Travel Credit Card Market Research, 2032

The global travel credit card market was valued at $16.4 billion in 2022, and is projected to reach $48.5 billion by 2032, growing at a CAGR of 11.8% from 2023 to 2032.

A travel credit card is a specialized financial tool designed to cater to individuals who frequently engage in travel-related activities. This type of credit card differs from conventional ones in that it offers a range of benefits and rewards tailored specifically to suit the needs of travelers. When using a travel credit card, cardholders typically accumulate points, miles, or other forms of rewards based on their expenditures. These accrued rewards are then redeemed for various travel-related privileges, including, however, not limited to discounted or complimentary airfare, accommodation, car rentals, and other related expenses. In addition, travel credit cards often come with supplementary features such as travel insurance, airport lounge access, and exclusive partnerships with airlines or hotel chains, further enhancing the overall travel experience for the cardholder.

The travel credit card market offers various rewards and benefits system that attracts consumers by offering points, miles, or cashback for expenditures, which be redeemed for travel-related expenses. This creates a compelling value proposition for frequent travelers. In addition, rising affluence and disposable income, particularly in emerging economies, have expanded the potential customer base, as individuals seek premium travel experiences. Therefore, these factors drive the travel credit card market growth.

However, high annual fees and interest rates, along with limited acceptance and partner restrictions, act as restraints, potentially preventing some consumers from adopting travel credit cards, thus restraining the growth of travel credit card market size. On the contrary, the opportunity for growth of travel credit card market share lies in technological advancements, which allow for personalized experiences. Thus, by leveraging data analytics and AI, card issuers tailor rewards and offers to individual spending habits and travel preferences, creating a more engaging and valuable customer experience.

The report focuses on growth prospects, restraints, and trends of the travel credit card market analysis. The study provides Porter’s five forces analysis to understand the impact of several factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the travel credit card market.

Segment Review

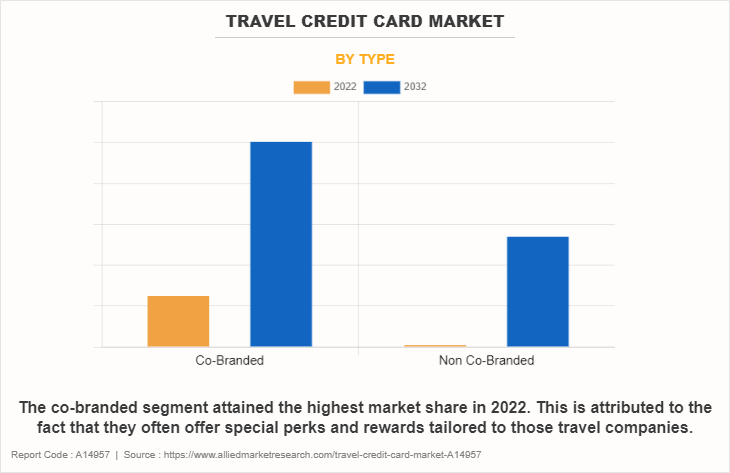

The travel credit card market is segmented on the basis of type, provider, application and region. On the basis of type, the market is bifurcated into co-branded and non-co-branded. By provider, the travel credit card market is classified into Visa, Mastercard, and others. On the basis of application, it is categorized into transaction, discounts and offer redemption, priority access, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the co-branded segment attained the highest market share in the travel credit card market. This is since they often offer special perks and rewards tailored to those travel companies. Moreover, people who frequently use a certain airline or stay at a particular hotel chain find these cards very appealing. On the other hand, the non-co-branded segment is attributed to be the fastest-growing segment during the forecast period. This is attributed to the fact that they offer more flexibility, and it be used for a wider range of travel expenses, not just with one particular company. This factor makes them attractive to a broader group of travelers who prefer flexibility over loyalty to one specific brand.

On the basis of region, North America attained the highest growthin the travel credit card market in 2022. This is attributed to the fact that many people in this region use these cards. They are popular as they offer great rewards for travel expenses. Also, consumers in North America tend to travel a lot, so these cards are very handy. On the other hand, Asia-Pacific is expected to be the fastest-growing region during the forecast period. This is due to the fact that the use of travel credit cards is growing fast in the region as more people here are starting to travel, and they are discovering the benefits of these cards. In addition, travelers want to enjoy perks such as free flights or hotel stays, which these cards offer. Therefore, Asia-Pacific is expected to witness the fastest growth in the travel credit card industry.

The report analyzes the profiles of key players operating in the travel credit card market such as American Express Company, Bank of America Corporation, Capital One Group, Caxton Payments Limited, Chase Sapphire Reserve, Citigroup Inc., HSBC, JPMorgan Chase & Co., Mastercard, and Standard Chartered. These players have adopted various strategies to increase their market penetration and strengthen their position in the travel credit card market.

Market Landscape and Trends

The travel credit card market outlook presents a dynamic landscape shaped by evolving consumer preferences and industry innovations. Currently, it is characterized by intense competition among card issuers striving to attract and retain customers through enticing rewards programs and supplementary benefits. Major players in the financial sector, including banks and credit card companies, actively participate in this market, offering a diverse range of travel-centric credit card products. One prominent travel credit card market trend is the customization of rewards and benefits. Card issuers are increasingly tailoring their offerings to cater to specific demographics or travel preferences, providing users with a more personalized experience. Another noteworthy trend in the travel credit card market is the integration of advanced technology.

This includes the incorporation of AI-driven algorithms to analyze spending habits and offer tailored rewards, as well as the enhancement of digital platforms for seamless user experiences. In addition, partnerships with airlines, hotels, and travel service providers are becoming more prevalent, allowing for exclusive discounts and privileges for cardholders. This trend not only fosters customer loyalty but also expands the reach and influence of travel credit cards within the broader travel industry. Overall, the travel credit card market landscape is characterized by fierce competition, technological advancements, and a focus on providing unique and valuable travel-related benefits to consumers.

