Transparent Ceramics Market Size & Insights: 2030

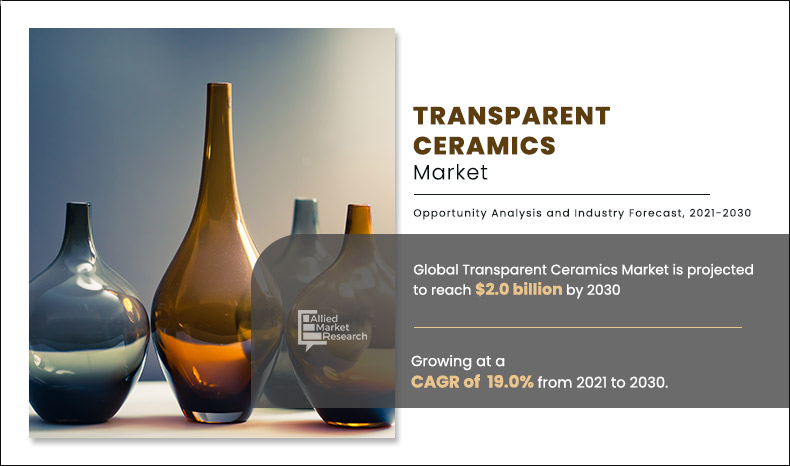

The global transparent ceramics market size valued at $0.4 billion in 2020 and is projected to reach $2.0 billion by 2030, growing at a CAGR of 19.0% from 2021 to 2030.

Introduction

Transparent ceramics are the materials that transmit light along with combining advantages of ceramic materials. Transparent ceramics are engineered ceramic materials with the added advantage of transparency. They are better substitute for the traditional materials in applications that demand high-quality transparency however robust mechanical properties. It is widely used in optics &sensors, defense, healthcare, and aerospace applications.

Transparent ceramics are widely used in consumer & household goods, defense & security fields, sensors & instrumentation, optics, aerospace, and so on. Glass was earlier used owing to its inherent property of transparency, however was soon discarded as the mechanical properties such as strength and toughness were found to be inadequate. Although metal is still widely used, it lacks transparency, which is desirable in optics and sensor & instrumentation applications; hence, use of transparent ceramics is boosting sensor & instrumentation application, which combine transparency with heat and electrical insulation properties. Transparent ceramics are superior to plastics due to their high strength and low deformation. The use of transparent ceramics is widely increasing as a substitute for glass, metal, and plastics.

Market Dynamics

Transparent ceramics utilize raw materials that are complex to manufacture due to which the unavailability of some raw materials can hamper the production of transparent ceramics. However, the advancement in nanotechnology is expected to boost the transparent ceramics market growth over the forecast period. Nanotechnology is the science of building complex objects and materials that are well below the range of 100 nanometers, with properties much more pronounced than the actual macro-scale product. Ceramic-nanocomposites gain attention as a novel replacement material for the traditionally used materials. Ceramic-nanocomposites are being used in the aerospace industry to manufacture smooth-surfaced objects that are 100 times stronger than existing materials however require 100 times less space thereby reducing the cost and increasing the effectiveness of the operation. They are also incorporated in energy generation and storage devices as electrolytes.

Segments Overview

The transparent ceramics market is classified into type, material, end-use, and region. On the basis of type, the market is segmented into monocrystalline transparent ceramics, polycrystalline transparent ceramics, and others. By material, the market is segmented into sapphire, yttrium aluminum garnet, spinel, aluminum oxynitride, and others. By end-use, the market is segmented into optics & optoelectronics, aerospace, defense & security and, mechanical/chemical, sensors & instrumentation, healthcare, consumer goods, and energy. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The transparent ceramics market share is analyzed across all significant regions and countries.

Global Transparent Ceramics Market, by Type

By type, monocrystalline transparent ceramics has emerged as the biggest product segment in the global market for transparent ceramics in 2020. Monocrystalline ceramics are single crystals of a characteristic crystal lattice, which are free from surface defects and internal pore irregularities. These advantages are beneficial for applications in radiation detection, particle detection, and X-ray devices used for security reasons, gas exploration, optics, and electronics.

By Type

Monocrystalline Transparent Ceramics is projected as the most lucrative segment.

