Travel Accommodation Market Research, 2035

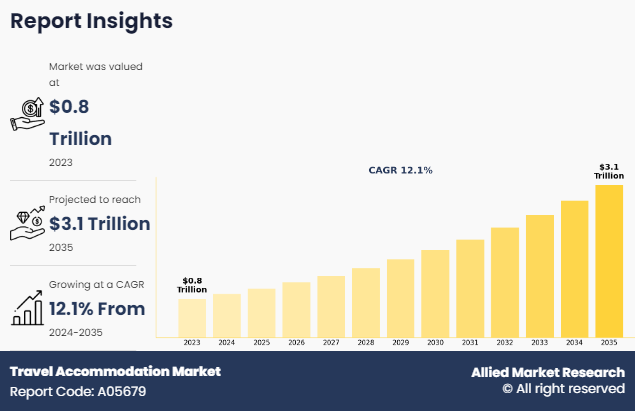

The global travel accommodation market was valued at $797.7 billion in 2023, and is projected to reach $3,144.7 billion by 2035, growing at a CAGR of 12.1% from 2024 to 2035. The demand for travel accommodation is driven by improvement in living standard, demographics, rise in per capita income, and preferences of modern travelers. As urban populations continue to grow, urbanization has also played a significant role in fueling the demand for accommodation options across various destinations as people seek respite from the stresses of city life through travel and vacations. Moreover, the growing trend of prioritizing experiences over material possessions, particularly among millennials and younger generations, is driving the demand. In addition, improved transportation infrastructure, including better air, rail, and road networks, has facilitated easier travel to different destinations, consequently increasing the demand for accommodation services. Furthermore, governments worldwide have acknowledged the economic advantages of tourism and have validated policies and initiatives to boost their travel destinations, resulting in a surge of travelers and a subsequent need for accommodation facilities.

Travel accommodation encompasses the diverse range of lodging options available to individuals commencing on journeys away from their usual place of residence. Travelers can choose from among various types of travel accommodations available, including hotels, hostels, resorts, vacation rentals, and others. The ideal choice of stay can be determined depending upon multiple factors such as extensive range of amenities and services, including room service, dining options, fitness facilities, and recreational activities, preferences & budget of travel accommodation, availability of the property, and mode of booking. These accommodations cater to travelers seeking convenience, comfort, and often a touch of luxury during their stays. Accommodation can be booked through various sources, which include online travel agencies, hotel websites, booking through agents, and direct bookings.

Key Takeaways of the Travel Accommodation Market Report

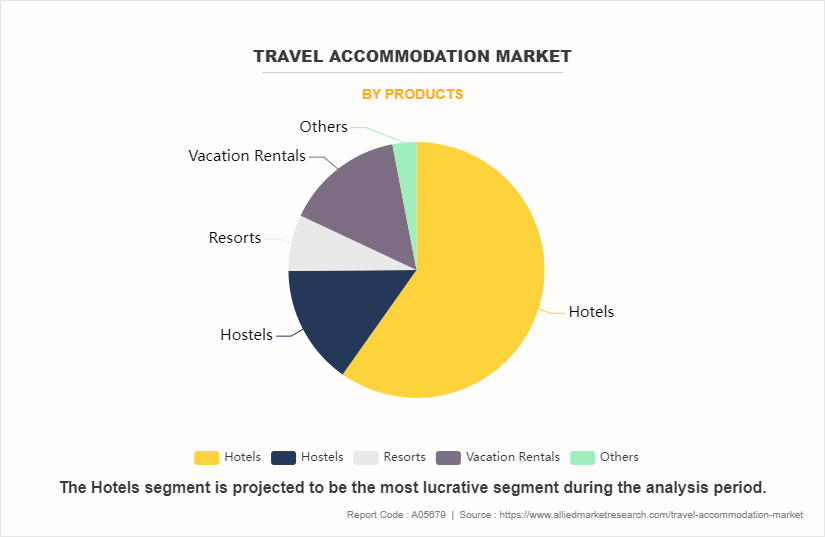

- By product, the hotels segment was the highest revenue contributor to the market in 2023.

