Turboprop Engine Market Research, 2033

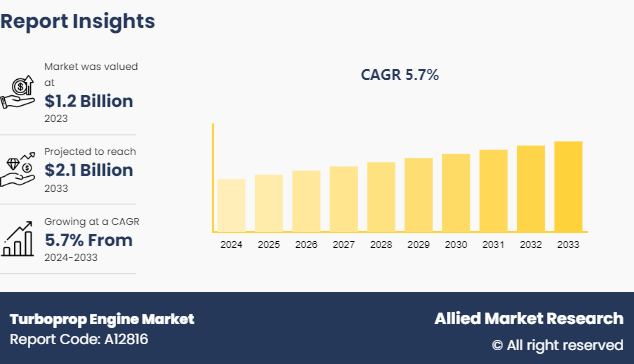

The global turboprop engine market size was valued at $1.2 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Market Introduction and Definition

The turboprop engine industry includes the development, production, and sale of turboprop engines, which are jet engines that drive an aircraft propeller. These engines are used predominantly in smaller regional aircraft and military transport aircraft, offering a balance between efficiency and power. The market is driven by several factors, including the rising demand for regional connectivity, the growth of air cargo, and military modernization programs.

Key Takeaways

The turboprop engine market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major turboprop engine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In January 2024, Turbotech partnered with Safran to conduct pioneering tests on the first hydrogen-powered turboprop engine designed for light aircraft. This milestone, part of the BeautHyFuel project, involved ground-testing a hydrogen-fueled gas turbine at ArianeGroup's facility in Vernon, France. Supported by the French Civil Aviation Authority (DGAC) and facilitated through France's post-Covid stimulus program, the initiative aims to advance hydrogen propulsion solutions for aviation.

Key Market Dynamics

The rise in demand for regional air connectivity is driving the growth of the turboprop engine market share. Turboprop engines are ideally suited for short to medium-haul flights, offering better fuel efficiency and lower operational costs compared to jet engines. Regional airlines favor turboprop aircraft for their ability to operate from shorter runways and their cost-effectiveness on routes with lower passenger volumes. As regional air travel expands, the need for reliable, efficient turboprop engines rises, driving market growth. Furthermore, growth in air cargo transportation, and rise in demand for fuel-efficient propulsion systems have driven the growth of the turboprop engine market growth.

However, competition from jet engines in regional aircraft is hampering the growth of the turboprop engine market size as jets offer faster travel times and smoother flying experiences, appealing to both airlines and passengers. Advances in jet engine technology have also improved fuel efficiency, narrowing the cost advantage of turboprops. Many airlines are opting for regional jets over turboprops, particularly on routes where speed and passenger comfort are prioritized, thereby limiting the growth potential of the turboprop engine market. Moreover, high initial investment and maintenance costs, and limited infrastructure in developing regions are major factors that hamper the growth of the turboprop engine market forecast.

On the contrary, the adoption of biofuels and alternative energy sources presents a lucrative opportunity for the turboprop engine market by addressing environmental concerns and regulatory pressures. Biofuels offer a sustainable alternative to conventional jet fuel, reducing greenhouse gas emissions and enhancing the eco-friendliness of turboprop engines. This shift aligns with global efforts to achieve carbon neutrality in aviation, attracting investments and innovations in turboprop technology. The demand for biofuel-compatible turboprop engines is poised to grow significantly as airlines seek greener solutions.

