Truck Bedliner Market Research, 2033

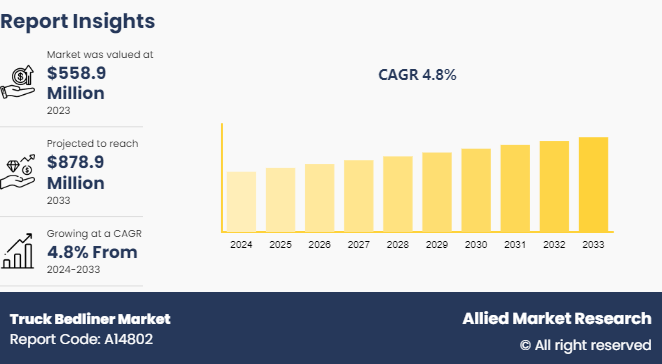

The global truck bedliners market size was valued at $558.9 million in 2023, and is projected to reach $878.9 million by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

A bedliner for trucks is a product designed to protect truck beds from damage caused by cargo, weather and environmental factors such as rain or snow. It is a type of paint or sheet material applied on the surface of the bed so that nothing can damage it but still give it a nice look like the rest of the vehicle bodies. Truck bedliners are protective coats applied on pickup trucks with the goal of preventing them rusting, dents as well as scratches. They make these vehicles stronger, hence increasing their resale prices as well as improving their visual appeal. Different types of truck bedliners are made in variety of designs including spray-on liners, which form a thick protective layer directly on top of the truck bed and drop-in liners that are custom designed for specific trucks, so they are quick and easy to install or remove. These may be composed of polyurethane, polyethylene, rubber or substances with texture such as rugs and are normally fitted by professionals or added later by truck owners as aftermarket accessories. One of the key drivers contributing to high demand for these bedliners is rise in purchasing power among consumers, which in turn fuels sales of pick-ups used in both commercial activities and private transportation.

Key Takeaways

The truck bedliners market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major truck bedliners industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The truck bedliners market forecast predicts a steady growth rate over the next few years due to several factors such as increase in demand for pickup trucks and commercial vehicles, growing awareness about vehicle protection and durability, rise in outdoor and recreational activities. However, high installation costs for certain bedliner types and availability of low-cost alternatives with limited durability hinder the market growth. In addition, development of advanced and durable bedliner materials and expansion of e-commerce platforms for easy accessibility will provide ample opportunities for the market development during the forecast period.

