Turbine Control System Market Research, 2032

The global turbine control system market size was valued at $18.7 billion in 2022, and is projected to reach $29.2 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Report Key Highlighters:

- The turbine control system market industry covers covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The turbine control system market share is highly fragmented, with several players including ABB, Emerson Electric Co., General Electric Company, Mitsubishi Heavy Industries Ltd, Rockwell Automation, Hitachi, Petrotech, Woodward, Inc., Honeywell International Inc., and Heinzmann GmbH & Co. KG. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the turbine control system market.

A turbine control system, often referred to as a Turbine Control Unit (TCU), is a complex set of control mechanisms, software, and hardware designed to manage the operation of turbines. These systems are specifically accountable for governing the speed and load of a turbine, ensuring it operates within predefined limits to maintain efficiency, safety, and stability.

Turbine control systems are substantially used in energy plants, inclusive of coal, natural gas, hydroelectric, and nuclear facilities. In these settings, steam or gas turbines are employed to turn generators and produce electricity. The turbine control system ensures that the turbine operates at the most advantageous speeds and power output, maintaining grid stability and responding to fluctuations in electricity demand.

Turbine control systems are vital to the aerospace industry, where gas generators strengthen jet engines. These structures manipulate thrust, speed, and efficiency, crucial for safe and environment-friendly flight. They play a pivotal function in making sure the plane responds to pilot commands and operates under various conditions, from takeoff to landing.

Turbines are employed in a range of marine applications, from cruise ships to naval vessels. Turbine control systems in the marine industry help manage propulsion turbines, making sure of the ship's velocity and maneuverability. They also control auxiliary generators for power generation and different ship functions, contributing to the basic effectiveness and protection of maritime operations.

The growth of automation technologies has significantly impacted the field of turbine control systems market.

The integration of AI and machine learning allows for predictive maintenance and even more precise control. The adoption of digital twin technology, which creates virtual replicas of physical turbines, has revolutionized maintenance and performance optimization. Turbine control systems are increasingly integrated with digital twin platforms to enhance efficiency and predictive maintenance. Turbine control systems are probably to become more integrated with broader industrial control systems (ICS) and the Industrial Internet of Things (IIoT). This connectivity enables the change of data between various gear and systems, leading to extra complete and environment-friendly industrial operations.

The trend toward decentralized power generation, including microgrids and allotted energy resources, will create new possibilities for turbine manipulation systems. These structures need to manipulate a numerous array of power sources and ensure grid stability. Some turbine control systems are exploring the integration of blockchain technology for expanded transparency and security. This ensures that records related to turbine operation, maintenance, and performance remain tamper-proof and easily auditable.

An increase in energy demand drives turbine control system market growth.

Turbine control systems are necessary components in power plants, overseeing electricity generation across various sources. They manage turbine speed, safety, and performance, particularly critical for renewables such as wind and hydropower, making sure efficient electricity supply. In 2022, global hydropower capacity grew by using 2.19% to 1393 GW, and it's poised for further expansion due to upcoming initiatives and technological advancements, as referred to by the International Renewable Energy Agency. These control systems are pivotal in assembly the rising strength needs by efficaciously harnessing various power sources and optimizing electricity generation.

