway used to transmit electrical signals or power from one point to another efficiently over long distances. They possess properties such as impedance, capacitance, inductance, and propagation velocity, crucial for maintaining signal integrity and minimizing losses. These are made of copper, aluminum, or fiber optic materials.

Furthermore, they are essential in telecommunications for data transmission, powering electrical grids, and distributing renewable energy. Transmission line enable long-distance communication, facilitate the distribution of electricity from power plants to consumers, and support the integration of renewable energy sources into the grid, playing a vital role in modern infrastructure and technology.

Key Takeaways:

- The transmission line industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The transmission line market is highly fragmented with several players, such as ABB, ARTECHE, General Electric, Hitachi Energy Ltd., MYR Group Inc., NEXANS, Prysmian Group, Salasar Techno Engineering Ltd., Sumitomo Electric Industries, Ltd., and Valard.

Market Dynamics

The surge in demand for renewable energy is a significant driver for transmission line market growth due to the need for connecting remote renewable energy generation sites to population centers and load centers. According to the International Renewable Energy Agency (IRENA), the capacity for renewable energy rose by 9.6% globally in 2022. 90% of the net additions came from solar and wind power, with nearly half coming from Asia, in 2022. Furthermore, approximately 90% of all new renewable energy installations are expected to be made up of wind and solar PV by 2022, with annual additions projected to increase up from 350 GW in the main case to 400 GW in the accelerated case.

The capacity for renewable energy has increased rapidly, especially from sources such as wind, solar, and hydroelectric power, as nations move away from fossil fuels and toward greener, more sustainable energy sources to combat climate change. However, many renewable energy resources are in remote or offshore areas with abundant natural resources but limited existing infrastructure for transmitting electricity to areas of high demand. This requires the development of new transmission lines and the upgrading of existing grid infrastructure to facilitate the integration of renewable energy into the electricity grid.

Transmission lines play a key role in enabling the efficient and reliable transmission of electricity generated from renewable sources over long distances to urban centers and industrial hubs where energy demand is highest. Transmission lines facilitate the supply of clean electricity to meet rise in energy needs while lowering greenhouse gas emissions and reliance on fossil fuels by connecting renewable energy installations to the grid. Thus, increase in demand for renewable energy is expected to boost the transmission line market share during the forecast period.

Increased interconnection projects drive significant growth in the transmission line market forecast by fostering regional energy integration, enhancing energy security, and facilitating the exchange of electricity between neighboring countries or regions. There is an increasing tendency towards creating cross-border interconnections to share resources, balance supply and demand, and maximize energy production and consumption as the global demand for electricity rises and governments seek to diversify their energy sources. Interconnection projects involve the construction of transmission lines that connect disparate electricity grids across borders, enabling the seamless flow of electricity between different regions. According to the transmission line market statistics, one such project is the Tambacounda Power Interconnection Project that spans a 225-kV high-voltage transmission line from Kayes in Mali to Tambacounda in Senegal. This project is financed by the World Bank, that aims to reinforce electricity trade between Senegal, Mali, and Mauritania. The commissioning of this 285.3 kilometers grid has sparked economic growth and improved power reliability in the region.

Furthermore, under the Prime Minister’s ‘Gati Shakti Master Plan’, India aims to expand its power transmission network. By 2024-25, approximately 27,000 circuit kilometers of transmission line are planned to be added at an investment of $1,027.5 billion. These projects focus on enhancing the Inter-State Transmission System (ISTS) network at 220kV and above voltage levels.

The interconnection projects create opportunities for transmission line development as they require the construction of new high-voltage transmission infrastructure to facilitate cross-border electricity trade and grid synchronization. Interconnection projects help to reduce the fluctuation of renewable energy sources, improve grid stability, and increase energy reliability by connecting geographically dispersed energy resources, such as conventional power plants or renewable energy projects. Moreover, interconnections allow for the sharing of surplus electricity during times of oversupply and the importation of electricity during periods of high demand or energy shortages, thereby promoting energy market efficiency and reducing the need for costly peaking power plants. Thus, rise in interconnection projects drives transmission line market size during the forecast period.

The high upfront investment required for transmission line projects restrains the growth of the transmission line market. Building transmission infrastructure involves substantial capital expenditure for land acquisition, engineering, equipment procurement, construction, and regulatory compliance. The extensive planning and development processes, including environmental assessments, permitting, and right-of-way acquisition, further add to the upfront costs and project timelines. In addition, transmission projects often span long distances and require specialized materials and equipment, such as high-voltage transmission towers and conductors, which are expensive to manufacture and install.

The financial commitment and long payback periods associated with transmission line investments pose challenges for developers, utilities, and investors, particularly in regions with uncertain regulatory frameworks, volatile energy markets, or constrained access to financing. The transmission line market overview demonstrates that high upfront investment requirements deter potential investors and developers from pursuing transmission infrastructure projects, leading to project delays, cancellations, or limited expansion of the transmission grid. Thus, high upfront cost hinders the growth of the transmission line industry.