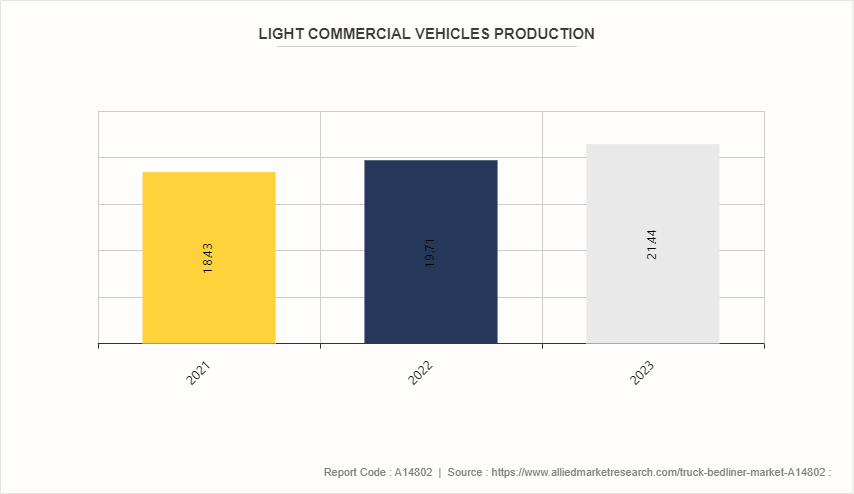

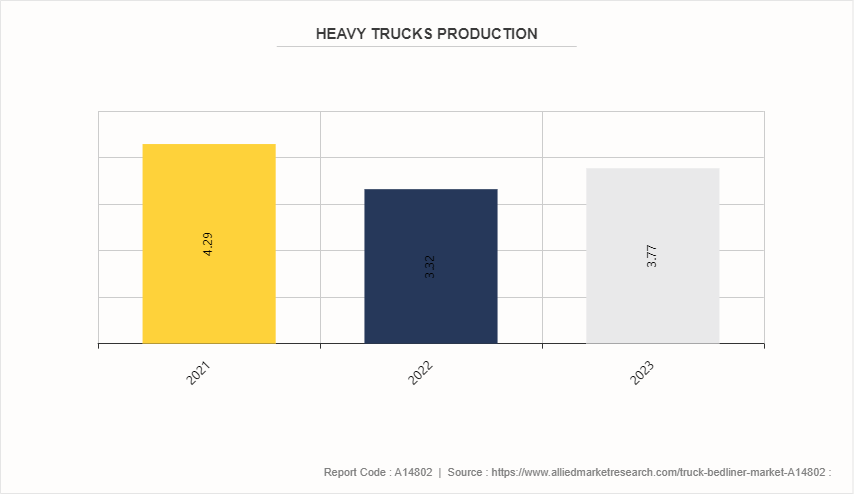

The growth in the truck bedliners industry has been driven by a number of reasons including growth in the construction sector globally, expansion of logistics and transportation sectors, and rise in popularity of outdoor and recreational activities. Pickup trucks have become popular options not only for businesses but also individual use as they perform various tasks, have large loading capacities, and are built to last. The truck bedliners market size has shown significant growth due to increased demand for pickup trucks in both commercial and personal use.

Thus, there is a greater demand for protective solutions such as truck bed liners. Truck beds endure wear due to heavy loads, harsh weather such as rain or snow, and scratches, dents, or rust from other objects. Bedliners help protect the truck’s bed from all these elements, thus acting as a barrier against them so long as they remain intact. Bedliners serve as a protective barrier, shielding the truck bed from these damaging elements, thereby enhancing the vehicle's durability and prolonging its lifespan. The truck bedliners market growth is propelled by the increasing use of pickup trucks for both commercial and personal purposes.

Besides this, the use of pickup trucks is rising at an alarming rate in relation to outdoor and recreational purposes like camping, hunting and other off-road activities, which further drives the demand for bedliners. They are also used to carry heavy gear when engaging in these activities as well as equipment and supplies that could scratch or damage the truck bed without any lining. In addition to protecting truck beds from scratching, bedliners provide a non-slip surface that makes sure items do not fall off during transportation. Moreover, one of the major truck bedliners market trends is the increasing preference for spray-on bedliners due to their durability and ease of application.

In addition, the need for strong and long-lasting bedliner materials has become important owing to increase in demand for commercial vehicles and pickup trucks across several industries and consumer categories. This has propelled growth within the truck bedliners market as truck owners along with their fleet managers identify value in investing into good quality bed liners, which is expected to help them save on maintenance costs while increasing their productive lives of those vehicles.

Market Segmentation

The truck bedliners market is segmented into technology, end-user, application, and region. On the basis of technology, the market is divided into drop-in bedliners, spray-on, bedliners, and others. As per material, the market is segregated into polyurethanes, aluminum, carpet, and others. On the basis of application, the market is bifurcated into original equipment market and aftermarket. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

North America holds the largest truck bedliners market share, primarily due to the high sales of pickup trucks in the region. North America, particularly the U.S. and Canada, is a key market for truck bedliners. The region's affinity for trucks, especially pickups, has made them integral to its culture, surpassing the popularity of other vehicle types like mini vans. As a result, accessories such as bed liners, which shield pickups from wearing out too soon, are essential. The construction industry heavily relies on pickups for transportation, among other sectors. Moreover, the building sector and the transport industry are heavily reliant on pick-up trucks as well as commercial vehicles, thus necessitating the need for long-lasting bedliners that can endure such unfriendly conditions.

In Europe, the truck bedliners market is driven mainly by industries of commercial vehicles and logistics. Germany, the UK, and France have strong manufacturing and construction industry presence that depend largely on pick-up trucks and commercial vehicles for purposes of transportation and hauling. The truck bedliners market analysis reveals a steady increase in demand across various regions.

In addition, the Asia-Pacific region is a major market for truck bed liners due to rise in demand in countries such as China, India, and Southeast Asian nations. There is a significant truck bedliners market opportunity in the Asia-Pacific region, where the automotive industry is rapidly expanding. Growth in construction & logistics sectors, increased outdoor leisure activities, and booming middle class are factors driving the market growth in the region.

In March 2022, Mitsubishi Motors Corporation launched the new Xpander crossover MPV alongside two new Ralliart special editions, the Triton Ralliart (Double-Cab) and Mirage Ralliart at the 43rd Bangkok International Motor Show 2022. The Triton Ralliart (Double-Cab) is based on the low-riding variant and comes equipped with distinctive features such as side decals, mud flaps, and a bed liner, all adorned with the Ralliart logo.

