Turbo Generator Market Research, 2032

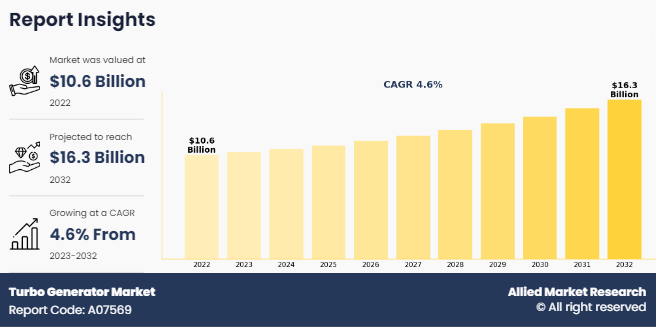

The global turbo generator market size was valued at $10.6 billion in 2022, and is projected to reach $16.3 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. The increase in power demand and ongoing modernization of electrical grids, coupled with a rise in investments in power generation infrastructure, are driving the demand for turbo generators across various industries and applications. As global populations expand and economies develop, the need for reliable and efficient electricity generation becomes more pronounced. This surge in power demand necessitates the expansion and upgrading of power generation infrastructure.

Introduction

A turbo generator is a type of generator used in power plants to convert mechanical energy into electrical energy. It typically consists of a turbine connected to a generator, where the turbine is driven by steam, gas, or water flow. The rotation of the turbine causes the generator to produce electricity through electromagnetic induction. Turbo generators are commonly employed in thermal power plants, hydroelectric plants, and some types of renewable energy facilities, such as those utilizing wind or geothermal energy. They play a crucial role in the generation and distribution of electrical power on a large scale.

Key Takeaways

- The global turbo generator market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, cooling system, end user, 4 major regions, and more than 15 countries.

- The global turbo generator market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the turbo generator market are ANDRITZ, Ansaldo Energia, Beijing Beizhong Steam Turbine Generator Co., Ltd., Bharat Heavy Electricals Limited, EBARA CORPORATION, GE Vernova, MITSUBISHI HEAVY INDUSTRIES, LTD., Siemens AG, Suzlon Energy Limited, and TOSHIBA CORPORATION.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global turbo generator market.

Market Dynamics

Turbo generators offer a reliable and efficient solution for power generation. As industries expand and urban populations increase, the demand for electricity escalates, necessitating the installation of additional power generation capacity. According to the International Energy Agency (IEA), global electricity demand is set to grow by close to 5% in 2021 and 4% in 2022 driven by the global economic recovery. Moreover, the modernization and upgrade of electrical grids increases the demand for turbo generators. As aging infrastructure needs to be replaced and existing systems require enhancement to accommodate renewable energy sources and new technologies, turbo generators play a crucial role in ensuring the stability and reliability of power supply. All these factors are expected to drive the demand for the turbo generator market during the forecast period.

However, the growth of turbo generators is hindered by the high initial investment costs associated with these sophisticated power generation systems. Turbo generators are complex machines that require significant upfront capital expenditure for design, engineering, procurement, construction, and commissioning. These high initial costs pose a barrier to entry for many potential users and investors, particularly in developing countries or in industries with limited access to capital. Furthermore, the cost of procuring turbo generators themselves, along with associated equipment such as turbines, generators, control systems, and auxiliary components, constitutes a significant portion of the overall investment. All these factors hamper the turbo generator market growth.

The adoption of Combined Heat and Power (CHP) systems presents significant opportunities for turbo generators in various industries and applications. CHP, also known as cogeneration, is a highly efficient method of generating electricity and useful thermal energy simultaneously from a single fuel source. Turbo generators play a central role in CHP systems by converting mechanical energy into electricity while also capturing and utilizing waste heat for heating, cooling, or industrial processes. Moreover, the adoption of CHP systems helps to reduce greenhouse gas emissions and other pollutants by displacing less efficient and more emissions-intensive forms of power generation. For instance, SycoTec GmbH & Co. KG launched small turbo generators in CHP plants to reduce carbon dioxide emissions and achieve energy efficiency targets. All these factors are anticipated to offer new growth opportunities in the turbo generator market forecast.

