Trichlorosilane (TCS) Market Research, 2033

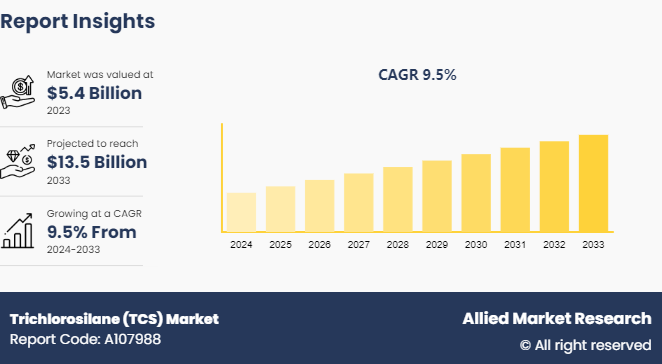

The global trichlorosilane market size was valued at $5.4 billion in 2023, and is projected to reach $13.5 billion by 2033, growing at a CAGR of 9.5% from 2024 to 2033.

Market Introduction and Definition

Trichlorosilane (TCS) with the chemical formula HSiCl3, is a volatile, colorless, and highly reactive liquid. It is primarily used in the production of high-purity silicon, a critical material for the semiconductor industry. Trichlorosilane is also utilized in the manufacturing of silicon-based polymers and resins. Its synthesis typically involves the reaction of silicon powder with hydrogen chloride at elevated temperatures. The unique properties of TCS make it a key player in the intricate processes that lead to the high-quality production of materials crucial for modern technology. It is primarily notable for its high reactivity with water vapor as it decomposes into silicon and hydrochloric acid during chemical vapor deposition.

Key Takeaways

The trichlorosilane market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major trichlorosilane industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

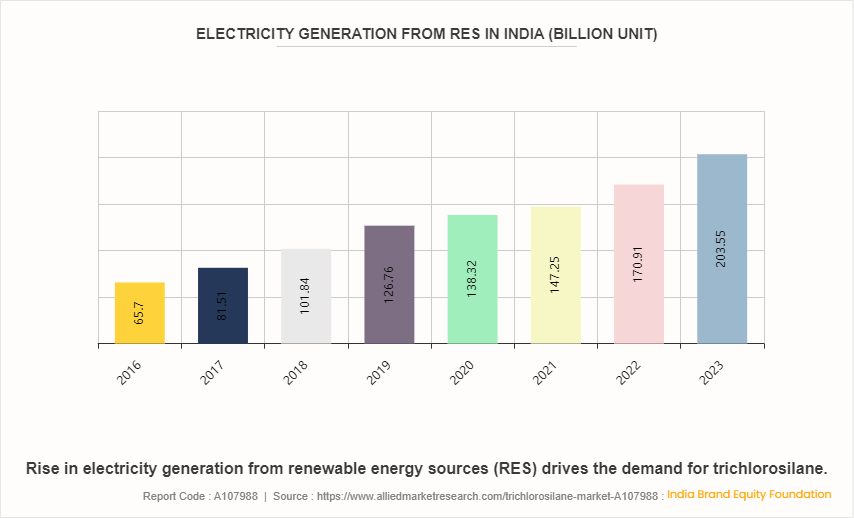

The expansion of the solar energy sector drives the demand for trichlorosilane (TCS) which is a crucial raw material in the production of high-purity silicon used in photovoltaic (PV) cells. As the world increasingly embraces renewable energy sources to mitigate climate change and reduce dependence on fossil fuels, solar power has emerged as a frontrunner in the global energy transition. This increase in demand for solar energy has driven the need for TCS, as it remains indispensable in the manufacturing processes central to the solar industry's growth. Furthermore, advancements in solar technology and manufacturing processes have led to increased efficiency and reduced costs that makes solar energy more competitive with conventional energy sources. All these factors are expected to drive the demand for the global trichlorosilane market.

However, the continuous development and adoption of alternative technologies and materials hamper market growth. Moreover, the solar industry, a major consumer of high-purity silicon derived from trichlorosilane, is witnessing a surge in research and investment in alternative photovoltaic technologies. Thin-film solar cells, organic photovoltaics, and perovskite solar cells are examples of emerging technologies that offer advantages such as flexibility, lightweight, and lower production costs compared to traditional silicon-based solar panels. All these factors hamper the global trichlorosilane market growth.

Technological innovations in silicon production present promising opportunities for trichlorosilane. Technological innovations in silicon production enable the customization of silicon products to meet specific industry needs and performance criteria. By tailoring the properties of silicon through precise control of impurities and dopants, manufacturers address emerging market trends and application requirements. Furthermore, advancements in purification techniques facilitate the production of silicon with higher purity levels, meeting the stringent quality requirements of industries such as electronics and photovoltaics. Trichlorosilane plays a crucial role in these purification processes by providing a reliable source of silicon feedstock. All these factors are anticipated to offer new growth opportunities for the global trichlorosilane market during the forecast period.