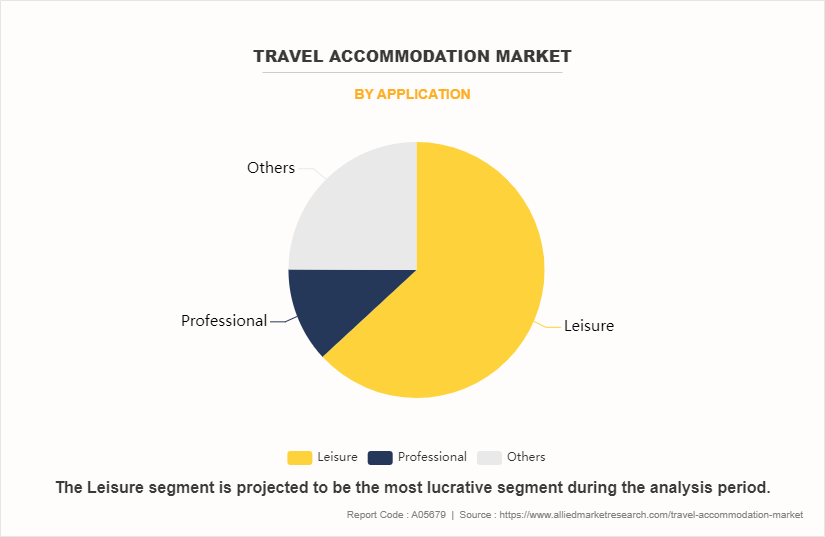

- According to application, leisure was the highest revenue contributor in 2023 owing to the desire for travel experiences and exploration.

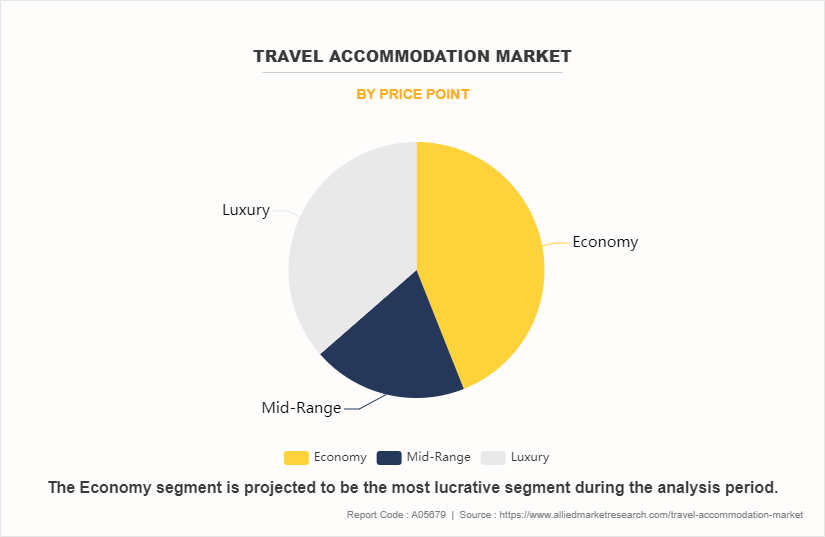

- As per price point, the mid-range segment was the largest segment in the global travel accommodation market during the forecast period.

