The global truck platooning market size was valued at $728.9 million in 2025, and is projected to reach $6,092.2 million by 2035, growing at a CAGR of 23.7% from 2025 to 2035.

Report Key Highlights:

- The report covers a detailed analysis on truck platooning used in the transportation industry.

- The truck platooning market has been analyzed from the year 2025 till the year 2035.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

Truck platooning is a technologically advanced method of lining up several vehicles in close proximity to one another on a highway in order to increase road safety, decrease fuel consumption, and improve efficiency; to achieve these advantages, companies are leveraging a combination of connected vehicle technology and automation. When driving in a truck platoon, the truck in front functions as the leader while the other trucks in the group follow the truck in front of them and replicate their motion as well as speed. The drivers of the vehicles who are following the lead vehicle have the option to enter or exit the platoon at any time throughout the maneuver and continue driving independently.

According to a recent study published by the American Journal of Transportation, currently, there is a shortage of 80,000 drivers in the U.S. alone; the association also estimated that by 2030, there will be a shortage of 160,000 truck drivers. As the U.S majorly relies on its trucking industry for inter-country goods transport, the demand for truck platooning technologies is expected to rise in coming years.

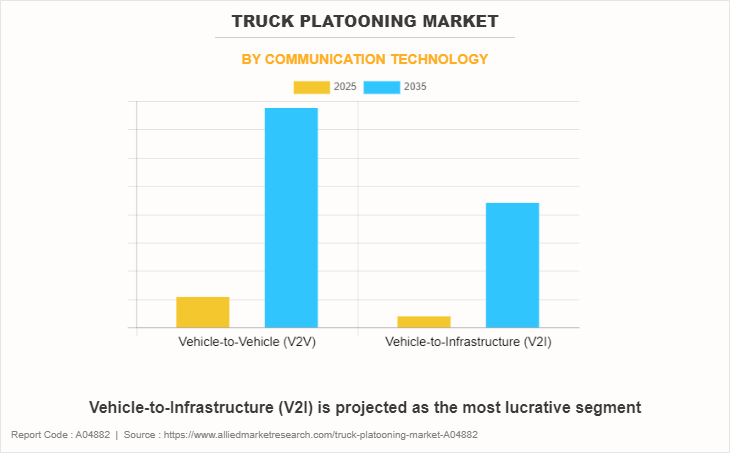

In addition, companies around the world are also collaborating with other companies and have begun testing their technology on public roads; for instance, in 2020, Peloton Technology started testing PlatoonPro and Auto Follow systems on public roads, the system utilizes V2V communication to form a platoon of trucks.

Similarly, on March 2022, IVECO S.P.A collaborated with the ENSEMBLE consortium; the collaboration will aim to develop the establishment and implementation of the technology in realistic traffic scenarios of a multi-brand platooning technology while collaboratively working with leading vehicle manufacturers in Europe. Factors such as strengthening government rules and regulations for the transportation industry, reducing fuel consumption and increasing road safety, and strategic collaboration between industry players and private-public partnerships are resulting in market expansion. However, high costs, new vehicle and infrastructure requirements, and rising security and privacy concerns hinder market growth.