Technological advancements offer significant growth opportunities for the transmission line market report by introducing innovations that enhance efficiency, reliability, and performance. Innovations in materials science have led to the development of advanced conductive materials with higher conductivity and lower resistance, reducing energy losses during transmission. In addition, transmission line market trends shows that advancements in transmission line design and construction techniques, such as modular construction methods and innovative tower designs, have enabled more cost-effective and faster deployment of transmission infrastructure.

Moreover, advancements in monitoring and control technologies, such as advanced sensors, real-time data analytics, and grid optimization software, have improved grid management capabilities, that allows operators to monitor transmission line' health, detect faults, and optimize grid performance. Furthermore, innovations in high-voltage direct current (HVDC) transmission technology and flexible alternating current transmission systems (FACTS) have enabled the long-distance transmission of electricity with lower losses and improved grid stability, opening new opportunities for interconnection projects and renewable energy integration. Thus, technological advancements present lucrative growth opportunity for the transmission line market.

Segments Overview

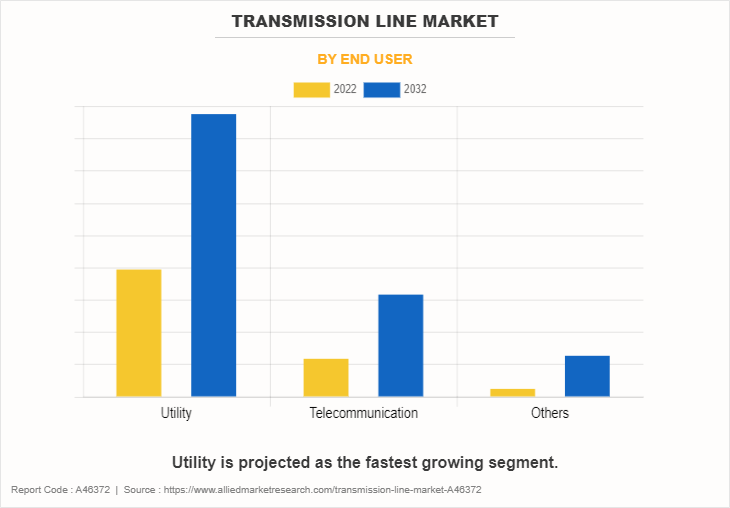

The transmission line market is segmented on the basis of product, type, voltage, end user, and region. On the basis of product, the market is bifurcated into AC transmission line and DC transmission line. By type, the market is divided into overhead transmission line, underground transmission line, and submarine transmission line. Depending on voltage, the market is classified into high voltage, extra high voltage, and ultra high voltage. Based on end user, the market is segregated into utility, telecommunication, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

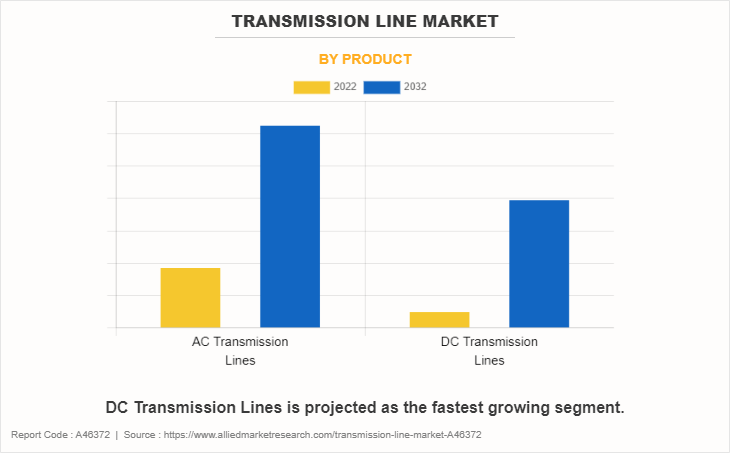

The AC transmission lines segment accounted for the largest share in 2022. This is due to their established infrastructure, cost-effectiveness, and compatibility with existing systems. Their widespread use stems from reliability, ease of implementation, and proven technology.

DC transmission lines is expected to register the highest CAGR of 7.5%. This can be attributed to the advantages in long-distance transmission, minimal power loss, and suitability for renewable energy integration, fostering increased adoption.

