Transportation Battery Recycling Market Research, 2030

The global transportation battery recycling market was valued at $4.75 billion in 2021, and is projected to reach $9.95 billion by 2030, growing at a CAGR of 8.2% from 2022 to 2030. As people across the globe are becoming more aware regarding Electric Vehicles (EVs), the market for recycling transportation batteries is projected to grow significantly in popularity. Electric vehicles are more affordable than those who are running on fuel as the fuel prices are rising daily. In order to promote EVs, Government of China has also undertaken numerous efforts and introduced various programs. For instance, in May 2021, Li-Cycle Corp. signed an agreement with Ultium Cells LLC (a joint venture of General Motors and LG Energy Solution). Moreover, this agreement aimed at recycling up to 100% of the scrap generated by battery cell manufacturing at Ultium's Lordstown, Ohio mega-factory.

Rising popularity of portable electronics, grid-scale energy storage, and electric vehicles worldwide are the main factors driving revenue growth of the global transportation battery recycling market. Fossil fuels are fuels found in nature and they are utilized in automobiles which work on combustion engines. Prices of these fuels have increased due to high demand and limited supply. EVs working on recycling batteries, are better option to these vehicles. Due to the global increase in price of fossil fuels, more people are choosing electric and hybrid vehicles over those. This might result in a rise in demand for battery recycling services. These factors are anticiapted to propel the transportation battery recycling market growth in the near future.

During the projection period, poor lithium separation, faulty disassembly, and inappropriate shredding are factors anticipated to restrain revenue growth of the transportation battery recycling market. Furthermore, the landfill process of these batteries has the potential to contaminate a large area.

Developments such as manufacturing on a large scale, lower component prices, and adoption of technologies to boost battery capacity are factors leading to a decline in prices of lithium-ion batteries.

For instance, Battery Resources, the world's most efficient commercial lithium-ion battery recycler, is planning to build a 154,000-square-foot recycling facility in the U.S. in August 2022, which is expected to be among the largest in the North American region. Moreover, this facility will have the capacity to recycle 30,000 metric tons of lithium-ion batteries yearly.

The key players profiled in this report include Call2Recycle, Inc., Battery Solutions, LLC, Exide Technologies, Umicore, Contemporary Amperex Technology Co., Limited, ENERSYS, GEM Co., Ltd., Johnson Controls, Fortum, and Aqua Metals, Inc.

The global transportation battery recycling market is segmented on the basis of type, sources, and region. By type, the market is sub-segmented into lead-acid battery, lithium-based batteries, nickel-based batteries, and others. By sources, the market is classified into automotive batteries, industrial batteries, electronic appliances batteries, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The transportation battery recycling market is segmented into Chemistry and Source.

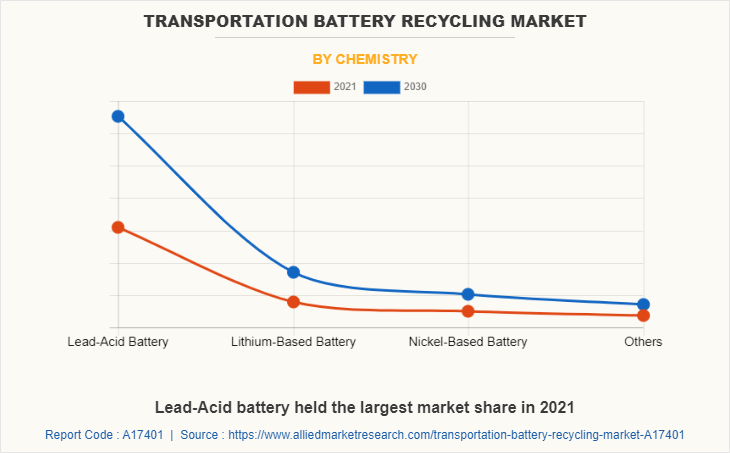

By chemistry, the lead-acid battery sub-segment is anticipated to have a dominant market share in 2021. The lead acid battery is an electrochemical storage device and has the same working of providing an electric current and voltage similar to other electrochemical batteries. However, it was the first battery which was rechargeable. Also, 97% of the lead is recyclable and reused in new batteries. These are predicted to be the major factors affecting the transportation battery recycling market size during the forecast period too.