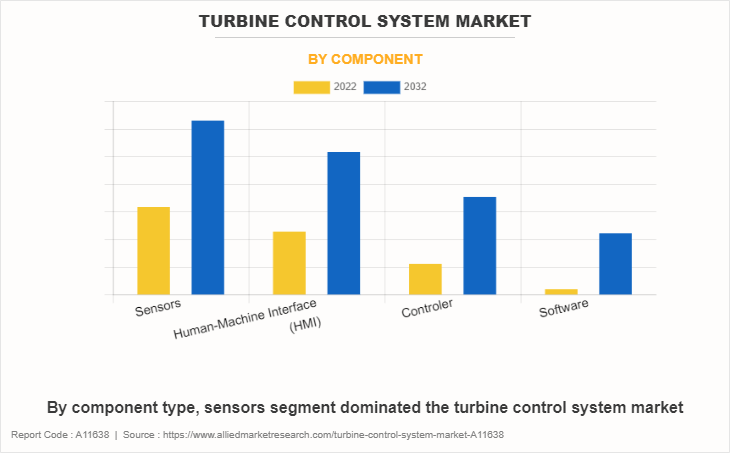

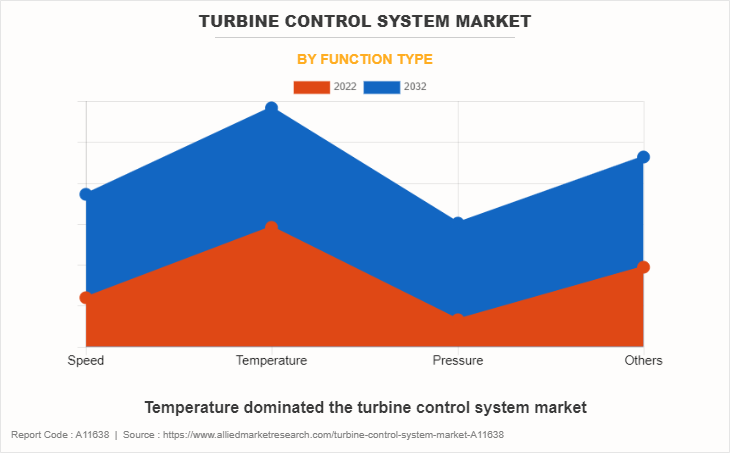

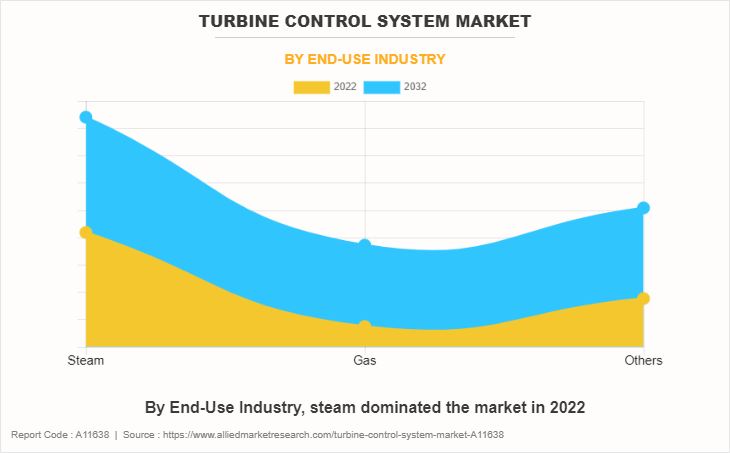

The turbine control system market is segmented into component, function type, end-use industry, and region. On the basis of component, the market is divided into sensor, human-machine interface (HMI), controller, and software. As per function type, the market is categorized into speed, temperature, pressure, and others. Depending on end-use industry, the market is classified into steam, gas, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Pressure sensors are a vital component in turbine control systems. They measure the stress of the working fluid, such as air or gas, at various levels of the turbine. These measurements help maintain the turbine's performance and safety. Flow sensors are critical in fuel and steam turbine control systems. They measure the go with the flow rates of the working fluid, helping ensure that the turbine operates within its design specifications. Vibration sensors are crucial for monitoring the mechanical health of a turbine. They detect any abnormal vibrations that could indicate a mechanical issue, such as unbalanced rotors or misaligned components.

Temperature control is a imperative component of turbine operation. Turbines generate a substantial quantity of warmth for the duration of their operation, and controlling the temperature within safe limits is essential. This is especially vital in gas turbines used for energy generation, where keeping the right temperature vary is essential for effectivity and longevity. One frequent method for temperature manipulation in fuel turbines is the use of variable inlet guide vanes and variable stator blades. These components can be adjusted to adjust the airflow and, in turn, the temperature within the turbine.

Steam turbines are generally used in energy plants to convert thermal energy from steam into mechanical energy, which is then transformed into electrical energy through generators. The turbine control system in this place is accountable for retaining a regular speed and output of electricity. It achieves this by way of controlling the float of steam into the turbine, adjusting the blade angles, and monitoring various parameters such as temperature, pressure, and vibration. Safety is of paramount significance in steam turbine operations, and the control system plays a sizable role in this aspect. It monitors crucial parameters and can automatically shut down the turbine if any abnormal stipulations are detected, such as excessive vibration or deviations in temperature and pressure.

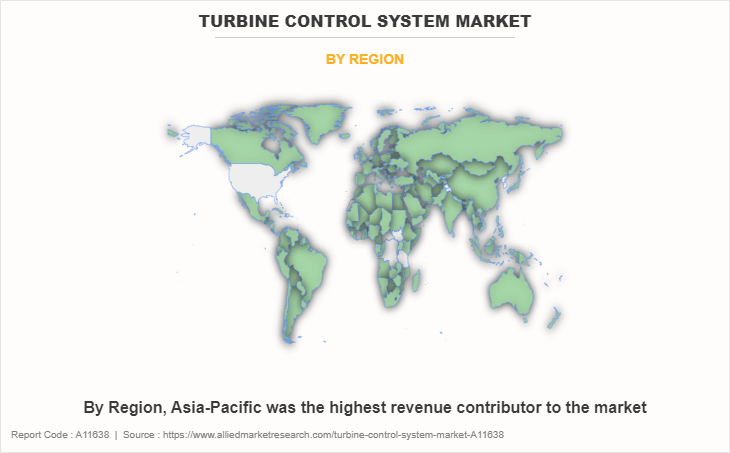

In the Asia-Pacific region, China and India are significant consumers of turbine control systems. China boasts a large quantity of power plants, encompassing fossil-fuel and renewable energy sources, all of which necessitate advanced control systems to optimize turbine performance. Similarly, India, driven by its expanding energy requirements, relies on turbine control systems for its diverse array of coal-fired and renewable energy power plants.