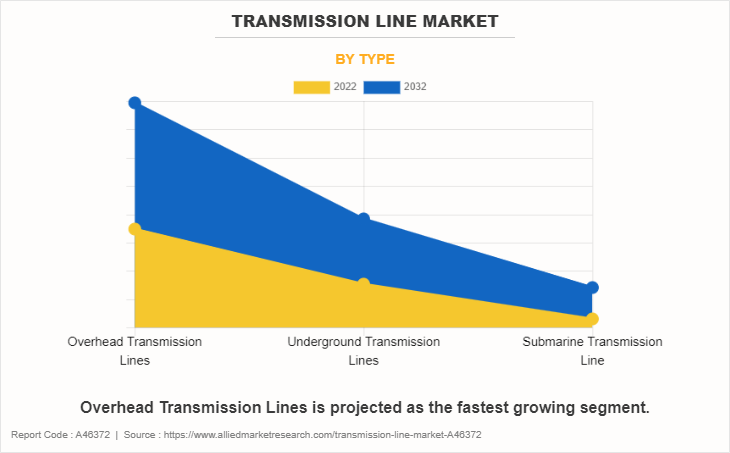

The overhead transmission lines segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 7.5%. Overhead transmission lines are a significant part of the infrastructure, transporting high-voltage electrical power across long distances. These lines, suspended on towers, connect power generation sources to distribution substations. Despite advancements in underground and submarine cables, overhead lines remain essential due to their cost-effectiveness and ease of maintenance.

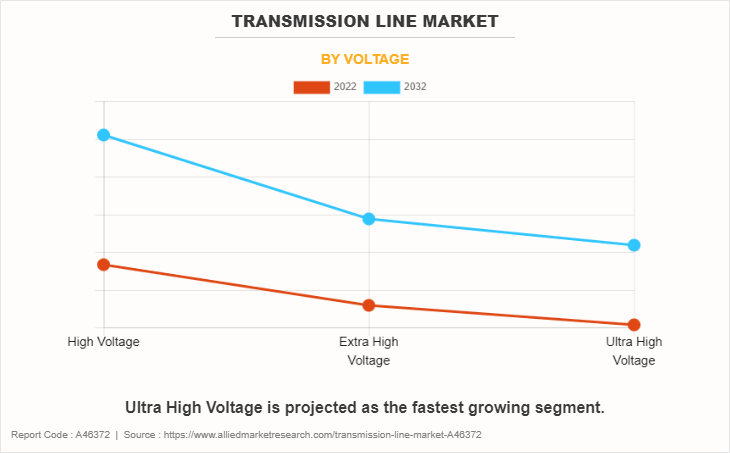

The high voltage segment accounted for the largest share in 2022. There were 1,873 high-voltage transmission line projects across 102 countries and six regions: North America, Latin America, Asia, Europe, Africa, and the Middle East in 2020. Furthermore, according to CleanTechnica, the U.S. currently has approximately 1 GW of HVDC capacity, contributing about 2% to the global total. Notably, China leads with numerous HVDC projects, surpassing the data reported by other sources in 2022.

Ultra high voltage is expected to register the highest CAGR of 7.6%. UHV transmission lines operate at extremely high voltages (typically 800 kV or above). China, for instance, has been at the forefront of UHV technology, planning to build a domestic UHV grid network covering more than 30,000 kilometers. These advancements enhance grid stability, reduce losses, and facilitate renewable energy integration.

The utility segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 7.4%. According to the U.S. Energy Information Administration, annual spending by major U.S. electric utilities on the U.S. electric transmission system increased from $9.1 billion in 2000 to $40.0 billion in 2019. This spending includes investment in new transmission infrastructure and operation/maintenance of existing systems. Investments have focused on station equipment, poles, and overhead power lines.

Asia-Pacific garnered the largest share in 2022. Rapidly growing economies such as India, Bangladesh, and China are investing significantly in upgrading their power grids. These countries aim to meet the rising energy needs of their urbanizing populations. Thus, there is an increase in demand for the construction of new high-voltage transmission lines and the refurbishment of existing ones.

Competitive Analysis

The major players operating in the global transmission line market are ABB, ARTECHE, General Electric, Hitachi Energy Ltd., MYR Group Inc., NEXANS, Prysmian Group, Salasar Techno Engineering Ltd., Sumitomo Electric Industries, Ltd., and Valard. Other players include AECOM, Beta Engineering, Burns & McDonnell, Jyoti Structures Ltd., Kiewit Corporation, LS CABLE & SYSTEM, Siemens Energy, and Southwire Company, LLC.

Some of the developments undertaken by key players are: On May 02, 2023, NEXANS launched a new range of low-carbon distribution grid cables, the first on the French market. The Group has been able to reduce the greenhouse gas emissions of its low- and medium-voltage cables from 35% to 50%, depending on the product, by using a comprehensive approach all throughout the value chain and throughout the cable life cycle. This product launch boosted the growth of the transmission line market

On August 02, 2021, Hitachi ABB Power Grids has put the final details on a new high voltage transmission network that will help Power Grid Corporation of India Limited, an Indian utility, ensure the dependability of its grid network and accelerate the nation's shift to renewable energy. The +/-800kV, 6,000MW and 1,800km transmission line connects Raigarh in Central India to Tamil Nadu in the southern parts of India.