Segments Overview

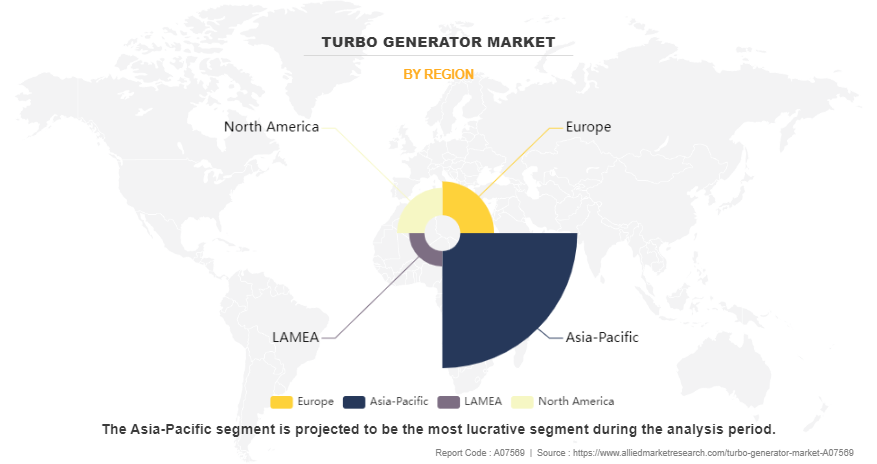

The turbo generator market is segmented on the basis of type, cooling system, end user, and region. On the basis of type, the market is segmented into gas turbine generators, steam turbine generators, water turbine generators. On the basis of cooling system, the market is classified into air-cooled, water-cooled, hydrogen cooled. On the basis of end user, the market is classified into coal power plants, gas power plants, nuclear power plants, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

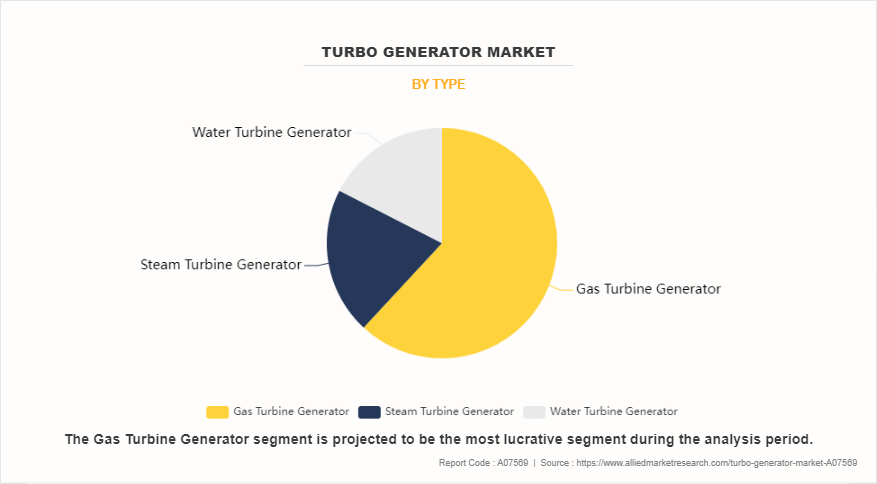

By type, the gas turbine generator segment accounted for more than three-fifths of global turbo generator market share in 2022 and is expected to maintain its dominance during the forecast period. Gas turbine generators offer relatively low emissions compared to other fossil fuel-based power generation technologies. Advances in combustion technologies, along with stringent environmental regulations, have led to the development of gas turbines with reduced emissions of pollutants such as nitrogen oxides (NOx) and particulate matter. Furthermore, the ability to utilize natural gas, which burns cleaner than coal or oil, as a primary fuel source contributes to the overall environmental profile of gas turbine generators.

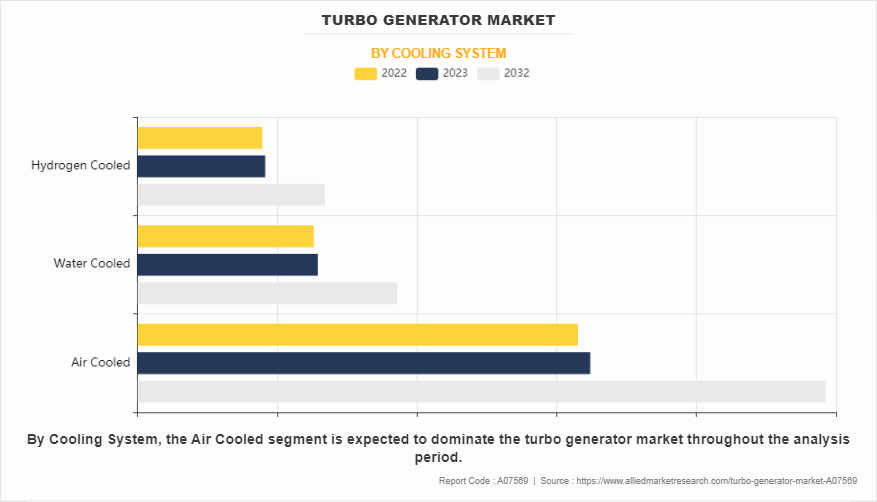

By cooling system, the air cooled segment accounted for less than three-fifths of global turbo generator market share in 2022 and is expected to maintain its dominance during the forecast period. The surge in adoption of small-scale renewable energy systems presents significant opportunities for the air cooled generator. According to the International Energy Agency (IEA), the U.S. renewable energy expansion has almost doubled in the last five years. The IRA passed in August 2022 extended tax credits for renewables until 2032 that provide long-term visibility for wind and solar PV projects. As the countries focus on sustainability and reducing carbon emissions, there has been a notable surge in the deployment of decentralized renewable energy solutions such as solar panels, small wind turbines, and micro-hydro systems.