The major players operating in the turbine control system market include ABB, Emerson Electric Co., General Electric Company, Mitsubishi Heavy Industries Ltd, Rockwell Automation, Hitachi, Petrotech, Woodward, Inc., Honeywell International Inc., and Heinzmann GmbH & Co. KG.

Apart from the above-listed companies, there are many companies in the energy turbine control system market including Voith Group, Moog Inc., Parker Hannifin, KSB Group, Andritz, Metso Outotec, Mita-Teknik, Vestas, Bachmann electronic, Danfoss, ESI Group, Hima, Turbomach, Basler Electric, Regal Beloit Corporation, Marelli Motori, WEG, Bonfiglioli and others.

Historic trends of the turbine control system market:

- In the 1990s, the application of control algorithms became a prominent feature in turbine control systems. These algorithms have been designed to continuously optimize the operation of generators by adjusting various parameters, such as fuel flow, air intake, and blade angles in real time.

- In the 2000s, turbine control systems indeed commenced to combine with broader power plant automation systems and became an essential part of the larger power administration and control framework. This integration was driven by numerous factors, including the need for accelerated efficiency, accelerated monitoring, and the integration of renewable electricity sources.

- In the 2010s, the turbine control system had a huge shift toward digitalization and the use of statistics analytics for turbine control, enabling predictive preservation and higher performance optimization.

- In the 2020s, turbine control systems have continued to evolve significantly, with a focal point on integrating renewable power sources and smart grid technology. This evolution is in response to the changing energy landscape and the growing significance of sustainability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the turbine control system market analysis from 2022 to 2032 to identify the prevailing turbine control system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the turbine control system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global turbine control system market trends, key players, market segments, application areas, and market growth strategies.

Turbine Control System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 29.2 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 270 |

| By Component |

|

| By Function Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Rockwell Automation Inc., Petrotech, Emerson Electric Co., ABB, Honeywell International Inc., Heinzmann GmbH & Co. KG, Woodward, Inc., Mitsubishi Heavy Industries Ltd., General Electric Company, Hitachi |

| | DNV GL, Spica Technology, HPI,LLC, Others |

Analyst Review

According to the opinions of various CXOs of leading companies, the global turbine control system market was dominated by the sensors segment. Speed sensors are employed to monitor the rotational speed of the turbine's components. These sensors provide real-time data on the turbine's RPM (Revolutions Per Minute), which is crucial for maintaining stability and efficiency. The control system can use this information to make adjustments in response to changing load conditions or unexpected events.

Technological advancements in turbine control system drives the growth of the turbine control system market. Recent advancements in turbine control systems have significantly transformed various industries reliant on turbines for power and propulsion. The integration of digital technologies is a standout development in this field. Traditional analog control systems have been replaced with digital ones that utilize microprocessors and sensors to monitor key parameters such as temperature, pressure, and speed in real-time. This data is processed to optimize turbine performance, resulting in enhanced efficiency and safety.

However, the high initial cost of turbine control system are expected to restrain industry expansion. The aviation and power generation industries face strict regulatory standards, necessitating rigorous testing, documentation, and compliance efforts. Turbine control systems, crucial for safety and reliability in these applications, require robust, fail-safe components and redundancy, which increases complexity and cost. These systems rely on specialized, high-quality components such as precision sensors and actuators that can withstand challenging environments but contribute to the system's overall expense.

The Asia-Pacific region is projected to register robust growth during the forecast period. The Asia-Pacific region boasts abundant hydroelectric resources, and hydro turbines are widely used for clean and renewable energy production. Turbine control systems are essential in optimizing the output of hydroelectric plants, ensuring efficient energy conversion and grid stability. Countries like China, India, and Japan have made substantial investments in hydroelectric power, contributing to the growing demand for advanced control systems in this sector.

The development of smart grids is the upcoming trends of turbine control system market in the world.

Temperature is the leading component of the turbine control system market.

Increase in energy demand and technological advancements in turbine control system are the driving factors of turbine control system market.

Asia-Pacific is the largest region of the turbine control system market.

The report covers profiles of key industry participants such as ABB, Emerson Electric Co., General Electric Company, Mitsubishi Heavy Industries Ltd, Rockwell Automation, Hitachi, Petrotech, Woodward, Inc., Honeywell International Inc., and Heinzmann GmbH & Co. KG.

The global turbine control system market was valued at $18.7 billion in 2022, and is projected to reach $29.2 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

The high initial cost of turbine control system are the restraints of turbine control system market.

Loading Table Of Content...

Loading Research Methodology...