The lithium-based battery sub-segment is anticipated to have the fastest growing global transportation battery recycling market share in 2021.The growth of this sub segment can be attributed to the use of recycling of transportation batteries for production of automotive components. The high energy density is one of the great advantages of lithium-ion battery technology. Lithium batteries work with one of the advanced battery technologies that specifically uses lithium ions as an important component for electrochemistry. Such applications of lithium batteries in the automotive sector will undoubtedly create growth opportunities for the sub-segment during the forecast period.

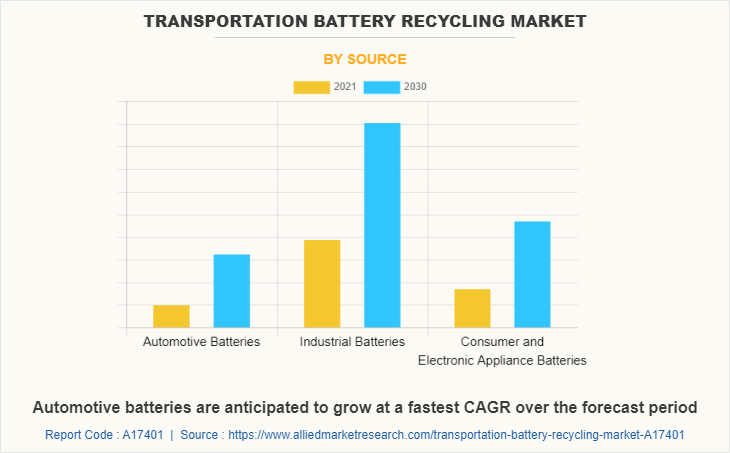

By sources, the automotive batteries sub-segment is anticipated to have the fastest growing global transportation battery recycling market share in 2021. Electric car owners are expected to save a lot of money, which other vehicle owners tend to spend on fuel. Furthermore, electric cars have a very efficient way of storing and holding energy while driving. The battery shuts down when the car is stationary to save energy and the battery is actually charged during braking which is called regenerative braking. This is the main factor that can improve the acceptance of automotive batteries in the market.

The industrial batteries sub-segment of the global transportation battery recycling market is anticipated to have dominate the global transportation battery recycling market share in 2021. Due to their widespread use in industrial applications including forklifts, emergency backups, UPS systems, and heavy machinery as well as their significant benefits such as low maintenance requirements and affordability, industrial batteries are major factors driving this sub-segment revenue growth.

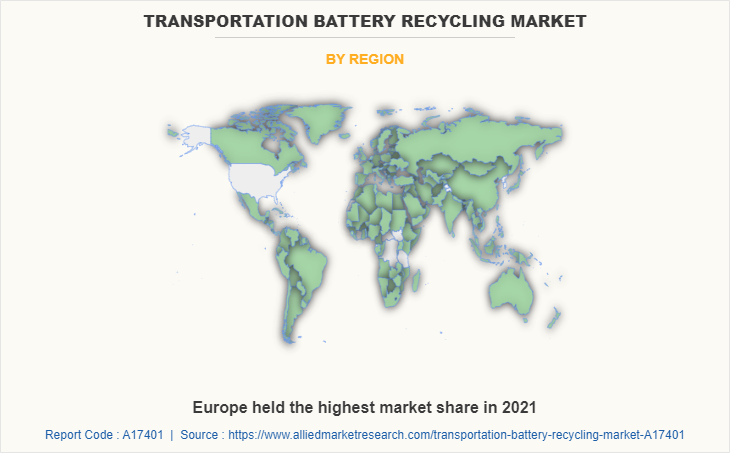

By region, Europe is projected to have the highest market share in 2021 and is anticipated to have dominated the market share during the forecast period.The rising adoption of sustainable activities in Europe is expected to drive revenue growth of the market in the region over the forecast period. Furthermore, massive presence of electric vehicle manufacturers in this region is expected to further fuel revenue growth of the regional transportation battery recycling market over the forecast period.

The Asia-Pacific transportation battery recycling market in 2021 is projected to be the fastest-growing sub-segment during the forecast period. China, Japan, India, South Korea, and Australia are the main market growth drivers in this region. Additionally, the Asia-Pacific region's rising economy and increasing awareness among the population regarding the adoption of EVs are factors driving the transportation battery recycling market.