Recent Developments in Transmission Line Industry

On December 14, 2023, NEXANS signed two agreements totaling USD 106 million as part of a larger investment plan to build the company's third medium-voltage cable plant in Morocco by 2026, in addition to its facilities in Casablanca and Mohammedia. The agreements were made with the Moroccan Ministry of Industry and Trade, Ministry of Energy Transition and Sustainable Development, Ministry of Investment, Convergence and Evaluation of Public Policies, the National Office of Electricity and Drinking Water (ONEE), and the Moroccan Investment and Export Development Agency (AMDIE). This agreement is expected to increase the demand for transmission line, leading to market growth.

On October 30, 2023, Prysmian Group signed an agreement worth approximately $959 million with Clean Path New York to provide submarine and land power cable systems for one of the largest transmission infrastructure projects in the U.S. The Clean Path NY project consists of a new 175-mile underground and submarine transmission link as well as 3,800 MW of wind and solar power generated from more than 20 new wind and solar generating resources. This agreement is expected to increase the growth of the transmission line market.

On September 18, 2023, Salasar Techno Engineering Ltd. announced that it has secured an EPC contract from Energy Development Corporation Limited for the construction of a 110kv transmission line, valued at USD 9.40 million. This expansion is expected to boost the demand for transmission line, leading to market growth.

On July 09, 2023, Prysmian Group has been awarded a new contract worth around $671 million by Terna Rete Italia S.p.A., a company that is wholly owned by Terna S.p.A., the Italian power grid operator (TSO). The Adriatic Link project, that aims to decarbonize Italy's energy system, will strengthen the country's standing as the Mediterranean energy hub through the design, procurement, construction, and commissioning of an HVDC undersea interconnection. The High Voltage Direct Current (HVDC) bipolar cable line will allow a transmission capacity of up to 1,000 MW and will increase the exchange of energy between the central-southern and central-northern areas of Italy, increasing the safety, efficiency, and resilience of the entire national electricity transmission grid.

On April 17, 2023, NEXANS was selected by Swissgrid, the national organization in charge of managing Switzerland's electrical transmission grid, after a bidding process for the project to bury the Very High Voltage (VHV) overhead power lines along the Geneva-Cointrin airport's southern flank. Underground cables are expected to replace the overhead ones, clearing up significant areas of land intended for urban expansion in the Geneva region. This expansion will strengthen the product portfolio of NEXANS, leading to the growth of the transmission line market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the transmission line market analysis from 2022 to 2032 to identify the prevailing transmission line market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the transmission line market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global transmission line market trends, key players, market segments, application areas, and market growth strategies.

Transmission Line Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 80.9 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By End User |

|

| By Voltage |

|

| By Product |

|

| By Region |

|

| Key Market Players | MYR Group Inc., Prysmian Group, Hitachi Energy Ltd., Sumitomo Electric Industries, Ltd., Arteche, GENERAL ELECTRIC, Salasar Techno Engineering Ltd., Nexans, Valard., ABB |

Analyst Review

According to the insights of the CXOs of leading companies, the global transmission line market is anticipated to experience significant growth due to rise in demand for renewable energy as various renewable energy sources are situated in distant or offshore regions abundant in natural resources but lacking sufficient infrastructure for transmitting electricity to high-demand areas. Transmission line are essential for efficiently and reliably transmitting electricity from renewable sources over long distances to high-demand urban and industrial areas, supporting the integration of clean energy into the grid.

Moreover, surge in interconnection projects boosts the demand for transmission line as it requires the construction of new high-voltage infrastructure to synchronize the grid and enable cross-border power trade.

However, high upfront cost is restraining market growth. The CXOs further added that technological advancements present lucrative growth opportunity for the transmission line market by introducing advancements that improve efficiency, reliability, and performance.

The global transmission line market was valued at $41.5 billion in 2022, and is projected to reach $80.9 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

The leading applications of the Transmission Line Market include power distribution, grid interconnection, and renewable energy integration. Transmission lines are essential for transmitting electricity from power plants to urban and industrial areas, connecting different parts of the grid, and facilitating the integration of renewable energy sources into the energy mix.

Upcoming trends in the Transmission Line Market include the adoption of ultra-high voltage lines for long-distance transmission, increased investment in grid modernization and smart grid technologies, integration of digital monitoring and control systems, and the expansion of transmission infrastructure to support the growth of renewable energy sources.

The major players operating in the global transmission line market are ABB, ARTECHE, General Electric, Hitachi Energy Ltd., MYR Group Inc., NEXANS, Prysmian Group, Salasar Techno Engineering Ltd., Sumitomo Electric Industries, Ltd., and Valard.

Asia-Pacific is the largest regional market for Transmission Line.

Loading Table Of Content...

Loading Research Methodology...