Fleet Composition and Utilization Trends for the Turboprop Engine Market

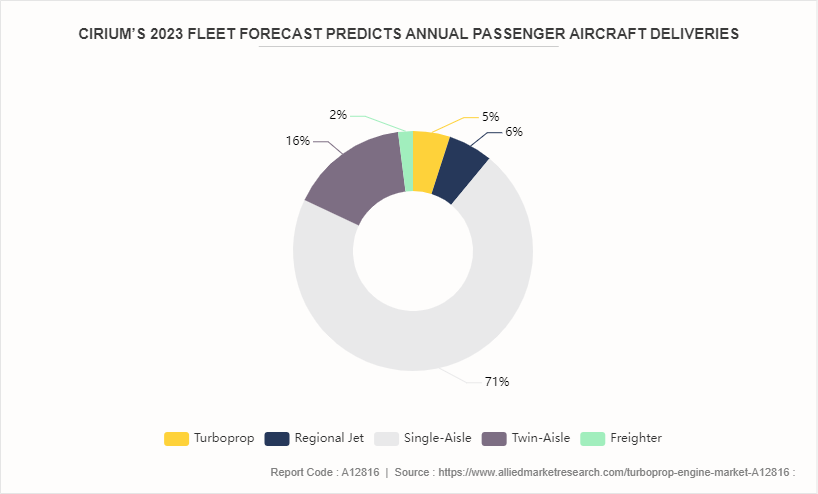

In the turboprop engine market, fleet composition and utilization trends play a crucial role in shaping demand and operational strategies. Turboprop aircrafts are predominantly used in regional and short-haul routes due to their ability to operate efficiently from smaller airports with shorter runways. This makes them well-suited for connecting remote or underserved communities where larger jets are not economically viable.

Fleet composition trends indicate a diverse range of turboprop aircraft models catering to various passenger capacities and operational requirements. Airlines often choose turboprops for their cost-effectiveness on routes with lower passenger demand and for their versatility in accessing airports with limited infrastructure.

Utilization trends reflect efforts to maximize aircraft efficiency and minimize downtime through optimized scheduling and maintenance practices. Turboprops typically see higher utilization rates compared to larger aircraft types, particularly in regions with dispersed populations or challenging terrain.

As regional air travel continues to expand globally, driven by economic growth and improved connectivity, the demand for turboprop engines is expected to remain robust, supported by their operational flexibility and cost advantages in regional markets.

Market Segmentation

The turboprop engine market is segmented into type, application, technology and region. On the basis of type, the market is bifurcated into single shaft, and free turbine. On the basis of application, the market is segregated into commercial aviation, military aviation, and general aviation. On the basis of technology, the market divided into conventional engine, and electric/hybrid engine. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Regional/Country Market Outlook

North America has attained the highest market share in the turboprop engine market due to several factors. North America has a well-developed regional aviation infrastructure, with numerous regional airlines operating turboprop aircraft to connect remote or underserved communities across vast geographical areas. Furthermore, the region benefits from a strong presence of leading aerospace companies involved in the manufacturing and maintenance of turboprop engines, bolstering market stability and innovation. Lastly, regulatory frameworks in North America often support the use of turboprop aircraft for short-haul routes, further enhancing their market dominance.

North America holds the highest market share in the turboprop engine market primarily due to its well-established regional aviation sector. The region's geography, with expansive areas and diverse terrains, necessitates efficient and versatile aircraft like turboprops for connecting remote communities and smaller airports. Major regional airlines in North America, such as Alaska Airlines and Horizon Air, extensively utilize turboprop aircraft to serve routes that are economically unfeasible for larger jets. Moreover, the presence of leading aerospace manufacturers and maintenance facilities, including Pratt & Whitney Canada and Bombardier Aerospace, contributes to a robust supply chain and technological advancements in turboprop engines.

The Asia-Pacific region has emerged as the fastest-growing market for turboprop engines due to its rapid economic growth, expanding middle class, and increasing regional connectivity demands. Countries in Asia-Pacific, such as India, China, and Indonesia, have vast populations spread over diverse landscapes, making turboprop aircraft a practical choice for reaching smaller airports and connecting secondary cities. Additionally, governmental initiatives and infrastructure investments aimed at improving regional air connectivity have further stimulated the demand for turboprop engines in the region, contributing to its rapid market expansion.