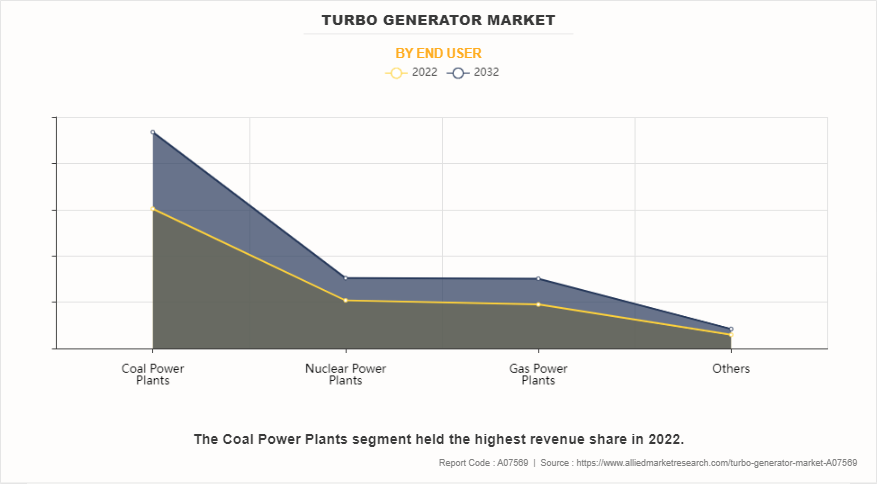

By end user, the coal power plants segment accounted for less than three-fifths of global turbo generator market share in 2022 and is expected to maintain its dominance during the forecast period. Coal remains a significant source of power generation due to its affordability and abundant reserves. As a result, there is a continued need to expand and modernize coal-fired power plants to meet increasing electricity demand. Turbo generators used in coal power plants for converting thermal energy from burning coal into electrical power are thus integral to this growth.

Asia-Pacific accounted for more than three-fifths of the global turbo generator market share in 2022 and is expected to maintain its dominance during the forecast period. The increasing emphasis on cleaner energy sources and environmental sustainability is driving the adoption of turbo generators in Asia-Pacific. Governments across the region are implementing policies and incentives to promote the development of renewable energy infrastructure and reduce greenhouse gas emissions. According to the International Energy Agency, in India, new installations are set to double till 2032, which is driven by competitive auctions implemented to achieve the government’s ambitious target of 500 GW of renewable power by 2030. Turbo generators are integral components of renewable energy systems such as wind farms, solar thermal plants, and biomass power stations.

Competitive Analysis

Key players in the turbo generator market include ANDRITZ, Ansaldo Energia, Beijing BEIZHONG Steam Turbine Generator Co., Ltd., Bharat Heavy Electricals Limited, EBARA CORPORATION, GE Vernova, MITSUBISHI HEAVY INDUSTRIES, LTD., Siemens AG, Suzlon Energy Limited, and TOSHIBA CORPORATION. Apart from these major players, there are other key players in the turbo generator industryt. These include ABB Group, Brush Group, Doosan Heavy Industries & Construction, Elliott Group, Harbin Electric Corporation, Honeywell International Inc., Hyundai Heavy Industries Co., Ltd., MAN Energy Solutions, and Shanghai Electric Group Co., Ltd.

In the global turbo generator market, companies have adopted agreement and joint venture strategies to expand the market or develop new products. For instance, in December 2023, Ansaldo Energia signed an agreement with Tecnicas Reunidas and an important German utility for the construction of a hydrogen-ready combined cycle power plant. This signature follows an agreement signed with RWE for the conversion of the Weisweiler lignite power plant, as part of the German decarbonization plan. Moreover, in September 2022, Honeywell International Inc. and Hindustan Aeronautics Limited (HAL) jointly signed a memorandum of understanding (MoU) to manufacture high-power, high-voltage turbogenerators.

Historical Trends of Turbo Generator:

- The early to mid-20th century marked the commercialization and widespread adoption of turbo generators in various industries such as power generation, oil & gas, and manufacturing. Companies such as General Electric, Siemens, and Mitsubishi emerged as key players, producing turbo generators for large-scale power plants and industrial applications.

