Turbocompressor Market Overview

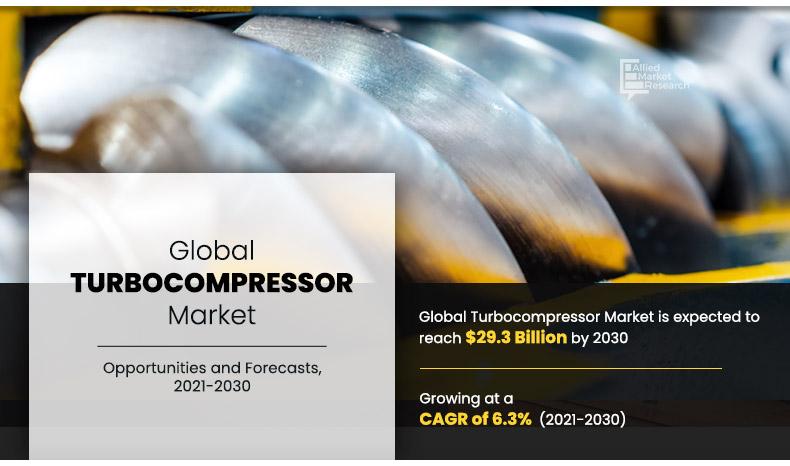

The global turbocompressor market size was $15,748.7 million in 2020, and is expected to reach $29,356.4 million by 2030, with a CAGR of 6.3% from 2021 to 2030. This is riven by the adoption of more efficient manufacturing processes across various industries. As production activities continue to expand, the demand for high-performance turbocompressors has increased significantly. This surge is further supported by the need for energy-efficient solutions and improved operational performance in modern manufacturing environments.

Market Dynamics & Insights

- The turbocompressor industry in Asia-Pacific held a significant share of over 38.2% in 2020.

- The turbocompressor industry in Canada is expected to grow significantly at a CAGR of 7% from 2021 to 2030

- By type, centrifugal segment is one of the dominating segments in the market and accounted for the revenue share of over 75.4% in 2020.

- By end-user, water & wastewater segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $15.7 Billion

- 2030 Projected Market Size: $29.3 Billion

- CAGR (2021-2030): 6.3%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant by Turbocompressor

Turbocompressor are a type of machine that increases the efficiency of engines in addition with increasing the power of engines. Turbocompressor are turbo machines that concentrate a compressible gas with the help of a dynamic principle. In turbocompressor, the gas continuously enters the rotating impeller, through which the mechanical shaft power is distributed to the fluid with the help of blades that result in significant pressure and temperature increase. The remaining kinetic flow energy is then mostly converted into pressure in the diffusor. The compressed gas is then either collected in a volute or transferred to a second compressor stage with the help of a return channel.

The major driving factor of the turbocompressor market is the growth in the liquified natural gas that uses the axial and the centrifugal compressors for building the pressure ratios. The LNG trade has grown due to the growth in exports from different countries such as Australia and the U.S. Different countries demand for cleaner sources of energy and the LNG is used in different industries for manufacturing, cooking, heating, generating electricity, and other applications. The government has introduced various regulations, such as the Clean Air Act which prompts the use of cleaner source of energy for industries. In addition, the turbocompressor is used in wastewater treatment plants as it requires minimum maintenance for applications. Moreover, it offers more increased pressure and builds more efficiency in removing pollutants, which increases the adoption of turbocompressor in wastewater plants.

However, the screw compressors have an advantage over the centrifugal compressors with efficiency and capacity control. The screw compressors provide more efficiency over the part load and provide more capacity control over the output range. In addition, in countries such as Japan and South Korea, the demand for the LNG gas drops in the commercial and the residential sectors because of warm weather. The high temperature over the LNG may lead to explosion, which restricts their use in these countries, and further leads to the decline in demand for turbocompressors in the global market.

Furthermore, the construction, manufacturing, hotel, and tourism industries were majorly affected during the COVID-19 pandemic. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to the decline in manufacturing of turbocompressor as well as their demand in the market, thereby restraining the growth of the turbocompressor market. Conversely, industries are gradually resuming to regular manufacturing and services. This is expected to lead to re-initiation of turbocompressor companies at full-scale capacities, which is expected to help the turbocompressor market to recover in the coming years.

However, the use of passenger vehicles is increasing over the years with more adoption of advanced vehicles. Turbocompressors are used for vehicles and different turbocompressor are developed with time, which provides fuel efficiency by more than 10%. In addition, turbocompressors are used in diesel engines, which reduces the NOx. In addition, different car manufacturers are developing their own turbocompressors. Moreover, the rise in automotive industry and government regulations for fuel consumption methods create major opportunities for the growth of the turbocompressor market.