In November 2023, The Coeur Rochester Mine in Pershing County, Nevada, collaborated with DINGO to shift its bed liner replacement strategy from time-based to condition-based service intervals. The site maintenance teams have adopted the Trakka Asset Health Manager app (TAHM) to monitor the condition of bed liners on their haul truck fleet. TAHM facilitates the capture of annotated photographs, documentation of wear, and logging of ultrasonic measurements at inspection points. As a result of this condition-based approach, the service life of 67% of their bed liners was extended in 2022 compared to the previous time-based strategy. This process enables real-time decision-making, reduces unscheduled downtime, and mitigates unbudgeted risks.

Competitive Landscape

The major players operating in the truck bedliners market include PendaForm Corporation, LINE-X LLC, Toff Industries Corporation, DualLiner LLC, Armadillo Liners Inc., Bedrug, LLC, Rhino Linings Corporation, WeatherTech Direct, LLC, Rugged Liner Inc., and Scorpion Protective Coatings, Inc. Other players in truck bedliners market includes TOFF Bedliners, Speedokote LLC, ProXL, and others.

Recent Key Strategies and Developments

In October 2023, LINE-X, a major manufacturer of high-performance protective coatings and automotive accessories, announced partnership with Lucas Oil, a renowned leader in high-performance lubricants and additives. LINE-X sponsored Team Lucas at national racing events, including the Lucas Oil Late Model Dirt Series and the Lucas Oil Pro Pulling League, for the 2021 season. This collaboration brings together Lucas Oil's legacy of exceptional lubricant performance and LINE-X's expertise in enhancing the durability of truck bed liners and other automotive products.

In January 2023, ProXL launched the ToughOX Truck Bed Liner Kits, designed to provide a robust protective finish for truck beds and other areas prone to scrapes and scuffs. This durable 2k polyurethane bed liner spray is user-friendly and cures quickly, creating a surface that is easy to clean and resistant to fuels, chemicals, and oils. In addition, it offers high resistance to water, UV radiation, and weathering, ensuring long-lasting protection even in harsh environments. The liner can be easily revitalized with a simple recoat as it wears. An added advantage of the ToughOX Truck Bed Liner is its sound dampening and noise reduction capabilities, contributing to a quieter and more comfortable ride.

Industry Trends:

In October 2022, Herculiner, a subsidiary of J-B Weld, unveiled two new products, the Herculiner Professional Grade Kit and the Herculiner Bed Liner Restore. The Professional Grade Kit features advanced two-part technology, surpassing both factory and DIY truck bed liners in performance. The Bed Liner Restore is an advanced solution for restoring and detailing truck bed liners, reviving their original color and shine for up to a year.

In January 2022, Volvo Trucks introduced an upgraded version of its Volvo VNR Electric truck, significantly extending its range. Initially, the Volvo VNR Electric had a range of up to 240 km (150 miles) . The latest model, a class 8* electric truck, now boasts an operational range of up to 440 km (275 miles) and features enhanced energy storage capacity, reaching up to 565 kWh. This improvement is attributed to a more advanced battery design and the introduction of a new six-battery package, among other enhancements.

Key Sources Referred

National Truck Equipment Association (NTEA)

Automotive Aftermarket Industry Association (AAIA)

Specialty Equipment Market Association (SEMA)

American Trucking Associations (ATA)

Truck & Engine Manufacturers Association (EMA)

National Truck Protection Coatings Association (NTPCA)

Automotive Refinishers Association (ARA)

Truck Bedliner Manufacturers Association (TBMA)

Industrial Finishes & Systems, Inc. (IFSI)

Automotive Body Repair News (ABRN)

National Association of Trailer Manufacturers (NATM)

Auto Care Association (ACA)

Commercial Vehicle Safety Alliance (CVSA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the truck bedliner market analysis from 2024 to 2033 to identify the prevailing truck bedliner market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the truck bedliner market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global truck bedliner market trends, key players, market segments, application areas, and market growth strategies.

Truck Bedliner Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 878.9 Million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Product |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Rugged Liner, DualLiner, Homestead Products, Rhino Linings, Aeroklas Co., Ltd., Toff Liner, LINE-X, Panda Corporation, Ultimate Linings, Industrial Polymers LLC |

Aftermarket is the leading application of Truck Bedliner Market

Development of advanced and durable bedliner materials and expansion of e-commerce platforms for easy accessibility are the upcoming trends of Truck Bedliner Market in the globe

North America is the largest regional market for Truck Bedliner

The global truck bedliner market was valued at $558.9 million in 2023, and is projected to reach $878.9 Million by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

The major players operating in the truck bedliners market include PendaForm Corporation, LINE-X LLC, Toff Industries Corporation, DualLiner LLC, Armadillo Liners Inc., Bedrug, LLC, Rhino Linings Corporation, WeatherTech Direct, LLC, Rugged Liner Inc., and Scorpion Protective Coatings, Inc.

Loading Table Of Content...