Top Impacting Factors

Rewards and Benefits Incentivize Consumer Adoption

Travel credit cards offer a range of rewards, including points, miles, and cashback, which entice consumers to opt for these cards. These rewards can be redeemed for travel-related expenses like flights, hotel stays, and car rentals. In addition, supplementary perks such as airport lounge access, travel insurance, and concierge services amplify the value proposition. As a result, consumers are motivated to use travel credit cards for their day-to-day spending, thereby bolstering the revenue stream for card issuers. For instance, an airline-affiliated travel credit card may offer accelerated miles for every dollar spent on airfare, attracting frequent flyers seeking to maximize their travel benefits. Therefore, rewards and benefits offered by the travel credit cards is a major driving factor for the market growth.

High Annual fees and Interest Rates

Many travel credit cards come with substantial annual fees and interest rates, which may deter potential users, especially those who do not travel frequently or do not maximize the rewards offered. The cost associated with maintaining a travel credit card can outweigh the benefits for some consumers, leading them to opt for alternative financial products. In addition, a premium travel credit card with a high annual fee and stringent spending requirements may not be a practical choice for occasional travelers or those on a budget. Thus, high annual fees and interest rates of travel credit cards hampers the growth of the travel credit card market.

Technological Advancements and Personalized Experiences

With advancements in data analytics and artificial intelligence, issuers have the opportunity to offer highly personalized travel experiences to consumers. By understanding spending patterns, preferences, and travel habits, card issuers can tailor rewards, offers, and benefits to individual cardholders. In addition, innovations in mobile apps and digital platforms provide a seamless and convenient user experience, further enhancing the appeal of travel credit cards.

Furthermore, a travel credit card issuer could utilize AI algorithms to suggest customized travel itineraries and exclusive offers based on a cardholder's historical spending behavior and travel preferences, creating a more engaging and valuable customer experience. Thus, technological advancements and personalized experiences offered by the best travel credit card players will provide major lucrative opportunities for the growth of the travel credit card market in the upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the travel credit card market forecast from 2023 to 2032 to identify the prevailing travel credit card market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the travel credit card market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global travel credit card market trends, key players, market segments, application areas, and market growth strategies.

Travel Credit Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 48.5 billion |

| Growth Rate | CAGR of 11.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 418 |

| By Provider |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Standard Chartered, Caxton Payments Limited, Mastercard, JP Morgan Chase & Co., Discover Bank, Citigroup Inc., Bank of America Corporation, HSBC, American Express Company, Capital One |

Analyst Review

In recent years, several significant factors have propelled the growth of the travel credit card market. The surge in global travel aspirations, particularly among millennials and an increasingly mobile workforce, has driven demand for travel-related financial tools. Travel credit cards, with their enticing rewards and benefits, have emerged as a preferred choice for individuals seeking to optimize their travel experiences. Moreover, advancements in technology have played a pivotal role. Mobile apps, contactless payments, and digital wallets have enhanced convenience and accessibility, aligning with the preferences of tech-savvy consumers. In addition, strategic collaborations between card issuers and travel industry partners, such as airlines and hotels, have expanded the range of benefits and incentives available to cardholders. These partnerships amplify the value proposition of travel credit cards, further stimulating their adoption. Thus, a combination of evolving consumer preferences, technological innovations, and fruitful industry collaborations has significantly contributed to the robust growth of the travel credit card market in recent years.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, On August 2023, Marriott International entered into a partnership with HDFC Bank in India to introduce the country’s inaugural co-branded hotel credit card. With a presence of 145 hotels across 16 distinct brands situated in 41 cities within India, Marriott stands as the largest hospitality entity in the nation, boasting the highest inventory of rooms. Moreover, the introduction of the co-branded credit card is anticipated to further add to this membership count. In addition, the credit card aims to leverage the aspirations of the emerging middle class within the nation. Furthermore, in August 2023, IndusInd Bank launched a first-of-its-kind multi-branded credit card 'IndusInd Bank Avios Visa Infinite Credit Card' for all customers, in partnership with British Airways Executive Club and Qatar Airways Privilege Club. The credit card has benefits for frequent travelers, and customers opt for their preferred airline loyalty program at the time of the application. Moreover, the customers also select their preferred international destination to maximize the opportunity to collect Avios- the rewards currency used at British Airways Executive Club and Qatar Airways Privilege Club. These strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include American Express Company, Bank of America Corporation, Capital One Group, Caxton Payments Limited, Chase Sapphire Reserve, Citigroup Inc., HSBC, JPMorgan Chase & Co., Mastercard, and Standard Chartered. These players have adopted various strategies to increase their market penetration and strengthen their position in the travel credit card market.

The travel credit card market presents a dynamic landscape shaped by evolving consumer preferences and industry innovations. Currently, it is characterized by intense competition among card issuers striving to attract and retain customers through enticing rewards programs and supplementary benefits.

When using a travel credit card, cardholders typically accumulate points, miles, or other forms of rewards based on their expenditures. These accrued rewards are then redeemed for various travel-related privileges, including, however, not limited to discounted or complimentary airfare, accommodation, car rentals, and other related expenses.

North America is the largest regional market for Travel Credit Card

The estimated industry size of Travel Credit Card is projected to reach $48,446.06 million by 2032, growing at a CAGR of 11.8% from 2023 to 2032.

American Express Company, Bank of America Corporation, Capital One Group, Caxton Payments Limited, Chase Sapphire Reserve, Citigroup Inc., HSBC, JPMorgan Chase & Co., Mastercard, and Standard Chartered.

Loading Table Of Content...

Loading Research Methodology...