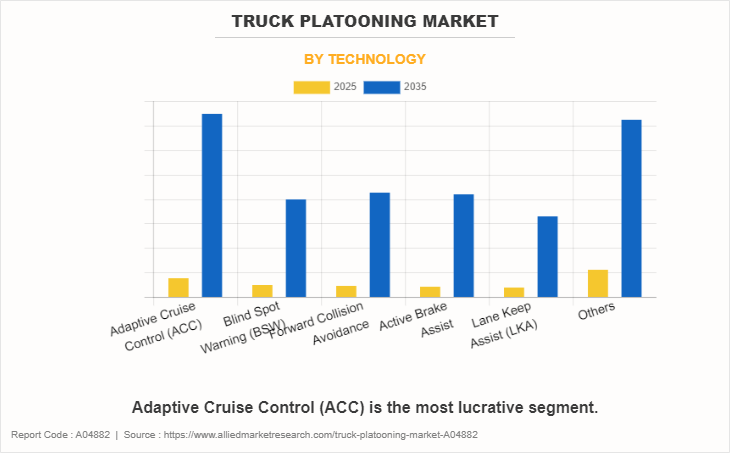

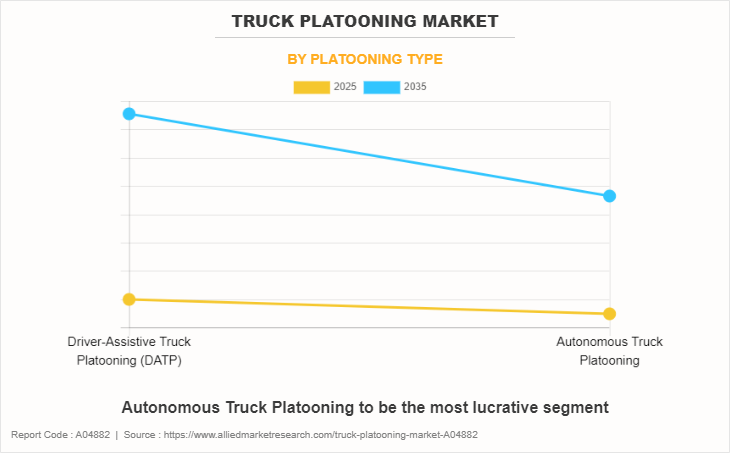

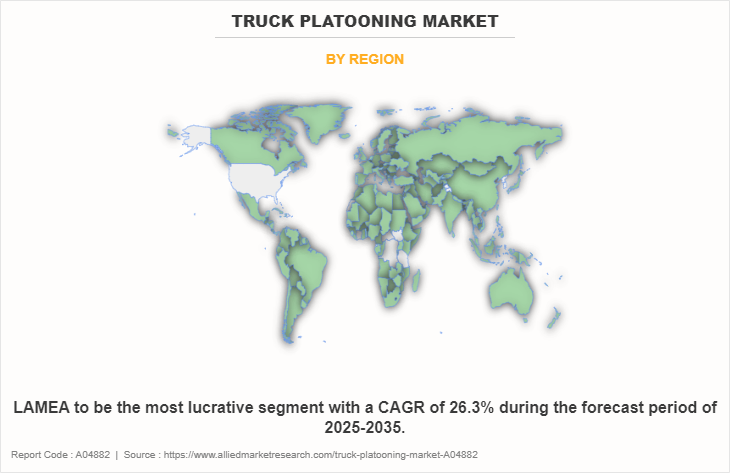

The truck platooning market has been segmented into component, platooning type, technology, and communication technology. On the basis of components, it is segmented into hardware and software. By platooning type, the market has been segmented into driver-assistive truck platooning (DATP) and autonomous truck platooning. On the basis of technology, the market has been segmented into adaptive cruise control (ACC), blind spot warning (BSW), forward collision avoidance, active brake assist, lane keep assist (LKA), and others. Based on communication technology, the market has been segmented into vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I). On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the truck platooning market are AB Volvo, Continental AG, Mercedes-Benz Group AG (former Daimler AG), Peloton Technology, LLC, Robert Bosch GmbH, Scania AB, TOYOTA MOTOR CORPORATION, Bendix Corporation, DAF Trucks N.V and IVECO S.P.A.

Strengthening government rules and regulations for the transportation industry

The transportation industry is accountable for pollution emitted on a global level; the major portion of the greenhouse gas in the atmosphere is emitted from trucks and other transportation vehicles used in the logistics industry. To overcome the issue, governments around the world have placed regulations to cut down the number of pollutants released from vehicles.

For instance, the European Emission Standards or Euro Norms are regulations that govern and limit the pollutants from vehicles and promote the development and use of automobile technologies that are cleaner and fuel-efficient. The government in the region is also increasingly encouraging truck platooning technology to limit fuel consumption and reduce pollution. As platooning vehicles move relatively closely to one another, helping lower the air resistance faced by the truck that is following them by around 40%, leading to approximately a 10% reduction in the amount of carbon dioxide (CO2) produced per mile traveled.

Reduction in fuel consumption and increase in road safety.

Platooning allows trucks to make use of aerodynamic drafting and smart driving technologies to achieve large fuel savings while maintaining road safety. Platooning has been shown to save fuel for trucks by lowering the amount of air resistance they face, also referred to as slipstream. The truck in front of the line endures the majority of the wind's resistance, which results in the formation of a slipstream that is to the benefit of the trucks that follow. Platooning helps not only the vehicle that is following but also the one that is in the lead in lower fuel consumption.