Impact of COVID-19 on the Global Transportation Battery Recycling Industry

- The automotive industry, among others, has been severely impacted by the COVID-19 pandemic, which has resulted in a dramatic decline in automotive sales. Due to the extensive use of automotive batteries in the automobile industry, demand for recycling transportation batteries substantially reduced.

- China is the leading producer and exporter of automobile batteries. However, China being the hotspot of the coronavirus, its export trade was affected, leading to a decline in battery production.

- Economic slowdown has affected the setup of new transportation battery recycling projects across the world as the majority of government funding was diverted towards the healthcare sector owing to the rapid spread of COVID-19, negatively impacting the market to the great extent

- For instance, in June 2021, Accuracy completed the reconstruction of the Krefeld plant which now has double security storage for lithium batteries and double the building capacity. This development emphasizes the company’s growth in the lithium-ion battery recycling market as it contributes to an increase in production.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the transportation battery recycling market analysis from 2021 to 2030 to identify the prevailing transportation battery recycling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the transportation battery recycling market forecast along with the segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global transportation battery recycling market trends, key players, market segments, application areas, and market growth strategies.

Transportation Battery Recycling Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 10 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2021 - 2030 |

| Report Pages | 270 |

| By Chemistry |

|

| By Source |

|

| By Region |

|

| Key Market Players | ECOBAT Logistics, GEM Co., Ltd., umicore, battery solutions, llc, Gopher Resource, EnerSys, Call2Recycle, Inc., Contemporary Amperex Technology Co., Limited, Fortum, Aqua Metals, Inc. |

Analyst Review

High price and limited supply of the fuel are key factors projected to drive revenue growth of the global transportation battery recycling market during the forecast period. In addition, Indian Government launched various programs such as FAME-2 (Faster Adoption and Manufacturing of Hybrid and Electric Vehicle Scheme) to boost adoption of electric vehicles in India. Rising popularity of portable electronics, grid-scale energy storage, and electric vehicles worldwide are the main factors driving the transportation battery recycling market growth.

However, poor lithium separation, faulty disassembly, and inappropriate shredding are factors anticipated to restrain revenue growth of the battery recycling market during the projection period. Furthermore, developments such as manufacturing on a large scale, lower component prices, and adoption of technologies to boost battery capacity are factors leading to a decline in prices of lithium-ion batteries in the future.

Among the analyzed regions, Europe is expected to account for the highest revenue in the market by the end of 2031, followed by North America, Asia-Pacific, and LAMEA. Over the projected period, rising adoption of sustainable activities in Europe is anticipated to fuel market expansion. Furthermore, it is also anticipated that substantial presence of electric car manufacturers in this region would further stimulate expansion of the transportation battery recycling market over the forecast period.

Increasing demand for hybrid and electric vehicles around the world is predicted to create massive growth opportunities for the global market. Indian Government has also launched various schemes and development programs for growth of the electric vehicles sector.

Lead-acid battery sub-segment acquired the maximum share of the global transportation battery recycling market in 2021.

The use of recycling batteries in electric cars, bikes, and electronics devices are some applications expected to drive adoption of transportation recycling batteries.

In addition to the classic methods, new ones such as pyrometallurgy, hydrometallurgy, and green technologies can be employed in India for recycling. The main techniques used by the firms during the previous few years have been mergers & acquisitions, agreements, and expansions. For instance, Electra and Marubeni collaborated to acquire the black mass produced by recycling Li-ion batteries in January 2022. To ensure a steady supply of Li/Co composites, Electra aims to make use of Marubeni's broad global network of battery cell recyclers. These are some current trends that will influence the transportation battery recycling market in the next few years.

Europe will provide more business opportunities for the global transportation battery recycling market in future.

The key players profiled in this report include Call2Recycle, Inc., Battery Solutions, LLC, Exide Technologies, Umicore, Contemporary Amperex Technology Co., Limited, ENERSYS, GEM Co., Ltd., Johnson Controls, Fortum, and Aqua Metals, Inc.

The major growth strategies adopted by transportation battery recycling market players are merger & acquisitions, investments, and agreement.

Automotive industry leaders are the major customers in the global transportation battery recycling market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global transportation battery recycling market from 2021 to 2030 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...