In February 2024, Safran partnered with Turbotech to develop hydrogen-powered turboprop engines for general aviation, conducting successful ground tests of a hydrogen-fueled gas turbine as part of the BeautHyFuel project. These tests, held at Ariane's Vernon facility, known for hydrogen propulsion in rockets, aim to create a hydrogen powertrain for light aircraft. Supported by French government funding, the project includes collaboration with Elixir Aircraft, Air Liquide, and Daher, advancing sustainable aviation solutions amidst growing environmental concerns.

In May 2023, NVIDIA, collaborated with Rolls-Royce, and Classiq to achieve a quantum computing breakthrough focused on enhancing jet engine efficiency, utilizing NVIDIA's platform to simulate a 10 million-layer deep quantum circuit with 39 qubits for computational fluid dynamics (CFD) . This innovation allows Rolls-Royce to prepare for future quantum applications, overcoming current quantum computer limitations that typically support circuits only a few layers deep, by leveraging the computational power of GPUs in the interim.

Competitive Landscape

The report analyzes the profiles of key players operating in the turboprop engine market. These include GENERAL ELECTRIC, Heron Engines, Honeywell International Inc., PBS AEROSPACE, Pratt & Whitney, Rolls-Royce Plc, SAFRAN, Textron Aviation Inc., TurbAero, and Turbotech. These players have adopted various strategies to increase their market penetration and strengthen their position in the turboprop engine market.

Industry Trends

In November 2023, Pratt & Whitney, a business unit of RTX, secured a long-term contract worth up to $870 million from the Defense Logistics Agency to sustain the TF33 engine, which powers aircraft like the Boeing B-52 Stratofortress and E-3 Sentry. This contract, a result of a long-standing partnership with the 448th Supply Chain Management Wing and Tinker Air Force Base, aims to create a comprehensive sustainment strategy to reduce obsolescence and enhance the U.S. Air Force's wartime readiness.

In September 2023, Rolls-Royce, headquartered in the UK, received official certification from the Federal Aviation Administration (FAA) for its Pearl® 700 engine for Gulfstream G700™ and Gulfstream G800™ business aircraft.

In February 2023, General Atomics Aeronautical Systems announced that it has finalized an expression of interest with Hindustan Aeronautics Limited of India to offer support services for the turbo-propeller engines of the MQ-9B aircraft. Under this initiative, the Hindustan Aeronautics Limited of India aims to offer maintenance, overhaul, and repair services.

In May 2022, Falko Regional Aircraft Limited has been fully acquired by Chorus Aviation Inc. With the ability to optimize value at every step of an aircraft’s lifespan, this purchase makes Chorus a leading full-service provider in regional aviation. The closing of this deal makes Chorus the largest aircraft lessor in the world with a sole focus on regional aircraft leasing investments. As a result, Chorus subsidiaries will now own, manage, and/or operate a portfolio of 348 regional aircraft with a total market value of about USD 4.5 bn.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of turboprop engine market segments, current trends, estimations, and dynamics of market analysis to identify the prevailing turboprop engine market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of turboprop engine market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global turboprop engine market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global turboprop engine market trends, key players, market segments, application areas, and market growth strategies.

Turboprop Engine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 Billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 434 |

| By Type |

|

| By Application |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Rolls-Royce plc., General Electric, Heron Engines, TurbAero, Honeywell International Inc., PBS AEROSPACE, Pratt & Whitney., Turbotech, Safran, Textron Aviation Inc. |

Upcoming trends in the global turboprop engine market include the development of more fuel-efficient and environmentally friendly engines, the increasing use of advanced materials and technologies for improved performance, and the rising demand for turboprop aircraft in regional and short-haul routes due to their cost-effectiveness and lower emissions.

Commercial Aviation is the leading application of Turboprop Engine Market

North America is the largest regional market for Turboprop Engine

$2.10 billion is the estimated industry size of Turboprop Engine

GENERAL ELECTRIC, Heron Engines, Honeywell International Inc., PBS AEROSPACE, Pratt & Whitney, Rolls-Royce Plc, SAFRAN, Textron Aviation Inc., TurbAero, and Turbotech.

Loading Table Of Content...