During platooning, vehicles also synchronize paths and speed by utilizing technologies such as adaptive cruise control and V2V communication. The combined use of these technologies results in minimizing random acceleration and deceleration, resulting in further fuel savings for long-haul operations. A part of the software utilized in platooning also considers conditions such as the terrain, traffic conditions, weather conditions, and real-time data, resulting in lowering fuel consumption and increasing road safety.

High cost and new vehicle and infrastructure requirements

Truck platooning will require software and hardware upgrades to work on the current fleet of vehicles. These changes include the installation of advanced communication systems, sensors, radars, and other autonomous driving components. Adaptive cruise control, forward collision warning, and other technologies have a substantial cost because they are dependent on expensive sensors such as Lidar, Radar, and others. These factors lead to the high cost of the truck platooning technology to the end customers.

Moreover, the truck platooning technology also requires high-end infrastructure development as they are majorly dependent on high-speed communication networks. In addition, these technologies require designated platooning lanes and entrance/exit points; moreover, they also require supplementary infrastructure that can be utilized during emergency services, such as during breakouts and accidents. As much of the road infrastructure and truck fleet are not currently equipped adequately, it is restraining the formation of routes for long-distance.

Production of fully autonomous trucks for platooning

The truck platooning technology is currently in the evolving stage, and a significant amount of development work needs to be conducted by manufacturers. Numerous truck manufacturers are drawn to platooning technology for its exceptional benefits, such as optimized fuel consumption, less emission, decreased traffic congestion, and less driver fatigue. The platooning that is used currently is based on driver-assistive truck platooning (DATP), which necessitates the driver's involvement in order to quit or enter a platoon at any point in time. On the other hand, the development of completely autonomous trucks for platooning will function without any input from the driver and will take place automatically. Fully autonomous trucks will reduce accidents, cut down on human error, and produce a synergy that will make it easier to govern and operate fleets in the logistics sectors. Thus, the production of fully autonomous vehicles for truck platooning holds a remarkable growth opportunity for the players operating in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the truck platooning market analysis from 2025 to 2035 to identify the prevailing truck platooning market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the truck platooning market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global truck platooning market trends, key players, market segments, application areas, and market growth strategies.

Truck Platooning Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 6.1 billion |

| Growth Rate | CAGR of 23.7% |

| Forecast period | 2025 - 2035 |

| Report Pages | 463 |

| By Technology |

|

| By Component |

|

| By Platooning Type |

|

| By Communication Technology |

|

| By Region |

|

| Key Market Players | IVECO S.P.A, Bendix Corporation, Mercedes-Benz Group AG (former Daimler AG), Robert Bosch GmbH, Scania AB., TOYOTA MOTOR CORPORATION, AB Volvo, DAF Trucks N.V, Continental AG, Peloton Technology, LLC |

Analyst Review

Truck platooning can be defined as two or more trucks driving very close and following the platooning leader, with other trucks in platoon following the leader using vehicle-to-vehicle (V2V) communication. Other than vehicle-to-vehicle (V2V) communication, platooning trucks rely on various technologies and sensors such as radar, GPS, and others, which allows them to sense the environment and be a part of platoon safely. Adoption of truck platooning will provide reduction in road freight operational costs due to higher productivity of both truck & driver, and fuel savings. In addition, widespread adoption of truck platooning helps reduce the volume of greenhouse gases originated road freight transport.

Factors such as rise in government rules for emission from transport sector and reduction in fuel consumption drive the growth of the truck platooning market. In addition, the truck platooning industry is experiencing growth owing to supportive government rules for platooning. However, high cost of platooning technology and rise in security and privacy concerns are the factors anticipated to hinder the growth of the truck platooning market. Furthermore, production of fully autonomous trucks for platooning and extension in size of truck platooning fleet are the factors expected to provide a remarkable growth opportunity for the players operating in the truck platooning market.

Among the analyzed geographical regions, currently, North America is the highest revenue contributor, and is expected to maintain the lead during the forecast period, followed by Europe, Asia-Pacific, and LAMEA.

Autonomous truck platooning is an upcoming trend of the Truck Platooning Market.

Fuel saving and safety is the leading application of Truck Platooning Market.

North America is the largest regional market for Truck Platooning

The Truck Platooning Market was valued at $728.9 million in 2025.

Peloton Technology, LLC and AB Volvo hold the market share in Truck Platooning.

Loading Table Of Content...

Loading Research Methodology...