Global Transparent Ceramics Market, by Material

By material, the sapphire segment provided the largest share of the revenue in 2020. Sapphire is a hard, durable, and scratch-resistant material with a transmission range from UV to IR wavelengths. It is an extremely favorable transparent ceramic when the electronics industry is concerned. It offers superior mechanical properties. It is preferred owing to the ease of manufacturing and scalability of production along with the customizability of shape.

By Material

Sapphire is projected as the most lucrative segment.

Global Transparent Ceramics Market, by End-use

By end-use, the optics and optoelectronics segment provided the largest share of the revenue in 2020. Transparent ceramic materials in optics and optoelectronics are mainly used for their high transmission of incident light and better mechanical properties as compared to traditionally used glass. Spinel and ALON are used for making night-vision goggles and in IR-optics such as domes, lenses, and sensor windows. Bar-code reader windows and bar-code readers utilize transparent materials in their making.

By End Use

Optics & Optoelectronics is projected as the most lucrative segment.

Global Transparent Ceramics Market, by Region

By region, North America is a leading region in transparent ceramics industry in 2020. Asia Pacific is expected to be fastest growing region over the forecast period. Attractive policies on foreign investment are a few factors that attracts transparent ceramics manufacturers to invest in Asia-Pacific. China, Japan, Australia, Korea, and India are the major revenue contributors in the region.

By Region

Asia Pacific is expected to be fastest growing region over the forecast period.

Competitive Analysis

The key players operating in the global transparent ceramics market size include American Elements, CeramTec GmbH, CeraNova, CoorsTek Inc., General Electric, Konoshima Chemical Co.Ltd, Kyocera Corporation, Saint-Gobain, Schott AG, and Surmet Corporation.

Key Benefits For Stakeholders

- The report includes an in-depth analysis of different segments and provides transparent ceramics market estimations between 2021 and 2030.

- The transparent ceramics market size is provided in terms of revenue and volume.

- A comprehensive analysis of the factors that drive and restrict the growth of the transparent ceramics marketis provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current transparent ceramics market trends and future estimations from 2021 to 2030, which helps to identify the prevailing market opportunities.

Transparent Ceramics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By End-Use |

|

| By Region |

|

Analyst Review

CXOs of the leading companies perceive that the rise in demand from end-users, especially from the developing countries, and developments in the enhancement of properties of the materials are the factors that majorly boost the global transparent ceramics market. However, their high cost and non-recyclability are expected to slow down the market. According to the CXOs, Asia-Pacific is expected to register significant growth as compared to North American and European markets.

Transparent ceramics are engineered materials that combine the advantages of transparency and better mechanical properties. It is used as a substitute for traditional glass due to its transparency and robust mechanical advantages. Monocrystalline transparent ceramics are the most preferred type of transparent ceramics, finding its application in solid-state laser in the optics industry. Research & development in the use of lasers for cancer treatment and fault detection while packaging & laser cutting is expected to boost the demand in the coming years. Therefore, it is expected that monocrystalline transparent ceramics is expected to be the first choice for the new entrants.

The rise in demand from end-users, especially from the developing countries, and developments in the enhancement of properties of the materials are the factors that majorly boost the global transparent ceramics market

The transparent ceramics market value is expected to be $ 2.0 billion in 2030.

The key players operating in the global transparent ceramics market include American Elements, CeramTec GmbH, CeraNova, CoorsTek Inc., General Electric, Konoshima Chemical Co.Ltd, Kyocera Corporation, Saint-Gobain, Schott AG, and Surmet Corporation.

Transparent ceramic materials are mainly used for their high transmission of incident light and better mechanical properties as compared to traditionally used glass due to which optics & Optoelectronics industry is expected to increase the demand for transparent ceramics market.

Type, material, end use, and region are the segments which are covered in the report

The use of transparent ceramics is widely increasing as a substitute for glass, metal, and plastics is a major driver for the market

Transparent ceramic materials are the most preferred material for protection and safety in defense and security sector due to which its adoption is expected to increase from aerspace & defense industry

COVID-19 pandemic caused a ban on imports and export, thereby disrupting the supply chain and hampering the transparent ceramics market growth.

Loading Table Of Content...