Market Segmentation

The trichlorosilane (TCS) market is segmented by purity, production process, application, and region. By purity, the market is bifurcated into medium and high. As per production process, the market is classified into hydrochlorination, direct chlorination, and hydrogenation. By application, the market is classified into polysilicon production, silicon deposition, solar photovoltaic (PV) cells, chemical intermediate, and others. Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The rapid expansion of the electronics industry in countries such as India, China, Japan, South Korea, and Taiwan has fueled the demand for high-purity silicon which is a primary raw material in semiconductor manufacturing. Trichlorosilane serves as a crucial precursor in the production of silicon that makes it indispensable for the region's burgeoning semiconductor sector. Furthermore, the growth of the solar energy industry has significantly contributed to the demand for trichlorosilane in the Asia-Pacific region. Countries such as China and India are investing heavily in solar power generation that drive the production of photovoltaic cells and modules. In addition, trichlorosilane is essential for the synthesis of silicon wafers used in solar panels, thereby driving its consumption in this sector.

The Indian government has widely recognized the strategic importance and growth potential of this industry in its National Policy for Electronics (NPE) . NPE was unveiled with a vision to make the country a comprehensive hub for Electronics System Design and Manufacturing (ESDM) by developing a supportive environment for the industry to compete with global peers.

The Indian government aims to make electronics one of the top three export categories by 2025-26. A $1 trillion digital economy target is projected to boost demand for electronics, which stand at around $180 billion by 2025-26.

According to the REmap 2030, the share of renewables in the power sector in China is expected to increase from 20% to nearly 40% by 2030. This assumes accelerated growth in wind and solar PV, and full deployment of hydroelectricity.

According to the International Solar Alliance (ISA) , global investments in the energy sector grew by 13.5% in 2022, reaching $2.6 trillion, of which $308 billion was spent on solar power generation. Asia-Pacific region accounted for 55% of investments in solar energy development in 2022, with Europe and North America totaling 33% and all other regions of the world making up 12% of the investments.

Competitive Landscape

The major players operating in the trichlorosilane market include Wacker Chemie AG, Tokuyama Corporation, Alfa Chemistry, Gelest Inc., NACALAI TESQUE, INC., Merck KGaA, VWR International, LLC., Tokyo Chemical Industry Co., Ltd., Pharmaffiliates, and Apollo Scientific Ltd.

Apart from these major players, there are other key players in the trichlorosilane market. These include Gruppo SIAD, Jigs Chemical, INNO SPECIALTY CHEMICALS, Matrix Fine Chemicals GmbH, and Otto Chemie Pvt. Ltd.

Recent Key Strategies and Developments

In July 2022, Wacker Chemie AG planned to expand its Charleston site and prepares for construction of silicone production facilities. WACKER has been producing high-purity polysilicon for the semiconductor and solar industries in Charleston since 2015. The planned expansion in Charleston is a further step toward making Charleston a fully integrated site with closed production loops that accelerate company growth.

In May 2022, Tokuyama Chemicals (Zhejiang) Co., Ltd. announced expansion of production capacity of its hydrophobic grade fumed silica production. Hydrophobic grade fumed silica is mainly used as a thickening and thixotropic agent.

Key Industry Trends

According to the India Brand Equity Foundation, call to action for broadening and deepening electronics manufacturing aims to achieve electronics manufacturing worth $300 billion by 2026.

The increase in demand for electronics and semiconductor devices, driven by emerging technologies such as 5G, Internet of Things (IoT) , artificial intelligence, and automotive electronics drive the demand for trichlorosilane. As a precursor in silicon production, trichlorosilane is essential for manufacturing high-quality silicon wafers used in semiconductor fabrication.

China is the world’s largest energy user, accounting for one-fifths of all global energy consumption. By 2030, China’s energy consumption is expected to increase by 60%. China’s energy choices are expected to be a major influence on the world’s ability to curb climate change.

Technology Trend Analysis

Chemical vapor deposition (CVD) is a process widely used in the semiconductor industry to produce high-quality films and coatings. In polysilicon production, CVD reactors are utilized to deposit layers of silicon onto a substrate by reacting to precursor gases. Advancement in the design of chemical vapor deposition (CVD) reactors, improvements in trichlorosilane (TCS) production methods, and the scaling up of manufacturing facilities have led to significant reductions in the costs of polysilicon production, dropping from several hundred dollars per kilogram to below $25 to $30 per kilogram. By refining these technologies and processes, manufacturers achieve higher efficiency and lower costs, thus making polysilicon more accessible for diverse applications. Moreover, the cost per kilogram of polysilicon has dropped significantly that makes it more accessible for various applications and has positive implications for the solar energy and electronics industries.

Key Sources Referred

World Intellectual Property Organization

US Department of Energy (DOE)

India Brand Equity Foundation

Internation Energy Agency (IEA)

Bureau of Economic Analysis

International Renewable Energy Agency

The Global Energy Association

International Solar Alliance (ISA)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the trichlorosilane market analysis to identify the prevailing trichlorosilane market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the trichlorosilane market share and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global trichlorosilane market trend, key players, market segments, application areas, and market growth strategies.

Trichlorosilane (TCS) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 13.5 Billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Purity |

|

| By Production Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | Wacker Chemie AG, Tokuyama Corporation, Gelest Inc., Merck KGaA, Tokyo Chemical Industry Co., Ltd., Pharmaffiliates, Apollo Scientific Ltd, NACALAI TESQUE, INC., VWR International, LLC., Alfa Chemistry |

Loading Table Of Content...