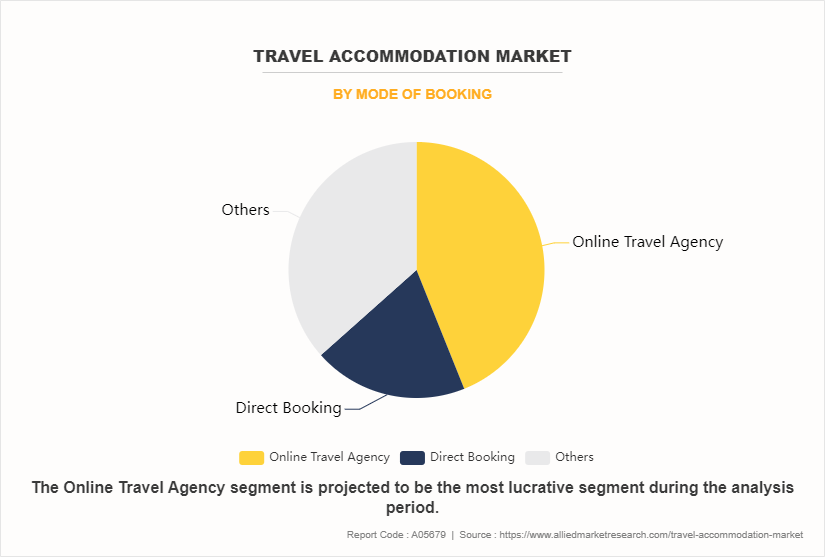

- Based on mode of booking, the online travel agency segment was the largest segment in the global travel accommodation market during the forecast period.

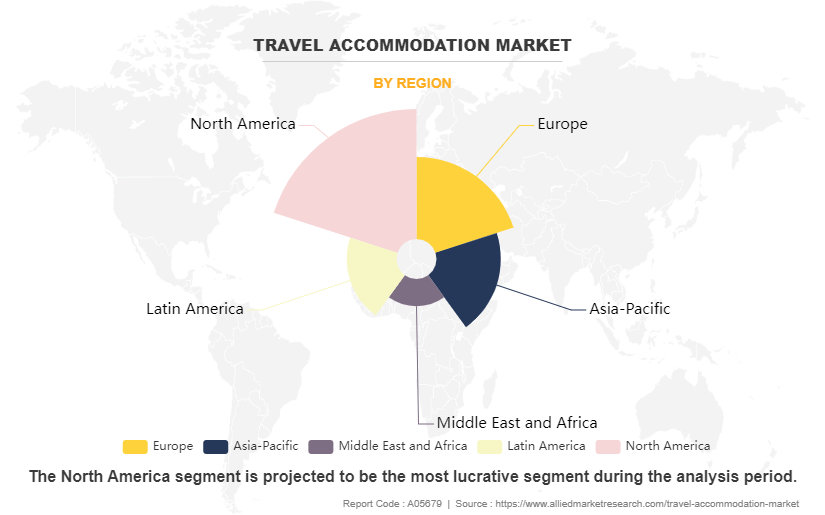

- Region-wise, North America was the highest revenue contributor in 2023 owing to high levels of disposable income and well-developed infrastructure for tourism.

Market Dynamics

The liberalization of visa regulations in many countries such as Africa, India, and China, have eased travel for visitors, which is a key factor expected to positively impact the growth of the travel & tourism industry. This has influenced the travel accommodation market for tourists since it has made travel convenient. In addition, increase in consumer spending across countries such as India, Australia, and New Zealand significantly contributes toward the growth of the global travel accommodation industry. This is majorly attributed to currency rate fluctuations in travel accommodation market size.

Moreover, the rise in the desire for genuine cultural experiences within the tourism sector has propelled the overall travel accommodation market growth. Moreover, modern travelers seek more than conventional sightseeing for immersive encounters with local cultures and traditions. Destinations deeply rooted in the heritage of the respective communities provide an ideal platform for such authentic experiences. In addition, tourists are attracted by the prospect of engaging with residents, actively participating in traditional rituals, indulging in indigenous cuisine, and delving into age-old customs.

However, economic downturns or fluctuations in currency exchange rates can affect consumer spending on travel and accommodation, leading to decreased demand for lodging services. High operating costs, including expenses related to property maintenance, utilities, and employee wages, can also pose challenges for accommodation providers, especially during periods of low occupancy or economic uncertainty. Regulatory challenges, such as changes in visa requirements, taxation policies, or zoning regulations, can create hurdles for accommodation businesses, impacting their ability to operate efficiently and remain competitive in the travel accommodation market share.