Turbocompressor Market Segment Overview

The turbocompressor market is segmented on the basis of type, stage, end user, and region. On the basis of type, the market is divided into centrifugal and axial. On the basis of stage, the market is divided into single stage and multi-stage. On the basis of end user, the market is segmented into oil & gas, power generation, chemical, water & wastewater, and others.

By Type

Axial segment is projected to grow at a significant CAGR

Region wise, the global turbocompressor market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of type, the centrifugal segment dominated the turbocompressor market, in terms of revenue in 2020, whereas the axial segment is expected to witness growth at the highest CAGR during the forecast period. On the basis of stage, the single stage segment led the turbocompressor market in 2020, however, the multi-stage segment is expected to exhibit highest CAGR in the near future. On the basis of end user, the power generation segment led the market in 2020, in terms of revenue, and the water & wastewater segment is anticipated to register highest CAGR during the forecast period. Region wise, Asia-Pacific garnered the highest revenue in 2020. However, LAMEA is anticipated to register highest CAGR during the forecast period.

By End User

Water & wastewater segment is expected to grow at a significant rate during the forecast period.

Competition Analysis

The major players profiled in the turboprocessor market include Atlas Copco AB, Elliott Group, General Electric, Howden Group, Ingersoll Rand, Kawasaki Heavy Industries, Ltd., KOBE STEEL, LTD., MAN Energy Solutions, MITSUBISHI HEAVY INDUSTRIES, LTD., and Siemens.

Major companies in the market have adopted agreement, product launch, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the turbocompressor market.

By Region

Asia-Pacific holds a dominant position in 2020 and LAMEA is expected to grow at a highest rate during the forecast period.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current trends and future estimations.

- Extensive analysis of the turbocompressor market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities in the turbocompressor market.

- The global turbocompressor market forecast analysis from 2021 to 2030 is included in the report.

- The key market players within the global turbocompressor market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the global market.

Turbocompressor Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Stage |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Turbocompressors provide end-user industries with life cycle savings by providing supreme energy efficiency, minimal maintenance, and maximum operating reliability. When compared with other compressor technologies, turbocompressors save a minimum of 20% to 30% of the electricity and maintenance costs during the complete life cycle. Industrial compressors generally account for about 13% to 15% of the total energy consumption, which further accounts for about 5% of the total energy consumption. Due to these concerns, companies develop oil-free, energy efficient, and maintenance-free turbocompressors. These energy efficient compressors utilize magnetic bearing motors with the motor shaft and turbo impellers directly attached to it that float in the air. The non-contact nature of the rotor and impellers reduces mechanical losses or/and wear.

Compressed air is generally required in all industrial facilities, globally. The demand for compressed air continuously increases with the rise in industrial growth and growing automation. For certain industrial facilities, inefficient compressors cause a loss of several hundreds of thousands of dollars of potential annual savings, depending on their usage. Appropriately managed compressed air systems can save energy, reduce maintenance, decrease downtime, increase production throughput, and improve product quality. Turbocompressors are designed, manufactured, and tested to comply with international standards, which increase the maximum uptime and all the components of these compressors are also easy to maintain, dismantle, and re-assemble. In addition, advanced control and monitoring possibilities available are provided to ensure there are minimal production interruptions.

Major companies in the market have adopted strategies such as product launch, agreement, acquisition, and business expansion to offer better services to customers in the turbocompressor market.

The turbocompressor market was valued at $15,748.7 million in 2020, and is expected to reach $29,356.4 million by 2030, registering a CAGR of 6.3% from 2021 to 2030.

The forecast period considered for the global turbocompressor market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

To get latest version of global turbocompressor market report can be obtained on demand from the website.

The base year considered in the global turbocompressor market report is 2020.

The top companies holding the market share in the global turbocompressor market report include Atlas Copco AB, Elliott Group, General Electric, Howden Group, Ingersoll Rand, Kawasaki Heavy Industries, Ltd., KOBE STEEL, LTD., MAN Energy Solutions, MITSUBISHI HEAVY INDUSTRIES, LTD., and Siemens

The top ten market players are selected based on two key attributes - competitive strength and market positioning

By type, the centrifugal segment dominated the global turbocompressor market, in terms of revenue and is expected to maintain this trend during the forecast period

By end user, the power generation segment is the highest share holder of global turbocompressor market.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The market value of the global turbocompressor market is $16,992.8 million in 2021.

Loading Table Of Content...