- The 1960s witnessed significant advancements in turbo generator technology with the introduction of higher-capacity units, improved materials, and more efficient cooling systems. This era saw the expansion of turbo generators into new markets such as petrochemical plants, refineries, and large-scale manufacturing facilities.

- In the 1970s, turbo generator technology experienced further evolution with the development of advanced control systems, digital instrumentation, and automatic voltage regulation. This led to increased reliability, efficiency, and operational flexibility of turbo generators, driving their adoption in a broader range of applications such as marine propulsion, aerospace, and district heating.

- The 1980s marked a period of innovation in turbo generator design, focusing on enhancing performance, efficiency, and environmental sustainability. Manufacturers introduced advanced blade designs, improved cooling technologies, and enhanced rotor dynamics to increase power output and reduce emissions.

- The 1990s saw a surge in demand for turbo generators driven by the globalization of energy markets and the need for reliable electricity supply in emerging economies. Companies invested in R&D to produce generators with higher efficiency, lower emissions, and longer maintenance intervals to meet the evolving needs of power utilities and industrial customers.

- By the early 2000s, turbo generator technology evolved to incorporate advanced materials such as superalloys and composite materials, enabling higher operating temperatures and greater efficiency. This enabled the development of combined-cycle power plants and other advanced energy systems, further driving the adoption of turbo generators in the global energy landscape.

- In the 2010s, turbo generator technology continued to evolve with a focus on digitalization, connectivity, and predictive maintenance. Innovations such as condition monitoring systems, remote diagnostics, and predictive analytics aimed to improve reliability, reduce downtime, and optimize performance across various sectors such as power generation, oil & gas, and marine propulsion.

- In the 2020s, the turbo generator market continued to evolve with a growing emphasis on sustainability and renewable energy integration. Innovations such as hydrogen-fueled turbines, carbon capture technologies, and grid stabilization solutions aimed to address climate change and support the transition to a low-carbon energy future.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the turbo generator market overview, segments, current trends, estimations, and dynamics of the turbo generator market analysis from 2022 to 2032 to identify the prevailing turbo generator market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the turbo generator market statistics and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global turbo generator market trends, key players, market segments, application areas, and market growth strategies.

Turbo Generator Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.3 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 240 |

| By Type |

|

| By Cooling System |

|

| By End User |

|

| By Region |

|

| Key Market Players | ANSALDO ENERGIA, GE Vernova, Mitsubishi Heavy Industries, Ltd., Andritz AG, Siemens AG, Suzlon Energy Limited, Beijing BEIZHONG Steam Turbine Generator Co., Ltd., EBARA CORPORATION, Bharat Heavy Electricals Limited, TOSHIBA CORPORATION |

Analyst Review

According to the opinions of various CXOs of leading companies, the turbo generator market is expected to witness growth during the forecast period owing to increase in power demand and grid modernization and rise in investments in power generation infrastructure. The ongoing trend of grid modernization is expected to further propel the growth of the turbo generator market. As power grids evolve to accommodate renewable energy sources, smart grid technologies, and decentralized power generation systems, there arises a need for advanced and adaptable power generation equipment. Turbo generators, with their versatility and capacity to integrate seamlessly into modern grid infrastructures, are increasingly becoming a preferred choice for utilities and grid operators.

Moreover, the surge in investments in power generation infrastructure is playing a pivotal role in driving the expansion of the turbo generator market. Governments and private entities are channeling significant funds into the development and enhancement of power plants, both conventional and renewable, to meet the growing energy demands of their respective populations and industries. This surge in investment is expected to drive the demand for turbo generators during the forecast period.

The global turbo generator market was valued at $10.6 billion in 2022, and is projected to reach $16.3 billion by 2032, registering a CAGR of 4.6% from 2023 to 2032.

Asia-Pacific is the fastest growing region for the Turbo Generator Market

Adoption of combined heat and power (CHP) systems is the upcoming trend of Turbo Generator Market in the world

Coal power plant is the leading end user of Turbo Generator Market

Surge in power demand and grid modernization and rise in investments in power generation infrastructure are the leading drivers for the Turbo Generator Market.

Asia-Pacific is the largest regional market for Turbo Generator

Key players in the turbo generator market include ANDRITZ, Ansaldo Energia, Beijing BEIZHONG Steam Turbine Generator Co., Ltd., Bharat Heavy Electricals Limited, EBARA CORPORATION, GE Vernova, MITSUBISHI HEAVY INDUSTRIES, LTD., Siemens AG, Suzlon Energy Limited, and TOSHIBA CORPORATION.

Loading Table Of Content...

Loading Research Methodology...