Further, increasing competition from alternative lodging options such as vacation rentals, home-sharing platforms, and peer-to-peer accommodation services can put pressure on traditional hoteliers and affect their market share and profitability. One significant restraint is the occurrence of unforeseen events such as natural disasters, pandemics, terrorist attacks, or political instability in popular tourist destinations. These events can disrupt travel plans, deter tourists from visiting certain areas, and lead to cancellations or reduced bookings for accommodation providers.

In addition, advancements in technology present opportunities for accommodation providers to enhance the guest experience and streamline operations. This can include implementing mobile check-in/check-out processes, integrating smart room features, and leveraging data analytics to personalize guest services and improve operational efficiency. Embracing technology not only improves the overall guest experience but also enables travel accommodation market demand to adapt to changing consumer preferences and stay competitive in the digital age.

Moreover, emerging markets and growing middle-class populations in regions such as Asia-Pacific, Latin America, and Africa present untapped opportunities for expansion in the travel accommodation market. By investing in infrastructure development, expanding their presence in key growth markets, and adapting their offerings to local preferences and cultures, accommodation providers can tap into new customer segments and drive revenue growth in these emerging markets with travel accommodation market forecast.

Segmental Overview

The travel accommodation market analysis is segmented into type, application, price point, mode of booking, and region. By Product, the market is categorized into hotels, hostels, resorts, vacation rentals and others. As per application, the market is classified into leisure, professional and others. By price point, the market is categorized into economy, mid-range, and luxury. Depending on mode of booking, the market is categorized into online travel agencies, direct booking, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Product

By Product, the hotels segment dominated the global travel accommodation market in 2023 and is expected to register the highest CAGR of 11.9% during the forecast period, owing to the well-established presence of major hotel chains, their brand recognition, and their ability to provide standardized and consistent experiences across different locations. Furthermore, hotels cater to a wide range of travelers, from business to leisure, by offering various accommodation options, amenities, and service levels to meet diverse needs and budgets. The hotel industry has also diversified into different types, such as luxury, boutique, and budget hotels, further solidifying its market share.

By Application

By Application, the leisure segment dominated the global travel accommodation market in 2023 and is expected to register the highest CAGR of 12.4% during the forecast period, owing to the well-established presence of major hotel chains, their brand recognition, and their ability to provide standardized and consistent experiences across different locations. Furthermore, hotels cater to a wide range of travelers, from business to leisure, by offering various accommodation options, amenities, and service levels to meet diverse needs and budgets. The hotel industry has also diversified into different types, such as luxury, boutique, and budget hotels, further solidifying its market share.

By Price Point

By Price Point, the economy segment dominated the global travel accommodation market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 12.2% during the forecast period. This segment encompasses a diverse range of lodging options, including hotels, boutique accommodations, and serviced apartments, offering amenities and services that appeal to cost-conscious travelers without compromising on quality. The popularity of the economy segment can be attributed to several factors, including the growing middle-class population globally, which has raised demand for affordable yet comfortable travel accommodations.

By Mode of Booking

By Mode of Booking, the online travel agency dominated the global travel accommodation market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 12.2% during the forecast period. online travel agency provides a one-stop platform for searching, comparing, and booking flights, hotels, and other travel services from various providers. They offer a wide range of options, price transparency, exclusive discounts, and user-friendly interfaces. Additionally, online travel agencies enable travelers to read reviews, earn rewards, and receive personalized recommendations, enhancing the overall travel planning experience. With their accessibility and value-added features, online travel agencies have become a preferred choice for many travelers, driving their demand in the market.

By Region

Region-wise, North America is anticipated to dominate the market with the largest share during the forecast period. The region's well-developed infrastructure, comprising a vast network of hotels, resorts, vacation rentals, and other accommodation options, caters to the diverse preferences and budgets of travelers. Furthermore, North America's strong economy, high standards of living, and robust tourism industry contribute to consistent demand for accommodation services. Additionally, the region benefits from government initiatives and promotional efforts aimed at boosting tourism, further fueling growth in the accommodation sector. Moreover, North America's technological advancements, including online booking platforms, mobile applications, and digital marketing strategies, have facilitated seamless booking experiences and enhanced customer engagement, driving revenue for accommodation providers.

Competitive Analysis

Several well-known and up-and-coming brands are competing for market dominance in the expanding travel accommodation industry. Smaller, niche firms have become more well-known for catering to consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Companies that can influence the preferences of their considered audience and coordinate with their ethical and environmental principles hold a competitive edge against competitors.

Recent Developments in Travel Accommodation Market

- In May 2022, Accor S.A. announced the purchase of Queen Elizabeth 2, a retired British ocean liner converted into a floating hotel, in Dubai in order to expand its portfolio of unique hotel offerings.

- In June 2022, Hilton Worldwide Holdings Inc. opened a new eco resort in Costa Rica named Botánika Osa Peninsula, Curio Collection by Hilton in order to expand its geographical reach.

- In June 2022, Hyatt Hotels Corporation announced the opening of its Hyatt Place Fort Worth/Alliance Town Center near the Fort Worth Alliance Airport, in order to help expand its portfolio of hotels and hospitality services.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the travel accommodation market analysis from 2023 to 2035 to identify the prevailing travel accommodation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the travel accommodation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global travel accommodation market trends, key players, market segments, application areas, and market growth strategies.

Travel Accommodation Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 296 |

| By Products |

|

| By Application |

|

| By Price Point |

|

| By Mode of Booking |

|

| By Region |

|

| Key Market Players | Wyndham Destinations, Marriott International, Accor Hotels Group, Red Lion Hotels Corporation, Oyo Rooms, Airbnb Inc., Radisson Hotel Group, A&O Hotels and Hostels GmbH, Hyatt Hotels Corporation, Hilton Worldwide Holdings Inc. |

Analyst Review

According to the CXOs of leading companies, the global travel accommodation market is emerging at a considerable pace owing to several factors such as change in lifestyle patterns and disposable income. The demand for travel accommodation is on the rise across the globe. Market players such as Marriott International, Hyatt Hotels Corporation, and Hilton Worldwide Holdings Inc. have adopted key developmental strategies such as business expansion and acquisitions to mark their presence in the global travel accommodation market. Moreover, they acquired brands worldwide and simultaneously took up joint ventures to create a strong global footprint.

Rapid boom in the tourism industry, shift of consumer spending from product to experience, upsurge in professional/business travel, and rise in number of people travelling for leisure propel the growth of the global travel accommodation market. In addition, exploring niche tourist destinations has become a new trend among travelers, and hence, has generated remunerative opportunity for market expansion in countries such as Indonesia, Greece, and Africa, and others.

The global travel accommodation market was valued at $797.7 billion in 2022 and is projected to reach $3,144.7 billion by 2032, registering a CAGR of 12.1% from 2023 to 2032.

The forecast period in the travel accommodation market report is 2024 to 2035.

The base year calculated in the travel accommodation market report is 2023.

The top companies analyzed for global travel accommodation market report are Marriott International, Hyatt Hotels Corporation, Wyndham Destinations, Hilton Worldwide Holdings Inc., Accor Hotels Group, Radisson Hotel Group, Airbnb Inc., A&O Hotels and Hostels GmbH, Red Lion Hotels Corporation, and Oyo Rooms.

Hotels segment is the most influential segment in the travel accommodation market report.

North America holds the maximum market share of the travel accommodation market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the travel accommodation market in 2023 was $797.7 billion.

Loading Table Of Content...

Loading Research Methodology...